Who Reigns Supreme in Profitability on Tencent Cloud?

![]() 02/17 2025

02/17 2025

![]() 508

508

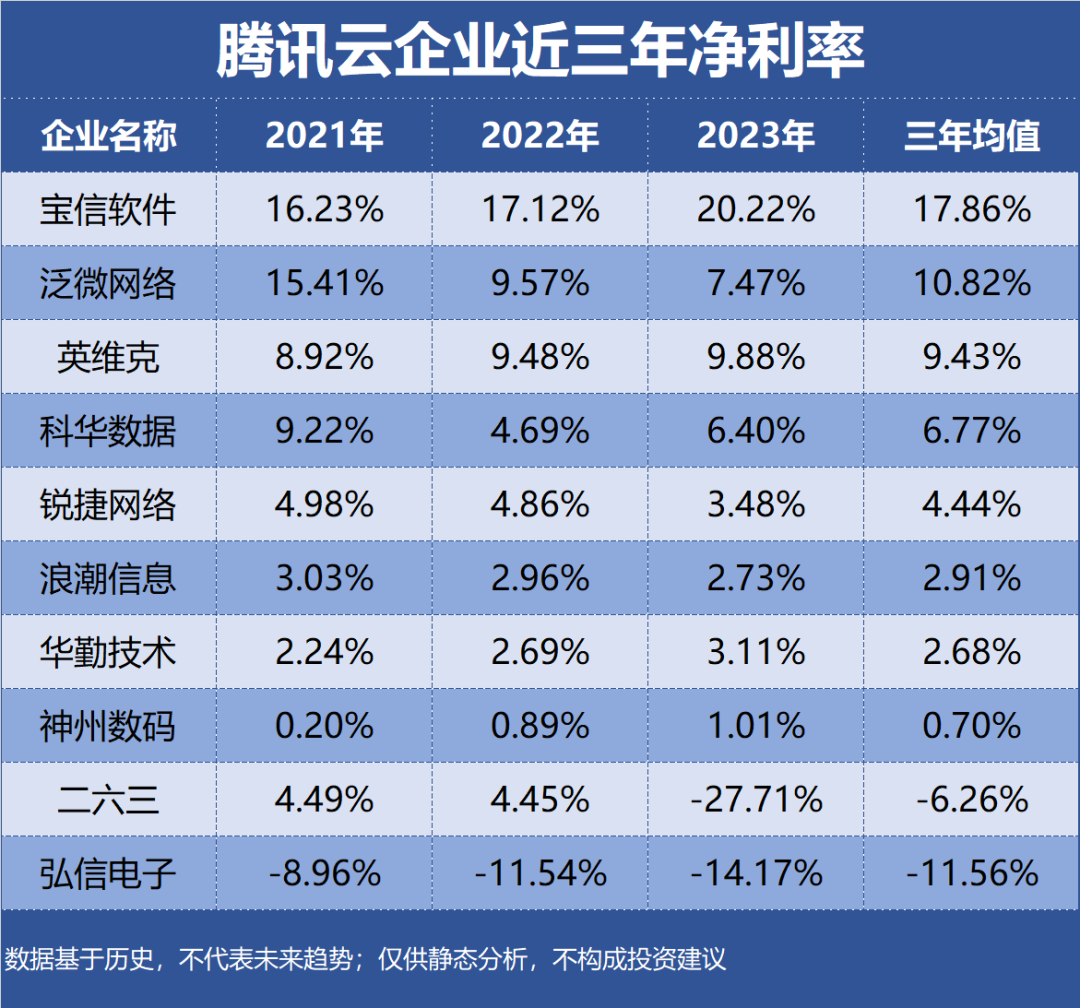

WeChat has discreetly introduced a deep-thinking AI search feature, albeit still in grayscale testing. Users can seamlessly access the large model by tapping the search box within the chat interface and opting for DeepSeek R1 under "AI Search." Furthermore, Tencent Yuanbao has seamlessly integrated the full-fledged version of DeepSeek-R1, allowing users to switch effortlessly between the Hunyuan model and the robust DeepSeek-R1. Tencent Cloud, a product of Tencent, offers developers and enterprises a comprehensive solution encompassing cloud services, cloud data, and cloud operations. This article, part of the "Profitability" series within the Enterprise Value series, scrutinizes 18 Tencent Cloud enterprises using ROE, gross profit margin, net profit margin, and other metrics as evaluation criteria. The data, based on historical information, is solely intended for static analysis and does not forecast future trends or constitute investment advice.

Top 10 Most Profitable Enterprises on Tencent Cloud:

10th - Ernet Group: Industry Segment - Communication Application Value-Added Services

Profitability: ROE -3.30%, Gross Margin 48.47%, Net Profit Margin -6.26%

Performance Forecast: Highest ROE in the past three years was 1.46%, latest forecast average is 5.37%

Main Products: Cloud network business, accounting for 45.67% of revenue with a gross margin of 30.72%

Company Highlights: Ernet Group has inked a strategic cooperation agreement with Tencent Cloud to collaborate deeply in areas such as enterprise digital transformation, cloud resource pool construction, and audio-video communication services.

9th - Weaver Network: Industry Segment - Horizontal General Software

Profitability: ROE 13.05%, Gross Margin 94.21%, Net Profit Margin 10.82%

Performance Forecast: ROE has steadily declined to 8.67% over the past three years, with the latest forecast average at 9.81%

Main Products: Technical services, accounting for 61.59% of revenue with a gross margin of 94.92%

Company Highlights: Weaver Network continues to deepen its integration with Tencent's comprehensive product line, providing a reliable information technology (IT) infrastructure built on Tencent Cloud TDSQL, and expanding its application scenarios in central and state-owned enterprises.

8th - Inspur Information: Industry Segment - Other Computer Equipment

Profitability: ROE 12.12%, Gross Margin 10.89%, Net Profit Margin 2.91%

Performance Forecast: ROE has fluctuated between 9%-14% in the past three years, with the latest forecast average at 11.29%

Main Products: Servers and components, accounting for 99.57% of revenue with a gross margin of 7.65%

Company Highlights: Inspur Information provides computational support to renowned AI-related enterprises like Tencent and is a key server supplier.

7th - Ruijie Networks: Industry Segment - Communication Network Equipment and Components

Profitability: ROE 23.70%, Gross Margin 38.68%, Net Profit Margin 4.44%

Performance Forecast: ROE has declined to 9.44% over the past three years, with the latest forecast average at 11.32%

Main Products: Network equipment, accounting for 79.01% of revenue with a gross margin of 37.29%

Company Highlights: Ruijie Networks is a prominent supplier of data center switch products to large internet companies such as Tencent.

6th - Kelong Technology: Industry Segment - Other Power Supply Equipment

Profitability: ROE 10.74%, Gross Margin 28.67%, Net Profit Margin 6.77%

Performance Forecast: ROE has fluctuated between 6%-13% in the past three years, with the latest forecast average at 11.33%

Main Products: New energy products, accounting for 51.83% of revenue with a gross margin of 16.88%

Company Highlights: Kelong Technology has collaborated with Tencent Cloud on the elastic resource pool model, integrating Tencent Cloud resources into data centers in Shanghai, Guangdong, and other locations, enhancing user access to Tencent Cloud services.

5th - Huaqin Technology: Industry Segment - Consumer Electronics Components and Assembly

Profitability: ROE 20.81%, Gross Margin 9.64%, Net Profit Margin 2.68%

Performance Forecast: ROE has fluctuated between 16%-24% in the past three years, with the latest forecast average at 12.72%

Main Products: High-performance computing, accounting for 56.31% of revenue with a gross margin of 9.58%

Company Highlights: Huaqin Technology has forged a deep partnership with leading internet and cloud computing customers like Tencent in the data business sector and serves as a core supplier.

4th - Highsun Electronics: Industry Segment - Printed Circuit Boards

Profitability: ROE -21.54%, Gross Margin 3.71%, Net Profit Margin -11.56%

Performance Forecast: ROE has remained negative for the past three years, with the latest forecast average at 5.03%

Main Products: Printed circuit boards, accounting for 49.98% of revenue with a gross margin of 1.51%

Company Highlights: Tencent is a major shareholder and customer of Thuiyuan Technology, and Highsun Electronics has jointly advanced the localization of AI computing chips and servers with Thuiyuan Technology.

3rd - Digital China: Industry Segment - IT Services

Profitability: ROE 11.28%, Gross Margin 3.75%, Net Profit Margin 0.70%

Performance Forecast: ROE has fluctuated between 4%-15% in the past three years, with the latest forecast average at 14.30%

Main Products: Consumer electronics business, accounting for 65.33% of revenue with a gross margin of 2.14%

Company Highlights: Digital China has bolstered its diversified MSP vendor landscape through the acquisition of GoPomelo, achieving comprehensive coverage of mainstream public clouds including Tencent Cloud.

2nd - Sunvic: Industry Segment - Other Special Equipment

Profitability: ROE 14.13%, Gross Margin 30.50%, Net Profit Margin 9.43%

Performance Forecast: ROE has risen to 15.03% over the past three years, with the latest forecast average at 18.69%

Main Products: Data center temperature control and energy-saving products, accounting for 49.96% of revenue with a gross margin of 30.62%

Company Highlights: Sunvic has supplied numerous efficient and energy-efficient cooling products and systems to large data centers belonging to users such as Tencent.

1st - Baosight Software: Industry Segment - IT Services

Profitability: ROE 23.05%, Gross Margin 34.16%, Net Profit Margin 17.86%

Performance Forecast: ROE has climbed to 24.65% over the past three years, with the latest forecast average at 22.65%

Main Products: Software development and engineering services, accounting for 75.44% of revenue with a gross margin of 32.24%

Company Highlights: Baosight Software and Tencent Cloud have embarked on a comprehensive strategic collaboration spanning areas like basic cloud infrastructure, industrial internet research, and the development and implementation of enterprise security and information technology innovation services.

ROE, gross profit margin, and net profit margin trends of the top 10 most profitable enterprises on Tencent Cloud over the past three years: