Industrial Landscape of 41 Cities in the Yangtze River Delta: Navigating Challenges to Build a World-Class City Cluster

![]() 02/26 2025

02/26 2025

![]() 591

591

In 2024, the 41 cities comprising the Yangtze River Delta region presented a commendable report card for their strides towards high-quality development.

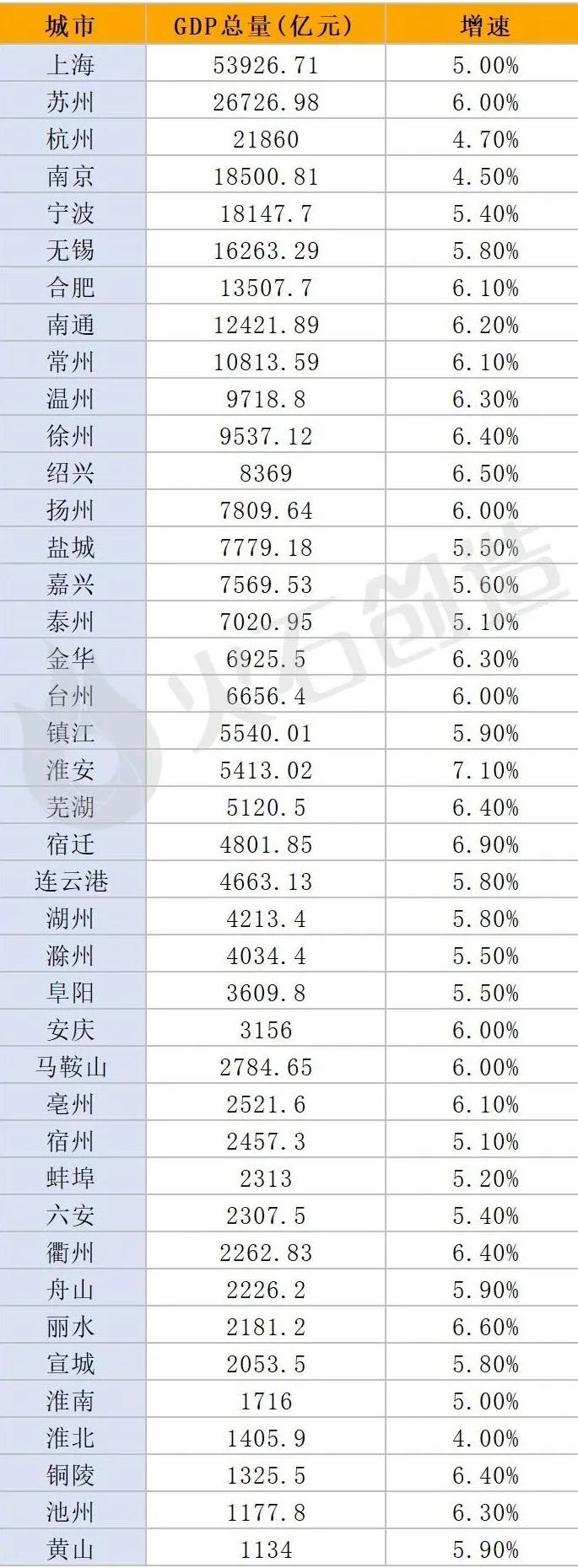

GDP of 41 Cities in the Yangtze River Delta in 2024

Source: Flintstone Creation Industry Data Center

The 'report card' revealed that 20 cities achieved economic growth of 6% or more, with Huaian (7.1%), Suqian (6.9%) in Jiangsu, and Lishui (6.6%) in Zhejiang leading the pack.

Cities with growth rates of 6% or above:

In Jiangsu: Huaian (7.1%), Suqian (6.9%), Xuzhou (6.4%), Nantong (6.2%), Changzhou (6.1%), Suzhou (6%), and Yangzhou (6%).

In Zhejiang: Lishui (6.6%), Shaoxing (6.5%), Quzhou (6.4%), Wenzhou (6.3%), Jinhua (6.3%), and Taizhou (6%).

In Anhui: Wuhu (6.4%), Tongling (6.4%), Chizhou (6.3%), Bozhou (6.1%), Hefei (6.1%), Anqing (6%), and Ma'anshan (6%).

01 Deepening the Gradient Development Model, Initial Formation of Innovation Network

The Yangtze River Delta has established a gradient development model comprising 'super cities - trillion-yuan cities - emerging growth poles.' Shanghai remains at the forefront with an economic aggregate of 5.39 trillion yuan, followed by trillion-yuan cities like Suzhou, Hangzhou, and Nanjing. Cities like Huaian, Suqian, and Lishui, boasting growth rates exceeding 6.5%, are emerging as new growth poles in the region.

As an international hub for finance, trade, and technological innovation, Shanghai is transitioning from 'scale-driven' to 'function-driven' growth. Despite a 5% growth rate, the output value of its leading industries—biomedicine, integrated circuits, and artificial intelligence—approaches 2 trillion yuan. In southern Jiangsu, Suzhou and Wuxi leverage the deep integration of digital technology and advanced manufacturing to gain global competitiveness in fields like nanomaterials and the Internet of Things. Hangzhou and Ningbo, with a high proportion of digital economy core industry added value in GDP, have fostered a new digital trade ecosystem.

Anhui has also made remarkable strides. Leveraging the National Science Center, Hefei has achieved breakthroughs in cutting-edge technologies such as quantum information and nuclear fusion, propelling cities like Wuhu and Chuzhou to form new energy vehicle and photovoltaic industry clusters. The contribution of the Wanjiang City Belt to the region's economic growth continues to rise, gradually shaping a collaborative network of 'innovation sources - industrial transformation belts.'

02 Industrial Restructuring Unveils the 'New Flying Geese Formation Model'

The traditional 'front shop and back factory' industrial division is giving way to innovation chain collaboration. Over 20 major scientific and technological infrastructure facilities, including Shanghai Zhangjiang, Hefei Binhu, and Suzhou Industrial Park, form an 'innovation matrix,' facilitating joint research and development on over 400 key technologies, including superconducting proton cancer therapy systems. The Yangtze River Delta New Energy Vehicle Alliance, led by SAIC, Geely, NIO, and others, integrates nearly 2,000 component enterprises across the four regions, achieving a localization rate exceeding 85% in core areas like battery management systems.

Industrial cross-domain restructuring has nurtured new growth poles. For instance, Nantong in Jiangsu has transformed its shipbuilding, marine engineering, and high-end textile industries through the 'Shanghai R&D + Nantong Manufacturing' model. Yancheng's new energy installed capacity has surpassed 15 million kilowatts, positioning it as a green energy hub in the Yangtze River Delta. In recent years, the industrial collaboration index among the 41 cities has steadily improved, with the proportion of cross-regional transactions in technology contract turnover exceeding 40%.

03 Navigating Challenges to Build a World-Class City Cluster

The Yangtze River Delta generates nearly 25% of China's economic aggregate with just 4% of its land. This 'strong core leadership, multi-polar support, and regional collaboration' model not only serves as a benchmark for China's city cluster evolution but also aims to establish an 'open and innovative China benchmark' amidst global industrial chain restructuring.

As the Yangtze River Delta city cluster progresses towards becoming a 'world-class city cluster,' it encounters several challenges. Let's delve into these from an industrial perspective.

The region's share of high-end segments in the international industrial chain remains modest. While the Yangtze River Delta boasts world-class production capacity in electronics, automobiles, biomedicine, high-end equipment, new materials, textile and apparel, among others, it still lags in high-end segments, with low autonomy in key core areas. For instance, integrated circuits and chips heavily rely on imports.

Significant industrial homogenization competition persists within the region. At least 20 of the 41 cities have listed new energy vehicles as a key industry, with multiple regions vying for the title of 'China's Silicon Valley,' and several cities experiencing photovoltaic industry planning capacities exceeding demand. The high similarity in key development industries leads to repeated construction and resource dispersion, impeding the overall linkage and rational deployment of the regional industrial chain.

The number of world-class leading enterprises in the industry is insufficient. In the biomedical industry, for example, while leading pharmaceutical enterprises like Fosun Pharma, Yangtze River Pharmaceutical Group, and WuXi AppTec have emerged in the region, they are generally smaller in scale and lack products with monopolistic competitiveness compared to global giants like Pfizer, Johnson & Johnson, Merck, and GE Healthcare. 'Hidden champions' are predominantly concentrated in machinery and equipment, electronics, and textile and apparel industries, with relative scarcity in strategic emerging industries such as new-generation information technology, new materials, and biomedicine.

The distribution of scientific and technological innovation resources is uneven. The Yangtze River Delta exhibits a polarized pattern of 'the strong becoming stronger and the weak becoming weaker.' Regions centered on 'science and education famous cities' like Shanghai, Nanjing, and Hefei are abundant in innovation resources, while other economically robust cities lag behind. The transformation of scientific and technological achievements is inadequate. Data reveals a significant gap between the Yangtze River Delta and Guangdong Province and Beijing in terms of technology market turnover. Even the higher figures for Shanghai and Jiangsu are only about 60% of Guangdong Province and 30% of Beijing, respectively. The patent transformation dilemma faced by national laboratories in the Yangtze River Delta is also prominent, and the minimal investment in scientific research funds hinders breakthroughs in key areas.

Administrative barriers impede the free flow of factors. Unlike the New York and Tokyo Bay Areas, which have built innovation ecosystems through market-driven factor mobility, the Yangtze River Delta is still heavily influenced by administrative constraints. Varying degrees of administrative barriers exist in market access, industry regulation, qualification recognition, credit evaluation, tax and fee reductions, financial subsidies, etc., affecting the free flow of factors and thereby restricting the development of world-class industrial clusters.

The essence of competition among world-class city clusters lies in institutional civilization. The Yangtze River Delta must accelerate collaborative innovation, further dismantle the invisible shackles of administrative boundaries on factor mobility, and expedite the construction of world-class industrial clusters. As the global industrial chain undergoes restructuring, the Yangtze River Delta has the potential to emerge as a quintessential example of being 'big and strong.'

—END—

Author | Weng Jianping, partially generated by AI large models

Review | Flintstone Creation, Yin Li