Under the price war, who are the winners and losers among the new forces in auto manufacturing in May?

![]() 06/12 2024

06/12 2024

![]() 490

490

Those ambitious new forces in auto manufacturing in 2020 have lost their luster or disappeared in 2024, such as WM Motor, HiPhi, ENOVATE, etc. As we enter June, major new forces have also announced their sales status in May, with some rejoicing and some worrying. Lixiang One surpassed Huawei Inside Intelligent Automotive System (HIAS), and NIO and Zeekr also broke their respective monthly delivery records. However, Xiaomi, which has garnered significant attention, did not exceed 10,000 deliveries in May, while XPeng and Nezha both just barely exceeded 10,000 deliveries.

The price war in the automotive market in 2024 is even more intense than last year, with internal competition continuing to intensify. New car companies lacking competitiveness in core technology face even more severe challenges. To survive this crisis, new forces in auto manufacturing need to actively seek a key to breaking the deadlock. Let's delve further into the specifics below.

GAC AION

GAC AION delivered 40,073 vehicles in May, the only new force brand with sales exceeding 40,000 units, representing a month-on-month growth of 42.5%. From January to May this year, GAC AION's cumulative sales reached 142,000 units. As a brand originating from a state-owned automaker, achieving such results is no easy feat. AION's outstanding performance is attributed to its technological moat, including the AEP3.0 high-end pure electric exclusive platform, Quark electric drive, and the latest Blade Battery 2.0. This powerful technology endorses the design level of the vehicles, making them popular in the market.

Although GAC AION only has 3 models, each model is formidable. For example, the AION S boasts an ultra-long range of 610 kilometers and comfortable space, while the AION Y offers spacious rear seating and a long range of 610 kilometers. Although the AION V's market sales are not high, its product strength is also quite impressive.

This year, AION has set a goal of challenging 700,000 and sprinting to 800,000 vehicles, meaning that AION's average monthly sales need to reach around 60,000 units to achieve this goal. From the current plan, in addition to the domestic market, GAC AION has also made the overseas market a new sales growth point. Earlier, GAC AION announced that it will deploy seven production and sales bases in Europe, South America, Africa, the Middle East, and East Asia over the next 1-2 years. Starting this year, the overseas market has become one of GAC AION's priorities, with a target of exceeding 30,000 overseas sales in 2024. Currently, GAC AION has successively completed overseas market layouts in Thailand, Cambodia, Indonesia, Singapore, and other regions.

Lixiang One

In May, Lixiang One delivered 35,020 new vehicles, representing a year-on-year increase of 23.8%. As of May 31, 2024, Lixiang One has cumulatively delivered 774,571 vehicles, performing quite well in the new energy vehicle market. Currently, Lixiang One has 5 new models, including four extended-range SUVs (L9, L8, L7, and L6) and one pure electric MPV (MEGA). Although the performance of the MEGA, Lixiang One's first pure electric MPV model, has not reached ideal levels, the SUV lineup of Lixiang One enjoys high popularity, contributing to the continuous rise of Lixiang One's market performance.

Since its delivery on April 24, the L6 has delivered over 15,000 units, setting a new record for the fastest delivery of a new model by Lixiang One. Lixiang One is fully committed to ensuring the supply and production ramp-up of the L6 to deliver vehicles to customers as soon as possible. Meanwhile, driven by the new product pricing system, the sales momentum of the 2024 L7, L8, and L9 models is also steadily improving.

Lixiang One's original sales target for 2024 was 800,000 units, but it recently adjusted the annual target to 560,000-640,000 units. With five months of the year gone, Lixiang One has only delivered 141,207 vehicles. Even based on the adjusted minimum target of 560,000 units, Lixiang One's best completion progress is only 25.2%, with a sales gap of nearly 420,000 units. To achieve the sales target in the remaining seven months, Lixiang One needs to deliver over 60,000 vehicles per month.

Huawei Inside Intelligent Automotive System (HIAS, including Wenjie and Zhijie)

In May, HIAS delivered 30,578 new vehicles across its entire lineup, with a cumulative delivery of 148,098 vehicles for the year. Although its monthly performance could not catch up with Lixiang One's 35,000 vehicles, it still showed a respectable performance. Most of these sales came from the Wenjie M9, which delivered 15,873 units in May, becoming the sales champion in the high-end luxury SUV market for two consecutive months, and still showing significant month-on-month growth compared to April's 13,000 units.

Due to the impact of the launch of new models, many people are holding a wait-and-see attitude towards the older Wenjie M7 and M5 models, preferring to wait for the new M5 or M7 models. Therefore, HIAS's sales in May decreased somewhat.

Earlier, Yu Chengdong revealed the progress of HIAS models. The new Wenjie M5 achieved a monthly sales of over 20,000 units within one month of its launch; the Zhijie S7 ranked third in the pure electric sedan market priced above 300,000 yuan in April; and the first model of the intelligent vehicle brand jointly developed by Huawei and JAC Motor is expected to be launched in spring 2025. The Xiangjie S9 will be the first model to feature ADS 3.0, with a pre-sale price ranging from 450,000 to 550,000 yuan, and is expected to be launched in early August. The entry of multiple new models will further strengthen HIAS's market competitiveness.

NIO

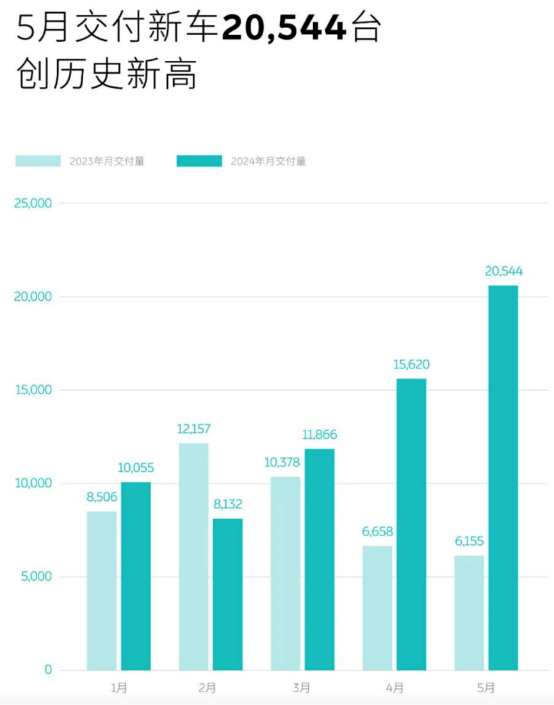

In May this year, NIO delivered a record-high 20,544 new vehicles, representing a year-on-year increase of 233.8% and a month-on-month increase of 31.5%, demonstrating a highly impressive performance. From January to May this year, NIO delivered 66,217 new vehicles, representing a year-on-year increase of 51%, with an overall increasing trend in monthly sales, indicating a good upward momentum.

In 2024, NIO did not launch any new models, so what enabled it to achieve such sales results? The newly launched Baas policy played a significant role. Taking the 75-kWh battery as an example, choosing the Baas plan can save 70,000 yuan on the vehicle price, combined with a policy of "buy four, get one free" on battery rentals. There are also flexible buyout and rental deduction options based on the rental duration. Such policies have significantly lowered the threshold for consumers to choose NIO, making the selection process more flexible. At the same time, NIO's diverse policies in other aspects are also attracting more consumers to purchase NIO vehicles.

However, it is still crucial for NIO to maintain a monthly sales volume of over 20,000 units. With significant investments in research and development and assets, NIO needs high sales volumes more than other companies to maintain its positive and long-term development.

Zeekr

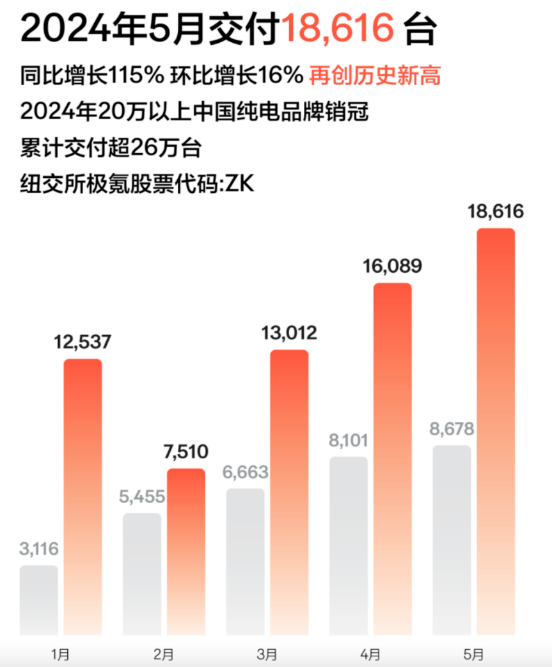

The latest delivery data from Zeekr shows that it delivered 18,616 new vehicles in May, representing a year-on-year increase of 115% and a month-on-month increase of 16%. From January to May 2024, the cumulative delivery volume reached 67,764 units, completing 29.46% of the 230,000-unit sales target. Since the delivery of its first model, Zeekr has cumulatively delivered over 260,000 vehicles.

Currently, Zeekr has 6 models on sale, namely Zeekr 001, Zeekr 007, Zeekr 001 FR, Zeekr X, Zeekr 009, and Zeekr 009 Glory. With over 18,000 monthly sales across 6 models, it is worth noting that the Zeekr 001 FR and Zeekr 009 Glory are ultra-luxury models and do not contribute significantly to sales volumes. The Zeekr 001 is the sales leader for Zeekr, while the Zeekr 007 also enjoys strong market performance. Other models lag behind somewhat.

Zeekr's annual sales target for 2024 has seen a significant increase compared to 2023, aiming for 200,000 units. Currently, Zeekr has delivered a total of 67,762 new vehicles, representing 33.9% of its target, with a sales gap of 133,000 units. To achieve its sales target, Zeekr needs to ensure a monthly sales volume of around 18,000 units for the remaining seven months. If Zeekr can sustain its current momentum or even increase sales to over 20,000 units, there is a good chance of achieving its annual sales target.

XPeng

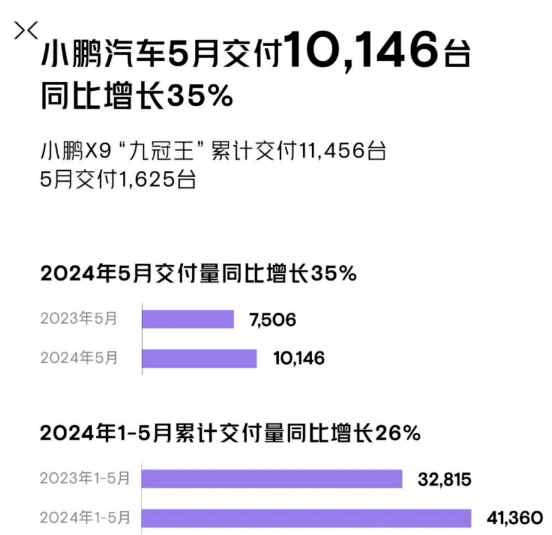

XPeng finally delivered over 10,000 vehicles in May, with a delivery volume of 10,100 units. Prior to this, XPeng had delivered less than 10,000 vehicles for four consecutive months. Among them, the XPeng X9 model delivered 1,625 units in May, with a cumulative delivery of 11,456 units in five months since its launch. In the first five months of this year, XPeng delivered a total of 41,360 new vehicles, representing a year-on-year increase of 26%.

Currently, XPeng has six models on sale, including two sedans (P5 and P7), three SUVs (G3, G6, and G9), and one MPV (X9). It is reported that XPeng plans to launch two new models in 2024 and approximately 30 new and updated models over the next three years. The MONA series, positioned in the 100,000-150,000 yuan range, is expected to be launched in the third quarter of this year. It is reported that the updated models will focus on the intelligent driving system, adopting a relatively advanced algorithm and relatively simple hardware to popularize XPeng's most powerful intelligent driving capabilities in the 100,000-150,000 yuan segment.

XPeng's target for 2024 is 280,000 vehicles, doubling its 2023 sales of over 140,000 units. After five months this year, XPeng has only completed 14.7% of its sales target, with a sales gap of nearly 240,000 units. To achieve its sales target, XPeng needs to deliver nearly 35,000 vehicles per month for the remaining seven months.

Nezha

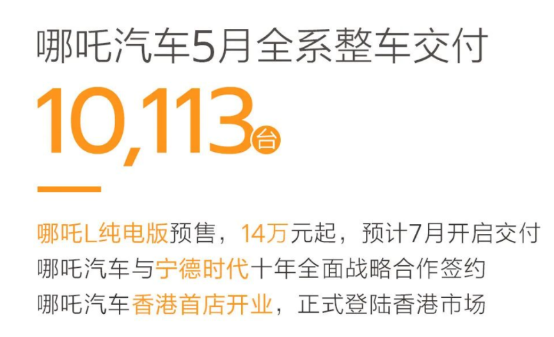

Nezha delivered 10,113 vehicles in May, representing a year-on-year decline but still higher than the 9,017 vehicles delivered in April. This is the first time this year that Nezha has delivered over 10,000 vehicles since January. The Nezha L extended-range version has become a new growth point for the brand. Launched in late April, it has received over 30,000 orders so far, successfully standing out in the market due to its price advantage and is currently in the production ramp-up stage.

Actually, Nezha's strength is not weak. Since its inception, it has placed significant emphasis on the development of core technologies. Currently, it has technologies such as HaoZhi Supercomputing, HaoZhi Skateboard Chassis, HaoZhi Electric Drive, HaoZhi Extended Range, and HaoZhi Thermal Control, demonstrating far stronger strength and image than other new car companies. I have also driven Nezha's models multiple times, and they exhibit good texture and rich configurations. However, there are obvious shortcomings in Nezha's product planning and marketing strategies that need further improvement.

Zhang Yong, CEO of Nezha, once said that Nezha would not compromise on product performance and configuration for low prices. Next, Nezha plans to appropriately reduce the production and sales volumes of some products that have sustained losses or cannot achieve positive short-term gross margins. Nezha's global sales target for 2024 is 300,000 vehicles, including 200,000 domestically and 100,000 overseas. From January to May this year, Nezha's total sales reached 42,000 vehicles, still a significant gap from its target. In the coming months, it needs to achieve a monthly sales volume of over 43,000 units.

Xiaomi Automotive

In May, Xiaomi Automotive delivered 8,630 new vehicles, representing an increase compared to the 7,058 delivered in April.