Does the 'Gartner Hype Cycle' Have Any Reference Value?

![]() 11/29 2024

11/29 2024

![]() 449

449

This article is written based on publicly available information and is intended for information exchange only. It does not constitute any investment advice.

Capturing and betting on emerging technologies has always been one of the most important themes in the capital market.

Especially when a technology is in its nascent stage, it often creates a huge bubble effect. During this stage, optimistic and pessimistic investors often have vastly different views, with debates raging on whether the new technology is the "internal combustion engine" or just a "tulip bubble," constantly reversing.

Scholars are particularly keen on exploring a scientific quantitative analysis framework to better predict the evolution of new technologies and validate their potential.

The Gartner Hype Cycle, also known as the Technology Maturity Curve, is one of the standouts in this field. This wavy line, created by the consulting firm Gartner in 1995 and continuously published for three decades, is considered a relatively reliable evolution path for investing in emerging technologies by many tech leaders and industry practitioners.

However, we all know that even the Gartner Hype Cycle relies solely on historical data, providing a rearview mirror perspective. While it has its unique insights, it inevitably has limitations.

In this article, we will revisit the Gartner Hype Cycle from the perspectives of technological industry development and investment, attempting to answer this question:

Does the 'Gartner Hype Cycle' Have Any Reference Value?

01

Basic Principles of the Gartner Hype Cycle

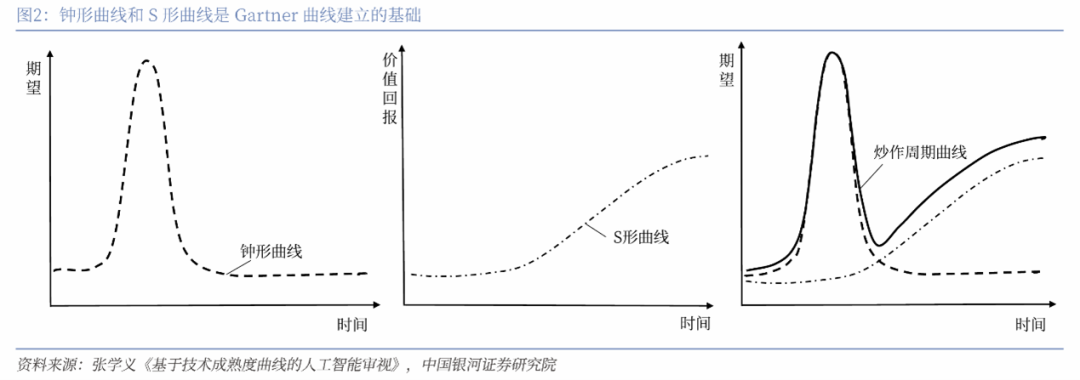

First, the Gartner Hype Cycle is composed of two curves merged together:

The bell curve representing the hype cycle is a normally distributed curve. Most purely speculative investment behaviors do not generate actual value and thus have no chance of a resurgence.

The S-shaped curve representing value return reflects a natural growth process as emerging technologies innovate, iterate, and mature.

The first half of the Gartner Hype Cycle uses the bell curve, which places higher weight on expectations, while the second half employs the S-shaped curve, which emphasizes value. This combination captures both the bubble and the value, providing a relatively ideal, unbiased representation.

Figure: Foundation of the Gartner Hype Cycle, Source: China Galaxy Securities Research Institute

Secondly, the four main elements of the Gartner Hype Cycle encompass not only hype and bubbles but also relatively rational development trends and speeds.

Let's directly look at the emerging technology curve released in August this year, which includes:

Figure: 2024 Emerging Technology Maturity Curve, Source: Gartner Official Website

● Fixed time dimensions: Technology Trigger, Peak of Inflated Expectations, Trough of Disillusionment, Slope of Enlightenment, and Plateau of Productivity, which form the horizontal axis of the Gartner Hype Cycle.

● Fixed expectation curve: Corresponding to the time axis, forming wavy intersections.

● Various emerging technologies located on the intersection curves

● Types of intersections, representing the time span until final maturity, categorized into within 2 years, 2-5 years, 5-10 years, over 10 years, and facing obsolescence.",The first three represent the commonly recognized hype cycle, but the type of intersection is actually the core indicator of technology maturity, largely determining the state of advancement and suitable investment period for emerging technologies in the cycle.

Taking the latest Gartner Hype Cycle as an example, for emerging technologies like deceptive information security, which mature within 2-5 years, the Trigger stage may last less than a year, with the initial Trigger stage possibly as short as 3-6 months. When such technologies appear on the Gartner Hype Cycle list, they may not have hyped investment opportunities.

However, for emerging technologies like general artificial intelligence, 6G, and humanoid work robots, which take over a decade to mature, their climb on the Gartner Hype Cycle is relatively slow. Therefore, even during the late Trigger stage, they offer considerable investment opportunities.",In market perception, there is a tendency to equate technology maturity with bubble and hype cycles, often overlooking the growth potential in the second half of the Gartner Hype Cycle and the fourth element that makes up the curve.",The reason why the Gartner Hype Cycle has existed for nearly three decades and is recognized by discerning investors in emerging industries, in our view, lies in its Exquisite points : It not only reflects the natural development laws of technology investment but also incorporates the potential impact of emotional fluctuations, balancing the rational and irrational aspects of emerging technology investors, making it a favored tool for many.

02

Low Accuracy in Predicting Industry Development

To evaluate the forward-looking predictive power of the Gartner Hype Cycle for emerging technologies, we can consider two dimensions:

● How many technologies have followed the development trajectory of the Gartner Hype Cycle?

● How many technologies have adhered to the intersection types (i.e., the technology maturity periods estimated by the Gartner Hype Cycle)?

Using these as guidelines, let's process the data for a review:

1) After removing duplicates, approximately 185 emerging technologies have appeared on the Gartner Hype Cycle from 2012 to 2024.

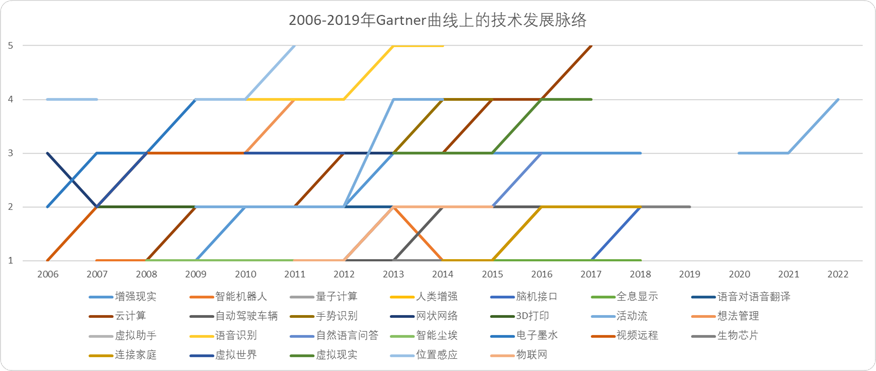

2) By extending the time axis and selecting technologies that have appeared on the Gartner Hype Cycle at least five times (since there are less than five years of data since 2020, we base our analysis on the 15-year period from 2006 to 2019, as per the special research report on emerging technology investment insights from the Gartner Hype Cycle by China Galaxy Securities), we find only around 26 unique technologies after removing duplicates.

3) Among these 26 emerging technologies that have appeared on the Gartner Hype Cycle at least five times, about 19 have progressed through the various stages of the technology curve (moving to the next stage).

4) Considering Gartner Hype Cycles across different fields, about nine technologies have crossed the Trough of Disillusionment and entered the Slope of Enlightenment.

5) With slightly relaxed criteria (considering the Slope of Enlightenment as the formal entry of emerging technologies), six technologies adhere to the intersection types.

6) Within the same period, only three technologies have reached the Plateau of Productivity: speech recognition, location-aware applications, and cloud computing. Among them, only speech recognition strictly meets the maturity expectations of the Gartner Hype Cycle.

Figure: Evolution of Technologies on the Gartner Hype Cycle from 2006 to 2019, Source: China Galaxy Research Institute, Gartner Official Website, compiled by Silk Research Institute. Click to view a larger image.

About 14.05% of the technologies on the Gartner Hype Cycle have achieved continuous industrialization, with about 10.27% showing at least one significant development. About 4.86% have crossed the bubble phase, and only 1.6% have truly matured.

The accuracy rate of the Gartner Hype Cycle in predicting technology maturity cycles is only 3.24%.

With a prediction success rate of less than 2%, does the Gartner Hype Cycle have no reference value at all? Of course not. If we look at it from a different perspective, among the emerging technologies that have appeared on the Gartner Hype Cycle at least five times, 34.61% have survived the Trough of Disillusionment, and 11.54% have matured.

Therefore, our view on the Gartner Hype Cycle is that emerging technologies within short cycles are not meaningful for reference. However, those that continuously appear on the Gartner Hype Cycle are worth paying attention to. In the past five years, only digital twins and generative AI have met this criterion.

03

Has Certain Guiding Significance for Emerging Technology Investment

Although the Gartner Hype Cycle is not accurate in predicting the forward development of emerging technologies, for investors, emerging technologies offer investment opportunities not only when they are highly mature.

Therefore, we revisit the Gartner Hype Cycle from an investment perspective, using the emerging technologies that have appeared on the curve for five consecutive times as a model and comparing their market performance in A-share concepts and sectors. We discovered some interesting patterns:

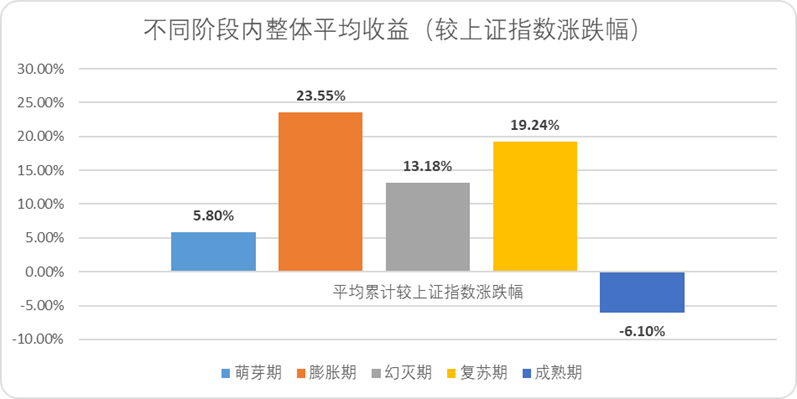

1) Emerging technologies tend to perform well in the market during the transitions from Trigger to Peak of Inflated Expectations, Peak to Trough of Disillusionment, and Trough to Slope of Enlightenment. Conversely, when the concept is first introduced or the industry matures, valuation tends to be more stable, with significantly lower returns.

2) In terms of dispersion, market disagreements are greatest when a new technology first emerges and smallest during maturity.

Figure: Relative Gains and Losses During Stage Transitions, Source: Choice Financial Client, compiled by Silk Research Institute

3) In terms of intra-stage performance, except for the Plateau of Productivity, where investment returns contradict the Gartner Hype Cycle, the returns during the Trigger, Peak of Inflated Expectations, Trough of Disillusionment, and Slope of Enlightenment stages roughly align with the curve.

Figure: Overall Average Relative Returns at Different Stages, Source: Choice Financial Client, Silk Research Institute

4) Regardless of the actual situation of industrial development, the Gartner Hype Cycle's prediction of maturity cycles aligns with market capital. Excluding cumulative long-term performance, technologies that mature within two years tend to perform best in the second year; those maturing within 2-5 years have higher returns in the second to fourth years; for technologies maturing within 5-10 years and over ten years, the average returns are highest from the sixth to tenth years.

Figure: Relative Returns Each Year Within Different Maturity Cycles, Source: Choice Financial Client, Silk Research Institute

In summary:

● Emerging technologies in the Peak of Inflated Expectations and Slope of Enlightenment stages perform well both during transitions and within cycles.

● The Trigger stage sees significant disagreements, resulting in lower average returns.

● The Plateau of Productivity often exhibits a "peak of good news" trend, leading to lower returns.

● Excluding the fulfillment period (less than a year from maturity), the market highly recognizes the Gartner Hype Cycle's predictions of maturity. During the maturity cycles predicted by the Gartner Hype Cycle, market performance is often excellent.

Clearly, although its guidance for industry development is limited, the Gartner Hype Cycle plays a significant guiding role in the complex field of emerging technology investment. This may be the reason for its enduring popularity.