Who Reigns Supreme in Cloud Computing SaaS Profitability?

![]() 02/10 2025

02/10 2025

![]() 355

355

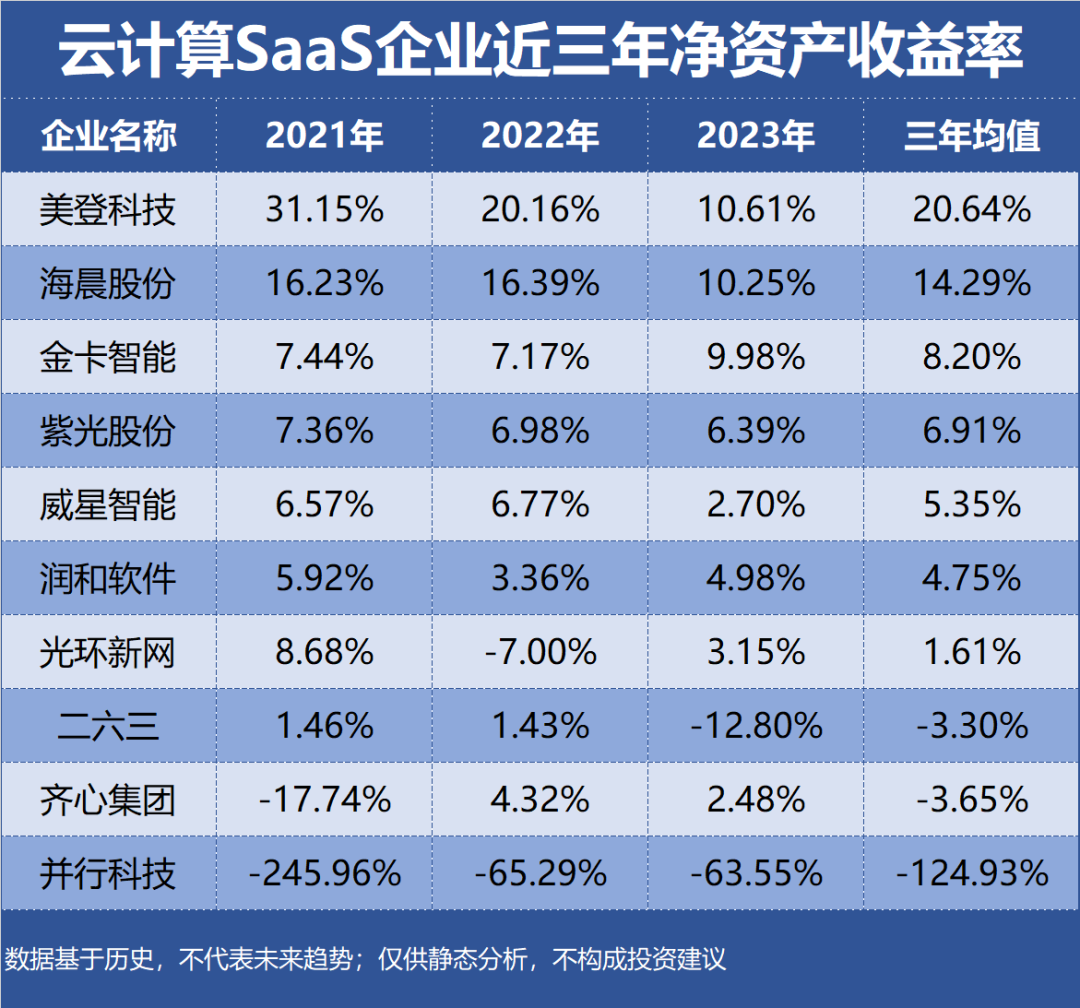

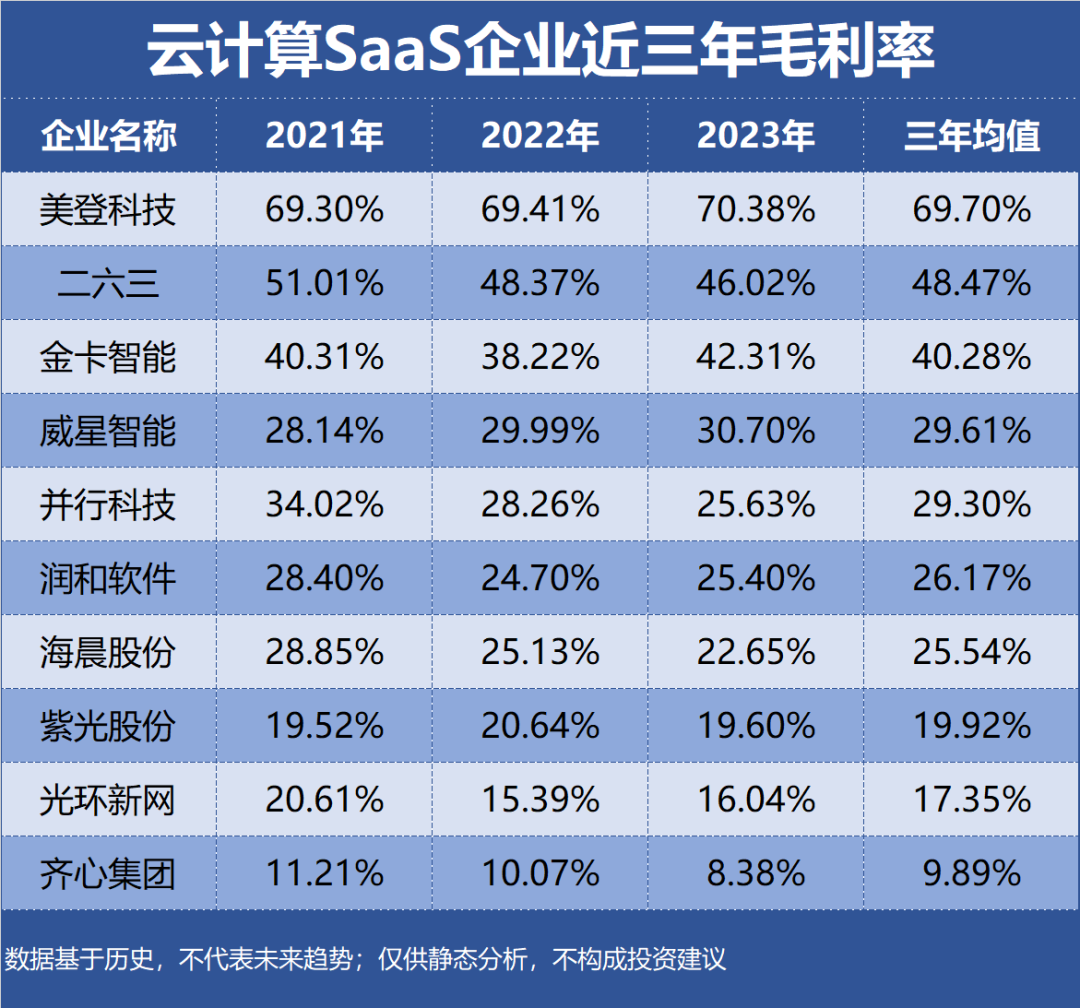

SaaS, an acronym for Software as a Service, represents a pioneering service model within cloud computing. This innovative approach enables enterprises and individuals to access software applications anytime, anywhere, provided they have an internet connection and a browser. This eliminates the need for installing software on local hard drives or servers. This article, part of the Enterprise Value series focusing on Profitability, analyzes the profitability of 29 cloud computing SaaS enterprises based on indicators such as Return on Equity (ROE), gross margin, and net margin. Note that the data is based on historical performance and is solely intended for static analysis; it does not predict future trends or constitute investment advice.

Top 10 Most Profitable Cloud Computing SaaS Enterprises:

10th: SinoNet Technology - Industry Segment: Communication Application Value-Added Services

- Profitability: ROE 1.61%, Gross Margin 17.35%, Net Margin 0.57%

- Performance Forecast: Highest ROE in the last three years was 8.68%, with the latest forecast average at 3.83%

- Main Products: Cloud computing and related services (71.06% of revenue, gross margin of 9.45%)

- Company Highlights: SinoNet Technology offers internet broadband access services, IDC and its value-added services, IDC operation management services, and cloud computing and related services.

9th: 263 Cloud Communication - Industry Segment: Communication Application Value-Added Services

- Profitability: ROE -3.30%, Gross Margin 48.47%, Net Margin -6.26%

- Performance Forecast: Highest ROE in the last three years was 1.46%, with the latest forecast average at 5.37%

- Main Products: Cloud network services (45.67% of revenue, gross margin of 30.72%)

- Company Highlights: 263 Cloud Communication provides users with integrated cloud services: cloud video, teleconference, and enterprise email, leading the domestic enterprise SAAS services market.

8th: ParaSci - Industry Segment: IT Services

- Profitability: ROE -124.93%, Gross Margin 29.30%, Net Margin -29.53%

- Performance Forecast: ROE has been negative for the last three years, with the latest forecast average at 0.21%

- Main Products: Supercomputing cloud services (95.81% of revenue, gross margin of 33.90%)

- Company Highlights: ParaSci has enabled over 200 supercomputing application software, forming a platform that integrates computing, application, service, and talent resources.

7th: Comix Group - Industry Segment: Cultural Supplies

- Profitability: ROE -3.65%, Gross Margin 9.89%, Net Margin -1.64%

- Performance Forecast: Highest ROE in the last three years was 4.32%, with the latest forecast average at 7.06%

- Main Products: Office supplies (99.18% of revenue, gross margin of 9.47%)

- Company Highlights: In cloud video conferencing, Comix Group uses SilverPen Cloud, combined with big data and AI, to innovate product research and development (focusing on intelligent hardware).

6th: HiHope - Industry Segment: IT Services

- Profitability: ROE 4.75%, Gross Margin 26.17%, Net Margin 5.16%

- Performance Forecast: ROE fluctuated between 3% and 6% in the last three years, with the latest forecast average at 7.07%

- Main Products: Financial technology business (53.08% of revenue, gross margin of 25.63%)

- Company Highlights: HiHope provides timely, efficient, and flexible SaaS application services to banks, insurance companies, and emerging financial enterprises, supporting the continuous development and innovation of their businesses.

5th: Unisplendour - Industry Segment: IT Services

- Profitability: ROE 6.91%, Gross Margin 19.92%, Net Margin 5.14%

- Performance Forecast: ROE continuously declined to 6.39% in the last three years, with the latest forecast average at 8.55%

- Main Products: ICT infrastructure and services (68.92% of revenue, gross margin of 24.37%)

- Company Highlights: Unisplendour offers one-stop, comprehensive digital platform solutions encompassing cloud computing, big data, large interconnection, information security, IoT, edge computing, AI, and 5G.

4th: Wisdom Gas - Industry Segment: Instrumentation

- Profitability: ROE 5.35%, Gross Margin 29.61%, Net Margin 5.26%

- Performance Forecast: ROE fluctuated between 2% and 7% in the last three years, with the latest forecast average at 8.80%

- Main Products: Remote gas meters (56.28% of revenue, gross margin of 33.87%)

- Company Highlights: Smart Gas Cloud, built by Wisdom Gas, is a professional SaaS industry cloud leveraging mobile internet, cloud computing, big data, and AI technology.

3rd: Haichen Logistics - Industry Segment: Intermediate Products and Consumer Goods Supply Chain Services

- Profitability: ROE 14.29%, Gross Margin 25.54%, Net Margin 19.55%

- Performance Forecast: ROE fluctuated between 10% and 17% in the last three years, with the latest forecast average at 9.32%

- Main Products: Integrated logistics services (82.87% of revenue, gross margin of 23.95%)

- Company Highlights: Haichen Logistics integrates third-party resources to create an integrated supply chain SaaS platform, pioneering the first leading vertical internet SaaS service platform in the supply chain field globally.

2nd: Golden Card Intelligent - Industry Segment: Instrumentation

- Profitability: ROE 8.20%, Gross Margin 40.28%, Net Margin 11.59%

- Performance Forecast: ROE fluctuated between 7% and 10% in the last three years, with the latest forecast average at 9.81%

- Main Products: Smart civilian gas terminals and systems (59.98% of revenue, gross margin of 35.94%)

- Company Highlights: Golden Card Intelligent boasts the largest SaaS cloud platform in the public utility field, connecting over 900 enterprises.

1st: Meideng Technology - Industry Segment: IT Services

- Profitability: ROE 20.64%, Gross Margin 69.70%, Net Margin 38.28%

- Performance Forecast: ROE continuously declined to 10.61% in the last three years, with the latest forecast average at 10.32%

- Main Products: SaaS software services (79.32% of revenue, gross margin of 73.84%)

- Company Highlights: Meideng Technology is a pioneer in developing and selling e-commerce SaaS software in China, focusing on meeting the marketing management and order management needs of e-commerce merchants.

ROE, Gross Margin, and Net Margin of the Top 10 Most Profitable Cloud Computing SaaS Enterprises in the Last Three Years: