Luxury with 'lice', is NIO still worth loving?

![]() 09/26 2024

09/26 2024

![]() 492

492

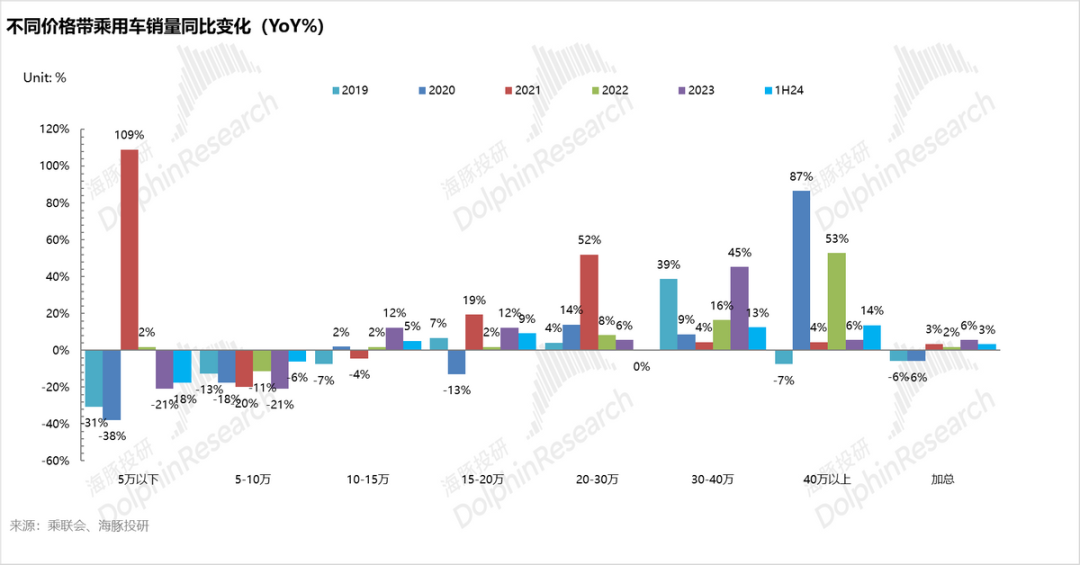

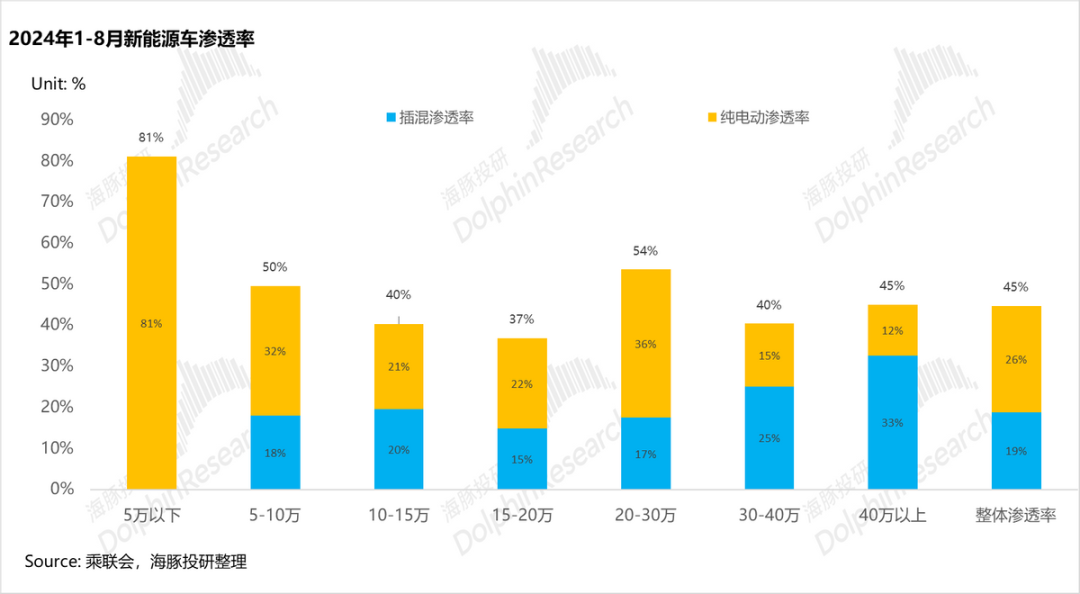

In Dolphin's previous analysis of the new energy industry, "New Energy Vehicles: A Chaotic War Among Warlords, Scattering Further, Will 2024 Be a Tragic Year?", we observed that the growth opportunities in the new energy vehicle market, primarily driven by the penetration rate, competition intensity, supply-demand match, and market size, lie primarily in two price segments: a) 50,000-200,000 yuan; b) above 300,000 yuan.

In the 50,000-200,000 yuan segment, which accounts for over half of total sales, Dolphin believes that cost-efficiency and economies of scale are key, with BYD, leveraging vertical integration, maintaining a cost advantage.

However, in the above 300,000 yuan segment, Dolphin believes that both product competitiveness and brand strength (differentiated product positioning + brand recognition) are crucial. A strong brand can enjoy pricing power while also having the flexibility to expand into lower price segments.

After the shuffle in the high-end new energy vehicle market, the landscape has stabilized, particularly in the pure electric segment above 300,000 yuan. With the descent of pure electric brands and models, NIO remains the sole player in this premium segment, facing significantly reduced competition compared to the 200,000-300,000 yuan range. Opportunities in 2025 remain promising.

Given this context, Dolphin explores NIO, a controversial company, to assess its potential for a turnaround. Dolphin's analysis will focus on the following questions:

1. Can NIO's main brand sales stabilize and continue to grow?

2. What is the growth potential for NIO's sub-brand ALTO and can it help NIO achieve break-even?

Detailed Analysis

I. Can NIO's main brand sales stabilize and continue to grow?

To answer this, let's first examine the overall market above 300,000 yuan:

a. Prestige-conscious owners prop up the high-end market

As shown in the chart below, despite overall weak sales growth in the passenger vehicle market over the past five years, vehicles priced above 300,000 yuan have resisted economic pressures, demonstrating resilience and growth potential.

The growth potential in this segment is driven by several factors:

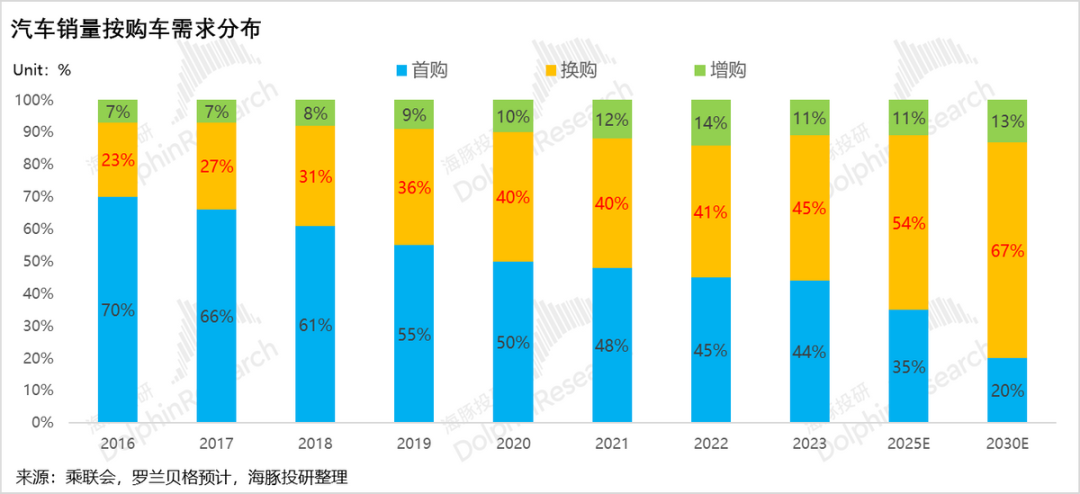

① China's passenger vehicle market is entering a maturity phase, with upgrade demand from repeat buyers:

The proportion of first-time buyers has declined, while repeat buyers have increased annually. The longer replacement cycle fuels the upgrade trend, driven by the Chinese car culture's emphasis on prestige. Over 80% of car upgraders opt for vehicles priced equal to or higher than their current ones, similar to the trend towards premium smartphones.

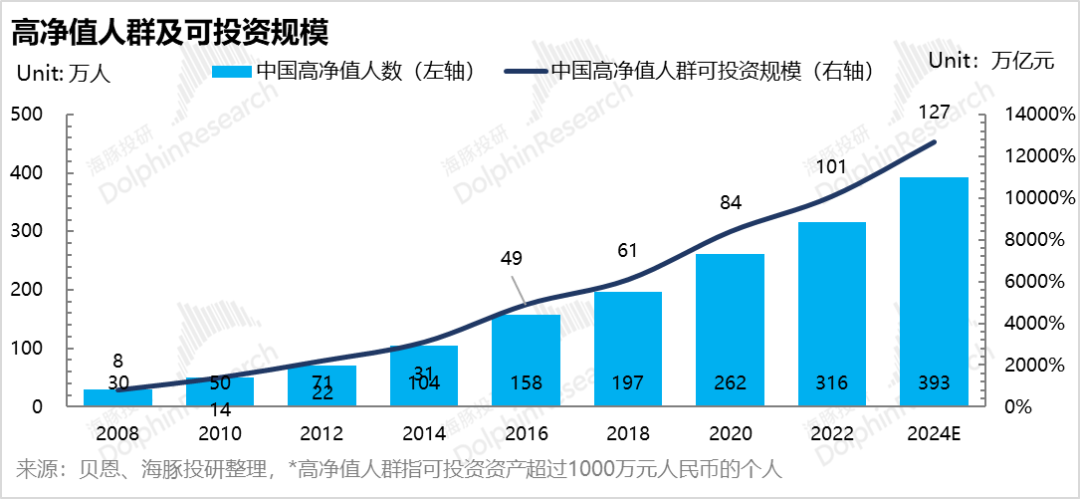

② Growing high-income population with stronger resilience to economic fluctuations:

According to Bain, the proportion of potential car buyers with a budget above 300,000 yuan has risen from 20% in 2021 to 30% in 2023, reflecting their greater resilience.

Next, let's look at the penetration rate of new energy vehicles in this price segment:

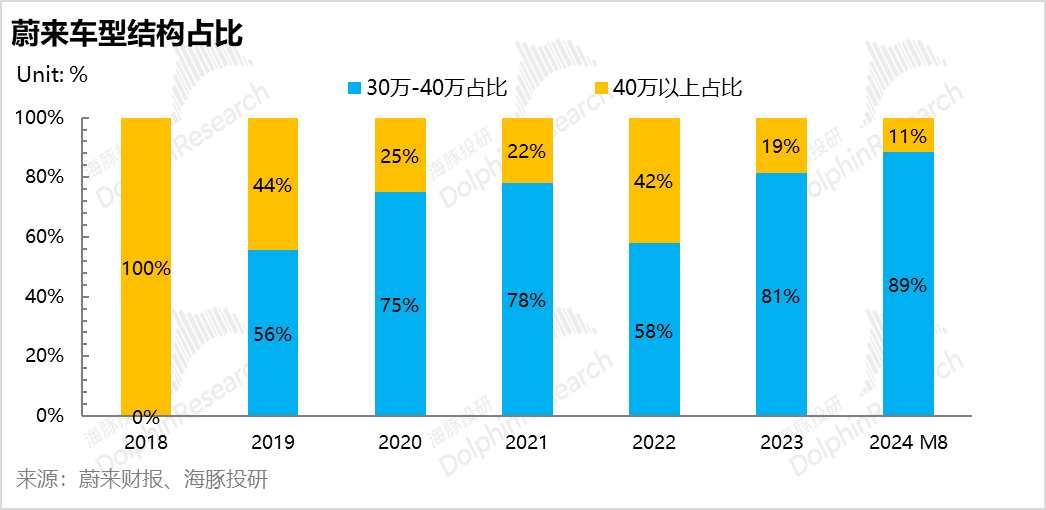

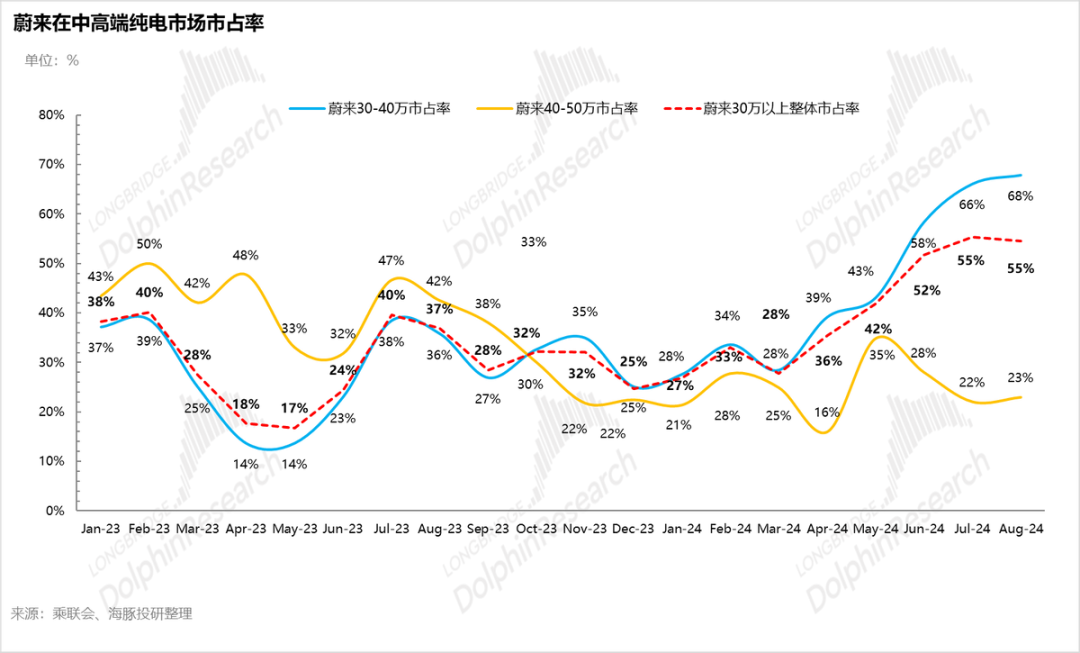

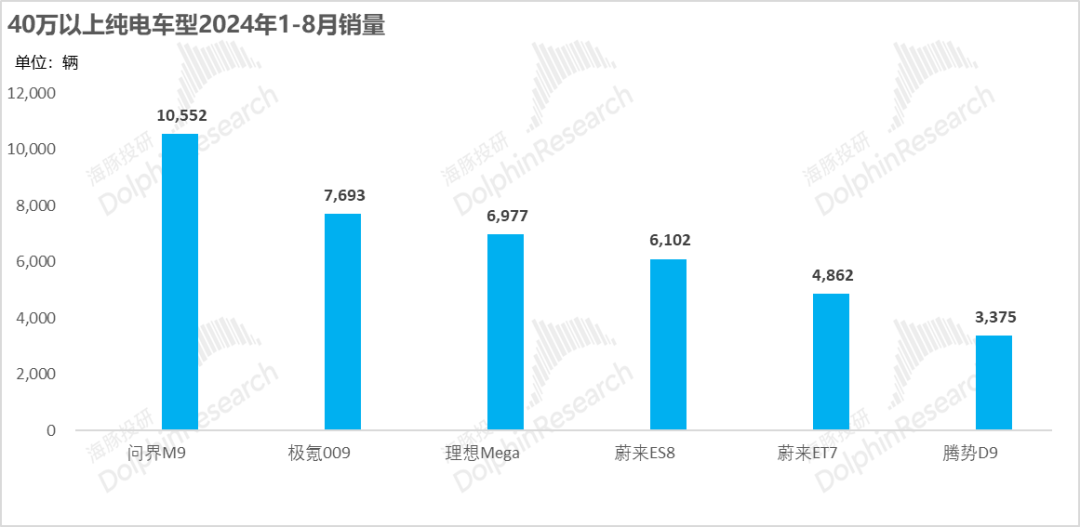

① NIO initially established a premium brand image with high-priced models (like the ES8 priced at 498,000-598,000 yuan) before expanding sales through more affordable options. Currently, NIO's primary price range has shifted to 300,000-400,000 yuan, accounting for 89% of sales in January-August 2024. Therefore, Dolphin focuses on this 300,000-400,000 yuan market.

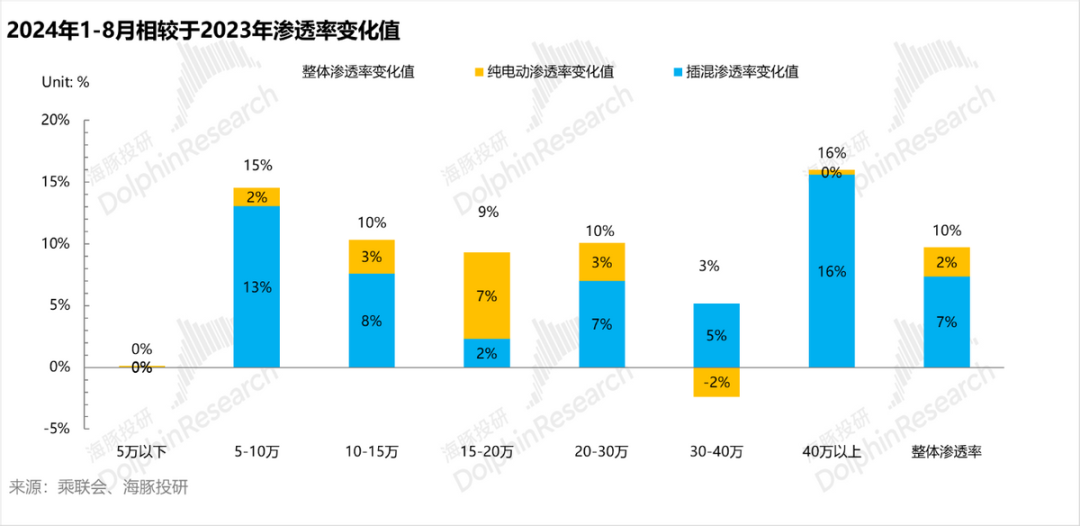

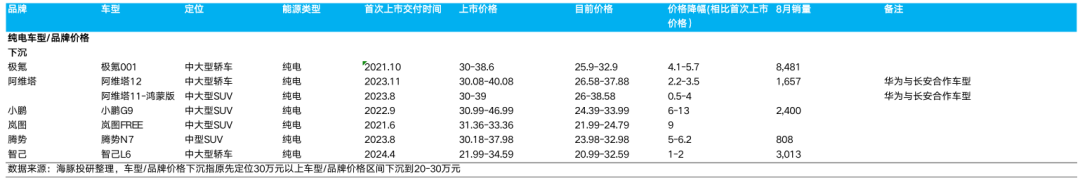

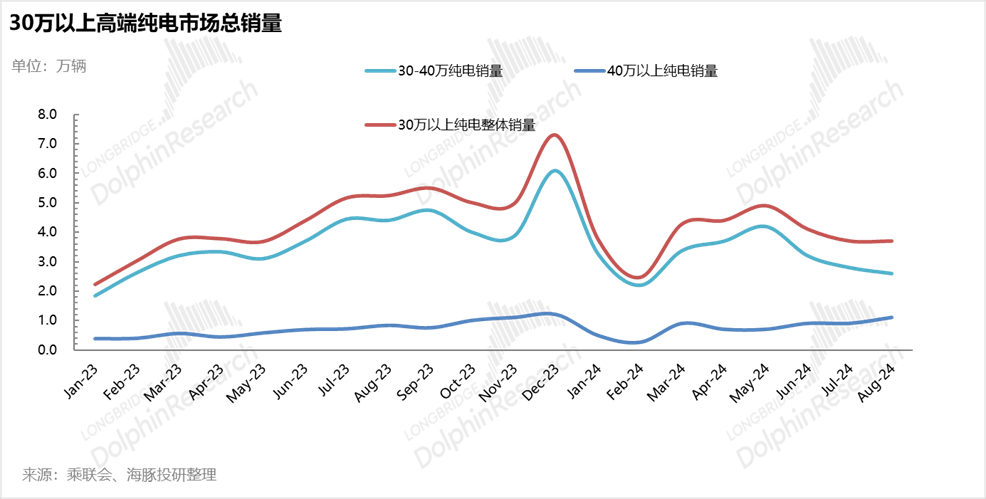

② The overall penetration rate of new energy vehicles above 300,000 yuan has reached over 40%, with limited room for further growth. However, within this segment, the growth in penetration has been driven primarily by plug-in hybrids, benefiting brands like AITO and LIXIANG. In contrast, pure electric vehicles have seen minimal growth above 400,000 yuan and even a decline in the 300,000-400,000 yuan range due to the lack of breakthrough models and price erosion strategies adopted by manufacturers to boost sales.

Despite the stagnation in the high-end pure electric market, NIO benefits as new competitors struggle to enter, and existing ones shift focus to lower price points, allowing NIO's market share to rise. Since April 2024, NIO's share in the mid-to-high-end pure electric market has surged to 55%, with an even more impressive 68% in the 300,000-400,000 yuan segment by August 2024.

The decline in overall pure electric penetration in the 300,000-400,000 yuan range, coupled with NIO's rising market share, can be attributed to two factors:

① Reduced competition as manufacturers shift focus to lower price points due to difficulties in creating breakout models in the high-end pure electric segment, which requires both product competitiveness and brand recognition.

② NIO's Battery-as-a-Service (BaaS) model, with adjusted rental fees in March 2024, has effectively boosted sales and market share, sustaining monthly sales at around 20,000 units. The adoption rate of BaaS has also risen from 20-30% to 60-70%, indicating that the rental fee adjustment is a key driver of sales recovery.

Assessing NIO's potential for sustained sales growth, Dolphin considers the following dimensions:

① NIO has established a competitive moat in the high-end pure electric segment, leveraging niche marketing, comprehensive services, and battery swapping to build brand strength.

② However, the current market space for high-end pure electric vehicles is limited, and upward mobility in brand and model structure is challenging. While NIO dominates the 300,000-400,000 yuan segment, further market share gains are constrained by the overall market decline in this price range. Expanding into the above 400,000 yuan segment is difficult due to limited market size and intense competition from hybrid and MPV models.

③ Sustained sales growth will likely depend on the expansion of the high-end pure electric market, driven by upgrade demand and a shift in consumer preferences towards pure electric vehicles. Addressing range anxiety remains a critical challenge for high-end pure electric manufacturers to compete effectively with plug-in hybrids.

But range anxiety exists in electric cars at different price ranges, so why is it so obvious in high-end pure electric vehicles?

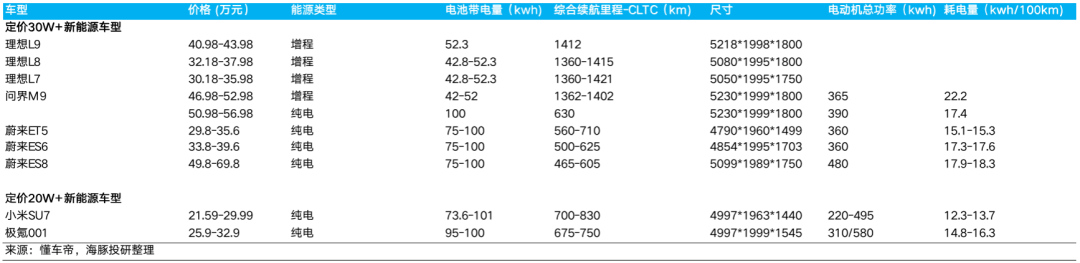

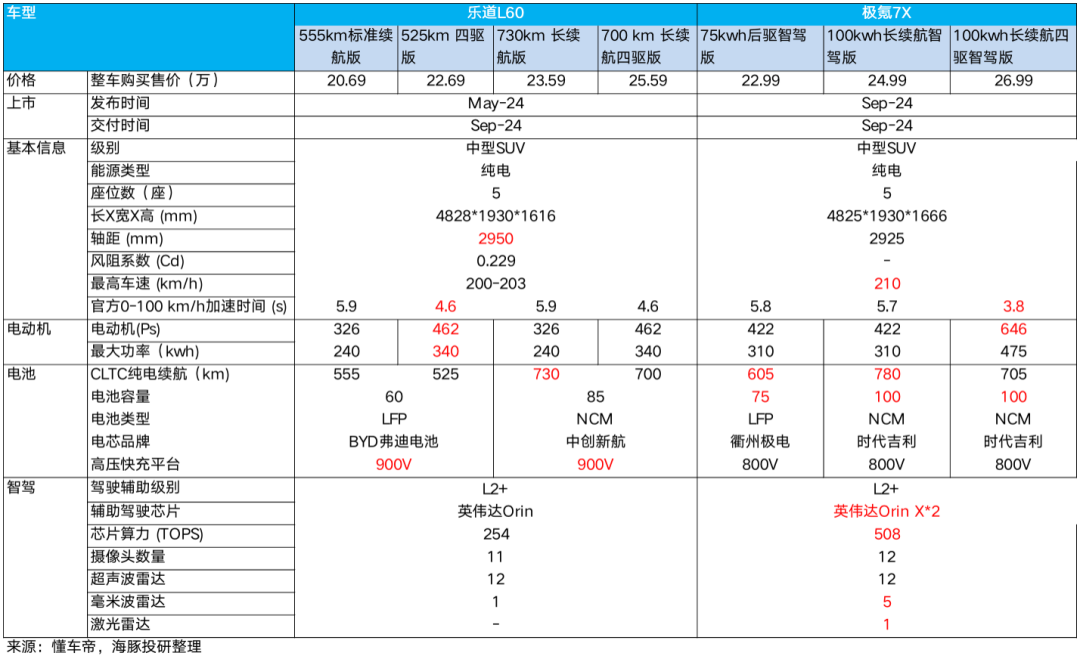

Dolphin compares the range of over 300,000 yuan pure electric models and over 200,000 yuan pure electric models and finds that even when both are equipped with large batteries (75-100kwh), the range of over 300,000 yuan pure electric models is generally lower than that of over 200,000 yuan pure electric models. The fundamental reason is that vehicles priced above 300,000 yuan generally have larger sizes and spaces, and higher motor power, which leads to higher energy consumption, resulting in a shorter driving range. Therefore, range anxiety is more pronounced in high-end electric vehicles.

However, users in the above 300,000 yuan price range have more diversified needs: they need to balance daily travel for multi-child families, outdoor off-road scenarios, high-end business receptions, etc. The range "bug" of high-end pure electric vehicles is more obvious, resulting in a narrower scope of application scenarios for high-end pure electric vehicles compared to plug-in hybrids.

Two ways to address range anxiety:

① Increase battery capacity to extend range: Currently, the upper limit of battery capacity carried by high-end pure electric models is around 100kwh. NIO's previously self-developed semi-solid-state battery has a capacity of 150kwh and a range of over 1,000 km, but due to mass production cost issues (battery cost of approximately 300,000 yuan), it is difficult to implement in the short term.

② Improve charging convenience by increasing energy replenishment infrastructure: The failure of the launch of the ideal pure electric MPV Mega can be attributed to insufficient investment in energy replenishment facilities in addition to pricing and positioning issues. (Only 300+ supercharging stations were in operation at the time of the Mega's launch).

Li Xiang also stated that high-end pure electric vehicle users do not want to spend time charging or compete for public charging stations. The best solution to these issues is the construction of supercharging stations and battery swap stations, which need to be numerous and densely distributed, and exclusive to owners of the brand's vehicles.

However, this model has inherent illogicality. Supercharging stations (especially those suitable for 800V high-power models) and battery swap stations are heavy asset investments. Increasing their number and density requires substantial upfront capital investment, which needs to be diluted through increased sales and improved asset turnover.

The high-end pure electric vehicle market is relatively niche, with a limited number of high-end pure electric vehicle owners for a single brand. It is necessary to open up third-party access to achieve break-even (as most charging stations of automakers are currently open to third parties), making it difficult to achieve exclusivity (open only to brand owners), and thus difficult to satisfy the demands of high-end pure electric vehicle owners.

However, due to the adaptability of batteries and vehicle bodies, battery swaps are more costly to retrofit and more difficult to open up to third parties. Therefore, in the early stages, battery swaps offer short recharge times and are exclusive to NIO owners, meeting the demands of high-end pure electric vehicle users. Battery swaps also provide multiple energy replenishment options for customers without home charging capabilities and extend battery life indefinitely, increasing the value of used cars, giving NIO a competitive advantage and moat in the high-end brand market.

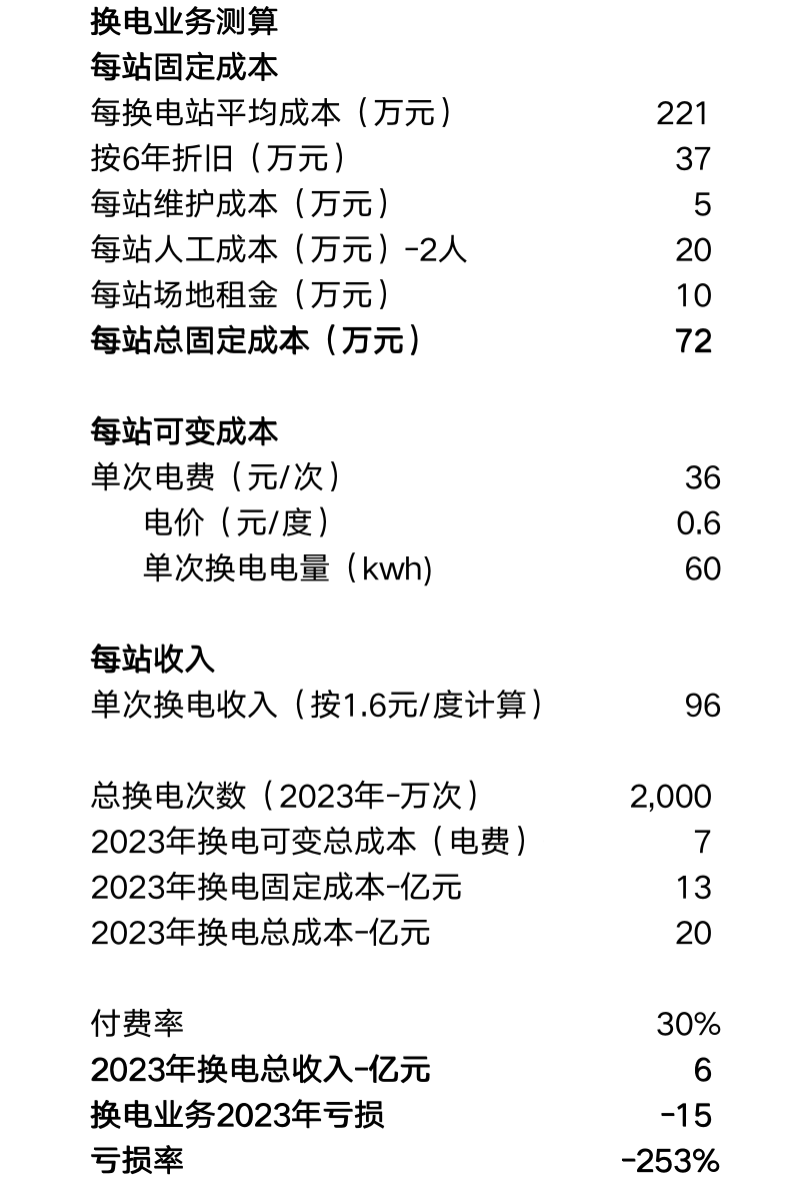

However, battery swap stations also suffer from: a) Insufficient density: The current ratio of NIO's existing models to swap stations is 228:1, and most swap stations are located in first-tier cities, resulting in insufficient density; b) Poor economics (Dolphin will calculate swap station economics later), raising doubts about the viability of the business model.

In summary, Dolphin believes that the high-end passenger vehicle market will continue to benefit from consumption upgrades, but the expansion of the high-end pure electric vehicle market will remain limited due to unresolved range anxiety in high-end pure electric vehicles. The trend of plug-in hybrids leading the penetration of high-end new energy vehicles may be difficult to reverse in the short term.

However, NIO has established certain competitive barriers in the high-end pure electric vehicle market, and Dolphin expects the main brand's sales to remain relatively stable, but significant growth is unlikely in the short term.

According to management estimates, NIO's main brand annual sales in 2025 will reach 250,000 units, equivalent to about 20,000 units per month, roughly in line with NIO's current monthly sales trend and Dolphin's assessment.

However, NIO has higher sales volume requirements for break-even compared to other similarly positioned high-end brands (such as Lixiang). NIO has previously guided that the break-even point for the NIO main brand requires monthly sales of 30,000 units and a gross margin on vehicle sales of 20%.

The reasons behind this are:

① The heavy asset model of battery swaps affects gross margin:

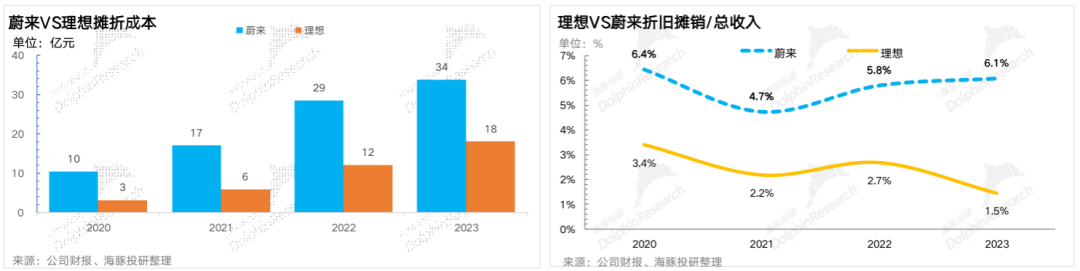

Comparing NIO and Lixiang's depreciation and amortization to total revenue, NIO's ratio reached 6.1% in 2023, 4.6 percentage points higher than Lixiang's!

The proportion of NIO's depreciation and amortization allocated to cost of sales in 2023 also reached 3.6%, significantly impacting gross margin.

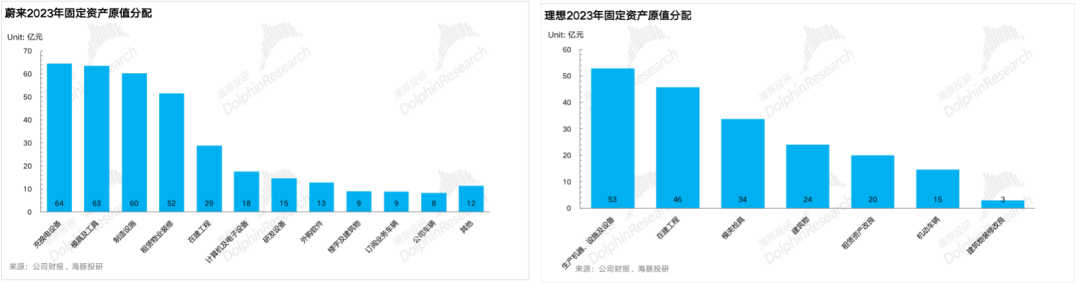

Comparing NIO and Lixiang's fixed asset structures, we can clearly see that the main difference lies in the initial investment in charging and swapping equipment. NIO's initial investment in charging and swapping equipment reached 6.4 billion yuan.

Combining the investment in charging infrastructure in XPeng's fixed assets (390 million yuan at the end of 2023 for 1,100 charging stations), we can roughly estimate that NIO's initial investment in battery swap stations reached 5.2 billion yuan (equivalent to an average initial investment of 2.2 million yuan per station vs. 350,000 yuan per XPeng charging station).

Assuming a depreciation period of 5-8 years for charging and swapping facilities, as announced by NIO, and an average of 6 years, NIO's annual depreciation for battery swap stations alone would reach nearly 900 million yuan.

However, NIO's other income from energy systems in 2023 was only 1.7 billion yuan, including revenue from the sale of charging piles and related charging and swapping services. Assuming 500 million yuan in revenue from charging pile sales (400 million yuan in 2022), revenue from charging and swapping services in 2023 was only 1.2 billion yuan.

Since NIO's charging piles are open to third-party automakers, but battery swap stations are exclusive to NIO owners, it can be inferred that most of the 1.2 billion yuan likely came from charging pile revenue, with actual revenue from battery swap services in 2023 possibly less than 600 million yuan.

Dolphin has roughly calculated that NIO's actual loss from battery swap services in 2023 may have reached 1.5-2.0 billion yuan, dragging down NIO's overall gross margin by approximately 3 percentage points.

② Establishing a high-end brand image through "comprehensive services," but resulting in difficulty in reducing sales expenses and impacting the profitability of NIO's other businesses.

Since its inception, NIO has focused on customer experience, building a brand culture through "comprehensive services" to establish a high-end positioning. However, this also leads to difficulty in reducing sales expenses and impacts the profitability of NIO's other businesses.

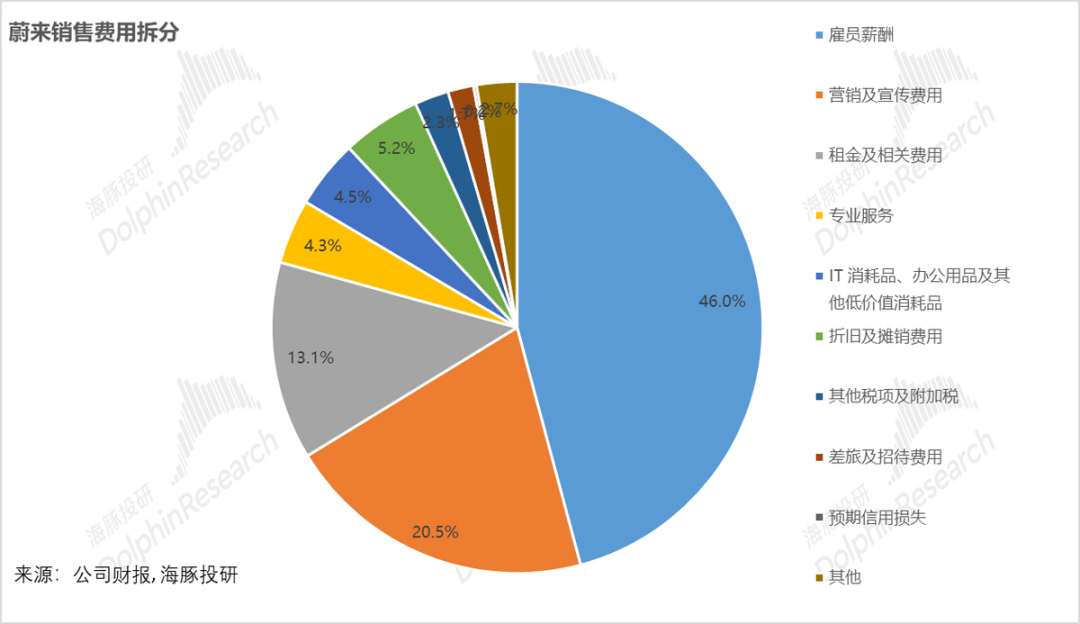

From a breakdown of NIO's sales expenses, the three largest components are employee compensation, marketing and promotion expenses, and rental expenses, accounting for nearly 80% of total sales expenses.

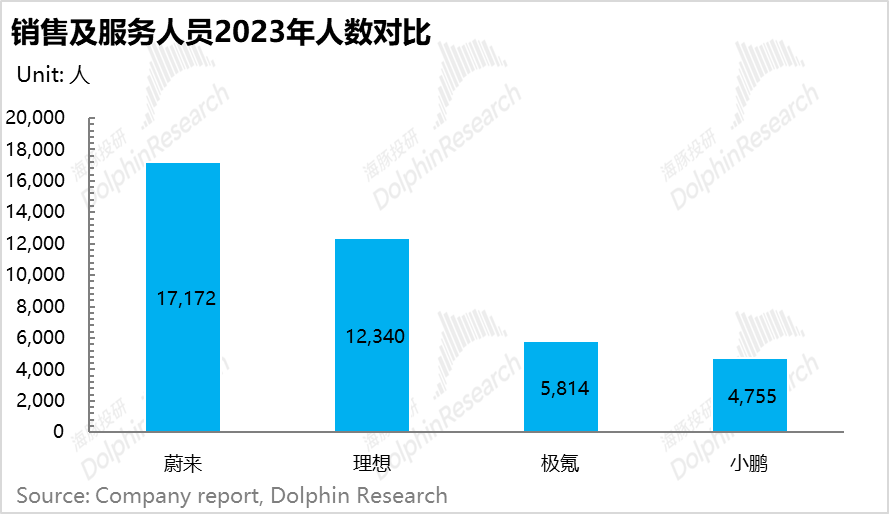

Compared to other new energy vehicle companies, NIO has a significantly larger sales force. Even when sales in 2023 were less than half of Lixiang's, NIO had almost the same number of retail stores (467 for Lixiang vs. 480 for NIO Nio house + Nio Spaces). With the same number of stores, NIO had nearly 5,000 more sales and service personnel than Lixiang and almost three times as many as Zeekr, which is also positioned in the high-end pure electric vehicle market.

While NIO has a large number of sales and service personnel, the actual number of sales consultants is not large (possibly only 5,000-6,000 at the end of 2023, according to NIO's earnings call). The real reason is that two-thirds of these personnel (almost 10,000 people) are NIO service personnel (such as Nio house service, community service, roadside assistance, battery swap station personnel, etc.).

This has two main impacts on NIO's financials:

1. Employee compensation for services directly related to NIO vehicle sales (such as Nio house service and community service) is directly included in sales expenses, making it difficult to reduce sales expenses.

2. Employee compensation for services related to other revenue streams may be included in other operating costs, which also contributes to other businesses barely breaking even, even excluding battery swap services. This is a significant difference from other new energy vehicle companies, such as Lixiang, whose other business gross margin reached 47% in 2023, and XPeng, whose other business gross margin reached 34%, positively impacting overall gross margin.

The second largest component of sales expenses is marketing and promotion expenses. As NIO is positioned in the high-end pure electric vehicle market, it naturally spends more on new vehicle promotion.

The third largest component of sales expenses is rental and related expenses. NIO's sales channels adopt a direct sales model, with two types of channels: Nio House and Nio Space. Nio House, initially established as NIO's offline experience stores, provides ample space for various functions in addition to showroom displays, serving as NIO's "facade" for building a high-end brand image offline. NIO Space is smaller and more focused on sales.

Two significant expenses in creating this high-end "facade" are renovation costs and rental expenses, both of which are high for NIO:

Comparing NIO and Lixiang's rental property renovation costs, NIO's renovation costs reached 5.2 billion yuan at the end of 2023, while Lixiang's was only 2.0 billion yuan and XPeng's was only 700 million yuan (most stores are franchised).

In addition to renovation costs, NIO's rental costs per store also reached nearly 3 million yuan, accounting for 13% of sales expenses in 2023 and difficult to reduce.

③ Other reasons

NIO has certain disadvantages in vehicle manufacturing costs due to its model positioning. Lixiang, positioned in the high-end range-extended electric vehicle market, has overall lower manufacturing costs due to the use of range-extension technology that does not require large batteries. At the same time, high-end plug-in hybrids have a larger market space, and sales volumes have a certain scale effect, pushing up vehicle manufacturing gross margins.

In contrast, NIO's pure electric models place more emphasis on "stacking materials," such as equipping all models with four NVIDIA Orin X chips (most competitors equip two), resulting in higher manufacturing costs.

The high R&D expenses are due to NIO's previous diverse R&D directions, such as mobile phones, autonomous driving chips, solid-state batteries, and in-vehicle smart hardware. However, after layoffs, R&D directions have been streamlined, with a focus on new models and autonomous driving research and development (NIO's self-developed autonomous driving chip will soon be equipped on the NT3.0 platform), roughly on par with Lixiang in terms of scale.

It can be seen that while NIO has established a high-end pure electric brand image through "premium services" and "battery swaps" in the early stages, this has also imposed a significant "burden" on NIO's financials, requiring higher sales volumes to dilute upfront capital investments and leverage expense reductions.

With it being difficult for NIO's main brand sales to increase significantly in the short term, NIO's second brand, "LeDao," was born.

2. Can NIO's sub-brand LeDao drive NIO towards break-even?

As NIO's second brand, LeDao targets the 200,000-300,000 yuan price range. Although this price range has a high penetration rate and intense competition in pure electric vehicles, with 800V+ standard autonomous driving products concentrated in this segment, and both newly launched pure electric models and high-end brands' downward extensions focusing on this price range, LeDao still has differentiated advantages:

1) Brand equity advantage from brand de-escalation: Compared to brands like Zero Run, XPeng, and BYD, which have attempted brand escalation but were ultimately constrained by brand value, resulting in mediocre sales of their high-priced models, automakers that de-escalate their brands, such as Lixiang with the L6 and Zeekr with the price de-escalation of the Zeekr 001, have achieved greater success in sales performance due to their brand value and high R&D investment-driven product capabilities.

2) Entry into the pure electric SUV segment: Looking at the top-selling models in the 200,000-300,000 yuan price range, there is a lack of pure electric SUVs besides the Tesla Model Y, indicating room for growth in this segment for pure electric SUVs.

3) Price advantage: The starting price of LeDao L60 is only 206,000 yuan, 20,000-40,000 yuan lower than direct competitors like the Zeekr 7X and Model Y. Under the BaaS model, the starting price of LeDao is only 149,900 yuan, lower than market expectations. The BaaS model directly lowers the barrier to entry for car buyers, effectively stimulating demand from those with a budget of only 150,000-200,000 yuan.

4) Unique energy replenishment advantage: LeDao L60 will support both 900V high-voltage fast charging and battery swaps, with access to over 1,000 battery swap stations and over 25,000 NIO-owned charging piles nationwide. The experience of 900V high-voltage fast charging and battery swaps is a differentiating highlight of LeDao L60 in the 200,000 yuan segment.

NIO is optimistic about the sales prospects of this vehicle and expects total deliveries of LeDao to reach 20,000 units in the fourth quarter of this year, with monthly sales climbing to 10,000 units in December. In 2025, LeDao will also launch a mid-to-large SUV (expected to be delivered in the third quarter). Management expects LeDao's annual sales to reach 120,000 units in 2025, complementing NIO's struggling primary brand sales.

The launch of LeDao will also create synergies within NIO's operations:

1) Both LeDao and NIO's next-generation models use the NT3.0 platform, allowing for shared components and economies of scale, thereby improving NIO's gross profit margin in vehicle sales.

2) LeDao attracts more users who will utilize NIO's services and battery swapping, accelerating the reduction of losses in other service revenue streams.

3) From a cost perspective: The introduction of LeDao adds minimal new operational expenses for NIO. Research and development costs for LeDao's NT3.0 platform are shared with NIO's primary brand, and LeDao L60 is a product of the primary brand's research and development achievements. Sales expenses are primarily related to channel expansion and increased sales personnel. However, as LeDao focuses more on expanding into second- and third-tier cities, both store renovation and rental costs are relatively low, making the additional sales expenses manageable. Nevertheless, there is a leverage effect based on increased sales, resulting in lower operating expense ratios.

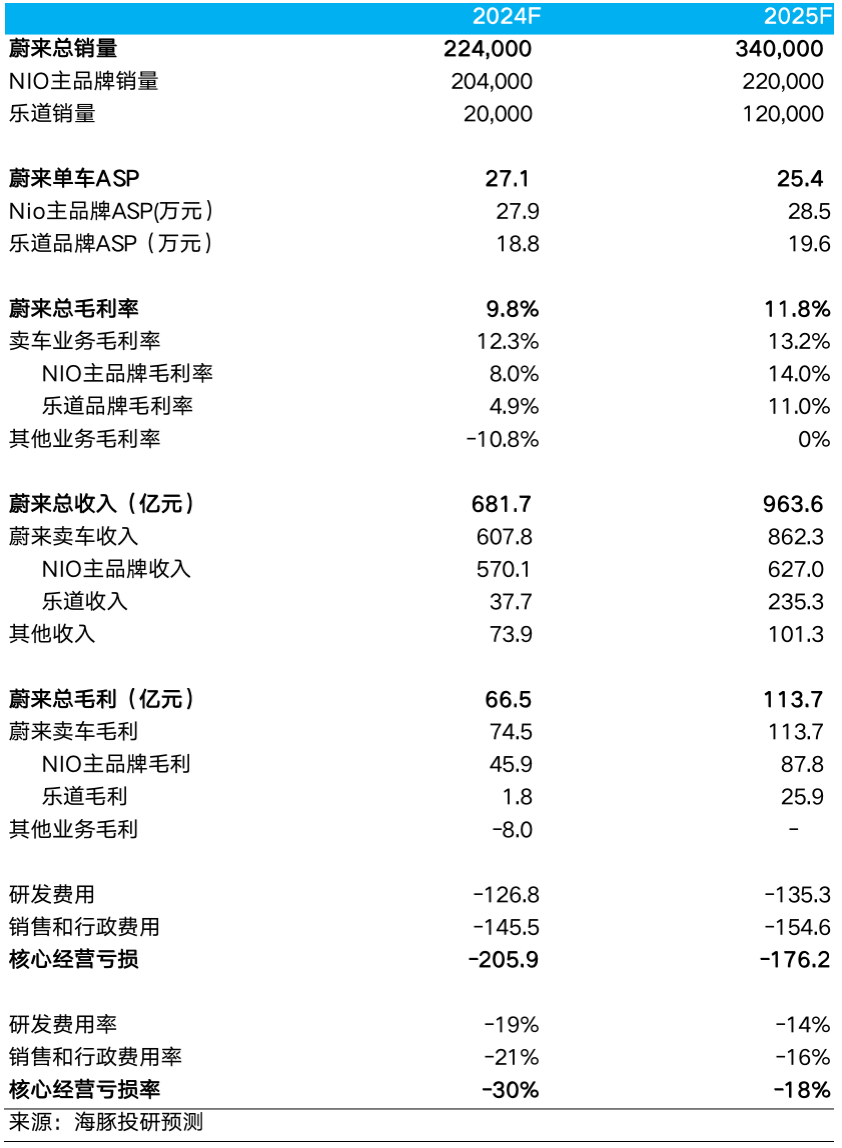

Even with these synergies, Dolphin Insights estimates that 2025 will not be the year NIO achieves profitability.

Although NIO's operating losses in 2025 will narrow compared to 2024, they will still amount to approximately RMB 17-18 billion. As gross profit margins improve and operational expense leverage effects are realized, the operating loss ratio is expected to narrow from -30% in 2024 to -18% in 2025.

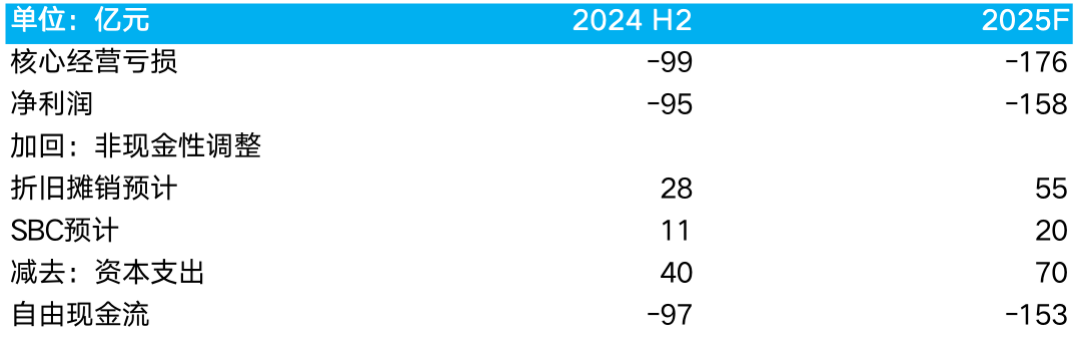

Given NIO's significant operating losses in 2025, calculating its cash flow burn rate becomes crucial. As of Q2 2024, NIO had RMB 41.6 billion in cash on hand. Based on Dolphin Insights' projected free cash flow burn rate, approximately RMB 25 billion in free cash flow is expected to be consumed from the second half of 2024 to the end of 2025. This suggests that NIO's current cash reserves should last until at least 2026-2027, indicating robust cash liquidity and that NIO has emerged from the depths of a distressed valuation.

Currently, NIO's share price reflects a 2024 P/S ratio (considering only vehicle sales) of 1.3-1.4x, but the corresponding 2025 P/S ratio is only 0.9-1x. While this valuation appears relatively reasonable, the risk of commercialization success remains high given the significant capital investment. Therefore, a sufficient margin of safety is essential. Dolphin Insights believes that for companies like NIO, investment opportunities lie in marginal reversals when valuations hit bottom (e.g., when the 2024 P/S ratio drops to 1x), provided cash flow security is relatively assured.

Previous NIO Research:

Financial Reports: September 5, 2024 - Financial Report Analysis: "NIO: Surprisingly Resilient, LeDao Propels the Future?" June 7, 2024 - Financial Report Analysis: "Sales Return, But Share Price Collapses: What Can Save NIO?" August 29, 2023 - Financial Report Analysis: "NIO: A Quarterly Loss of RMB 6 Billion? Stay Calm, Hope Isn't Far" June 9, 2023 - Financial Report Analysis: "NIO: Reflection Matters More Than Selling Cars" March 2, 2023 - Financial Report Analysis: "Too Many Ideas, Poor Execution: How Much Trust Does NIO Have Left?" November 10, 2022 - "NIO: When Pricing Is Pessimistic Enough, How Damaging Can a Failed Test Be?" September 7, 2022 - Financial Report Analysis: "Don't Let the Huge Losses Scare You, NIO Is Approaching Better Days" June 9, 2022 - Q1 Financial Report Analysis: "NIO Still Soft, Can New Cars Provide Confidence?" March 25, 2022 - Q4 2021 Financial Report Commentary: "Under Pressure, Will NIO Face Further Darkness or Dawn?" November 10, 2021 - Q3 2021 Financial Report Commentary: "After a Steep Decline, Will NIO Bounce Back in the First Half of Next Year?" August 12, 2021 - Q2 2021 Financial Report Commentary: "Beyond the Boom, What Drives NIO's Future?" August 15, 2021 - Q2 2021 Outlook Update: "NIO: High Valuation vs. Low Deliveries, Beware of the Illusion of 'Future'" Research: December 21, 2021 - NIO NIO DAY Research: "The 'Blockbuster' ET5 Arrives, Reigniting NIO's 'Future'" In-Depth: June 9, 2021 - Part 1 of a Comparative Study of Three Upstarts: "New Auto Forces (Part 1): Betting on the Right People and Strategies" June 23, 2021 - Part 2: "New Auto Forces (Part 2): As Enthusiasm Fades, What Solidifies the Position of These Upstarts?" June 30, 2021 - Part 3: "New Auto Forces (Part 3): Doubling in 50 Days, Can These Upstarts Continue Their Momentum?"