Samsung's Momentary Elation Fades as US Exempts Key Electronic Products from Tariffs

![]() 04/14 2025

04/14 2025

![]() 448

448

Samsung must be experiencing quite a rollercoaster of emotions these days.

First, they were caught off guard by the retaliatory tariffs imposed by the US. Then, they momentarily saw an opportunity but soon realized their optimism was misplaced. It was a series of unexpected twists and turns.

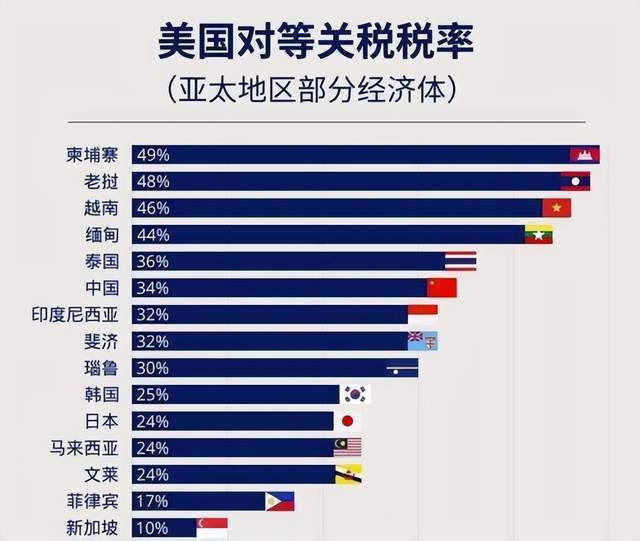

Initially, the US imposed retaliatory tariffs on various countries and regions, with a 25% tariff on Korean products and a 34% tariff on Chinese goods...

Early Data

This initially appeared favorable for Samsung, as it meant that Chinese products would face higher tariffs when entering the US market, while Korean products would face lower tariffs. Consequently, Korean goods would be more cost-effective in the US.

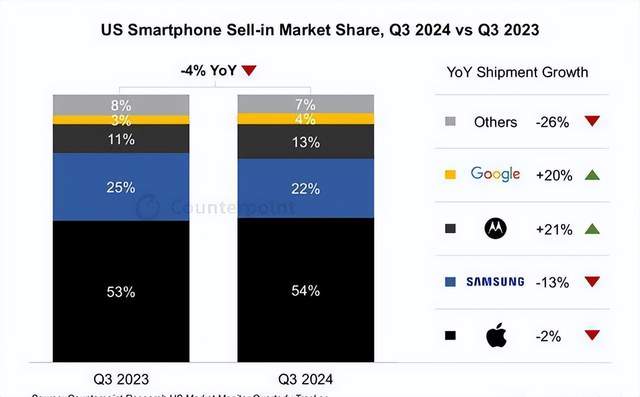

Particularly in the mobile phone market, agency data indicates that Apple currently holds about 50% of the US market share, Samsung has 30%, and Google has 13%.

Since Apple's products are predominantly manufactured in China, they would have faced higher retaliatory tariffs, potentially leading to price increases. In this scenario, Samsung would have enjoyed a clear advantage and might have experienced significant market growth, catching up with or even surpassing Apple.

Furthermore, due to China's countermeasures, the US retaliatory tariffs continued to escalate, from 34% to 125%. It's plausible that Samsung must have been overjoyed at this prospect.

This would have meant that Samsung's phones, memory, TVs, and other products would face significantly lower retaliatory tariffs when entering the US market. After all, there is a vast difference between a 25% and a 125% tariff.

I suspect that Samsung was poised to make a substantial push into the US market, aiming to overtake Apple and become the number one player in the US.

In terms of memory, Samsung was also prepared to supply large quantities to the US market, competing with Micron. This was particularly significant given that the US had previously hinted at potential price increases of up to 50%.

As for TVs, since Chinese TVs entering the US market would be subject to a 125% tax, Samsung's TVs would have enjoyed a clear competitive edge.

However, subsequent developments defied Samsung's expectations, and their elation proved to be premature.

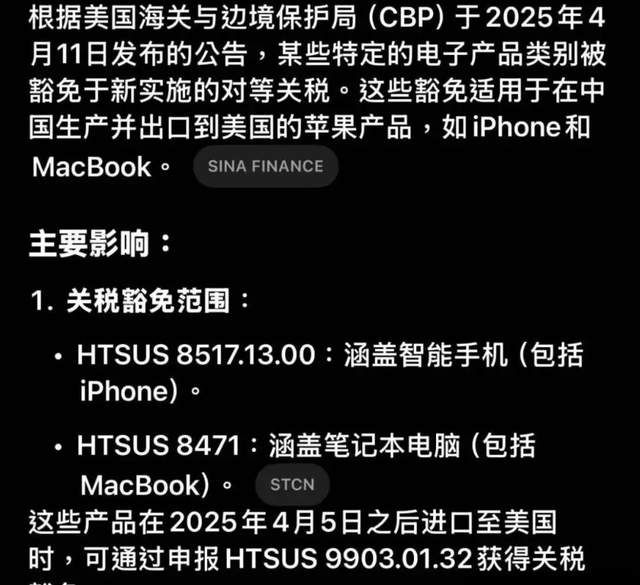

Due to China's continued countermeasures and President Trump's disregard for the situation, companies like Apple and Micron could not feasibly operate under the so-called 125% retaliatory tariffs. Consequently, Trump was forced to sign a memorandum exempting most electronic products from these tariffs.

This exemption included Apple's iPhone, Mac, iPad, Watch, AirPods, and other products, as well as storage chips, wireless base stations, semiconductor-related products, and home appliances. The 125% tariff was no longer imposed on these items.

Essentially, this returned things to their original state. Products like Samsung's, Apple's, and Chinese TVs from companies like TCL and Hisense would now enter the US market without tariffs. The 125% tariff was lifted, and everyone returned to the status quo.

Therefore, I believe that Samsung's recent mood has been akin to riding a rollercoaster, transitioning from initial depression to joy and ultimately to misplaced elation. It's quite an intriguing turn of events.