Big model spending war, Baidu Cloud urgently needs a breakthrough

![]() 10/10 2024

10/10 2024

![]() 612

612

Baidu Cloud has invested significant resources in the field of large AI models, but high R&D and operating costs have posed significant challenges to its profitability, becoming an issue that Baidu Group must address.

@Original by Tech New Knowledge

At the end of last month, the Baidu Cloud Intelligence Conference, themed "Intelligence·Leap", garnered significant attention. The conference brought together industry leaders and pioneering enterprises, with Baidu, as the host, busy non-stop. It first formed a strategic partnership with Samsung, then showcased its capabilities at the main forum, inviting key partners to jointly display benchmark cases, and creating a smart interactive technology exhibition hall spanning tens of thousands of square meters to comprehensively display its smart cloud products.

"Openness, Cooperation, Win-Win" is the slogan of Baidu Cloud's event, and in reality, Baidu Cloud is also inviting friends, advertising, launching new products, and building an ecosystem. However, in China's public cloud market, Alibaba Cloud, Huawei Cloud, China Telecom Tianyi Cloud, and Tencent Cloud have long dominated the front ranks, with Baidu Intelligent Cloud consistently playing catch-up.

With a small scale but big ambitions and many aspirations, Baidu Cloud is falling into the trap of abundant yet mediocre cloud computing.

Part.1

Is Smart Cloud Not a Good Business?

The seemingly bustling cloud market has its own temperature for participants.

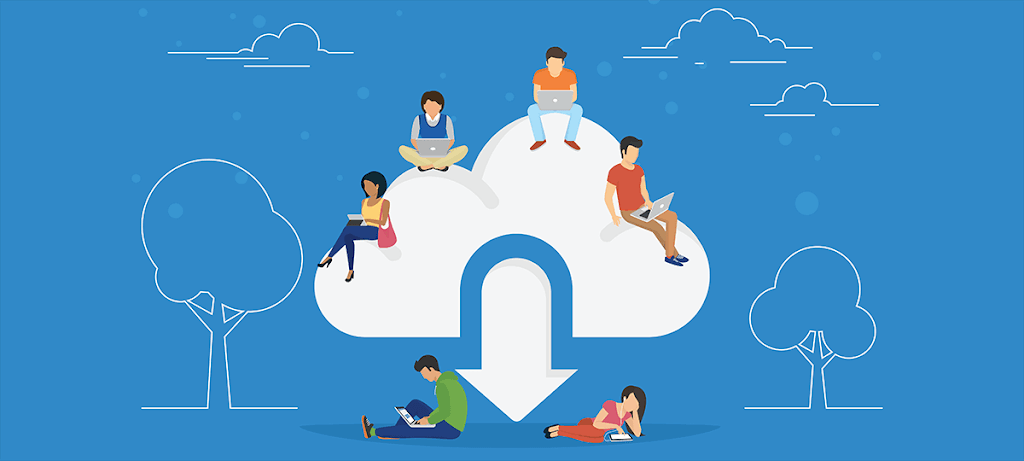

According to IDC, a global market research firm, China's public cloud market growth rate is declining. In 2023, the total size of China's public cloud market was $39.49 billion, with a growth rate of 12.7% for China's public cloud (IaaS+PaaS) market, marking the third consecutive year of decline.

In fact, even as the growth rate of the public cloud market declines, Baidu Cloud has never been a major player. Baidu Cloud, which only began development in 2012, was two to three years later than Alibaba and Tencent. In the second quarter of 2024, Alibaba Cloud's market share exceeded 36%, while Tencent's exceeded 16%. Baidu Cloud, however, could only be classified as "others" and did not rank among the top players.

But with the rise of AI, Baidu saw an opportunity to overtake. According to an IDC report on August 26, the size of China's AI public cloud market reached RMB 12.61 billion in 2023, up 58.2% year-on-year, significantly outpacing the growth of the public cloud market. This was a five-year wait for Baidu – after establishing the "Smart Cloud" strategy in 2019, AI became Baidu's core business direction. Since then, Baidu Cloud's reputation in the AI public cloud sector has grown, with IDC data showing that Baidu Smart Cloud accounted for 26.6% of the AI public cloud market in 2023, ranking first for five consecutive years.

However, the size of the AI cloud market remains uncertain. According to IDC's latest report, Baidu Smart Cloud ranked first in China's large model platform market share in 2023, with 19.9%. But from January to May 2024, nearly 260 bid announcements for domestic large model projects were released, and Baidu topped the list with only 10 project bids. As a large model business deeply integrated with cloud services, this performance is clearly insufficient to support Baidu Cloud's market expectations.

It is even more important to note that this is the result of the AI market's shift from internet users to traditional industries such as government, finance, telecommunications, manufacturing, and energy, providing comprehensive solutions. With upgraded customer structures, demands, and services, the potential of the AI cloud market needs to be reassessed.

A senior executive from a competitor company noted that Baidu Cloud's market position is based on its differentiated AI product layout – AI computing power at the IaaS layer, AI platforms at the PaaS layer, AI models at the MaaS layer, AI applications at the SaaS layer, as well as ERNIE, Qianfan large model platform, and Baige heterogeneous computing platform, all of which support its overall product layout.

"Fortunately, Baidu Cloud still has some AI capabilities. If it relied solely on basic cloud products, it would face a sea of red."

Part.2

Racing to Expand, Feeling the Pain

Baidu Cloud's ambitions are well-known.

According to internal records shared by Robin Li, Baidu Cloud has applications covering over 30 industries, including education and training, real estate and home furnishing, machinery and equipment, and business services. This widespread promotion shares the same logic as Alibaba's Daniel Zhang's statement that "all industries deserve to be redone with AI."

Moreover, Baidu Cloud, which has entered multiple industries, has indeed delivered results. Revenue growth rates for the past three quarters (Q4 2023 to Q2 2024) were 11%, 12%, and 14%, respectively. In the Q2 2024 earnings call, it was disclosed that Baidu Smart Cloud's large model revenue share had increased from 4.8% in Q4 2023 to 9% in Q2 2024.

This is a commendable achievement, but insiders have raised doubts. Some believe that Baidu Cloud's excessive exaggeration of usage effects to expand its market influence and attract developers, regardless of actual application effects, will invite criticism. They argue that "marketing and technology are fundamentally different logics."

However, it is clear that Baidu Cloud currently needs market recognition more than ever. According to agency records, Baidu won 143 projects in the first half of 2024, 30 of which were strongly related to large models or AI products, with significantly higher gross margins than turnkey projects primarily based on human services. An even more impressive achievement is usage frequency; data shows that the Qianfan large model platform reached 700 million daily calls in September, more than ten times higher than in 2023, demonstrating a high level of market recognition.

However, paradoxes also arise here. "The competition in large models is essentially a competition for computing power, and in this regard, Baidu is not yet a match for those top players. But with the onset of price wars, Baidu cannot afford to back down," said an industry insider regarding Baidu's current situation. "As a result, profits are bound to be affected."

"Before, everyone was making some money, but with these price cuts, gross margins have plummeted from over 60% to 0%, with each call resulting in a loss. It's a race to see who has more ammunition rather than focusing on expanding the market," expressed an industry insider's doubts about the brutal price wars.

The choice between stock and increment is a dilemma. A typical case comes from leading startup Minimax, which held a bidding event to procure computing power to support its business. Alibaba Cloud, Baidu Cloud, and ByteDance's Volcano Engine all participated in the bidding. While each company showcased its capabilities during the presentation, Minimax was solely concerned with one thing: price.

No one wanted to lose the high-quality customer Minimax. For regular customers, cloud computing platforms can offer prices ranging from 40% to 50% off, but this time, bidding reached as low as 20% off, a fierce competition.

Baidu Cloud's logic represents the attitude of most major players involved: the large model market is still in its early stages, and the number of customers is crucial for market growth.

However, the trend is even more apparent. Some suggest that the number of large model calls will increase exponentially over the next one to two years. Under marginal effects, cloud vendors' computing power costs will be diluted as customer demand grows, ultimately leading to positive profits. This means that only three to five basic model enterprises will survive the elimination rounds, with absolute market share advantages as a prerequisite.

It seems like a dead end. At this juncture, Baidu Cloud is betting on its technological capabilities, with ERNIE, Qianfan large model platform, and Baige heterogeneous computing platform, all focusing on computing power scheduling and performance, hoping to gain market recognition by helping customers address computing power shortages and high costs.

While this appears to be a promising path, the issue is that other competitors are likely thinking along the same lines, and homogeneity is an inevitable problem for all players.

Part.3

Can AI Cloud Be Afforded?

In fact, the high number of calls to large model platforms, which are a source of pride for many companies, is a money-burning endeavor. Amidst these escalating costs, Baidu Cloud has also faced rumors.

Last month, rumors circulated that Baidu was likely to abandon its general-purpose large model. The content suggested that competition in the sector was fierce, with disproportionate input and output, leading Baidu to consider abandoning the large model.

As the rumors intensified, Baidu had to respond. On September 9, Zhang Quanwen, head of ERNIE's marketing department, posted on WeChat Moments, "The claim that we are 'abandoning general-purpose large model research and development' is purely a rumor! ERNIE has just completed a comprehensive functional upgrade. We will continue to increase R&D investment in the field of general-purpose large models."

Large models are crucial to Baidu Cloud, and withdrawing from them at this time would indeed be illogical. However, these rumors serve as a warning to players in the sector: How long can players sustain the burning of cash?

Gartner's "Hype Cycle for Emerging Technologies, 2024" released in August this year shows that generative AI is two to five years away from production maturity. However, during this period, the costs can be significant, requiring Baidu Cloud to carefully manage its finances. Taking Anthropic as an example, its CEO revealed that the training cost of the AI model currently under development is as high as $1 billion, with future training costs for large models expected to rise to $10 billion within just three years.

Foreign companies aside, Baidu's costs are not insignificant either. A year ago, Guosheng Securities estimated that the training cost of GPT-3 was approximately $1.4 million per run. For larger LLM models, training costs ranged from $2 million to $12 million, while Baidu's large language model, ERNIE, which aims to rival ChatGPT, incurs significant expenses, especially in cloud infrastructure. Higher costs also stem from cloud facilities, as Baidu AI's market prominence relies on basic computing power. The amount Baidu needs to invest in this arms race is likely substantial.

Is Baidu prepared? There are concerns. Baidu's Q2 2024 financial report showed total revenue of RMB 33.9 billion, with core revenue of RMB 26.7 billion and core operating profit of RMB 5.6 billion, up 23% year-on-year. However, Baidu's largest revenue source, online advertising, generated RMB 19.2 billion in revenue, down 2% year-on-year. In cloud services, Baidu Cloud's revenue for the quarter was RMB 5.1 billion, with 9% coming from external customers' demand for large models and generative AI-related services. It is important to note that there are no direct data on the profit composition of these two major revenue streams.

"How much money does Baidu have to spend on cloud and large models? It's a mystery," commented an industry observer on Baidu Cloud's future investments. In his view, while Baidu held cash, cash equivalents, restricted cash, and short-term investments totaling RMB 162 billion as of June 30, 2024, "these funds are not easily spent, with only RMB 6.2 billion in actual free cash. If the cloud platform price war does not end soon, Baidu will face a complex situation."

In fact, Baidu Smart Cloud has repeatedly reduced its product prices this year: in May, it announced that its ERNIE-Speed, ERNIE-Lite, and ERNIE-Tiny series model preset services would be open to customers for free; in July, it announced significant price reductions for its flagship ERNIE 4.0 and ERNIE 3.5 models, with ERNIE 4.0 Turbo fully open to enterprise customers at prices as low as RMB 0.03 and RMB 0.06 per thousand tokens for input and output, respectively.

This may explain why individual profit data is hidden in the financial report: losing money to gain popularity is not a pretty sight.

The dilemma is not limited to Baidu Cloud but also extends to its parent company. Its ability to generate revenue is insufficient to support this period of intense competition, further testing Baidu Cloud's ability to commercially empower its products. Ultimately, customers need to make money before Baidu Cloud can make money – a simple truth with a challenging process.

Reference Materials:

IDC: Post-Pandemic Growth Falls Short of Expectations – China's Public Cloud Service Market Growth Continues to Slow in the First Half of 2023, IDC: Surprising Top Three in 230 Large Model Bidding Contracts, Digital Frontline: The "Ghost Story" of Large Models Isn't Just Haunting Baidu, Business Secrets: Baidu's "AI Secret" to Growth Exposed! ERNIE Large Model Daily Calls Exceed 600 Million, Sina Finance