Aion RT uses LiDAR, better than similarly priced Xiaopeng?

![]() 11/08 2024

11/08 2024

![]() 542

542

After November 6, the hot sales of Xiaopeng MONA M03 are likely to end early, as the starting price of Aion RT is the same as that of MONA M03 at 119,800 yuan, but it offers better space and range performance. Crucially, the high-end intelligent driving version equipped with LiDAR is priced at 155,800 yuan, the same as Xiaopeng MONA M03's pure vision intelligent driving version. Before this, such intelligent driving perception hardware was rarely seen at this price point. Therefore, in terms of overall product competitiveness, the cost-effectiveness of Xiaopeng MONA M03 no longer stands out. So, what are Aion RT's deeper strengths?

New battery charges 200km in 10 minutes, is Xiaopeng's rear space more cramped?

There are many ways to create more space in electric vehicles, such as following a short L113 design or short front and rear overhangs to position the wheels as close to the corners as possible, or integrating the battery with the body. These are all space-friendly designs. However, for cost-effective pure electric A-class cars, achieving large interior space with smaller dimensions is more challenging. Xiaopeng's solution is to adopt a hatchback design, utilizing the design requirements of the C-pillar inclination to ensure headroom in the second row and provide more storage space in the trunk. But is this really the optimal solution?

The answer is obviously no. Comparing the parameters of Aion RT and Xiaopeng MONA M03, both cars are significantly larger than traditional A-class cars, with lengths around 4.8 meters and widths close to 1.9 meters. While these dimensions are not much smaller than most B-class cars on the market, the key lies in the wheelbase and height. Aion RT is 4cm shorter than Xiaopeng MONA M03 in wheelbase and 7.5cm taller in height. To understand this design, we need to introduce the Y0 line, which refers to a curve running from the front compartment, across the roof, and ending at the rear. The inflection point in this curve represents the highest point of the entire cabin. In SUVs and shooting brakes, this inflection point typically appears above the vertical axis of the rear wheels, meaning the Y0 line slopes more steeply after the C-pillar.

For Aion RT, the Y0 line follows a design that slopes gently at the front and steeply at the rear, with no obvious inflection point. The highest point is reached at the B-pillar, ensuring a net height within the cabin, which is the fundamental reason why Aion RT is 7.5cm taller. However, to achieve a low drag coefficient conducive to low energy consumption, the usual approach is to lower the vehicle's height, which can compromise headroom. A solution is to increase the curvature difficulty to G4 level, testing the precision of the entire vehicle manufacturing process. As a result, the front end of Aion RT lacks angular designs. Although it does not achieve the extremely low Cd0.194 of Xiaopeng MONA M03, which sacrifices some interior space, Aion RT still manages a Cd0.208 after increasing its height. The value here is significantly different.

Some might compare trunk capacity, with Xiaopeng MONA M03 offering 621 liters in its regular state versus only 480 liters for Aion RT, a nearly 22% difference. The question arises: why would Xiaopeng prioritize more trunk space over interior cabin space? The answer is that it's a matter of capability rather than choice. Due to its hatchback design, Xiaopeng MONA M03's overall height is constrained, so the rear seats are positioned further back, and the C-pillar is angled down, further limiting headroom in the second row. To compensate, the wheelbase is extended, and the rear seats are positioned closer to the front end, following the design logic of the Xiaopeng P7+. Overall, Aion RT offers more headroom and legroom in the second row compared to Xiaopeng MONA M03.

Frankly, Aion RT's entry-level version is priced at 119,800 yuan, and its high-end intelligent driving version at 155,800 yuan, clearly targeting Xiaopeng MONA M03. When the prices of the two products overlap, only differences in product competitiveness can determine the winner. In terms of range, Aion RT uses CATL's "new battery." Aion has not provided much information about this battery, only briefly mentioning Cell to Pack 2.0 technology. However, in terms of capacity, the 520km version (CLTC conditions) uses a 55.1kWh LFP battery, while the 650km version uses a 68.1kWh battery. Considering Aion's current product lineup, these two batteries are not found in other models. Therefore, both versions offer 5km and 30km more range than Xiaopeng MONA M03, respectively. Since both models use LFP batteries, which are inherently less suitable for high-voltage fast charging compared to NCM batteries, achieving higher charging rates requires stacking more battery cells. As a result, under the same SOC 30%-80% scenario, Aion RT can reduce charging time to 18 minutes due to its battery capacity advantage, while Xiaopeng requires 30 minutes.

The cheapest city navigation with better results than Xiaopeng's pure vision?

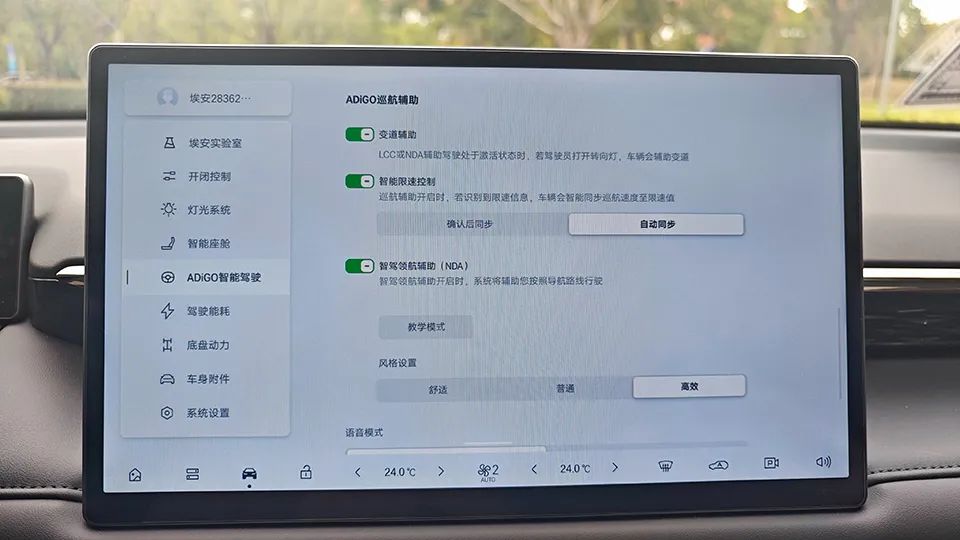

Certainly, Aion RT's core competitiveness lies in its intelligent driving system. At a price of 155,800 yuan, it includes a LiDAR with 126 lines, which, while not as powerful as higher-line LiDARs, still enables city and highway navigation. From real-world tests, this intelligent driving system can perform unprotected left turns, U-turns, navigating unmarked roads, and remote parking. Especially in roundabouts and complex intersections where system degradation is most likely, the takeover rate is relatively low. Considering its price of less than 160,000 yuan, has Aion RT used LiDAR to drive down the price of high-end intelligent driving systems? Is it more effective than Xiaopeng's pure vision + AI big model approach?

This question requires an understanding of Aion RT's underlying intelligent driving technology. LiDAR, as the perception hardware in an intelligent driving system, quickly captures road environment data. However, it is the neural network model behind the scenes that enables the system to mimic human driving behavior and habits, which is the core of the end-to-end approach. Aion RT's intelligent driving solution is a modular design combining BEV, OCC, and Transformer. This approach is similar to mainstream technologies of the past year, resembling Huawei's ADS 2.0, early Tesla FSD, and Li Auto's NPN. The system's working principle is straightforward: external perception hardware, including LiDAR, collects images and data, which are then fed into the OCC occupancy network for 3D data reconstruction. The Transformer, based on the self-attention mechanism, correlates these features and projects radar data into a vector space to identify objects' 3D coordinates and analyze their motion trajectories. Finally, the neural network extracts features and makes judgments. OCC and BEV complement each other, as OCC can distinguish between "untouchable objects" and "touchable grids," enhancing the system's understanding of the surrounding environment. Geely's pure vision intelligent driving solution also employs OCC technology to reduce data errors and provide the neural network with comprehensive data.

Therefore, compared to Huawei's ADS 3.0, which integrates BEV into the GOD network, Aion RT's intelligent driving solution cannot be considered outdated. Huawei assigns more safety redundancy tasks to the PDP network responsible for planning and prediction. The next stage for the GOD network is to achieve a one-model form, where a single network handles everything, including perception, prediction, and execution, placing high demands on hardware configuration. Based on this logic, if the LiDAR has a low line count, the modular intelligent driving technology places the heaviest burden on the chip. This is why Aion RT uses an NVIDIA Orin-X with 508 TOPS of computing power, sufficient for handling data from a 126-line LiDAR, five millimeter-wave radars, and eleven cameras. In a way, this solution is the most suitable choice at this price point.

Xiaopeng MONA M03's AI Eagle Eye intelligent driving system relies more on high-performance cloud models. The Lofic camera enhances data acquisition accuracy in high-contrast environments. The system's logic is similar to Tesla's FSD, requiring extensive data and long-term model training to improve over time. However, the current bottleneck for pure vision technology may be insufficient data volume and cloud computing power. Tesla removed all radar sensors from FSD V12, retaining only cameras, because it has accumulated substantial databases. As of the latest data, Tesla's cloud computing power has reached 100 EFLOPS, while Xiaopeng plans to achieve only 10 EFLOPS by 2025, one-tenth of Tesla's capacity. Whether pure vision or multi-sensor technology, both are still evolving. Currently, these technologies offer similar hands-free functionality. Therefore, offering similar or better performance at the same or lower cost is undoubtedly more attractive.