Google's Q4 Report: Even a Profit-Generating Powerhouse Requires a Respite

![]() 02/08 2025

02/08 2025

![]() 511

511

After scrutinizing Google's Q4 report and witnessing a 7% decline from after-hours to overnight trading, one might share the sentiment: even a stock that generates substantial profits needs a pause before resuming its ascent.

Throughout Q4 2024 to date, Google's stock price has surged by nearly 40%, making it a standout performer among the Big Seven. This significant upswing can be attributed to two primary factors: despite AI disruptions, the search business has maintained steady growth, defying market pessimism; and Google's cloud services segment has achieved high growth, gradually narrowing the gap with industry leader AWS.

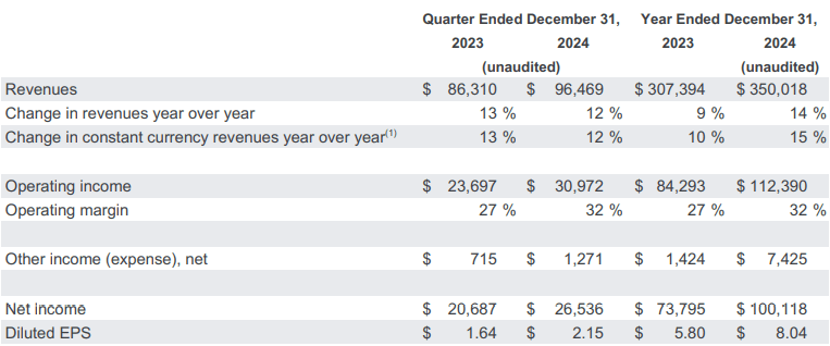

Looking back, has Google's current performance deviated from the two core drivers of its remarkable rise? Apparently not. Overall, Google's Q4 performance was one of its best in recent years, with revenue of $96.67 billion, just $0.17 billion shy of expectations—a negligible margin. Earnings per share (EPS), a crucial metric in the U.S. stock market, reached $2.15, surpassing market expectations of $2.13.

For a company with a market capitalization of trillions and quarterly revenue nearing $100 billion, achieving a 12% year-on-year growth rate is commendable. Moreover, while achieving double-digit revenue growth, the company's operating profit increased at a year-on-year rate of 27%, substantially higher than the revenue growth rate for the same period. This expansion increased the company's operating profit margin by 5 percentage points to 32%, with full-year operating profit surpassing $110 billion.

Furthermore, Google has always been a high-quality company committed to shareholder returns. Driven by share repurchases, EPS for Q4 2024 increased by 39% year-on-year. Overall, Google's performance is replete with positive news, boasting high growth rates across the board, making it hard to believe that this is a behemoth with annual revenue of $3.5 trillion. Where is the so-called "big company disease"?

Therefore, the accumulated selling pressure from earlier significant gains, emotional sparks ignited by negative news related to the trade war, and doubts about the effectiveness of Google's large-scale capital expenditure due to DeepSeek collectively contributed to a swift short-term decline in the company's stock price. However, for investors seeking stable and robust targets, this presents a favorable opportunity.

01 Prominent Scale Effect

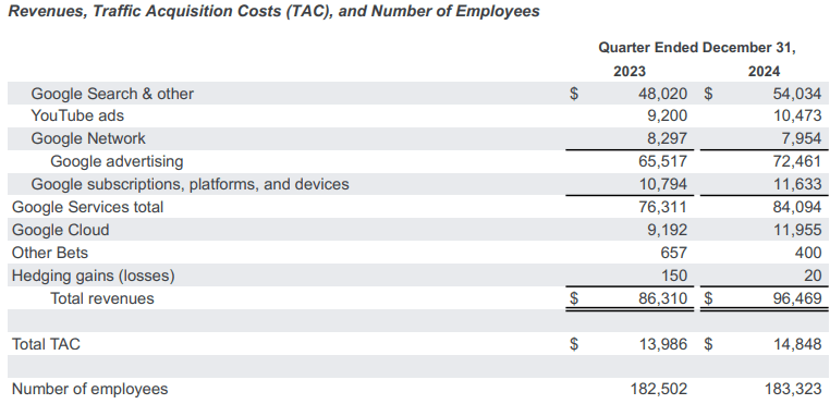

Breaking down Google's performance across specific business segments, all are performing well except for Google Network.

First, let's discuss the search business. We believe this was the core source of divergent expectations that fueled Google's rapid stock price growth in the fourth quarter of last year. Simply put, since the advent of ChatGPT, many believed that Google's search business was doomed, with people's attention shifting to AI search offering better results. However, Google's search business revenue has continued to rise since then, showing no signs of being squeezed by AI.

This quarter, Google's search revenue reached $54 billion, with a year-on-year growth rate of 12.5%, considered excellent for a massive advertising business. YouTube's advertising grew by 14%, and all subscription businesses, including YouTube, grew by 8% to $11.6 billion. Google Services revenue increased by 10% year-on-year, while only Google Network revenue saw a decline of 4%.

The fastest-growing segment is Google Cloud. Cloud services revenue increased by 30% to $11.96 billion this quarter, maintaining high growth but slightly missing market expectations of $12.16 billion. Nonetheless, this is a commendable performance. Like subscription services, cloud services are also a business with high-quality revenue. AWS achieves an operating profit margin of nearly 40% from this segment, while Google has only 17.5%, indicating a significant gap compared to the industry leader.

It should be emphasized that the core competitiveness driving Google's current growth lies in its "scale effect." With powerful computing power and cloud resources as the foundation for search, video, and AI, coupled with its near-monopoly market position in global markets excluding China, the company has few competitors. While its innovation capabilities may be criticized, this scale effect is unmatched.

In summary, describing Google as a "profit-generating powerhouse" is not an exaggeration, whether in terms of overall size or profitability. However, even the stock price of a profit-generating powerhouse sometimes needs a pause.

02 Emerging Risks

On the afternoon of Beijing time on the 5th, facing Trump's aggressive tariff threats, the European Union considered retaliating against major U.S. technology companies. On the surface, this appears as major negative news; however, it's practically ineffective. If the U.S. targets Europe, it will undoubtedly succeed.

The crux of the matter is that the EU lacks retaliatory power against Google. The entire EU cannot produce any significant technology companies. Both sides are well aware that without major U.S. technology companies like Google, the EU might regress to a pre-internet society. The ultimate outcome, after negotiations between the two sides, will be a penalty that is neither too large nor too small, fully within Google's acceptable range.

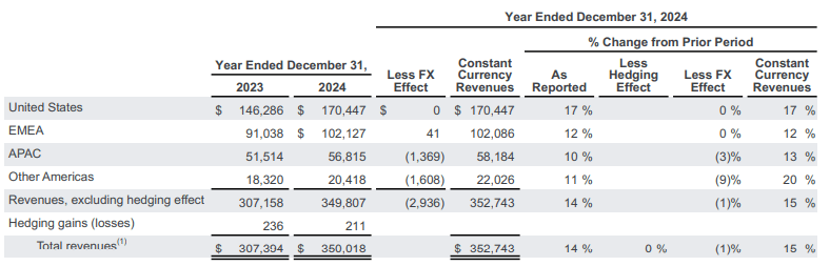

The other retaliation stems from China. Admittedly, the revenue proportion from the Asia-Pacific region is relatively small within Google, and its growth rate lags far behind that of North America. Even if retaliatory measures are taken, they will be limited by the business scale and pose no threat to Google.

The genuine risk factors originate internally. First, Trump's unilateral initiation of a tariff war and the elimination of the tax-free policy for cross-border transactions under $800 introduce business instability. In terms of revenue sources, regardless of the specific business department, advertising accounts for the largest proportion of Google's revenue. A substantial portion of the incremental advertising revenue in recent quarters has come from Chinese e-commerce platforms. As Chinese enterprises accelerate their overseas expansion and branding efforts, Google is a crucial option.

When the process of significantly expanding overseas is hindered, it is bound to impact Google's largest advertising business. If Trump persists on the path of "isolationism," the negative impact of this news on Google's performance could be evident as early as the second quarter of this year.

Another risk factor is excessive capital expenditure. During the earnings call, the company's management stated that capital expenditure in 2025 will reach $75 billion, a 40% increase compared to the actual expenditure of $52.54 billion in 2024. Of this, $16 billion to $18 billion will be invested in the first quarter, primarily for computing infrastructure, including servers and data centers, to support AI demands.

As we all know, after DeepSeek released several large models with low cost and high effectiveness in succession, the entire U.S. tech circle was greatly shocked, leading investors to distrust the high capital expenditure claimed by major tech companies. However, in our view, such capital expenditure is actually inevitable; just because DeepSeek has emerged does not mean that money does not need to be spent.

As mentioned earlier, Google Cloud's revenue growth rate is 30%, and the cloud services industry is highly competitive. Without a definitive competitive advantage, Google operates on a "you get what you put in" basis, earning revenue based on the number of servers it has. Comparing the 30% revenue growth rate to the 40% capital expenditure growth rate, the relatively advanced 10% is actually understandable.

Overall, with evident risk points, it is challenging for Google to replicate the high-speed growth of the fourth quarter of last year. However, after this significant post-earnings drop, Google's current valuation is relatively moderate, presenting a suitable opportunity for attention. In the long run, we maintain an optimistic outlook for Google's future performance, and these negative factors that significantly disturb the short term will be smoothed out by future growth.

Disclaimer: This article is for learning and exchange purposes only and does not constitute investment advice.