US Threatens 125% Tariff on China; Cook Charters Planes to Stockpile iPhones

![]() 04/10 2025

04/10 2025

![]() 372

372

Text/Leon

Edited/Hou Yu

A tariff war looms large on the horizon. Starting from April 9, local time, the United States imposed a total of 104% tariffs on Chinese imports. In response, China's Ministry of Foreign Affairs declared that China would never accept the extreme pressure and bullying from the United States and would continue to take resolute and effective measures to safeguard its legitimate rights and interests. Simultaneously, China raised the tariff rate on imports originating from the United States from 34% to 84%.

Subsequently, President Trump announced on social media that tariffs on China would immediately rise to 125%, while equivalent tariffs on 75 other countries would be suspended for 90 days, with a tax rate of 10% during this period.

The Trump administration's real objective in instigating this tariff war is to bring manufacturing back to the United States. It is reported that the Trump administration has announced the imposition of "reciprocal tariffs" on 185 countries and regions worldwide. Therefore, American companies heavily reliant on the global supply chain and possessing overseas factories will be the first to feel the impact.

Taking Apple as an example, its stock price fell for four consecutive days, with a drop of nearly 23%, and its market value dwindled by nearly $780 billion (approximately RMB 5.7 trillion). As of the close of April 8, local time, Apple's market value shrank to $2.59 trillion, and Microsoft surpassed it to become the world's most valuable listed company with a market value of $2.64 trillion. At the same time, all three major US stock market indices declined to varying degrees.

Apple CEO Tim Cook, fresh from his visit to China, is undoubtedly the most anxious person at the moment. Therefore, Apple has rarely initiated emergency measures in hopes of stabilizing product prices in the US domestic market for some time in the future.

According to a report by The Times of India, in the last week of March, Apple arranged five cargo planes loaded with iPhones and other products to fly from India and China to the United States within just three days, preparing for possible tariffs. However, for the vast US market, stockpiling is merely a drop in the ocean.

Assuming that the tariff issue does not ease, Apple will face a significant cost increase during Trump's term of office over the next four years. The challenging problem facing Cook is: how to absorb the additional costs resulting from the increased tariffs and stabilize Apple's performance and stock price.

Will the iPhone price increase?

First, it's crucial to clarify a concept: Though Apple is an American company, it does not produce iPhones in its home country. Currently, all iPhone models are manufactured in countries outside the United States, with mainland China accounting for over 80% of production. Hence, for the United States, the iPhone is considered an "imported product." Consequently, after the imposition of tariffs, the sales cost of iPhones in the United States will increase substantially.

Faced with rising costs, companies typically have two options: either require suppliers to reduce prices to lower costs or pass them on to consumers, or both. UBS analysts estimate that tariffs will increase the price of the iPhone 16 Pro by at least $350 (approximately RMB 2,572). Combined with the current selling price, the starting price of this model in the United States will reach $1,349 (approximately RMB 9,915, excluding sales tax).

According to Bloomberg, due to tariffs, American consumers flocked to Apple stores to buy iPhones over the weekend. An Apple employee told Bloomberg that the influx of people felt like a holiday shopping season, resulting in a short-term surge in sales. As of press time, the price of iPhones on Apple's US official website had not changed.

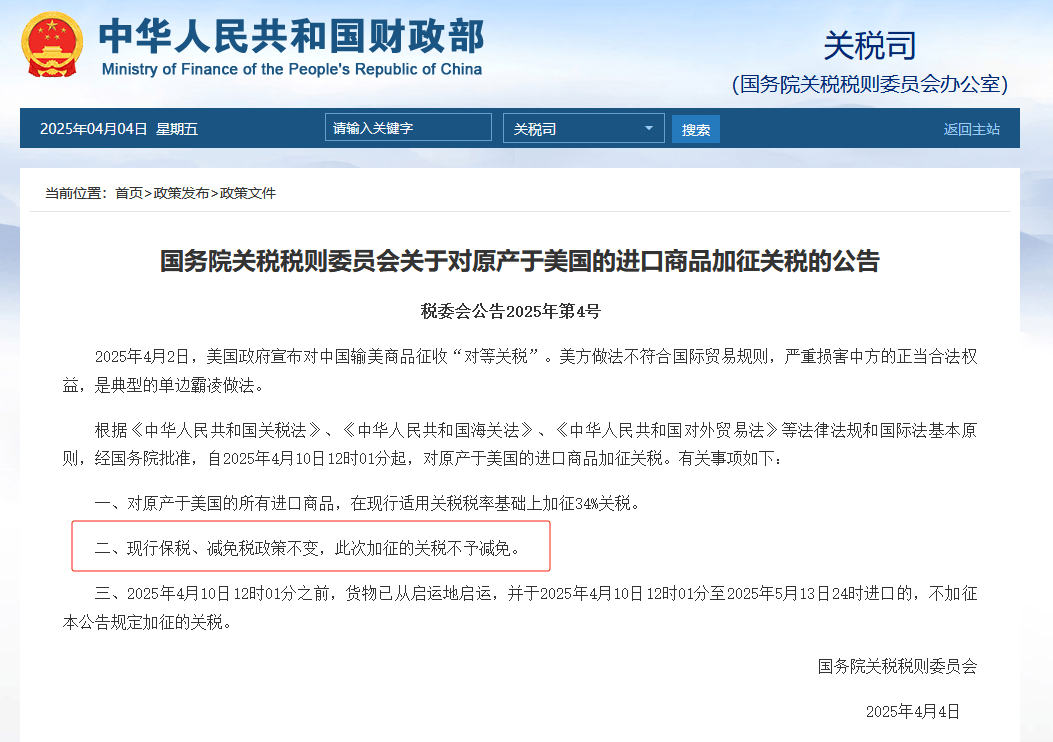

As for the Chinese market, the likelihood of an iPhone price increase is currently low. According to relevant documents from the State Council, products subject to additional tariffs on the United States must first meet the criterion of "originating in the United States." As mentioned earlier, most of the iPhone's components come from the Chinese mainland and Taiwan markets; even for US components, since the iPhone is assembled in China's bonded zone, according to the regulation of "current bonded and tax reduction policies remain unchanged," it is generally not necessary to pay a separate 84% tariff on these components.

Analyst: It is unlikely that Apple will produce iPhones in the United States

As a multinational technology giant, Apple's products are highly dependent on the global supply chain, with Chinese enterprises occupying an indispensable position. Obviously, from a practical standpoint, it is difficult for Apple to meet Trump's demand for "manufacturing return."

In Apple's official annual supply chain list for fiscal year 2023, a total of 187 companies were listed. Among them, mainland Chinese companies topped the list with 45 companies, accounting for 24%, followed by Taiwan and the United States. According to statistics, each iPhone has approximately 1,500 components, and the total proportion of components from mainland China and Taiwan reaches 49%. If calculated based on the distribution of supplier factories, mainland China leads with an overwhelming number of 155 factories, followed by Taiwan with 49 factories and the United States with only 25 factories.

Every September, Apple releases a new generation of iPhones, and stock preparation begins around July. In just over two months, contract manufacturers need to assemble tens of millions of new iPhones to meet global market demand. Foxconn settled in Zhengzhou in 2010 and remains the global main production base for iPhones, with nearly 300,000 employees during the peak production season each year. Considering factors such as labor costs and population density, it is nearly impossible for Apple to move its mobile phone production lines back to the United States and completely replace Chinese component suppliers.

Laura Martin, an analyst at US investment bank Needham, recently stated on a CNBC program: "It is impossible to produce iPhones entirely in the United States. Even if Apple wants to transfer its supply chain to the United States, it will take several years." Another analyst, Dan Ives, said that if an iPhone were produced in the United States, its selling price would be at least $3,500 (approximately RMB 26,000), which is too expensive for consumers to bear.

Apple is not without concerns about its over-reliance on China's industrial chain. In fact, as early as 2017, Apple began transferring part of its industrial chain from China. Among them, India and Vietnam have undertaken production lines for products such as iPhones, iPads, and AirPods, and factories in the United States have also begun producing computer products such as the Mac Pro.

Taking India as an example, there are currently three Apple contract manufacturers: Foxconn, Pegatron, and the Tata Group of India, which contributed 14% of global iPhone production in fiscal year 2024. Although the labor market price in India is indeed lower than that in China, there are issues such as management chaos and low yields. At the same time, the business environment for foreign companies in the Indian market is concerning, further limiting investment by contract manufacturers in India. For example, Wistron's contract manufacturing plant was vandalized by Indian workers and was forced to sell its entire business line to the Tata Group of India.

Under the tariff stick, Apple's performance is under pressure

Since taking over as Apple's CEO from Steve Jobs in 2011, Tim Cook has led Apple to repeated successes over the past 13 years, making it the world's most valuable listed company for a time. Now, he may face the biggest challenge of his tenure, which is how to maneuver between China and the United States to ensure Apple's interests.

At the end of March this year, Cook visited China, where he met with relevant officials and visited Apple's Chinese partners and innovative enterprises. More importantly, Cook once again emphasized that Apple would continue to increase its investment in China. Behind this is Apple's concern about its performance in Greater China.

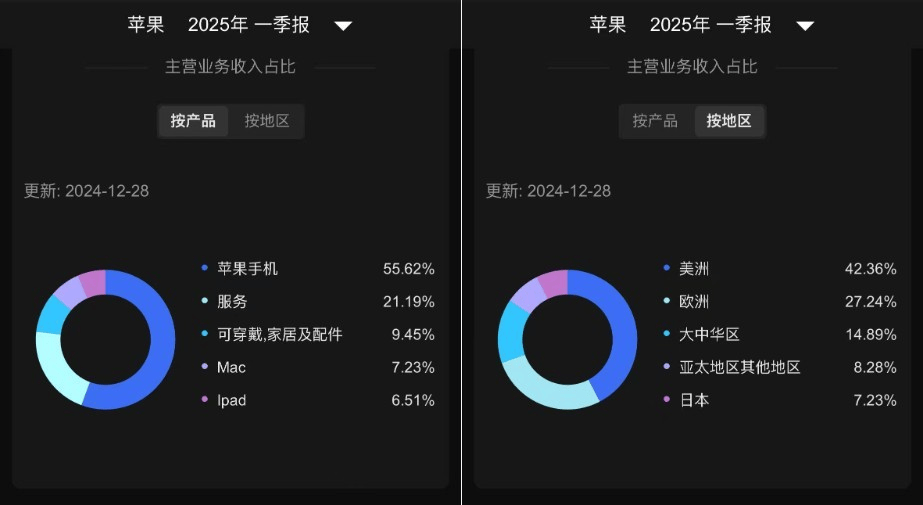

According to the first-quarter financial report for fiscal year 2025, Apple's total revenue reached $124.3 billion, a record high. However, the year-on-year growth in revenue and net profit was only 4%, actually revealing a weak growth trend in the business. Over-reliance on the iPhone business remains the main reason, accounting for 55.62% of Apple's total revenue, but its own revenue decreased by 0.9% year-on-year.

Additionally, from a regional market perspective, the Americas and European markets maintained certain growth, but revenue in Greater China fell from $20.8 billion to $18.513 billion, a year-on-year decrease of 11%. In other words, during the financial reporting period (the fourth quarter of fiscal year 2024), the sales performance of the iPhone 16 series in the Chinese market was lower than expected.

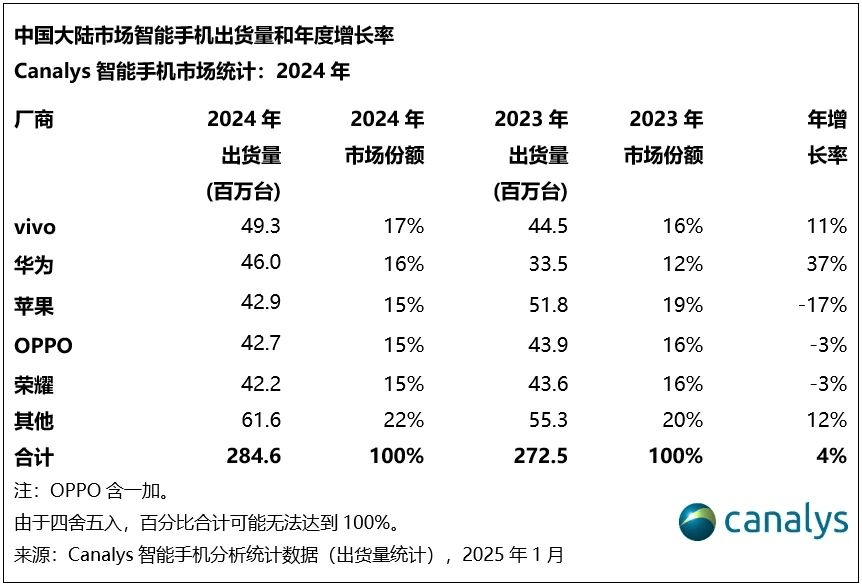

Data from third-party research institutions shows that in 2024, Apple's shipments in the Chinese mainland smartphone market were 42.9 million units, a year-on-year decrease of 17%, ranking only third. The reason for this is that on the one hand, competition in the Chinese mobile phone market has intensified, with numerous brands and models diverting Apple's sales; on the other hand, iPhone innovation has slowed down in recent years, and the new iPhone 16 series has not changed much in design and functionality. The core feature of "Apple Intelligence" has not yet been implemented, which has affected new machine sales to a certain extent.

Now facing the tariff stick, Apple is in a very passive position. First, in its main battleground of North America, if prices increase in the United States, it will inevitably affect sales in the American market, and competitor Samsung may take advantage of this opportunity to compete for its high-end market share. Samsung has fully transferred its mobile phone production lines from China to countries such as Vietnam, and the US tariff on Vietnam is 46% (currently 10%, with a 90-day deadline), which is lower than that on mainland China.

On Cook's part, he has done his utmost to appease the Trump administration. After Trump took office, Cook met with him and promised to invest $500 billion in the United States over the next four years to build AI server factories and provide 20,000 jobs, but this investment did not seem to satisfy Trump.

It is foreseeable that unless Apple obtains special tariff exemption rights, its performance will be significantly affected. Not only Apple, but also US technology companies such as Tesla, Dell, and HP that are highly dependent on China's supply chain will not be spared.