Who Reigns Supreme in Cloud Computing PaaS Profitability?

![]() 02/10 2025

02/10 2025

![]() 586

586

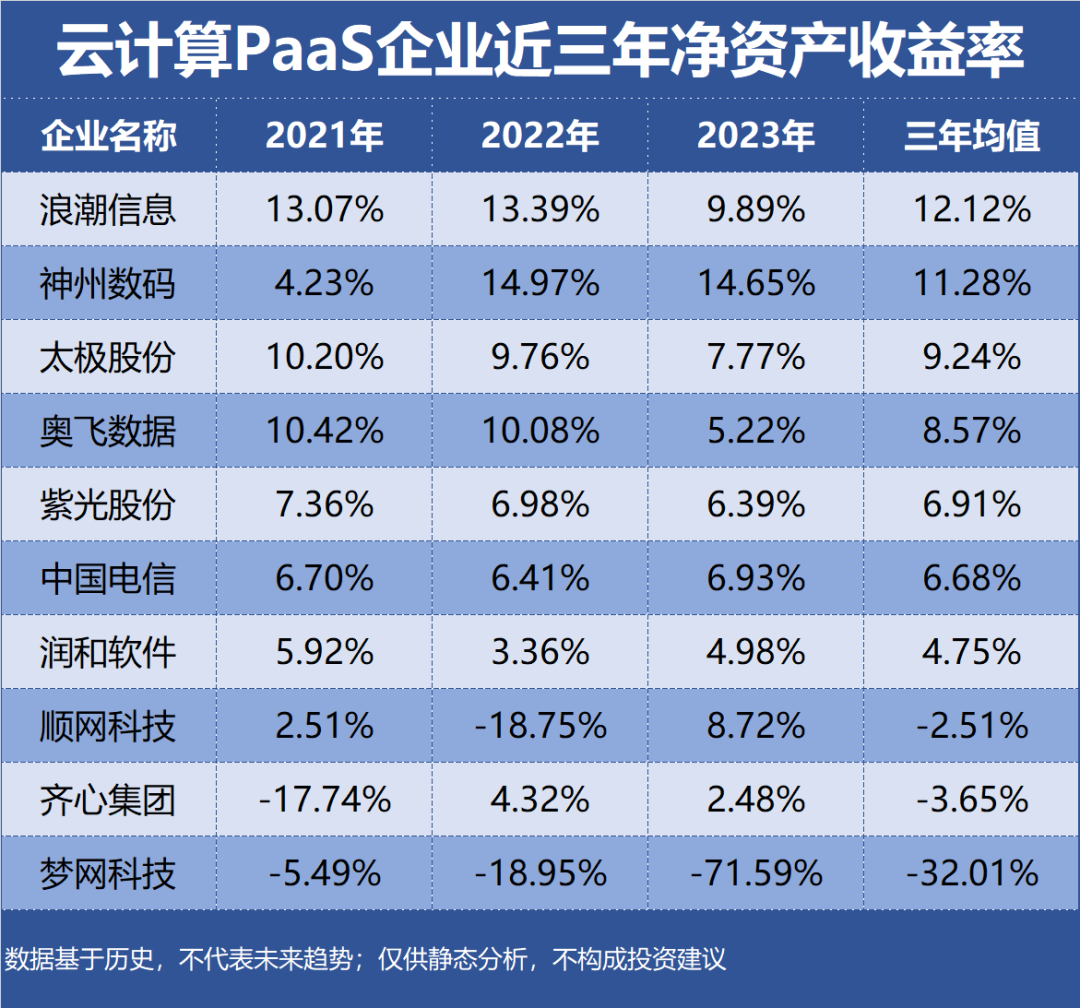

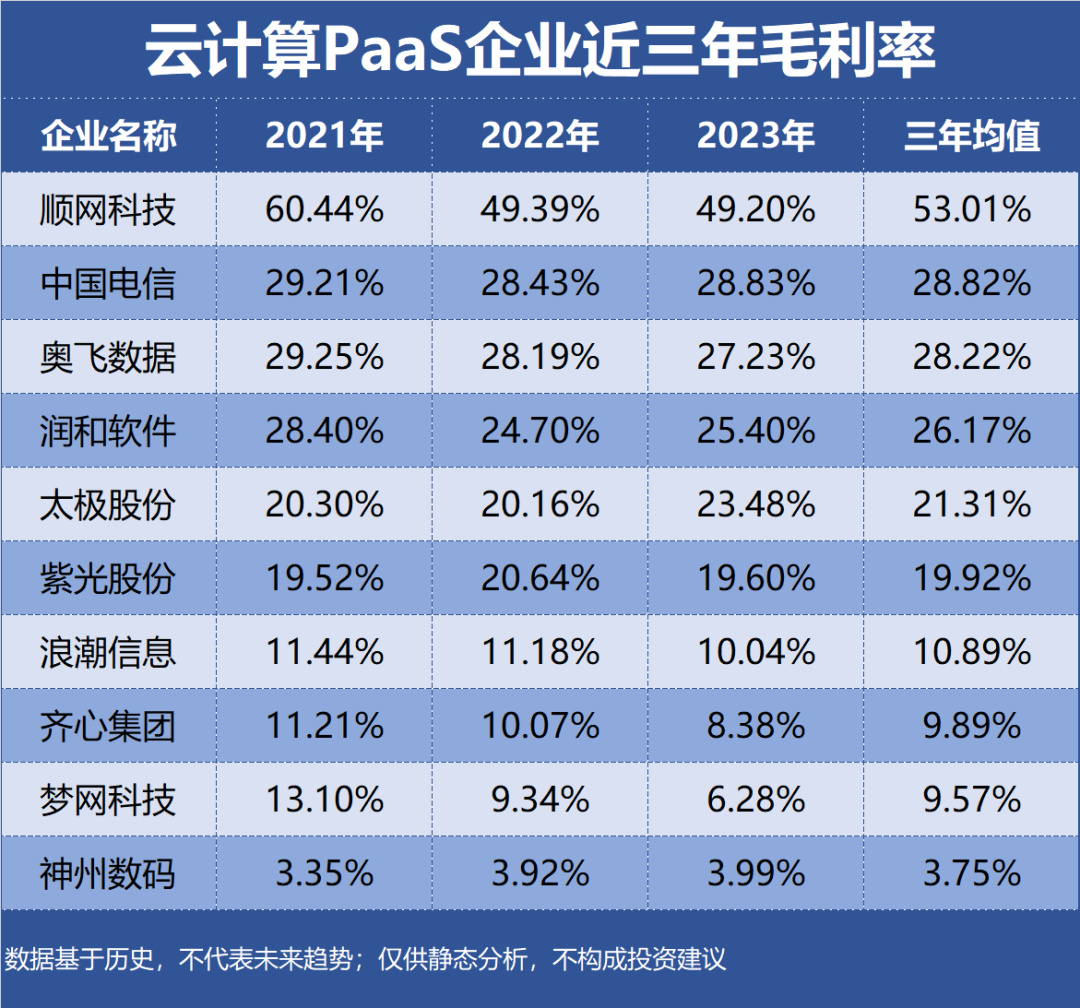

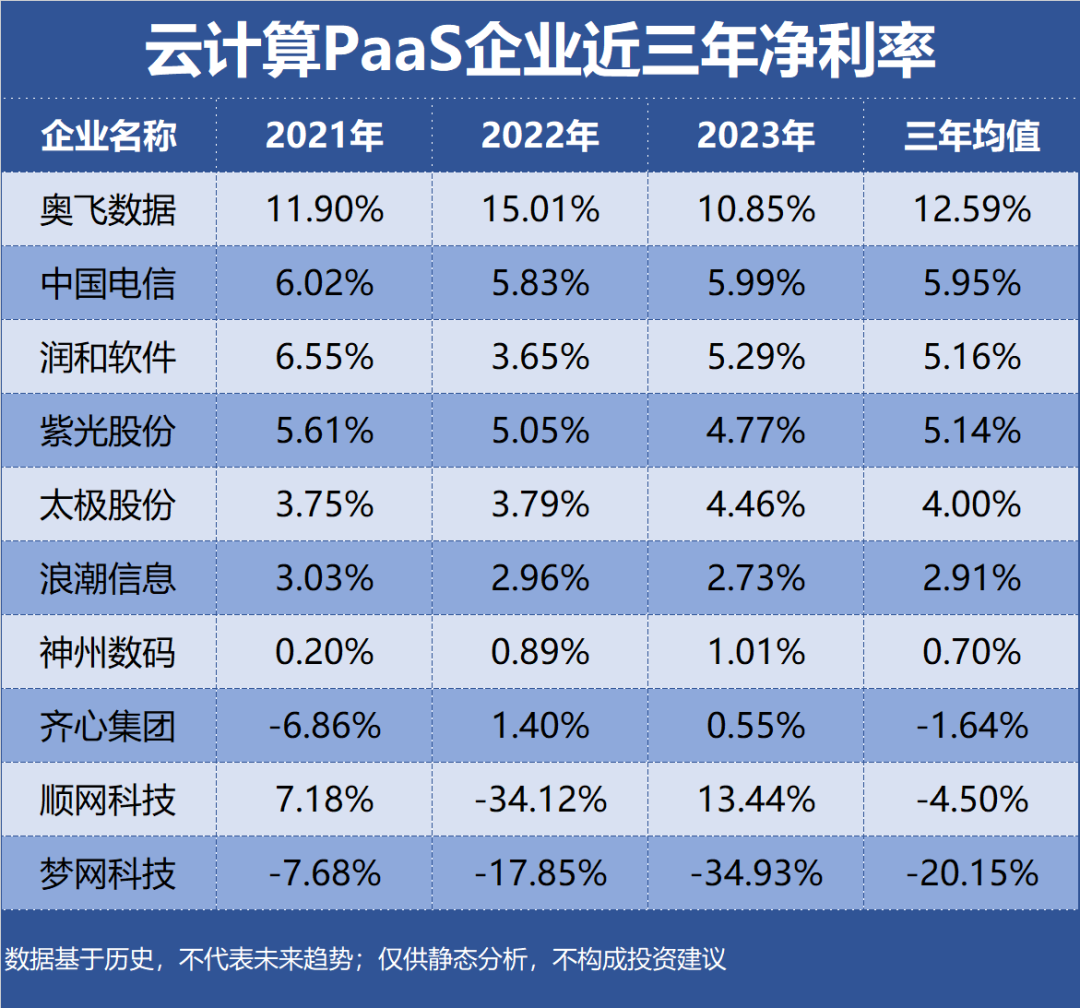

PaaS (Platform as a Service) is a cornerstone of cloud computing, offering a software platform built on cloud infrastructure. This platform integrates essential resources like servers, storage, and networks with software components such as operating systems, database management systems, and middleware. This holistic approach provides developers with a seamless environment for developing, running, and managing applications, allowing them to concentrate on innovation rather than infrastructure management. This article, part of the [Profitability] chapter in our enterprise value series, analyzes 41 cloud computing PaaS enterprises using key metrics like return on equity (ROE), gross profit margin, and net profit margin. Please note that the data is based on historical trends and is intended for static analysis only; it does not constitute investment advice or predict future performance.

Top 10 Cloud Computing PaaS Enterprises in Profitability:

No.10 China Telecom

Industry Segment: Telecom Operators

Profitability: ROE 6.68%, Gross Profit Margin 28.82%, Net Profit Margin 5.95%

Performance Forecast: ROE has fluctuated between 6%-7% in the past three years, with the latest forecast averaging 7.16%

Main Products: Telecommunications, accounting for 100.00% of revenue with a gross profit margin of 28.83%

Company Highlights: China Telecom leads in revenue scale among global operator public cloud IaaS industries and ranks fourth in national public cloud IaaS+PaaS revenue.

No.9 Aofei Data

Industry Segment: Communication Application Value-Added Services

Profitability: ROE 8.57%, Gross Profit Margin 28.22%, Net Profit Margin 12.59%

Performance Forecast: ROE has continuously declined to 5.22% over the past three years, with the latest forecast averaging 5.16%

Main Products: IDC services, accounting for 59.34% of revenue with a gross profit margin of 26.40%

Company Highlights: Aofei Data offers value-added services including network intrusion detection, data backup, distributed massive file storage, and game acceleration.

No.8 Comix Group

Industry Segment: Cultural Products

Profitability: ROE -3.65%, Gross Profit Margin 9.89%, Net Profit Margin -1.64%

Performance Forecast: ROE peaked at 4.32% in the past three years, with the latest forecast averaging 7.06%

Main Products: Office supplies, accounting for 99.18% of revenue with a gross profit margin of 9.47%

Company Highlights: In data marketing, Comix Group leverages Hangzhou Maimiao as its primary platform, enhancing big data marketing and promotion services, positioning itself as an AI-powered service provider.

No.7 Taiji Computers

Industry Segment: IT Services

Profitability: ROE 9.24%, Gross Profit Margin 21.31%, Net Profit Margin 4.00%

Performance Forecast: ROE has continuously declined to 7.77% over the past three years, with the latest forecast averaging 7.27%

Main Products: Industry solutions, accounting for 42.79% of revenue with a gross profit margin of 19.39%

Company Highlights: Taiji Computers has evolved its business structure to include cloud services, network security, smart applications, and system integration.

No.6 HiHope Corp.

Industry Segment: IT Services

Profitability: ROE 4.75%, Gross Profit Margin 26.17%, Net Profit Margin 5.16%

Performance Forecast: ROE has fluctuated between 3%-6% in the past three years, with the latest forecast averaging 7.07%

Main Products: Financial technology, accounting for 53.08% of revenue with a gross profit margin of 25.63%

Company Highlights: HiHope Corp. collaborates closely with Alibaba Cloud, leveraging its computing platform, cloud products, and services to offer end-to-end financial information solutions for the financial industry.

No.5 Unisplendour Corp.

Industry Segment: IT Services

Profitability: ROE 6.91%, Gross Profit Margin 19.92%, Net Profit Margin 5.14%

Performance Forecast: ROE has continuously declined to 6.39% over the past three years, with the latest forecast averaging 8.55%

Main Products: ICT infrastructure and services, accounting for 68.92% of revenue with a gross profit margin of 24.37%

Company Highlights: Unisplendour Corp. is a leading digital solution provider with comprehensive capabilities in digital infrastructure, spanning computing, storage, networking, and security.

No.4 Mengwang Technology

Industry Segment: Communication Application Value-Added Services

Profitability: ROE -32.01%, Gross Profit Margin 9.57%, Net Profit Margin -20.15%

Performance Forecast: ROE has remained negative for the past three years, with the latest forecast averaging 6.45%

Main Products: Cloud communication services, accounting for 93.23% of revenue with a gross profit margin of 8.79%

Company Highlights: Mengwang Technology operates one of China's largest enterprise cloud communication platforms, offering a full range of mobile Internet cloud communication services to enterprises.

No.3 Inspur Information

Industry Segment: Other Computer Equipment

Profitability: ROE 12.12%, Gross Profit Margin 10.89%, Net Profit Margin 2.91%

Performance Forecast: ROE has fluctuated between 9%-14% in the past three years, with the latest forecast averaging 11.29%

Main Products: Servers and components, accounting for 99.57% of revenue with a gross profit margin of 7.65%

Company Highlights: Focusing on cloud computing IaaS layer R&D, Inspur Information is the first domestic vendor to achieve an independent technology layout in this sector.

No.2 Snail Games

Industry Segment: Communication Application Value-Added Services

Profitability: ROE -2.51%, Gross Profit Margin 53.01%, Net Profit Margin -4.50%

Performance Forecast: ROE peaked at 8.72% in the past three years, with the latest forecast averaging 11.30%

Main Products: Online advertising and value-added services, accounting for 75.66% of revenue with a gross profit margin of 26.25%

Company Highlights: Snail Games actively incorporates edge computing and cloud services into internet cafe management, exploring multi-scenario implementations and transitioning into a cloud platform for computing power sharing.

No.1 Digital China

Industry Segment: IT Services

Profitability: ROE 11.28%, Gross Profit Margin 3.75%, Net Profit Margin 0.70%

Performance Forecast: ROE has fluctuated between 4%-15% in the past three years, with the latest forecast averaging 14.30%

Main Products: Consumer electronics, accounting for 65.33% of revenue with a gross profit margin of 2.14%

Company Highlights: Digital China has strengthened its collaboration with Alibaba Cloud, AWS, and Huawei Cloud in hybrid cloud solutions, jointly expanding the domestic enterprise market.

Top 10 Cloud Computing PaaS Enterprises in Profitability: Return on Equity, Gross Profit Margin, and Net Profit Margin in the Last Three Years: