Why Automakers Hesitate to Label Their Systems as L3 Intelligent Driving?

![]() 04/24 2025

04/24 2025

![]() 512

512

On April 22, Jin Yuzhi, CEO of Huawei's Intelligent Automobile Solution BU, officially unveiled Huawei's latest intelligent assisted driving system, ADS 4, at the Huawei Kunlun Intelligent Technology Conference. This system supports large-scale commercial deployment of high-speed L3 capabilities. Intriguingly, automakers have been reluctant to use the term L3 when promoting their autonomous driving features, preferring instead to coin terms like "L2+", "L2++", and "L2.9". These terms emphasize that while the system may exhibit some L3-like capabilities, the driver still needs to continuously monitor and be ready to take over control at any time. So, why don't automakers boldly promote their systems as L3?

Analyzing from the Perspective of Autonomous Driving Standards

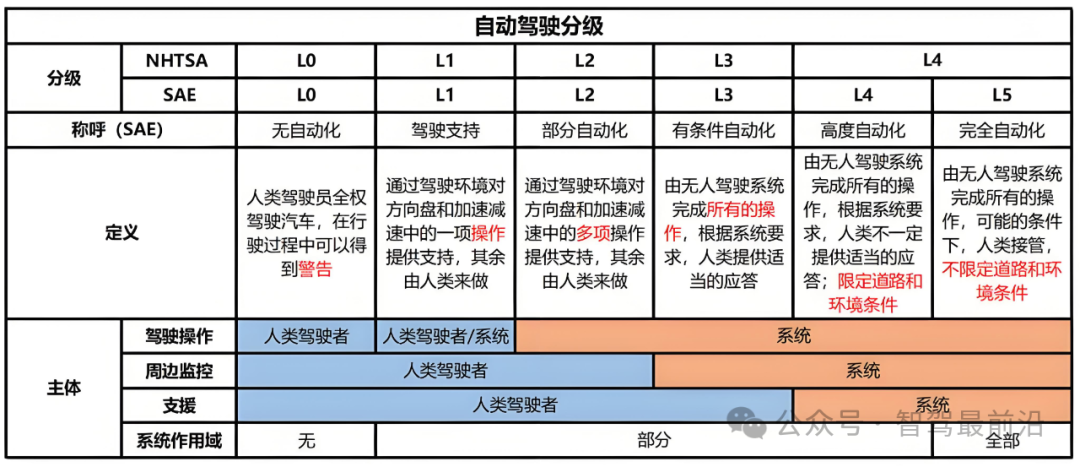

To understand this, we must first grasp the requirements for achieving L3. According to the Society of Automotive Engineers (SAE), L3 is defined as a level where the autonomous driving system can handle all driving tasks in certain scenarios, with the driver required to provide appropriate responses as needed by the system. The primary responsibility for driving operations and environmental monitoring shifts to the system, with the human driver merely providing support.

At L3, the legal responsibility for driving tasks shifts from the driver to the system. A World Economic Forum report points out that manufacturers will be liable for accidents at SAE L3 and above, while drivers will be responsible at L2 and below. This legal distinction is significant; in the event of an accident in L3 mode, the compensation traditionally borne by the driver shifts to product quality and safety liability, exposing automakers to more severe legal and regulatory scrutiny. Consequently, most manufacturers avoid using the "L3" label in promotions, preferring "L2+" or "L2.9" to maintain the responsibility boundary within the L2 category.

Relevant Standards and Requirements in Various Countries

The United Nations Economic Commission for Europe's Regulation No. 157, effective since 2021, provides a unified framework for L3 automated lane-keeping systems (ALKS). It imposes stringent requirements on system performance, failover, and driver monitoring. Simultaneously, Regulations R155 and R156 mandate cybersecurity management and software update systems, requiring manufacturers to ensure software traceability, rollback, and security during OTA updates. Labeling vehicles as "L3" necessitates full compliance with these regulations, or automakers face risks of failed type approval, market bans, and hefty fines.

In the U.S., the National Highway Traffic Safety Administration (NHTSA) has proposed the "Autonomous Vehicle Safety, Transparency, and Evaluation Program" (AV STEP) to encourage safety assessment reports and operational data submission. However, it's voluntary and lacks rigid quantitative requirements for core parameters like sensor performance and low-visibility perception. Additionally, while the Federal Motor Vehicle Safety Standards (FMVSS) allow steering wheel and pedal removal under certain conditions, it mandates clear driver takeover prompts during system control transitions.

In China, there are no clear standards for L3 accident responsibility. The "Regulations on Autonomous Driving Vehicles in Beijing", passed in December 2024, do not specify L3 accident handling measures. This legal ambiguity makes automakers hesitant to use "L3" in promotions, preferring to wait for regulatory clarity and mass production testing.

Analyzing from the Perspective of Technology and Related Supporting Aspects

Currently, technology maturity struggles to meet L3 safety requirements across all scenarios. L3 systems must achieve full automation within specific operational design domains (ODD), but doing so in complex urban roads, interchanges, tunnels, and adverse weather conditions requires multi-modal fusion of high-precision LiDAR, cameras, and millimeter-wave radars. Adverse weather degrades LiDAR and camera performance, while millimeter-wave radars struggle with small non-metallic targets. Sensor timing and coordinate deviations complicate real-time data fusion, and leading perception solutions still struggle with edge case robustness and interpretability.

L3 verification is exponentially difficult. Traditional real-world testing requires billions of miles to cover edge cases. While accelerated evaluation methods can simulate millions of miles, scenario library construction, complexity assessment, and traceability need improvement. Each verification iteration demands large-scale simulation and real-world testing, with prohibitively high costs and cycles. Therefore, automakers prefer gradual sensor and algorithm deployments at L2.9, accumulating data as they progress.

L3 also impacts insurance regulations and liability. As systems take the lead, insurance liability shifts from personal to product and commercial insurance. By 2040, personal auto insurance's share will drop from 87% to 58%, while commercial and product liability insurance will rise to 42%, according to KPMG. In the U.S., L3 highway scenario premiums may be 1% higher than traditional insurance, amounting to billions of dollars market-wide. Insurers and automakers must design complex hybrid insurance schemes to clarify compensation and liability in case of system failure or delayed takeover.

From a business and ROI perspective, L3 high-speed use cases require substantial investment. McKinsey research shows over USD 2 billion in R&D and validation for L3 high-speed systems, doubling for urban, parking, and low-speed congestion scenarios. While a USD 300-400 billion market is projected, achieving economies of scale in mass production is challenging in the short term. Automakers prefer investing in profitable L2+ or ride-sharing solutions to balance R&D costs and financial pressures.

Incomplete infrastructure also limits L3 implementation. V2X communication can provide collaborative perception in complex scenarios but is costly. High-precision maps and edge computing nodes face investment and operational challenges. This incomplete ecosystem forces automakers to reduce system dependence on infrastructure, lowering confidence in L3 capabilities.

Consumer perception and market education are barriers to L3 adoption. Autonomous driving promotion must match current capabilities. For example, L2 systems must educate consumers on convenience while emphasizing the need for continuous attention. Research shows over 70% of drivers overestimate semi-autonomous systems' capabilities, some even watching videos or sleeping while using "high-speed assistance," leading to delayed takeover and hazards. Misleading promotions in China have fueled unrealistic expectations, making consumers wary of intelligent driving systems. Premature "L3" labeling risks trust collapse due to user misunderstandings, causing irreparable brand damage in the event of accidents.

-- END --