The AI Era Transforms Auto Marketing Landscape

![]() 04/14 2025

04/14 2025

![]() 479

479

Author: Poetry and Starry Sky

ID: SingingUnderStars

In 2024, Beijing Hyundai unveiled several new car models, typically a time when automakers engage key opinion consumers (KOCs) and key opinion leaders (KOLs) on platforms like Dongchedi and Autohome to publish engaging content. However, Beijing Hyundai took a novel approach by partnering with Zhejiang Internet, a technology company, to generate over 800 AI-driven articles based on trending topics, swiftly capturing the attention on Dongchedi and Autohome.

Similarly, during the Spring Festival, Volvo also leveraged Zhejiang Internet's AI capabilities, producing over 2,000 short videos to maintain brand relevance.

This technological shift is spearheaded by Zhejiang Internet.

In recent years, as content creators have flooded the market, major platforms have adjusted their traffic distribution algorithms to favor newcomers. This has weakened the influence of established "big V" accounts, allowing even new content creators to receive significant traffic if their content is engaging and widely shared. This shift has provided ample opportunities for AI-driven content creation.

Notably, ByteDance, the parent company of platforms like Today's Headlines, Dongchedi, and Douyin, utilizes its Volcano Engine for AI-assisted content creation, particularly in the construction of its coze system, positioning ByteDance as a frontrunner in AI applications in China.

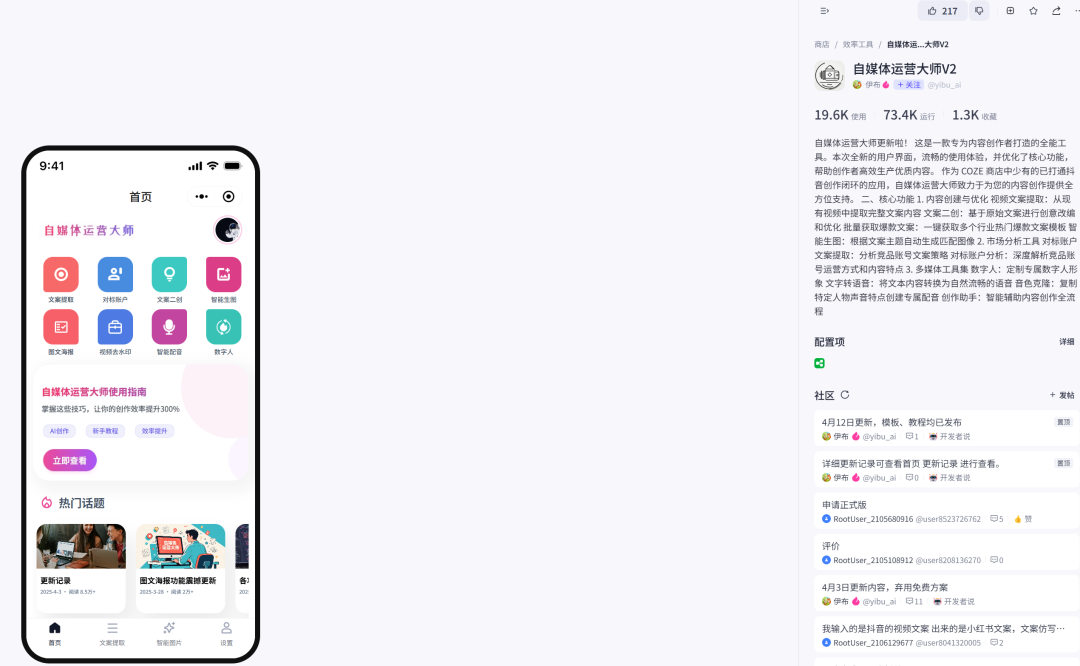

Two popular applications within the coze system are Xiaohongshu Copywriting Master and We-Media Operation Master.

AI and automation are the ultimate goals for all platforms.

What role do content creators play in this evolving landscape?

They serve as batteries.

Creators convert their text and other materials into a corpus that feeds the platform's large models, which are then trained to replace them as AI tools.

I once stated that you shouldn't fear AI replacing your job because it's inevitable. Instead, focus on how you can contribute to AI after being replaced.

Stefan Zweig reminisced about pre-war times, penned "The World of Yesterday," nostalgic for Europe's golden age, and ultimately took his own life.

These are the best of times, these are the worst of times.

No one can reverse the tide of time. We must embrace our role as batteries and strive to be the best ones.

01

Zhejiang Internet's AI Marketing Tools

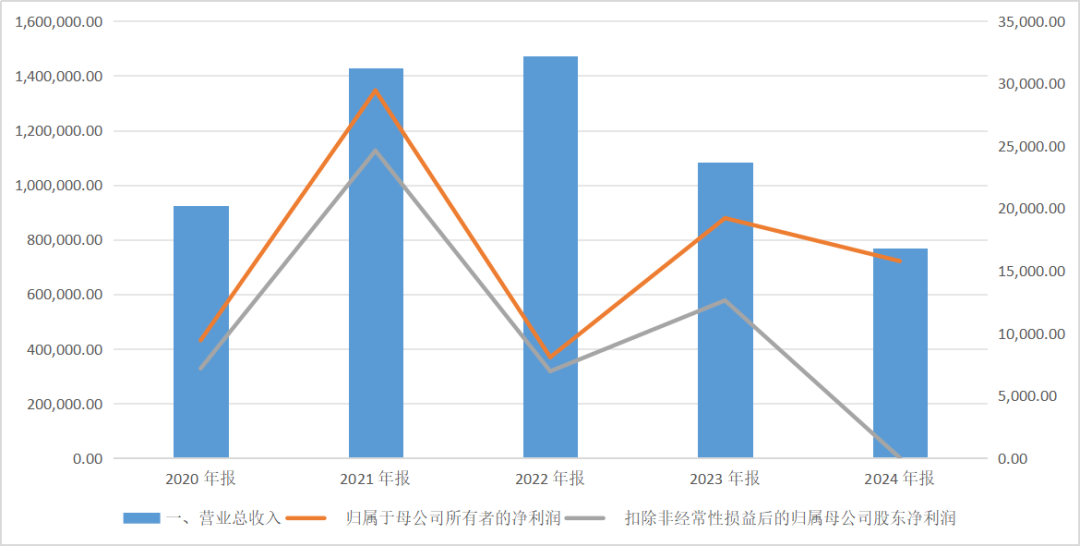

Zhejiang Internet's 2024 annual report revealed a decline in operating revenue from 10.818 billion yuan in 2023 to 7.703 billion yuan, a drop of 28.80%. Net profit attributable to shareholders also fell from 192 million yuan to 158 million yuan, a decrease of 17.92%. Non-recurring profit and loss deductions dropped sharply from 126 million yuan to 206,900 yuan.

Data Source: iFind

Despite the overall performance, Zhejiang Internet has achieved notable success in brand marketing and AI+marketing, with performance marketing witnessing a decline.

In brand marketing, 2024 operating revenue reached 3.421 billion yuan, an increase of 12.42% year-on-year. In the automotive industry, it holds a leading position, serving brands like FAW-Volkswagen Audi, SAIC Audi, Lincoln, Chery Jaguar Land Rover, and new energy intelligent driving brands like Lixiang, Polestar, and BYD. In non-automotive sectors, it collaborates with major brands such as China Telecom, Haier Group, and iFlytek, continuously expanding its business scope.

In AI+marketing, Zhejiang Internet launched the "Curious Series" of AI tools, including the "Curious Shuttle" AIGC Super Content Factory and "Video Creation in Thousands." These tools excel in content production, dissemination, and distribution, as evidenced by the Beijing Hyundai and Volvo cases.

However, as industries cut non-essential expenses, soft article placements are among the first to be axed, affecting the company's performance marketing revenue, which stood at 4.227 billion yuan in 2024, a year-on-year decrease.

02

Financial Report Maneuvers

On December 12, Zhejiang Internet announced plans to dispose of some trading financial assets.

What are trading financial assets?

Historically known as short-term investments, trading financial assets have undergone several revisions in accounting standards for enterprises, now encompassing financial assets (derivative instruments, equity instruments, and debt instruments) held for sale, such as stocks and bonds.

For Zhejiang Internet, this involves selling Doushen Education shares. The company holds 61,057,556 shares, representing 2.95% of Doushen Education's total share capital, which will be freed from trading restrictions on December 29, 2024.

In the second half of 2023, Zhejiang Internet invested 145 million yuan to acquire Doushen Education shares as part of a financial investor consortium, participating in its restructuring.

This investment stems from Doushen Education's bankruptcy reorganization. Due to policy changes, Doushen Education had to divest its K12 after-school training business and pivot to education informatization and vocational education. However, during this transition, the company faced significant losses, management turmoil, and business adjustments, culminating in three consecutive years of losses from 2020 to 2022, totaling 3.846 billion yuan. Facing insolvency, Doushen Education filed for bankruptcy reorganization, which was accepted by the Beijing First Intermediate People's Court in November 2023. On December 18, 2023, the court approved Doushen Education's reorganization plan.

The 2024 annual report revealed that the company's fair value change gains from the Doushen Education bankruptcy reorganization project amounted to 212 million yuan, a significant contributor to net profit.

03

Transformation into AI Education

Frankly, I'm not optimistic about education enterprises.

Since 2018, the birth rate has plummeted, shrinking the education market's base. As this cohort grows up, education enterprises will face intense competition. However, Doushen Education's partnership with Zhipu offers a ray of hope.

Zhipu, an AI startup with a Tsinghua University background, is renowned for its ChatGLM product, which also has an open-source version. I tested the open-source quantized version of ChatGLM on a 12G graphics card, sparking a deep interest in China's AI capabilities.

The fusion of education and AI yields fascinating results.

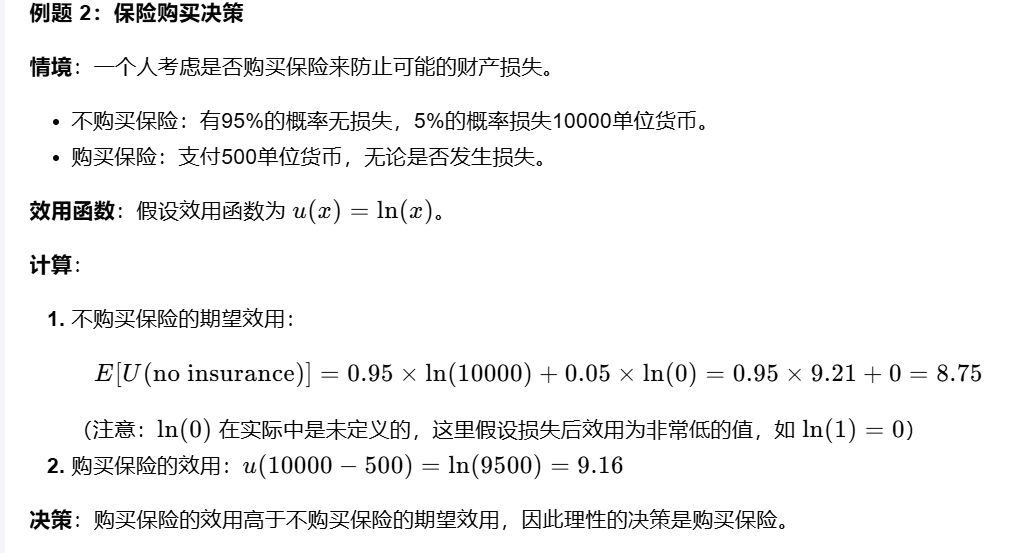

For instance, while compiling economics courseware, I sought AI assistance to design example problems, which provided questions, answers, and derivation processes within seconds.

Combined with digital human technology, AI can fully realize teaching without human intervention, automatically generating and grading assignments, and providing personalized tutoring based on each student's learning ability.

AI will revolutionize everything.

04

Strained Buybacks and Dividends

In its annual report, the company emphasized "high-quality development with a focus on returns," demonstrating forward-thinking. The company implemented stock buybacks totaling 50.0775 million yuan and cash dividends of 73.7952 million yuan.

While buybacks and dividends are positive, the source of funding raises concerns.

The cash flow statement shows a negative net operating cash flow of over -22 million yuan, indicating that despite a year's efforts, the company did not generate profits.

Moreover, the company's impairment of credit has increased annually, reaching 230 million yuan in 2024, suggesting unreliable revenue from credit sales and a high risk of bad debts.

Under these circumstances, the funding for buybacks and dividends relies heavily on loans. The company's short-term borrowings amount to 1.389 billion yuan, with annual interest expenses hovering around 50 million yuan, indicating high capital usage costs.

-END- Disclaimer: This article is based on public information disclosed by listed companies in compliance with legal requirements (including but not limited to interim announcements, periodic reports, and official interaction platforms). Poetry and Starry Sky strives for fairness in content and opinions but does not guarantee accuracy, completeness, or timeliness. The information or opinions expressed herein do not constitute investment advice, and Poetry and Starry Sky shall not be held responsible for any actions taken based on this article.

Copyright Notice: The content of this article is original to Poetry and Starry Sky and may not be reproduced without authorization.