Tough Google, Standing at $2 Trillion

![]() 11/29 2024

11/29 2024

![]() 562

562

Introduction: Under the impact of ChatGPT and against the backdrop of a series of antitrust lawsuits, how is Google faring recently?

Li Ping | Author, Lishi Business Review | Production

1

Third-Quarter Earnings Exceed Expectations

Not long ago, Google's parent company Alphabet released its third-quarter financial report for 2024, ending on September 30. Data shows that in the third quarter of this year, Google achieved revenue of $88.268 billion, a year-on-year increase of 15%, exceeding analysts' expectations of $86.44 billion; net profit under Non-GAAP (Non-Generally Accepted Accounting Principles) was $26.301 billion, a year-on-year increase of 34%; diluted earnings per share were $2.12, a year-on-year increase of 37%, exceeding market expectations of $1.83.

In terms of revenue composition, Google's main business is divided into three parts: Google Services, Google Cloud, and Google's Other Investments (AI, robotics, autonomous vehicles, healthcare); among them, Google Services are further divided into advertising business and Google Other (Google Play, hardware, YouTube subscription revenue). Among them, the advertising business and cloud business are the company's two core businesses.

The financial report shows that in the third quarter of 2024, Google Services generated revenue of $76.510 billion, a year-on-year increase of over 12%; Google Cloud revenue increased from $8.411 billion in the same period last year to $11.353 billion, a year-on-year increase of 35%; emerging businesses, including autonomous driving and robotics, generated revenue of $388 million, also higher than the $297 million in the same period last year.

As the company's foundation, Google's advertising business increased from $59.647 billion last year to $65.854 billion, exceeding market expectations of $65.5 billion. Among them, search advertising revenue increased from $44.026 billion in the same period last year to $49.385 billion, a year-on-year increase of 12%, still the largest contributor to the company's revenue growth; YouTube advertising revenue was $8.921 billion, a year-on-year increase of 12%, slowing down from the second quarter's growth rate of 13%.

Since ChatGPT emerged, discussions about the disruption of search engines have followed. Obviously, if AI-generated results replace search engine results, it would be catastrophic for Google, which heavily relies on search advertising.

However, given that ChatGPT has been available for over a year, Google's search engine has not been significantly impacted. ChatGPT, the AI chatbot, has not destroyed Google as search engines once did to the yellow pages. On the contrary, with the help of AI technology, Google still dominates the search field. As of the end of February 2024, Google still held a 91.02% share of the global search market.

In fact, facing challenges from competitors like ChatGPT and Microsoft, Google has not been passive. Instead, in recent years, Google has significantly optimized its search function through advanced AI technology. This transformation has not only improved the quality of search results but also changed the way users interact with information.

In May 2024, Google launched the AI Overviews in Search feature in the US and expanded it to some markets outside the US in August this year. This feature integrates the AI search capabilities of the Gemini large model, optimizing AI summaries of search results to help users quickly find high-quality content. At the same time, Google introduced ads in AI Overviews, using generative AI to summarize content from various sources and display concise results for search queries.

Since Google's search market share remains stable, Google's advertising revenue is more influenced by macroeconomic factors, especially the US economy and changes in advertiser spending. In the third quarter of this year, strong performance in the US financial insurance and retail verticals, along with events like the Olympics, Euro Cup, and Copa América, and incremental political advertising from the US elections, drove unexpected growth in advertising demand in the US, jointly contributing to the steady growth of Google's advertising business.

On October 28, 2024, Google announced that its AI Overviews in Search feature would be expanded to over 100 countries and regions globally, providing convenient information access to over 1 billion monthly active users. It will be available on all platforms, including web, mobile devices, and as part of the search engine experience in browsers, demonstrating Google's further layout and innovation in AI.

2

AI Commercialization Takes Root, Cloud Business Grows Rapidly

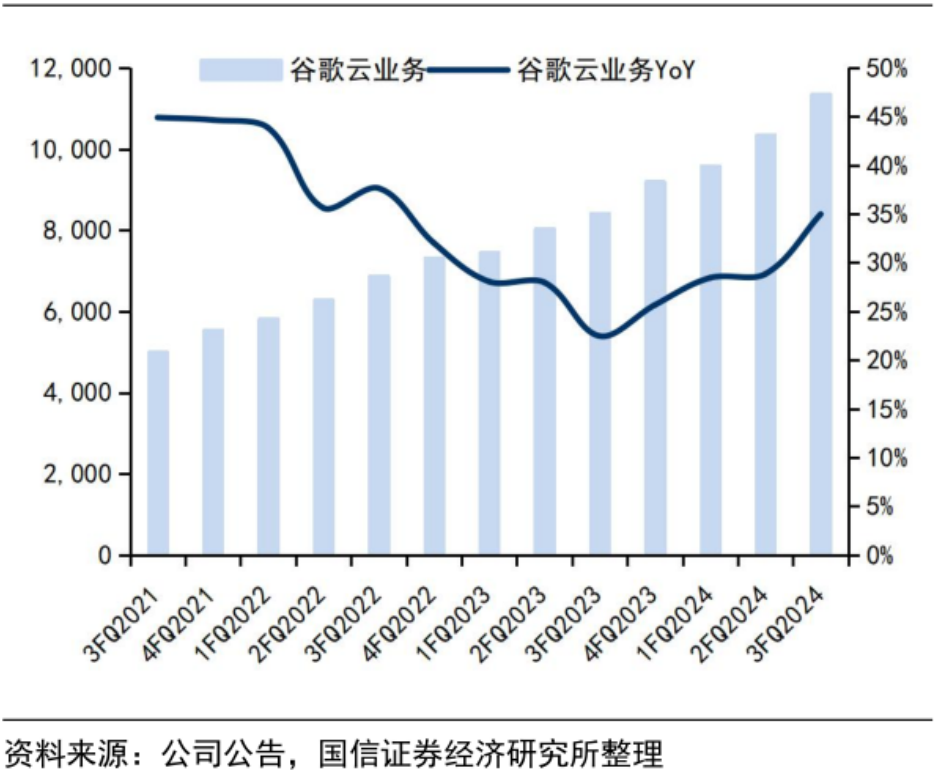

Compared to the advertising business, Google Cloud, considered Google's second growth curve, has shown even stronger growth momentum. The financial report shows that in the third quarter, Google Cloud generated revenue of $11.353 billion, a year-on-year increase of 35%, marking the second consecutive quarter that Google Cloud revenue exceeded $10 billion.

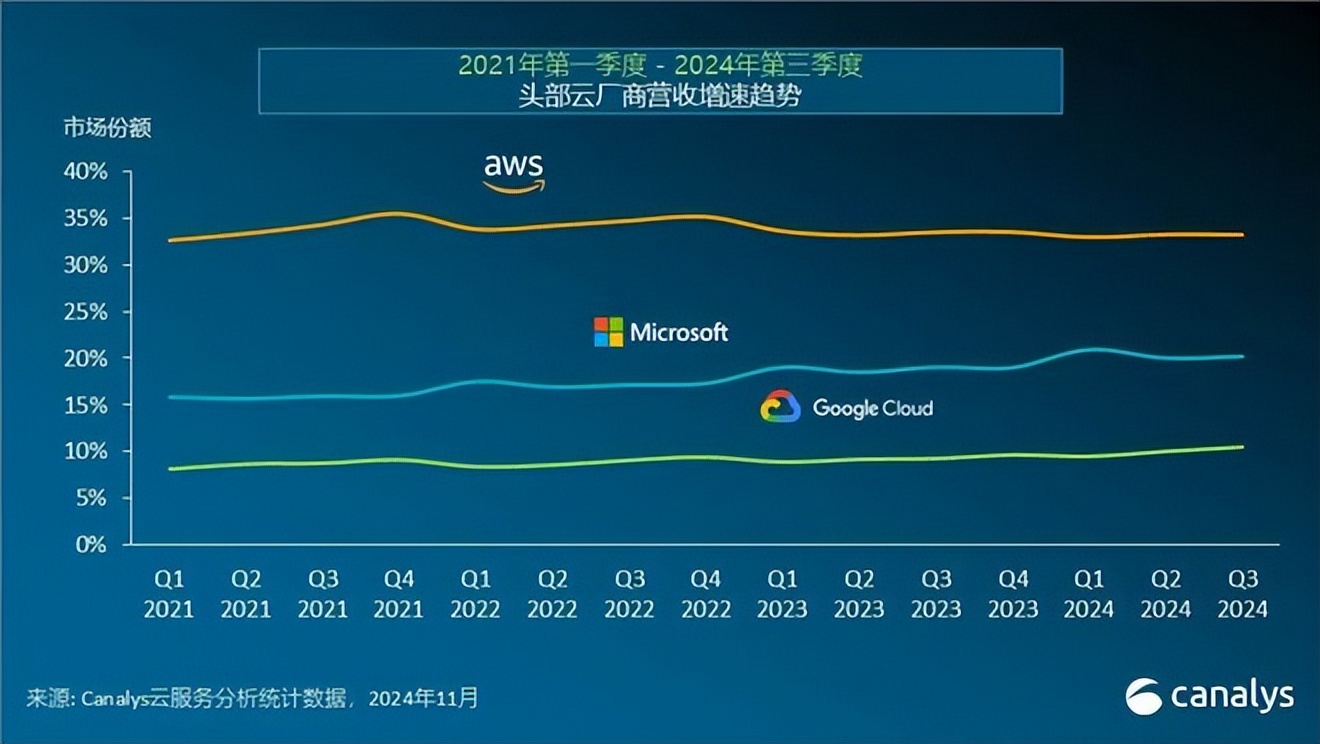

In recent years, with the acceleration of enterprise digital transformation, cloud services have become the infrastructure supporting modern enterprise operations. Especially post-pandemic, more enterprises have accelerated their migration to the cloud. According to the latest data from market research firm Canalys, global spending on cloud infrastructure services reached $82 billion in the third quarter of 2024, a year-on-year increase of 21%.

In addition to strong demand, Google also attributes its robust cloud business performance to the growing demand for its AI products. In this regard, Google CEO Sundar Pichai said during the third-quarter earnings call that seven of Google's products and platforms with over 2 billion monthly active users are now integrated with the Gemini model, and 30% of existing customers are adopting a deeper portfolio of AI products; meanwhile, Google is using AI internally to improve coding processes, enhance productivity and efficiency, with over a quarter of new code generated by AI.

Google got an early start but was late to the party. As one of the earliest proponents of cloud computing, Google once lagged significantly behind the Big Three of Amazon, Microsoft, and Alibaba in the cloud computing field. Since Thomas Kurian, the former president of Oracle, became the CEO of Google Cloud, the company has increased investments in technological innovation, product development, and market expansion, achieving significant breakthroughs in AI, big data, and machine learning.

Over the past few years, Google Cloud has maintained its competitive advantage in AI infrastructure through active R&D investments and has widely deployed applications, successfully attracting numerous AI startups to sign contracts. Data shows that as of September 2024, adoption of Google's enterprise AI platform Vertex has significantly increased, with Gemini API calls growing nearly 14 times in the past six months.

In fact, among leading vendors, Google Cloud has seen the most significant revenue growth driven by AI, with a relatively leading growth rate. According to the latest data, in the third quarter of 2024, Microsoft Azure generated revenue of $24.092 billion, a year-on-year increase of 33%; Amazon's AWS cloud computing business generated revenue of $27.5 billion, a year-on-year increase of 19%, both lower than Google Cloud's 35% growth rate.

3

Antitrust Strikes Again, Chrome May Be Forcibly Divested

Entering 2024, Google's two core businesses have grown rapidly despite AI resistance and entered the "$2 trillion market capitalization club" for the first time in April this year, becoming the fourth listed company globally to surpass a $2 trillion market capitalization after Microsoft, Apple, and NVIDIA.

High capital expenditures have been a crucial factor in Google's leadership in AI. Since 2024, Google's capital expenditures have significantly accelerated. In Q1-Q2 2024, Google's capital expenditures were $12 billion and $13 billion, respectively, nearly doubling year-on-year. The market generally expects Google's capital expenditures this year to increase to nearly $50 billion, compared to $32 billion last year.

On April 15, Demis Hassabis, CEO of Google's DeepMind, stated at the TED conference in Vancouver that Google would invest over $100 billion in AI development in the future and boldly claimed that Google's computing power surpassed that of competitors like Microsoft.

Excessively high capital expenditures once put pressure on Google's share price. In August 2024, Google's market capitalization fell below the $2 trillion mark again. However, with the disclosure of the third-quarter report, Google's capital expenditures in the third quarter did not continue the surge seen in the second quarter, with a sequential decrease of about 0.9%. Meanwhile, Google's profit growth accelerated again, indicating that the company's previous high AI investments are now entering a harvest period.

The day after the financial report was released, Google's share price surged nearly 3%, and its total market capitalization stabilized above the $2 trillion mark.

However, shortly after the third-quarter report was released, antitrust lawsuits dealt another heavy blow to Google, causing its share price to fall again.

On November 20, the US Department of Justice officially filed a request with the court, urging the federal judge to force the sale of Google's Chrome web browser. Previously, Google had been found to have violated US antitrust laws with its search business.

The Department of Justice believes that divesting Chrome will allow Google's competitors to compete for the market share they deserve and break Google's long-standing monopoly on the search engine market.

Meanwhile, the Department of Justice is also considering splitting Google's Android division and Google Play Store. It is reported that the Department of Justice wants the judge to give Google two options: either sell Android or prohibit Google from forcing users to use its services on Android devices, seeking to further break Google's monopoly.

Affected by this news, Google's share price fell nearly 5% the next day, erasing over $100 billion in market capitalization from the previous trading day, putting its status in the "$2 trillion market capitalization club" at risk again.

As a crucial part of Google's ecosystem, Chrome is vital to Google's advertising business and a key traffic driver for AI products like Gemini. If the US government's proposal to "permanently end Google's control over this key search entry" is implemented, it will have a profound impact on Google's core advertising business and AI products.

On one hand, Google is making steady progress in its AI transformation; on the other hand, it faces persistent antitrust investigations and penalties. At the critical juncture of a $2 trillion market capitalization, can Google hold on?