Xiaomi's key to replacing "NIO, Xpeng, and Li Auto" lies in the battle for extended-range SUVs?

![]() 07/10 2024

07/10 2024

![]() 620

620

Xiaomi hasn't even released its second car yet, but details about its third model have already surfaced.

Recent reports from multiple sources indicate that Xiaomi's current product plan is to launch one car per year from 2024 to 2026. In addition to the already released pure electric sports sedan Xiaomi SU7, the 2025 model will be a pure electric SUV, spy shots of which have been exposed multiple times, resembling the Ferrari Purosangue in appearance.

Compared to the first two models, Xiaomi's third car, set to debut in 2026, will undergo significant changes in both design and powertrain. It is rumored that the car underwent two design revisions during the pre-research stage, highlighting Xiaomi's emphasis on this model. It could even be the cornerstone of Xiaomi's position among the top three new-energy vehicle makers, alongside NIO, Li Auto, and HarmonyOS Smart Mobility.

Since 2024, Xiaomi Automotive has garnered significant attention, but its competitors are no slouches: Li Auto and HarmonyOS Smart Mobility have monthly deliveries exceeding 40,000 units. While Xiaomi SU7 has performed well as a single model, there is still a significant gap between them.

So, the question arises: Can this drastic reform of Xiaomi's third car propel it to new heights in the automotive market?

Three Major Changes: Xiaomi's New Car Becomes "Alternative"

While not much information has been revealed about Xiaomi's third car, three key details have been preliminarily confirmed.

Firstly, the powertrain. Xiaomi's first two cars used pure electric powertrains, but the third will adopt extended-range technology. The downside of this technology is increased travel costs, but the upside is that it alleviates users' range anxiety. In an era where 4C and 5C charging stations are not yet widespread, the extended-range solution can simultaneously meet users' demands for power, range, and intelligence.

Li Auto and AITO (under HarmonyOS Smart Mobility), the top two brands among new-energy vehicle makers in terms of sales, have achieved their current success by relying on extended-range SUVs and intelligence. Among AITO's M5/7/9 models, the M9 sold 1,391 pure electric units in May 2024, while extended-range versions sold 14,936 units, a difference of over tenfold. In June 2024, the M7, which has no pure electric version, sold 18,493 units, becoming AITO's top-selling model.

Xiaomi has made significant achievements in the field of intelligence and will place even more emphasis on it with its second and third cars. By incorporating an extended-range powertrain, Xiaomi may be able to achieve another breakthrough in sales.

Secondly, the car's design. Reports indicate that Xiaomi's extended-range SUV will offer users greater freedom, allowing certain automotive-grade components not related to safety functions to be replaced with consumer electronics-grade hardware. In fact, we have already seen Xiaomi's exploration of the "DIY car" business model with the SU7, where hardware such as physical buttons for the center console screen, car microphones, smart dual dials, and tablet brackets for seat backs are offered as options.

Based on this business model, Xiaomi Automotive can reduce some configurations to lower manufacturing costs, thereby benefiting consumers while also giving users greater customization options.

By allowing users to freely purchase and combine hardware unrelated to safety, Xiaomi's extended-range SUV can enable consumers to replace only certain hardware when certain intelligent configurations become "outdated" rather than considering replacing the entire car, thus reducing the frequency of car replacements and saving users money.

Finally, the price. Sources indicate that Xiaomi's extended-range SUV may be priced around 150,000 yuan, serving as a volume model. By switching from a pure electric powertrain to an extended-range one and significantly reducing battery capacity, Xiaomi can significantly lower overall vehicle costs. Additionally, some hardware unrelated to safety can be freely swapped and may become optional, further reducing costs.

After extreme cost compression, Xiaomi's extended-range SUV will be priced below 200,000 yuan, making the product undoubtedly more competitive.

Furthermore, Xiaomi has invested in nearly 50 companies in the automotive field, enabling it to provide DIY hardware to users at lower prices. If the DIY car model succeeds, Xiaomi car owners will have abundant customization options, giving Xiaomi Automotive a unique competitive advantage and the confidence to challenge brands like Li Auto, HarmonyOS Smart Mobility, and NIO.

Comparing Endurance: Xiaomi's Matrix Urgently Needs Enrichment

As the new-energy vehicle industry has developed, a divide has gradually emerged among new-energy vehicle makers. Currently, Li Auto and HarmonyOS Smart Mobility rank at the top, with monthly sales exceeding 40,000 units, leaving a significant gap with other new-energy vehicle makers. NIO and Zero Run belong to the second tier, with monthly sales of around 20,000 units, demonstrating healthy development. Other new-energy vehicle makers belong to the third tier and still need blockbuster products to boost sales.

Among these new-energy vehicle makers, Xiaomi is unique because it has only one product. However, within 24 hours of its launch, Xiaomi SU7 received 88,898 large orders, and a few days later, large orders exceeded 100,000 units, demonstrating the product's popularity.

Previously, Lei Jun and Lu Weibing stated that Xiaomi Automotive's goal for this year is to deliver 100,000 vehicles, with an ambitious target of 120,000 vehicles. To achieve this goal, Xiaomi has continuously increased production capacity and finally achieved its first monthly delivery of over 10,000 vehicles in June.

However, for automakers, the key points are not just current order volumes and delivery capabilities; the ability to continuously receive new orders is equally important. The existence of new orders is a sign of normal development for automakers. For example, AITO and Li Auto currently receive about 40,000 vehicle orders each month, allowing them to confidently maximize production capacity without worrying about a lack of orders after completing production.

According to auto blogger Sun Shaojun, Xiaomi SU7 received over 10,000 orders in June 2024. Although this number pales in comparison to giants like Li Auto and AITO, considering that Xiaomi's first product has only been on the market for a few months and it currently has only one product, this order volume is not bad.

When Xiaomi's second model, a pure electric SUV, and its extended-range SUV in 2026 are launched next year, Xiaomi Automotive's product line will gradually become richer, offering consumers more choices and potentially ushering in a wave of sales growth.

As an SUV with extended-range technology, Xiaomi Automotive, having chosen the right track, will challenge the top three positions among new-energy vehicle makers. Xiaomi's extended-range SUV also has a core competitive advantage: a lower price. While HarmonyOS Smart Mobility and Li Auto are also targeting the lower-end market, they are unwilling to launch products priced below 200,000 yuan, both to maintain higher profit margins and to preserve their premium positioning.

At last month's 16th China Automotive Blue Paper Forum, Yu Chengdong, Chairman of Huawei's Intelligent Automobile Solutions BU, stated that HarmonyOS Smart Mobility does not currently have the capability to produce products priced below 200,000 yuan, as doing so would result in significant losses.

HarmonyOS Smart Mobility and Li Auto's reluctance to do so presents an opportunity for Xiaomi Automotive. Some even believe that Xiaomi has already secured a ticket to become one of the top three new-energy vehicle makers.

Competing for Market Share: Intelligence Cannot Be Neglected

In terms of production capacity and new order volumes, the young Xiaomi Automotive has stabilized its position and is growing rapidly. However, having a ticket does not equal success. Other new-energy vehicle makers such as Zero Run, NIO, Xpeng, and Nezha have also long coveted the top three positions.

Domestic sales of new-energy vehicles have gradually slowed down this year, especially for pure electric vehicles, with year-on-year growth of only 17.5% from January to May, indicating that the market has entered a bottleneck period. Coupled with the transformation of established automakers and the efforts of new-energy vehicle makers, competition in the industry has become increasingly fierce. Xiaomi Automotive, which entered the market late, has lost the first-mover advantage, and even with the influence of Lei Jun and Xiaomi, achieving a sales breakthrough will not be easy.

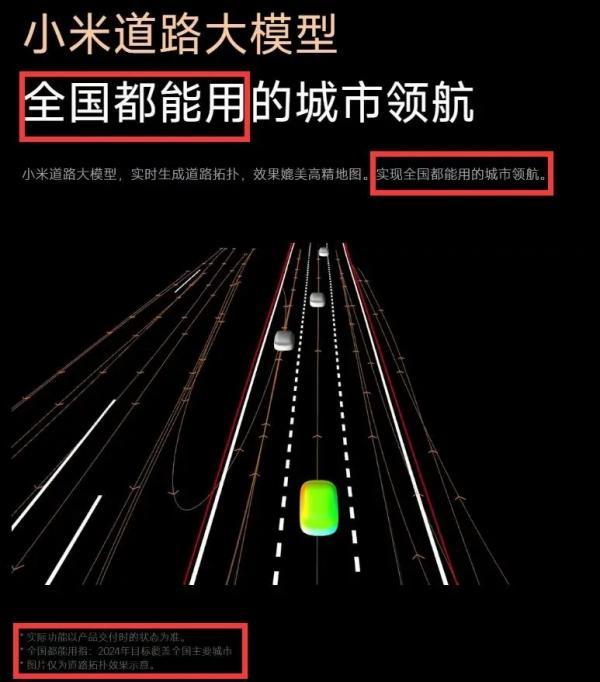

Additionally, in terms of intelligent driving, although Xiaomi has announced that its intelligent driving features will be available nationwide by the end of this year, it still follows the old practice of using small font to indicate that "nationwide availability refers to covering major cities in China in 2024." In contrast, HarmonyOS Smart Mobility has already achieved nationwide availability, and both Xpeng and Li Auto have launched advanced intelligent driving features available nationwide. This suggests that Xiaomi's intelligent driving technology may lag behind that of HarmonyOS Smart Mobility, Li Auto, and Xpeng by one level.

With the help of Xiaomi's brand influence and the price advantage of its extended-range SUV, Xiaomi Automotive is expected to achieve a sales breakthrough in 2026. However, as advanced intelligent driving features gradually become ubiquitous and L3 commercialization is on the horizon, Xiaomi needs to upgrade its intelligent driving capabilities as soon as possible.

Xiaomi's path to becoming a giant will not be smooth sailing. Relying on the influence of Lei Jun and the Xiaomi brand can achieve temporary victories, but to achieve long-term success, the quality of Xiaomi's products is more important. Xiaomi needs to highlight its core competitiveness while ensuring that its main functions and configurations do not lag behind.

Whether Xiaomi's intelligent driving features can catch up with the first tier as soon as possible is the first hurdle Xiaomi Automotive faces. Whether the DIY car business model can succeed is the key for Xiaomi Automotive to make up for its lack of "unique" core competitiveness.

Facing the fierce competition in the automotive industry, Xiaomi Automotive has made choices in terms of powertrain and business model. Now, it needs time to validate Xiaomi's technological research and development capabilities and business model acumen. After years of hard work in the mobile phone and internet industries, we eagerly await to see whether Xiaomi can carve out a niche for itself in the automotive industry.

Source: LeiTech