WeChat Accelerates the Demise of ChatBot Traffic Wars

![]() 02/19 2025

02/19 2025

![]() 566

566

For super apps looking to consume the AI ecosystem, the only apparent constraint appears to be computing power.

Author | He Jian

Editor | Jiang Jiao

Cover | WeChat

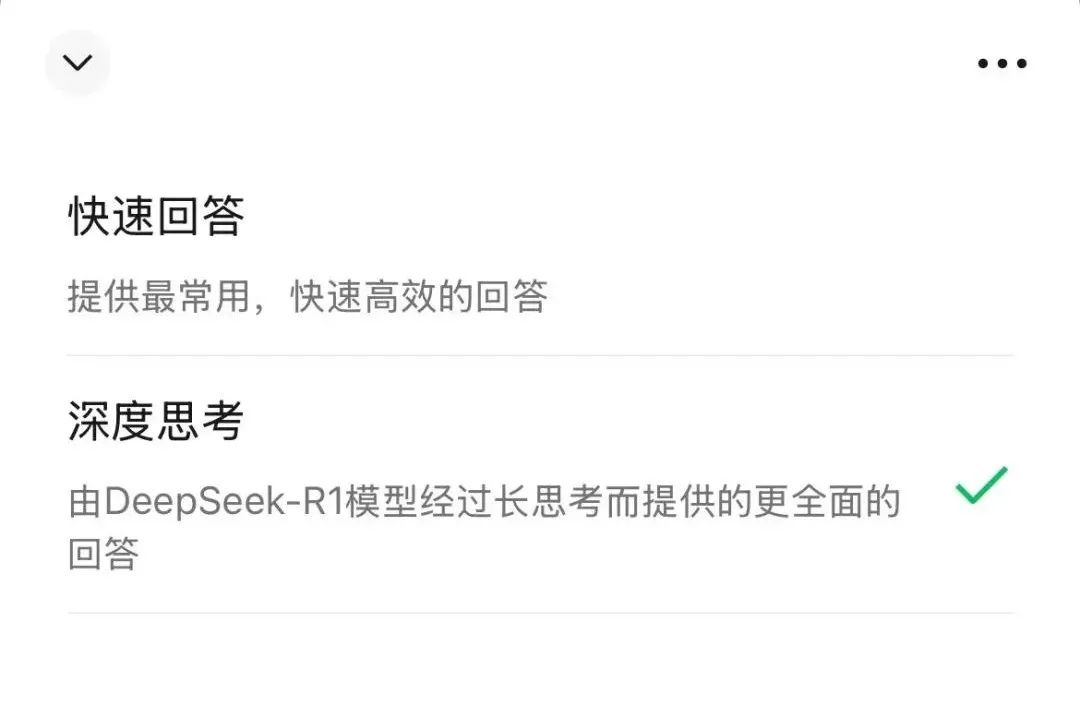

China's most prominent super app, boasting the largest monthly active user base, is now aiming to prematurely end the traffic wars among ChatBot services. Last weekend, WeChat commenced internal testing to integrate the DeepSeek-R1 large model into its search function. Tencent has confirmed this news, stating that while WeChat Search utilizes the Hunyuan large model to enrich AI search capabilities, it has recently officially commenced a grayscale test to incorporate DeepSeek.

Prior to this, multiple cloud service providers, AI applications, and even government and enterprise entities had integrated DeepSeek, yet none garnered the same level of attention as WeChat. Over the past few days, the Chinese internet has been abuzz with intense discussions about "WeChat + DeepSeek," with related news briefly topping Weibo's trending topics. Some users commented, "National-level AI combined with a national-level application—a truly explosive mix."

From a user experience standpoint, the functionality offered by DeepSeek-R1 within WeChat is still in its nascent stages. For instance, while WeChat has integrated access to official account historical messages, mini-program services, and even public internet information, it does not support multi-turn dialogues or continuous question-and-answer sessions, nor does it allow users to view historical messages. The experience falls short of most ChatBot applications currently available on the market.

Nevertheless, with WeChat's monthly active user base reaching an impressive 1.3 billion, the world holds exceedingly high expectations for the integration of DeepSeek into WeChat. Some commentary articles claim that this will mark a pivotal moment for AI applications, while securities analysts have also stated that the integration will lead to a revaluation of Tencent-affiliated companies.

On February 17, when the Hong Kong stock market opened, the share prices of Tencent and related concept stocks soared, with Tencent's market value surging by over HK$300 billion. Companies like Weimob, China Literature, and Youzan also witnessed share price increases of over 10%.

However, the most immediate impact of WeChat's integration of DeepSeek may be felt by ChatBot applications. Over the past year, China's AI giants and startups have been engaged in relentless traffic wars on the market, hoping to acquire more users.

But as of last December, according to QuestMobile data, Doubao, the AI-native application with the largest monthly active user base in China, boasted a mere 75.226 million monthly active users, a fraction of WeChat's user base. Overall, the monthly active user base of AI-native applications in 2024, as counted by QuestMobile, was only 120 million.

The entire industry is eagerly seeking a super app tailored for the AI era. Two years ago, Baidu founder Robin Li proclaimed that the application layer in the AI era would present brand-new entrepreneurial opportunities tenfold greater than current opportunities in WeChat and Douyin. However, to date, no such super app for the AI era has emerged. Li's latest statement suggests that we are still far from achieving that level of application, and the world is currently anxiously searching for such a super app.

A more crucial reason may be that before the smartphone-based application ecosystem is disrupted, super apps like WeChat still possess the power to consume everything. As WeChat begins to integrate large model capabilities like DeepSeek, most ChatBot applications on the market will struggle to withstand the impact.

The demise of Baidu's search monopoly established in the first decade of the new millennium was not due to misjudgments in Baidu's technical prowess or strategic direction but rather because under the impact of mobile smartphones, the entire PC ecosystem inevitably declined.

In other words, until the next hardware that disrupts smartphones or a more ubiquitous application scenario on this ecosystem emerges, the monopoly position of super apps will persist. They represent a user entry point that multiplies geometrically.

Just as Apple's AI implementation in China has attracted competition from almost all major Chinese internet companies, in the current nascent stage of AI technological iteration, the entry point remains more critical than other factors.

This may explain why Tencent is not rushing to compete in the wave of large models. As China's largest internet company with the largest user base, Tencent has more time to prepare for the AI wave.

At the shareholders' meeting two years ago, Pony Ma stated that they initially believed AI to be an opportunity that comes once every ten years in the internet industry. However, the more they pondered, the more they felt it was an opportunity that comes once every few hundred years, akin to the industrial revolution that introduced electricity. "For the industrial revolution, whether the light bulb is released one month earlier or later is not significant in the long run."

His statement at this year's Tencent annual meeting was even more direct. He said that in the short term of one to two years, he does not anticipate a large purely native AI application to emerge. He believes that in the future, Tencent should integrate its own scenarios to apply the AI Hunyuan large model across various scenarios, hoping all Tencent's business units can embrace the productization and implementation of large models.

For super apps looking to consume the AI ecosystem, the only apparent constraint appears to be computing power.

All rights reserved by Shanshang, reproduction prohibited without authorization