vivo's Vision for the Next Decade: Innovating Through Imitation and Beyond

![]() 04/11 2025

04/11 2025

![]() 453

453

By VR top

A 500-person team has crafted a Chinese counterpart to the 'Apple Vision Pro'.

The entry of leading Chinese mobile phone manufacturers can significantly propel the XR industry forward. Among them, vivo stands out as one of the most anticipated players.

Recently, at the Boao Forum for Asia, vivo unveiled its first MR headset, the vivo Vision. Visually, this headset bears a striking resemblance to Apple's Vision Pro, more so than any other product we've seen thus far.

Name imitation, appearance mimicry: vivo's unabashed copying

vivo's first MR headset is named 'Vision,' while Apple's is 'Vision Pro'—differing only by a 'Pro.' This might mislead some into thinking Apple has released a youth version.

The product's design almost perfectly mirrors Apple's curved glass panel, even incorporating a woven material for the headband. vivo has even replicated the much-maligned 'battery pack design,' paying attention to even the smallest details, such as cloning the 'dial interface' data cable connecting the battery.

On the content ecosystem front, vivo officially announced last year that its flagship phone, the vivo X100 Ultra, supports 3D video and 3D photo shooting, becoming the second mobile phone brand after the iPhone 15 Pro series to offer this feature. This also hinted at the impending launch of vivo Vision.

It has to be said that vivo's approach can be described as 'pixel-level copying.' This isn't just 'strategic layout,' but rather 'strategic Ctrl+C/V.'

While tech companies often draw inspiration from each other, for a mobile phone giant like vivo, such blatant imitation, from name to appearance, does reframe perceptions.

However, from a market perspective, leveraging the existing spatial computing awareness of the 'Apple Vision Pro,' vivo's MR headset can be considered quite astute. From product definition, application scenarios, to market positioning, it's crystal clear. In navigating an uncertain technology market, 'imitation' can minimize risk costs and investments to a certain extent.

Furthermore, for vivo, this product serves more as a technology showcase rather than a genuine intent for immediate sale. After all, even Apple struggles to sell hardware that isn't a hit, and vivo would likely face significant challenges with rapid commercialization due to the high opportunity cost. Earlier, Hu Baishan, Executive Vice President of vivo, stated in an interview that the product is expected to be available for high-fidelity prototype experiences in over a dozen cities nationwide in September 2025, with commercial progress contingent on the matching of the content ecosystem.

Additionally, as early as May 2024, vivo's flagship phone, the vivo X100 Ultra, supported 3D video and 3D photo shooting, becoming the second mobile phone brand after the iPhone 15 Pro series to offer this feature. It also collaborated with AR manufacturer Rokid to provide a spatial imaging experience based on AR glasses.

Half-hidden headset, vivo's focus shifts to robots

Although the headset hasn't been publicly unveiled, vivo is poised to enter the robot race.

At this year's Boao Forum for Asia, Hu Baishan also announced the establishment of a robotics lab, indicating that vivo will focus on developing the 'brain and eyes' of robots, leveraging artificial intelligence and spatial computing capabilities.

From a technical standpoint, there are many similarities between XR spatial intelligence and robots, both fundamentally rooted in the broad direction of computer vision technology, particularly in the application of camera-based VSLAM algorithms.

VSLAM (Visual Simultaneous Localization And Mapping) technology is a cornerstone in fields such as XR, autonomous driving, and intelligent robots. It analyzes image information through camera sensors, enabling robots to achieve autonomous localization and real-time 3D mapping in unknown environments. This aligns with Hu Baishan's emphasis on the 'eyes' of robots.

Image source: Internet

In XR spatial intelligence, VSLAM technology helps devices understand the physical space where the user is located, thus achieving precise fusion of the virtual and real worlds. Simply put, it's the more precise visual localization technology we often discuss. The alignment between the virtual map and the physical environment is a crucial criterion for our evaluation. Many XR headsets can also actively recognize surrounding environmental objects and avoid obstacles autonomously, ensuring a safer user boundary.

Similarly, robots need to utilize VSLAM technology for autonomous navigation and obstacle avoidance in complex environments, enhancing their flexibility and adaptability in practical scenarios. For example, currently commercially available sweeping robots, albeit less complex than embodied intelligent robots, primarily use lidar or cameras combined with SLAM algorithms to recognize the surrounding environment and map indoor spaces, enabling intelligent cleaning within rooms.

In fact, given the commonality of technologies and the current push from the overall AIGC trend, many XR vendors have also become active in the field of robotics. Last month, insiders revealed that Meta is making significant investments in embodied intelligence and forming a new team within its Reality Labs hardware division (Meta's metaverse division) to carry out this work. vivo's move can be seen as preparing to follow Meta in simultaneously developing robots, even before 'submitting' its homework on the Apple Vision Pro. While a bold step, the business and technical connections are robust.

'Others' for two consecutive years: easy to copy, harder to innovate

As one of China's major mobile phone manufacturers ('Huawei, Xiaomi, OPPO, vivo'—Huami OV), vivo has reaped the benefits of the past decade's smartphone development.

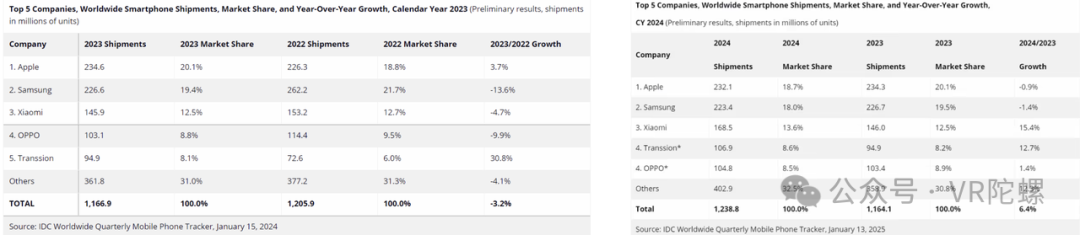

However, on the global stage, this venerable manufacturer is facing new challenges. According to data from market research firm IDC, vivo has been categorized as 'others' in the global mobile phone market for two consecutive years. This is primarily due to Transsion's expanding presence in overseas markets such as Africa, intensifying global competition and consequently pushing vivo out of the top five global mobile phone manufacturers.

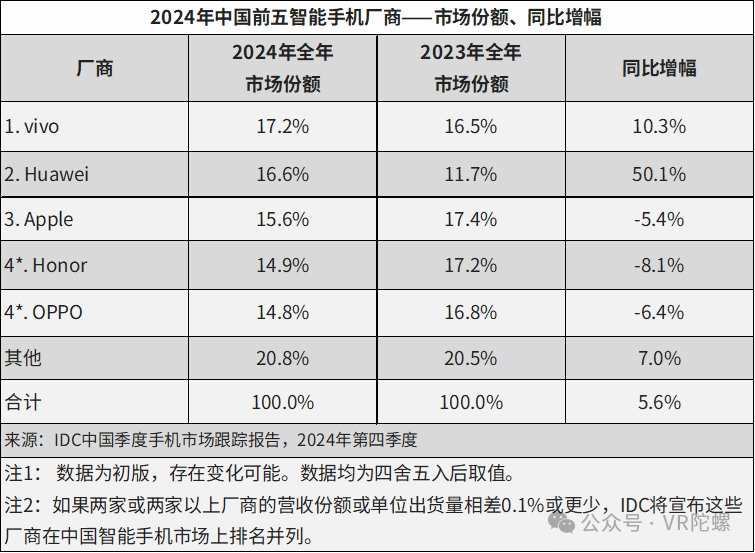

Nonetheless, the decline in global rankings shouldn't be equated with stagnant growth. Focusing on the domestic market, vivo exhibits a distinct competitive edge. The latest IDC report shows that in 2024, vivo topped the Chinese smartphone market with a market share of 17.2%, a year-on-year increase of 10.3%, affirming the effectiveness of its 'base strategy.'

For vivo, the mobile phone business remains its core, supporting cash flow, while MR headsets and robots represent important future growth areas. However, translating vivo's existing user base and strategies into incremental growth in these new ventures poses a significant challenge.

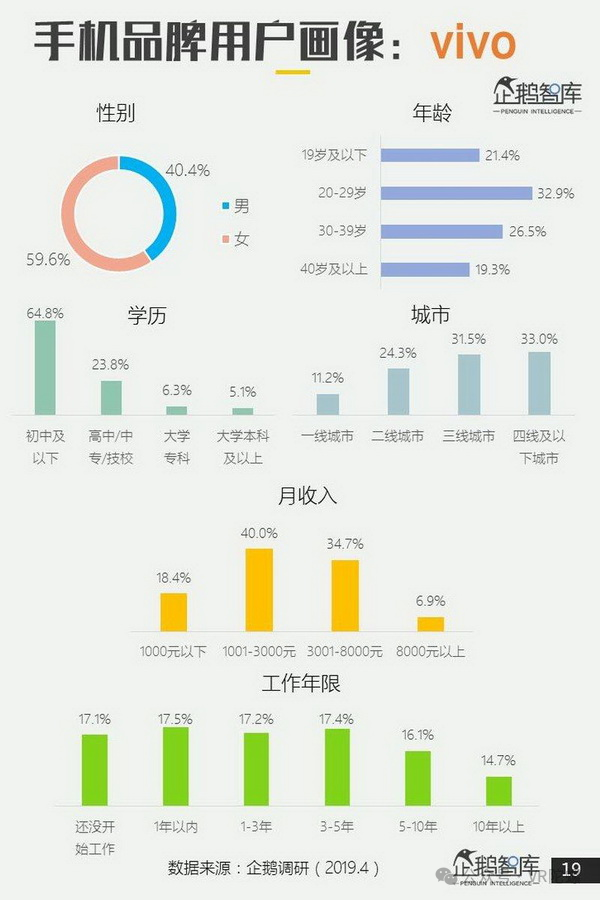

On one hand, vivo's user profile limits its potential. According to an early survey by Penguin Intelligence, the gender ratio of vivo phone users is approximately 4:6, with users primarily from third- and fourth-tier cities, earning around 1000-3000 yuan. Despite vivo's recent efforts in the high-end mobile phone market (phones priced above 600 USD), data from research firms like Counterpoint Research shows that in China, Huawei and Apple account for over 80% of the high-end mobile phone market share, leaving little room for other manufacturers.

On the other hand, whether it's MR or robots, vivo needs to prove that it can transcend the 'hardware mindset' of a mobile phone manufacturer. Relying solely on supply chain integration may degrade vivo into a 'high-end solution integrator,' struggling to secure a significant market share. High-end technology products often have high unit prices and are challenging to popularize. vivo's past 'sea of stores' tactic for mobile phones can provide a larger experience platform to a certain extent, but whether it can pass the practical verification of consumer scenarios remains a daunting question.

Regardless, China's XR industry needs 'catalysts' like vivo. 'Trying and exploring' is preferable to isolation. Ultimately, problems of development should be left to development to solve.