BMW goes back on its word? Price cuts follow broken promises

![]() 09/25 2024

09/25 2024

![]() 587

587

In the Chinese automotive market, once the price war was raging fiercely. Due to intense competition, BMW took the lead in announcing its withdrawal from the price war, claiming to free up dealers and so on. However, after only a few months of implementation, BMW has now reignited the price war. The reason is simple: sales are dismal, and there is little room for sales without price cuts.

At one point, some international automakers also followed BMW's strategy and withdrew from the price war. But now that BMW has made a U-turn, one wonders what these international automotive giants are thinking? How could they be so shameless? They promised to resist the price war, create a relaxed marketing environment, free up dealers, maintain brand value, provide the best service to service providers, and maintain brand awareness. Yet here they are, going back on their word.

In the face of sales pressure, everything else becomes insignificant. Ultimately, the ability to sell products is what matters most. This may be the reason why BMW has gone back on its promise. It is reported that BMW has reduced the prices of several of its popular models. A salesperson at a 4S store said, "The current discounts on car orders are indeed larger than last month, but not as much as in June. For example, the bare car price of the i3 can reach around 190,000 yuan, and the specific price can be negotiated further. However, it's unlikely that prices will drop to June levels because there are no more cars available. Next month, the new models of the i3 and 3 Series will be released, and the prices at launch won't be as low."

In addition to the i3, discounts are also available for the 3 Series, 5 Series, 7 Series, and other models, albeit to varying degrees. However, the discounts for pure electric vehicles are even more substantial. For example, on an automotive information platform, the original price of the i7 is 1.459 million yuan, but domestic 4S stores have offered discounts of up to 38%, with some offering reductions of over 500,000 yuan. It is reported that this is because "there are not many i7 vehicles available, and most of the inventory has been sitting for a long time, leading to larger discounts."

When discussing BMW's return to the price war, dealers commented, "You can just take a look at the news online. BMW has been trending on search engines for a while now. The recent price drops are due to our high sales targets at the end of the month, so we're offering larger discounts to reach those targets. The targets haven't been met yet, so we're willing to negotiate on prices. Another reason is that models like the i3 and 3 Series are clearing out inventory before the new models come out in October, so prices won't be as low then." In essence, there's still sales pressure, and only when prices become more flexible do consumers start inquiring and potentially making purchases.

Traditional luxury car brands like BMW and Mercedes-Benz have experienced varying degrees of decline in the Chinese market. Data shows that BMW sold 34,846 new vehicles in August, a decrease of 14,092 units from the previous month. Mercedes-Benz sold 49,560 units in August, roughly the same as the previous month. Audi sold 47,900 units in August, an increase of 2,667 units from the previous month. When direct competitors can achieve good sales, BMW obviously feels the pressure, which is a direct reason for the price flexibility.

Data shows that BMW Group delivered a total of 1.213 million new vehicles globally (including BMW, MINI, and Rolls-Royce) in the first half of 2024, a year-on-year decrease of 0.1%. Among them, China was the market with the largest decline in sales for BMW Group, with a total of 376,400 vehicles delivered, a year-on-year decrease of 4.3%. However, even so, China remains BMW Group's largest single market globally, accounting for 31% of its total global sales. If China is "lost," it would have a significant impact on BMW's global performance, which is why BMW is adjusting prices to seek sales growth.

Regarding the pressures faced in the Chinese market, BMW Group stated that BMW and its peers are under pressure in the Chinese market, as local Chinese automakers are gaining market share with their lower-cost electric vehicles, forcing their European competitors to slash prices significantly. In May of this year, BMW introduced a new policy to unshackle prices. Subsequently, prices of many BMW models plummeted, particularly those in the pure electric series such as the i3 and ix3. Once luxury brands, they could now be purchased for less than 200,000 yuan. BMW's price war has, to some extent, stimulated an increase in sales.

However, by the end of June, BMW gradually withdrew from the price war. BMW China officially responded that in the second half of the year, BMW will focus on business quality in the Chinese market and support dealers in their steady progress. As a result, BMW dealers reduced their terminal price promotions and increased the prices of individual vehicles. Nevertheless, within less than three months, BMW once again challenged prices, clearly indicating severe sales issues. From engaging in the price war to withdrawing and then returning, BMW has repeatedly gone back on its word due to the intense competition in the Chinese market. In particular, the decline in sales has made dealers anxious about pricing strategies.

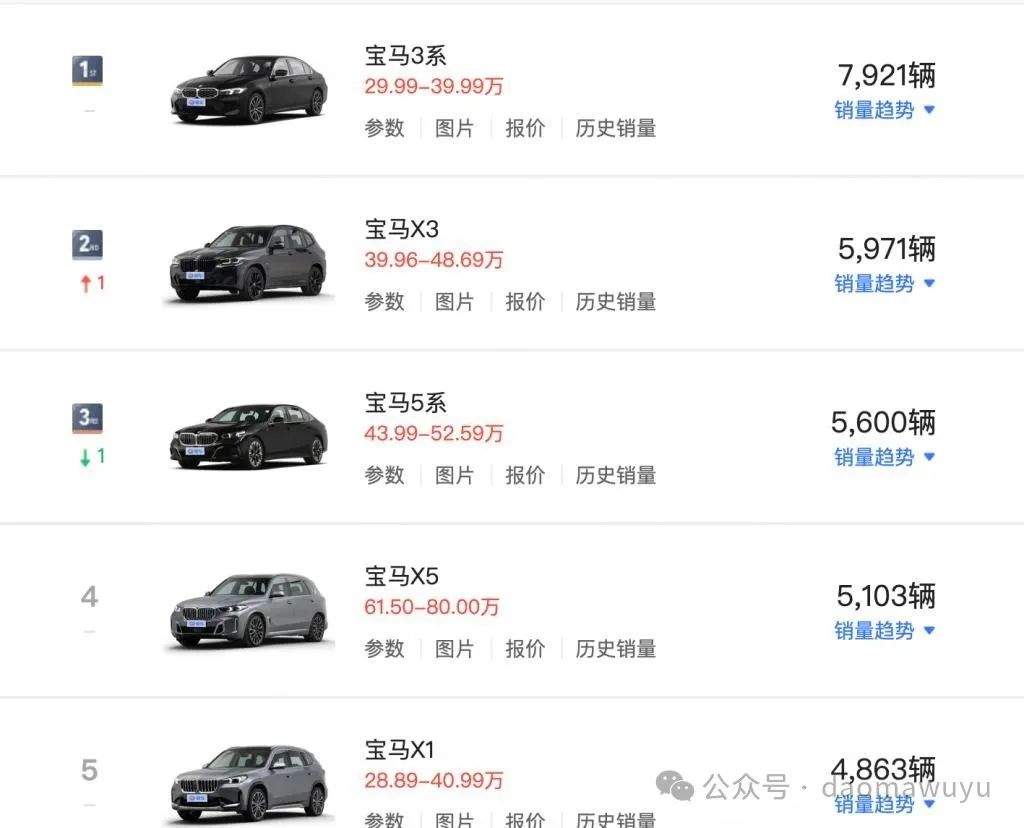

Amidst increasingly fierce competition in the luxury car market, BMW's sales in August nearly halved. As a result, BMW has returned to the price war, with terminal prices of multiple models plummeting. For example, the official guide price of the BMW 3 Series ranges from 299,900 to 399,900 yuan, while dealer prices range from 216,000 to 288,000 yuan, offering discounts of 80,000 to 110,000 yuan. The official guide price of the BMW 5 Series ranges from 439,900 to 525,900 yuan, with dealer prices ranging from 319,900 to 405,900 yuan, offering discounts of around 120,000 yuan. The market generally believes that BMW's return to the price war is related to factors such as plunging sales, market pressure, the failure of previous price hikes, and intense market competition.

As we all know, Chinese automakers are gaining market share with their lower-cost electric vehicles. It can be said that BMW is in a dilemma. If it continues to engage in the "price war," it will undoubtedly erode its brand value and affect its profit margins. However, if it does not adopt an aggressive pricing strategy, it will struggle to effectively defend its market share, leading to sustained downward pressure on sales. This situation poses a severe challenge for BMW. While price cuts may compress brand profit margins, they are an effective means of boosting sales and maintaining market share.

It is well-known that price competition is not a long-term solution. To maintain brand competitiveness in a price war, breakthroughs must be made in new technologies and products. In the Chinese market, the rise of new automotive forces and the gradual maturity of Chinese new energy vehicle brands have gained recognition from consumers, especially with their technological innovation and cost-effective advantages, rapidly occupying the market and posing a threat to traditional automotive giants. For BMW to survive better in the Chinese market, it needs to increase investment in new energy technologies, enrich its product line, and adapt to the increasingly stringent global market environment.