Alibaba Cloud: Which Enterprise Boasts the Strongest Profitability?

![]() 02/19 2025

02/19 2025

![]() 562

562

Recent reports indicate that Apple is partnering with Alibaba to develop and deploy artificial intelligence (AI) features tailored for Chinese iPhone users. The duo has reportedly submitted their jointly crafted AI features to regulatory bodies for approval. Alibaba Cloud, serving as the digital technology and intelligent backbone of the Alibaba Group, stands as one of China's largest cloud service providers. Based on incomplete statistics, it dominated the Chinese cloud service market in the first quarter of 2024.

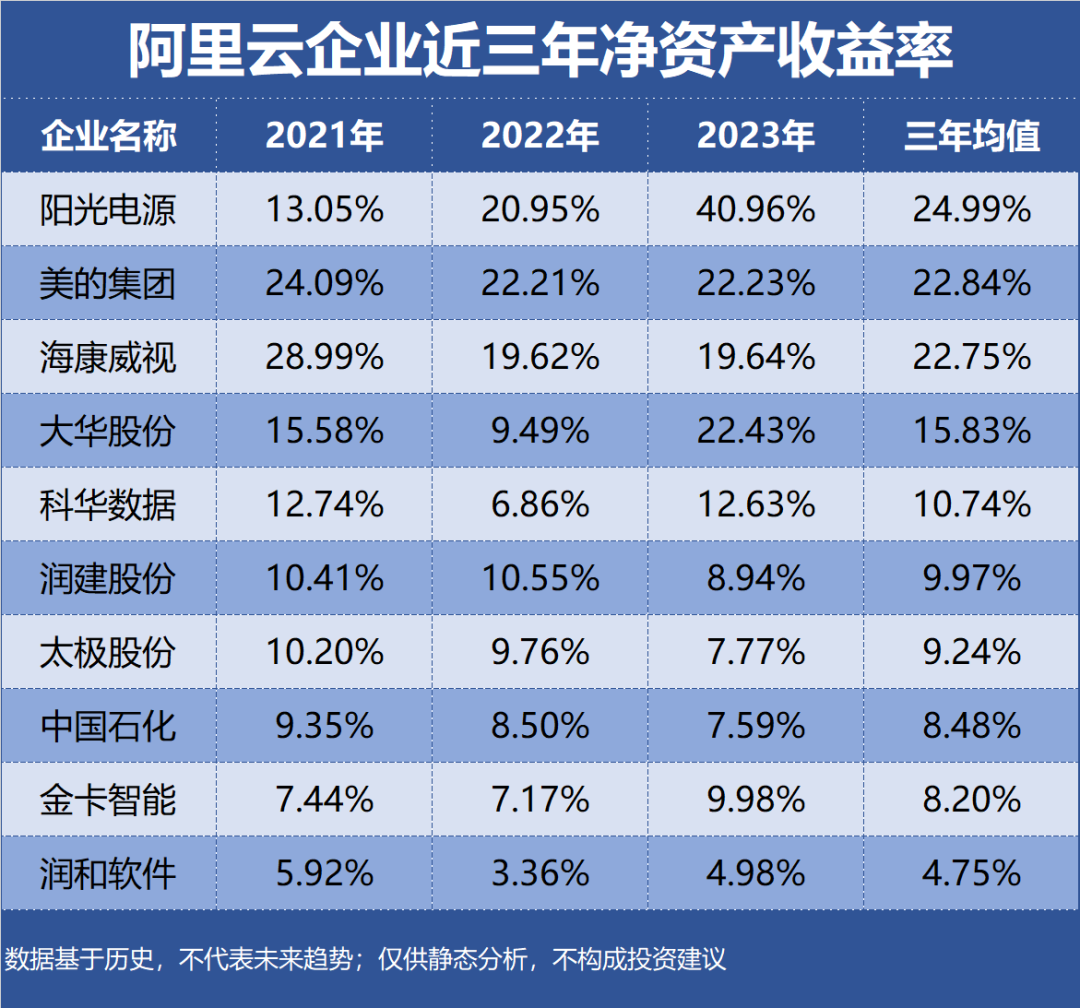

This article forms part of our series on enterprise value, with a specific focus on [Profitability]. We have selected 23 Alibaba Cloud-affiliated enterprises as our research samples, utilizing return on equity (ROE), gross margin, net margin, and other metrics as our evaluation criteria. It's essential to note that the data provided is rooted in historical information and does not predict future trends; it is intended solely for static analysis and does not constitute investment advice.

Top Ten Enterprises in Alibaba Cloud Profitability:

10. Sinopec

Industry Segment: Refining and Petrochemicals

Profitability: ROE 8.48%, Gross Margin 16.60%, Net Margin 2.52%

Performance Forecast: ROE has steadily declined to 7.59% over the past three years, with the latest forecast averaging at 7.10%

Main Products: Marketing and distribution account for 54.79% of revenue, with a gross margin of 5.62%

Company Highlights: Sinopec and Alibaba Cloud have entered into a technical collaboration, enabling Sinopec to leverage Alibaba's cloud computing and big data expertise to upgrade traditional petrochemical operations.

9. Runjian

Industry Segment: Telecommunications Engineering and Services

Profitability: ROE 9.97%, Gross Margin 19.07%, Net Margin 4.91%

Performance Forecast: ROE has fluctuated between 8%-11% in the last three years, with the latest forecast averaging at 6.39%

Main Products: Telecommunications network business accounts for 46.95% of revenue, with a gross margin of 20.08%

Company Highlights: Runjian, a manager and operator of communication and energy networks, has jointly invested with Alibaba Cloud in the construction of the China-ASEAN Smart Computing Cloud.

8. Taiji

Industry Segment: IT Services

Profitability: ROE 9.24%, Gross Margin 21.31%, Net Margin 4.00%

Performance Forecast: ROE has declined steadily to 7.77% over the past three years, with the latest forecast averaging at 7.27%

Main Products: Industry solutions account for 42.79% of revenue, with a gross margin of 19.39%

Company Highlights: Taiji offers cloud and data services, proprietary software, industry solutions, and digital infrastructure. The company has signed a strategic partnership agreement with Alibaba Cloud.

7. Runhe Software

Industry Segment: IT Services

Profitability: ROE 4.75%, Gross Margin 26.17%, Net Margin 5.16%

Performance Forecast: ROE has fluctuated between 3%-6% in the last three years, with the latest forecast averaging at 7.07%

Main Products: Financial technology business accounts for 53.08% of revenue, with a gross margin of 25.63%

Company Highlights: Runhe Software and Alibaba Cloud have collaborated closely in various aspects of the financial industry, leveraging Alibaba's cloud computing platform, products, and services.

6. Dahua Technology

Industry Segment: Security Equipment

Profitability: ROE 15.83%, Gross Margin 39.61%, Net Margin 13.66%

Performance Forecast: ROE has fluctuated between 9%-23% in the last three years, with the latest forecast averaging at 8.96%

Main Products: Smart IoT products and solutions account for 80.91% of revenue, with a gross margin of 43.41%

Company Highlights: Dahua Technology has introduced the smart home brand "Lechange" and joined forces with Alibaba Cloud to create smart home Internet solutions.

5. Jinka Smart

Industry Segment: Instrumentation

Profitability: ROE 8.20%, Gross Margin 40.28%, Net Margin 11.59%

Performance Forecast: ROE has fluctuated between 7%-10% in the last three years, with the latest forecast averaging at 9.81%

Main Products: Smart civilian gas terminals and systems account for 59.98% of revenue, with a gross margin of 35.94%

Company Highlights: Jinka Smart has become an Alibaba Cloud partner, with Alibaba Cloud providing cloud computing services as its domestic public cloud provider.

4. Kehua Data

Industry Segment: Other Power Supply Equipment

Profitability: ROE 10.74%, Gross Margin 28.67%, Net Margin 6.77%

Performance Forecast: ROE has fluctuated between 6%-13% in the last three years, with the latest forecast averaging at 11.33%

Main Products: New energy products account for 51.83% of revenue, with a gross margin of 16.88%

Company Highlights: Kehua Data specializes in the production and sales of UPS power supplies for information equipment and industrial power applications. The company has partnered with Alibaba in building data centers.

3. Hikvision

Industry Segment: Security Equipment

Profitability: ROE 22.75%, Gross Margin 43.69%, Net Margin 18.26%

Performance Forecast: ROE has fluctuated between 19%-29% in the last three years, with the latest forecast averaging at 17.00%

Main Products: Main products and services account for 73.36% of revenue, with a gross margin of 46.47%

Company Highlights: Hikvision has entered into a strategic partnership with Alibaba Cloud to jointly promote the application of cloud computing and big data technologies in areas such as home surveillance, personal safety, and smart city construction.

2. Midea Group

Industry Segment: Air Conditioning

Profitability: ROE 22.84%, Gross Margin 24.40%, Net Margin 8.75%

Performance Forecast: ROE has fluctuated between 22%-25% in the last three years, with the latest forecast averaging at 20.22%

Main Products: HVAC accounts for 46.52% of revenue, with a gross margin of 26.35%

Company Highlights: Midea Group has collaborated with Alibaba's intelligent cloud platform, O2O channel construction, and data system integration to create a profound example of Internet + manufacturing.

1. Sungrow Power Supply

Industry Segment: Inverters

Profitability: ROE 24.99%, Gross Margin 25.72%, Net Margin 9.85%

Performance Forecast: ROE has steadily increased to 40.96% over the past three years, with the latest forecast averaging at 29.53%

Main Products: Photovoltaic inverters and other power electronic conversion devices account for 42.21% of revenue, with a gross margin of 37.62%

Company Highlights: Sungrow Power Supply has extensively collaborated with Alibaba Cloud in areas such as smart PV power stations, energy internet, internet finance, cloud computing, big data, and information security.

Top Ten Enterprises in Alibaba Cloud Profitability, ROE, Gross Margin, and Net Margin Over the Last Three Years: