23 billion! Google offers the highest acquisition price in history! The cloud security market is booming

![]() 07/25 2024

07/25 2024

![]() 502

502

As humanity gradually opens the door to the era of intelligence, the "Pandora's Box" named data security is also being opened. In the future, companies that can stand tall and maintain long-term competitiveness will undoubtedly be those capable of deploying their own security infrastructure. Therefore, giants represented by Google have begun to take proactive actions.

According to foreign media reports, Google's parent company, Alphabet, is in advanced negotiations to acquire the cloud computing cybersecurity startup Wiz for approximately $23 billion. If the deal is finalized, it could potentially mark Google's largest acquisition ever.

This acquisition comes at a time when U.S. antitrust scrutiny is increasingly stringent. Previously, the U.S. Department of Justice has filed two antitrust lawsuits against Google. Despite these challenges, Google is pushing ahead with this massive acquisition, highlighting its determination to strengthen its cybersecurity infrastructure amidst the growing threat of cybercrime.

As a leading global technology giant, Google's strategic moves often set the tone for the entire tech industry, and its heavy investment in Wiz reflects the booming cloud security market.

The World's Largest Cybersecurity Unicorn: Wiz

What makes Wiz worthy of Google's $23 billion offer?

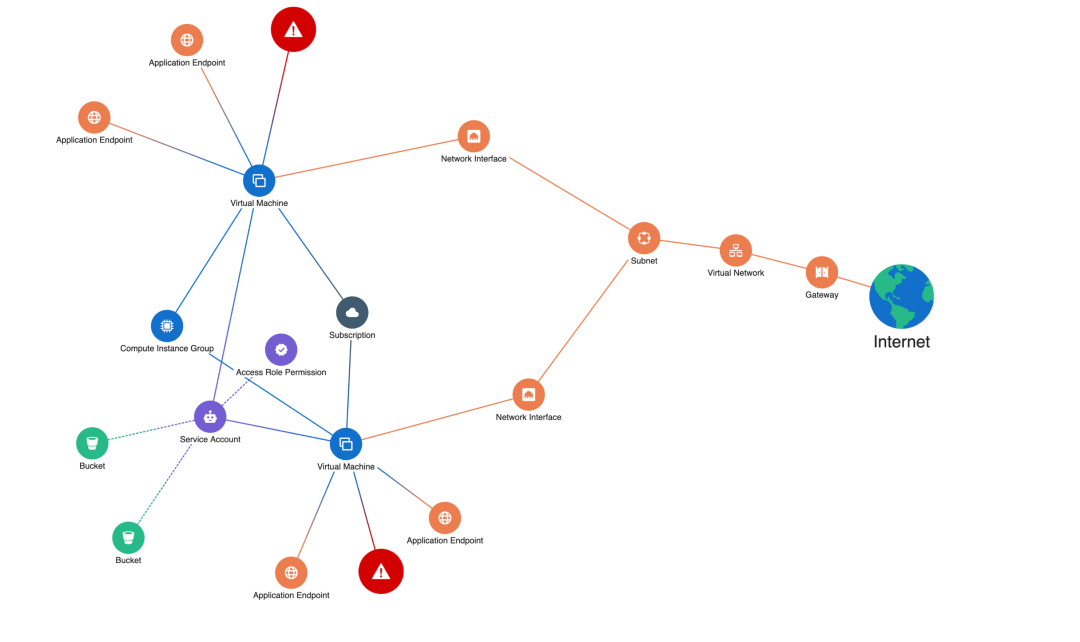

Through public sources, I discovered that Wiz was founded in 2020 by former Microsoft executive Raafat "Rafi" Gabay and several colleagues. The company specializes in cloud-native security, analyzing the infrastructure hosted in public cloud services to identify risk factors that could allow hackers to gain control over assets and access sensitive customer data. By creating a normative layer between cloud environments, Wiz enables organizations to quickly identify and eliminate critical risks. It has created the first cloud visibility solution for enterprise security, providing a 360-degree view of security risks across clouds, containers, and workloads, making it the first full-stack multi-cloud security platform.

According to the official website, Wiz can connect through APIs in minutes, providing comprehensive coverage of PaaS resources, virtual machines, containers, serverless functions, or sensitive data stored in public buckets, data volumes, and databases, without disrupting customers' business operations. It can scale to any cloud environment without impacting resource or workload performance.

Since its inception, Wiz has experienced rapid growth. By the end of 2022, the company had increased its annual recurring revenue (ARR) from $1 million to $100 million in just 18 months. This rapid growth led to significant funding rounds of $120 million and $250 million.

In February 2023, Wiz raised $300 million in its Series D funding round led by Lightspeed Venture Partners and Greenoaks Capital Partners. Angel investors including Starbucks owner Howard Schultz and French business magnate Bernard Arnault also participated. Following this round, Wiz's post-money valuation was approximately $10 billion, leading the company to claim the title of the world's largest cybersecurity unicorn.

Alongside funding, Wiz has also made two significant acquisitions in four years.

In December 2023, Wiz acquired Israeli startup Raftt, a cloud-based developer collaboration platform, for $50 million. This acquisition rapidly expanded Wiz's cloud-native application protection platform (CNAPP) capabilities and provided customers with more efficient development security coverage. Raftt's co-founder and CEO, Roy Iarchy, stated at the time, "We couldn't miss the opportunity to join Wiz," demonstrating his confidence in the company.

In March of this year, Wiz acquired Gem Security, a cloud threat detection and response platform provider, for $350 million. Gem Security leverages existing infrastructure and solutions to provide automated detection, investigation, and response capabilities specifically built for cloud environments. Additionally, the platform integrates with identity providers, source code repositories, secret managers, and other platforms, leveraging additional data for contextual analysis.

Currently, over 40% of Fortune 100 companies are Wiz customers, including notable firms such as BMW, Merrill Lynch, Morgan Stanley, Salesforce, Slack, Colgate-Palmolive, and Blackstone. With such an impressive track record, it's no wonder Google favors Wiz.

Google Bets Big on Cloud Security Amid Pressure

In January last year, the U.S. Department of Justice filed an antitrust lawsuit against Google alleging monopolization of digital advertising technology. This year, in January, the Federal Trade Commission (FTC) issued investigative orders to five companies, including Google's parent company Alphabet, requesting information on recent investments and partnerships with generative AI companies and major cloud service providers. Despite this pressure, Google is relentlessly pursuing this acquisition, demonstrating its deep commitment.

Renowned economist and member of the Ministry of Industry and Information Technology's Information and Communication Economics Expert Committee, Pan Helin, told Global Times reporters on the 16th that data is the new production factor for large technology enterprises. Google's two core businesses – search and artificial intelligence – are centered around data. Data creates value for Google, and thus, the company has a responsibility to protect data security. This has led to increasing demands for cybersecurity from technology companies, with cloud security being the current trend in cybersecurity development.

According to CNN, Dan Ives, managing director and senior equity research analyst at Wedbush, wrote in a client note on the 15th that acquiring Wiz signals that Google is "making a big bet on the cybersecurity space to complement its flagship products in the cloud."

Google Cloud has shown impressive growth momentum in recent years, evident from its financial reports. At the beginning of this year, Google Cloud announced that its fourth-quarter revenue for 2023 was $864 million, marking the highest quarterly profit in Google Cloud's history, a significant increase from an operating loss of $186 million in the same period in 2022. This means that Google Cloud's revenue increased by over $1 billion from the fourth quarter of 2022 to the fourth quarter of 2023, a significant achievement.

For years, Google Cloud was in a state of loss, but that changed in 2023. In the first quarter of that year, Google Cloud achieved profitability for the first time, with operating income reaching $191 million. For the full year 2023, its operating margin reached 5.2%, marking the first year of positive operating margins, compared to a loss of 7.2% in 2022.

Google CEO Sundar Pichai is optimistic about Google Cloud's performance. Pichai stated that generative AI is driving cloud computing growth. Google Cloud's revenue for the most recent quarter was $9.2 billion, exceeding expectations of $8.9 billion. This marks a renewed acceleration in cloud revenue growth to 25.7% from the previous quarter, though it is lower than the 32% recorded in the same period last year. Google executives also indicated during the earnings call that the company will soon launch the Gemini Ultra AI model, with the team already working on the next version, which will be applied to search products first.

Overall, the acquisition of Wiz is likely to help Google enhance its cloud security capabilities, enabling it to catch up with competitors in the increasingly competitive cloud computing market.

Accelerated Consolidation in the Cloud Security Market

In recent years, as companies have invested heavily in migrating data to cloud platforms, cloud security has become increasingly crucial. Companies like Facebook, Google, Microsoft, and Amazon collect vast amounts of data, ranging from behavioral patterns and user preferences to proprietary algorithms and sensitive corporate data, making them highly lucrative targets for cybercriminals. Last year alone, companies such as Norton, MailChimp, X, Verizon, Google, Activision, ChatGPT, T-Mobile, Microsoft, Walmart, Samsung, Fujitsu, and American Express all experienced cyberattacks.

Just a few days ago, AT&T revealed that data from tens of millions of its customers had been compromised, including call and text message records for almost all mobile phone users from May 1 to October 31, 2022, with a smaller number of records from January 2, 2023, also affected. The company stated that the information was illegally downloaded from a workspace on a third-party cloud platform.

The transition to cloud infrastructure and cloud-native applications has resulted in significant security vulnerabilities, which threat actors are relentlessly exploiting. Reports predict that cloud security companies with novel approaches to addressing these challenges will become one of the fastest-growing and most valuable companies in the cybersecurity industry in 2024.

Currently, the cloud security market is not dominated solely by Wiz. Aqua Security, founded in 2015, has raised over $265 million in funding and became a unicorn with a valuation exceeding $1 billion in its Series E funding round in 2021. It also focuses on cloud-native security and is recognized by Gartner as a leader in the CNAPP space. CrowdStrike, founded in 2011 and listed on Nasdaq in 2019, provides cloud security solutions including CSPM (cloud security posture management), CIEM (cloud infrastructure entitlement management), and CWPP (cloud workload protection).

Meanwhile, several significant integrations or collaborations have emerged in the foreign cloud security industry.

On May 30, Cloudflare announced a strategic partnership with CrowdStrike, aimed at integrating their platforms to help enterprise customers achieve vendor consolidation within their cybersecurity infrastructure. Specifically, the collaboration combines Cloudflare One's cloud-native zero-trust protection and connectivity with CrowdStrike Falcon's AI-native cybersecurity capabilities (including its next-generation SIEM). The goal is to provide SOC teams with comprehensive capabilities to detect and respond to attacks across networks, devices, endpoints, clouds, identities, data, and applications.

On June 10, Fortinet announced that it had reached a definitive agreement to acquire Lacework, a data-driven cloud security company, with the transaction expected to close in the second half of 2024. Fortinet's acquisition of Lacework aims to strengthen the industry's most comprehensive cybersecurity platform by incorporating an AI-driven cloud-native application protection platform (CNAPP) into Fortinet's security architecture, accelerating Fortinet's unified SASE expansion strategy.

It is foreseeable that Google's acquisition of Wiz will reshape the competitive landscape of the cloud security market, promote further consolidation and competition within the industry, and ultimately drive technological advancements and enhancements in security standards across the board.

References:

"Wiz, the $6 billion cloud-native security unicorn, sees ARR soar from $1 million to $100 million in 18 months," Alpha Startup

"Key Points from Google Cloud's Earnings Report: Cloud Profitability Hits New Highs, AI Product Deployment Steadily Advances," ZDNet

"U.S. Media: Google Offers $23 Billion to Acquire Wiz, Betting Big on Cloud Computing Security," Huanqiu.com

"Massive Leak of AT&T Customers' Calls and Texts Prompts Regulatory Investigation," Caijing

"Is 2024 the Year of Biggest Opportunities for Cloud Security? Hear from 10 Top Cloud Security CEOs," Foreign VPS Website Reviews