Price War "Reverses"! BYD Eyes Car Maintenance Market, Could TuHu and Others Feel the Pinch?

![]() 04/18 2025

04/18 2025

![]() 572

572

BYD's ambitions may no longer be confined to vehicle sales alone.

Through the Qichacha official website, Xiaotong discovered that BYD has filed for six trademarks related to car maintenance, including "Jingcheng Yangche" (Sincere Car Maintenance), "Xiaodi Yangche" (Little Di Car Maintenance), and "Didi Yangche" (DiDi Car Maintenance). These trademarks cover construction repair and transportation tools and are currently in the "application receipt" status, meaning the Trademark Office has received the application materials.

Screenshot: Qichacha official website

While BYD has yet to confirm its entry into the car maintenance market, it's clear that the company isn't solely an automaker. Beyond automobiles, BYD also operates in sectors such as batteries, rail transit, electronics, and semiconductors. Even within the automotive segment, BYD dabbles in insurance and finance.

Given its current capital reserves, BYD's foray into the car maintenance market isn't a far-fetched idea. In fact, Xiaotong believes BYD has the wherewithal to establish a strong foothold in this field.

Will auto manufacturers' entry into the car maintenance market spell trouble for players like TuHu?

According to official financial reports, TuHu operated nearly 7,000 store networks in 2024, generating annual revenue of 14.76 billion yuan, adjusted net profit of 620 million yuan (a 29.7% YoY increase), and a registered user base exceeding 140 million. Tmall Car Care's general manager, Li Yi, revealed that Tmall Car Care had 2,500 stores last year, with average revenue increasing by 11.6% YoY. JD Car Care's data shows that by 2024, it had over 2,200 stores, covering more than 92% of domestic districts and counties.

This raises a question: with 4S shops already offering car maintenance services, how do brands like TuHu, JD, and Tmall manage to thrive in the car maintenance market?

Image source: TuHu official website

Third-party car maintenance brands gain traction primarily due to two advantages: pricing and network coverage.

While 4S shops receive manufacturer-trained maintenance technicians, ensuring professional service, they tend to be more expensive due to higher labor and accessory costs. Additionally, car owners may find themselves unwittingly agreeing to additional maintenance items. TuHu, Tmall Car Care, and JD Car Care, on the other hand, offer transparent pricing and services on par with 4S shops, making them competitive in the auto aftermarket. From personal experience, for the same set of car maintenance items, third-party brands can be about 20% cheaper than 4S shops. This high cost-effectiveness is a key draw for users.

Moreover, third-party car maintenance brands enjoy an edge over 4S shops in terms of network coverage, particularly in third- and fourth-tier cities.

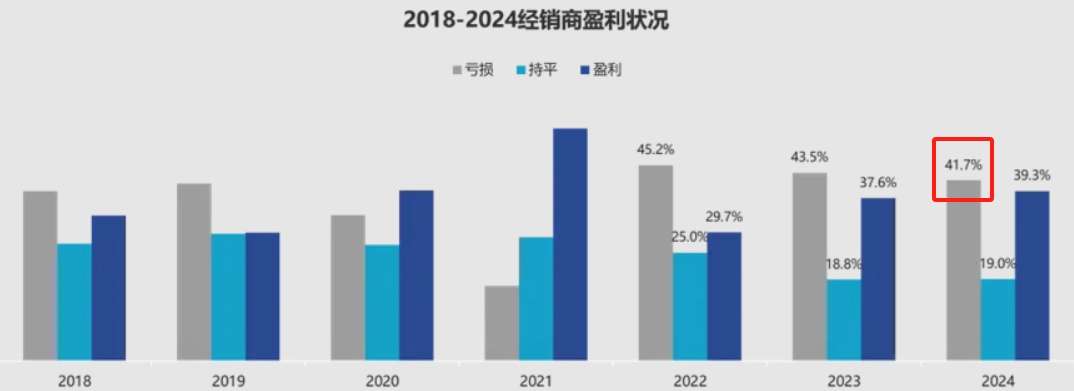

4S shops handle both pre-sales and after-sales functions, but in cities with smaller populations and lower consumer spending power, maintaining normal operations can be challenging. According to the "2024 National Auto Dealer Survival Status Survey Report" by the China Automobile Dealers Association, last year's auto dealer loss ratio reached 41.7%, with 84.4% of dealers experiencing varying degrees of price inversion.

Image source: China Automobile Dealers Association

Under these circumstances, 4S shops prioritize locations with higher demand in first- and second-tier cities. In contrast, third-party car maintenance brands, which focus solely on maintenance services, can cater to a wider audience, even in smaller towns.

Auto manufacturers entering the car maintenance market could essentially create "4S shops with only after-sales functions." If these official car maintenance brands adopt a similar market strategy to charging stations, allowing other car owners to use their services, they could gradually erase the network coverage advantage of third-party brands.

In terms of maintenance technology, car maintenance brands from auto manufacturers and third-party brands can achieve comparable standards. As for pricing, after removing the pre-sales function, there's room for price reductions, depending on whether auto manufacturers are willing to wage a "price war" in the car maintenance market.

The biggest threat to third-party car maintenance brands from auto manufacturers' entry into the market lies in the convenience offered by the full lifecycle service closed loop of auto brands.

Unlike car manufacturing, car maintenance may not require extensive knowledge, but auto manufacturers possess all product data, enabling them to provide more accurate and personalized maintenance services or repair suggestions. If Xiaotong had to choose between an official car maintenance brand and a third-party one, and price were equal, I'd inevitably opt for the official brand due to the auto manufacturer's technical and brand advantages.

BYD Faces a Formidable Challenge in Entering the Auto Aftermarket

Xiaotong understands that several traditional auto manufacturers have previously attempted to venture into the auto aftermarket.

In 2015, Ford introduced the Quick Lane after-sales chain project, which has since been discontinued. Dongfeng Nissan launched OKcare, a chain service brand for the auto aftermarket in 2015, but gradually withdrew from the market by 2018. Guangzhou Automobile Group invested in the Dasheng Car Service brand in 2016, but due to the influence of LeTV Holding, one of its shareholders, Dasheng Car Service exited the auto aftermarket.

Additionally, SAIC-GM's "Che Gong Fang," BAIC's "Hao Xiu Yang," SAIC's "Che Xiang Jia," and Chery Automobile's "Che Bei Jian" are still operational, but with store counts barely exceeding 1,000, they pale in comparison to Tmall Car Care and JD Car Care.

These brands mostly adopted a direct sales model, involving large initial investments and rapid expansion. For instance, Che Xiang Jia achieved 1,100 direct sales stores within just two years of operation. Unfortunately, they overestimated market demand at the time, leading to venue and labor costs that triggered a wave of store closures. According to an "AC Auto" media report, as of November 2024, Che Xiang Jia's direct sales store count had dwindled to 220.

After cost reductions, these brands are currently breaking even. However, if BYD decides to enter the car maintenance market, its development challenges may be significantly lower than those faced by other brands.

Why? The answer lies in the following image.

Image source: Yiche

According to Yiche's compiled data, BYD is China's most popular auto brand, ranking first in sales in 25 provincial administrative regions and selling over 100,000 vehicles in 12 regions last year.

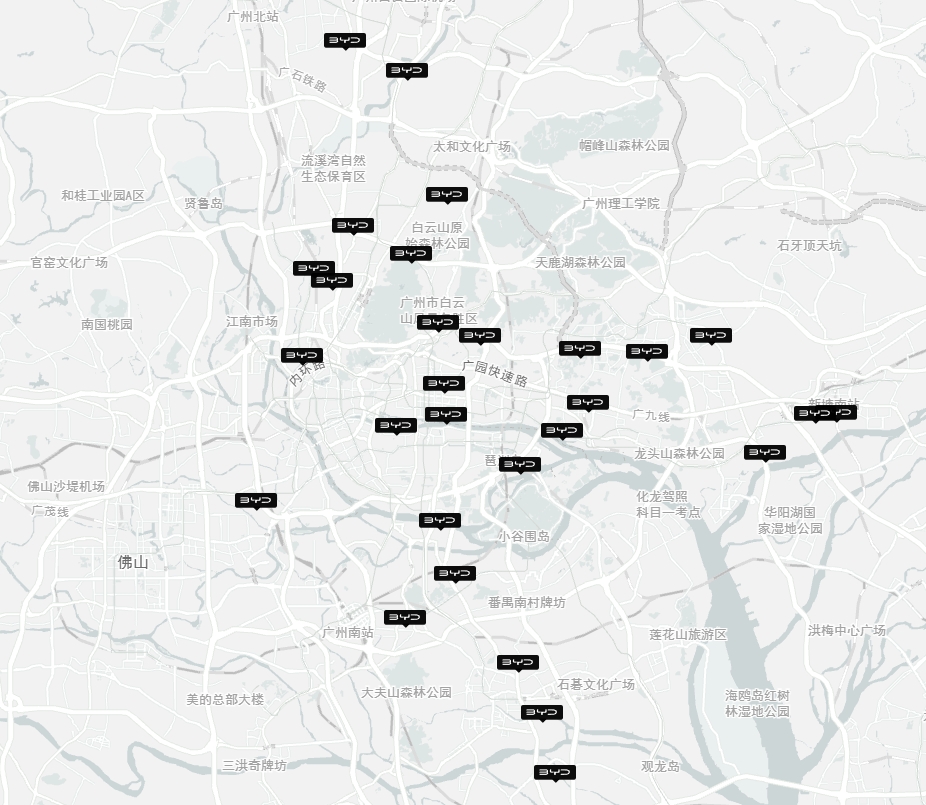

Due to its substantial market audience, BYD's 4S shop density is much higher than that of other brands.

Layout of BYD Dynasty Network 4S shops in Guangzhou | Screenshot: BYD Auto official website

Even in small counties with lower populations, building 4S shops might take a long time to recoup investments, potentially leading to losses. However, users in these counties are a key target group for BYD, necessitating attention to their after-sales service experience.

In this scenario, "Didi Yangche," which doesn't have the pressure of selling cars, could be the optimal solution. BYD's initial investment costs would be lower, and it could also reduce users' travel time, killing two birds with one stone.

If so, the only hurdle BYD needs to overcome in entering the car maintenance market is that the maintenance brand might divert significant after-sales service revenue from 4S shops. Increasing the combined revenue of both entities is a challenge BYD must consider.

Intensifying Price War in the Auto Aftermarket Amidst Multiple Players

Whether BYD will enter the car maintenance market remains speculative until an official announcement.

In Xiaotong's view, BYD's inherent advantages lie in its technical prowess and substantial demand, attributes not shared by other brands. Similarly, Chang'an Automobile Group, Chery Holding Group, FAW-Volkswagen, and Geely Automobile Group, with monthly sales exceeding 100,000 vehicles, also possess similar advantages when considering the car maintenance market.

Taking action isn't difficult for auto manufacturers; the challenge lies in ensuring both dealers and maintenance brands thrive. Of course, in the face of the emerging trend of mainstream auto manufacturers entering the auto aftermarket, current mainstream car maintenance brands are in for a tough ride.

As an established player in the auto aftermarket service, TuHu offers maintenance items and accessory prices significantly cheaper than those of 4S shops. To grab more market share, JD Car Care even launched the "Zhenhu Price" marketing campaign last year, announcing that all "Zhenhu Price" products must be 5% cheaper than competitors'.

Perhaps due to the campaign's direct naming, TuHu sued JD Car Care for "Zhenhu Price," alleging unfair competition and demanding that JD Car Care immediately cease using the brand and pay 5 million yuan in compensation.

Currently, Xiaotong hasn't found any information about "Zhenhu Price" on JD Car Care's page, but this doesn't signal the end of the price war. Both JD Car Care and TuHu still display discount information on their homepages.

The case of TuHu suing JD Car Care remains unresolved, but as an established enterprise, TuHu, faced with competitors' low-price strategies, is likely to join the price war to avoid losing users.

On April 16, for the same Comfort SUV520 225/65R17 102H Giti tire, the price on TuHu's platform was 312 yuan, while JD Car Care offered it at 312.30 yuan after a discount.

Screenshot: JD Car Care (left) & TuHu (right)

When it comes to "price wars," BYD is no stranger.

After years of competition in the auto market, BYD undoubtedly has ample experience in cost control: official maintenance services can fully provide ultimate cost-effectiveness, and the challenge lies in convincing suppliers to offer the "lowest price on the entire network."

As everyone knows, annual price negotiations with suppliers are common in the auto industry. Not everyone can afford to engage in a "price war," but if BYD enters the car maintenance market, its current sales scale is a powerful bargaining chip to force suppliers to lower prices.

It's worth noting that with the growth of new energy vehicle sales, the electric vehicle maintenance market holds great potential for growth.

Fuel vehicle maintenance involves replacing parts like engine oil, engine filters, and spark plugs. Electric vehicles, without complex internal combustion engines, have fewer maintenance items, mainly focusing on battery and tire maintenance, as well as inspection of the three-electric system.

While it may seem there are fewer maintenance items, third-party car maintenance brands in the new energy vehicle field haven't yet reached the level of fuel vehicle brands. Wu Feng, president of Tmall Car Care, revealed that among its over 2,500 stores, 20% are new energy stores.

Xiaotong believes the primary reason is that pure electric vehicle maintenance technology requires a higher threshold, and hybrid vehicles' maintenance difficulty and complexity surpass that of pure fuel vehicles, making it challenging for general maintenance shops to handle, often leaving it to 4S shops.

Therefore, as a leader in the new energy field, BYD's entry into the car maintenance market could largely address the basic maintenance and repair needs of BYD car owners. If BYD also possesses the capability to handle maintenance and repairs for other brands' new energy vehicles, the new energy auto aftermarket pie is well within its reach.

(Cover image source: TuHu official website)

Source: LeiTech