Firefly Ignites Hopes Amidst NIO's Pressures

![]() 04/11 2025

04/11 2025

![]() 461

461

Firefly has officially unveiled interior images of its inaugural small car model, setting the stage for its April 19 launch. As the third brand under NIO Group, Firefly is positioned as a premium electric compact car, sharing its name with its debut model. Based on previous information, the new car's pre-sale price commences at 148,800 yuan.

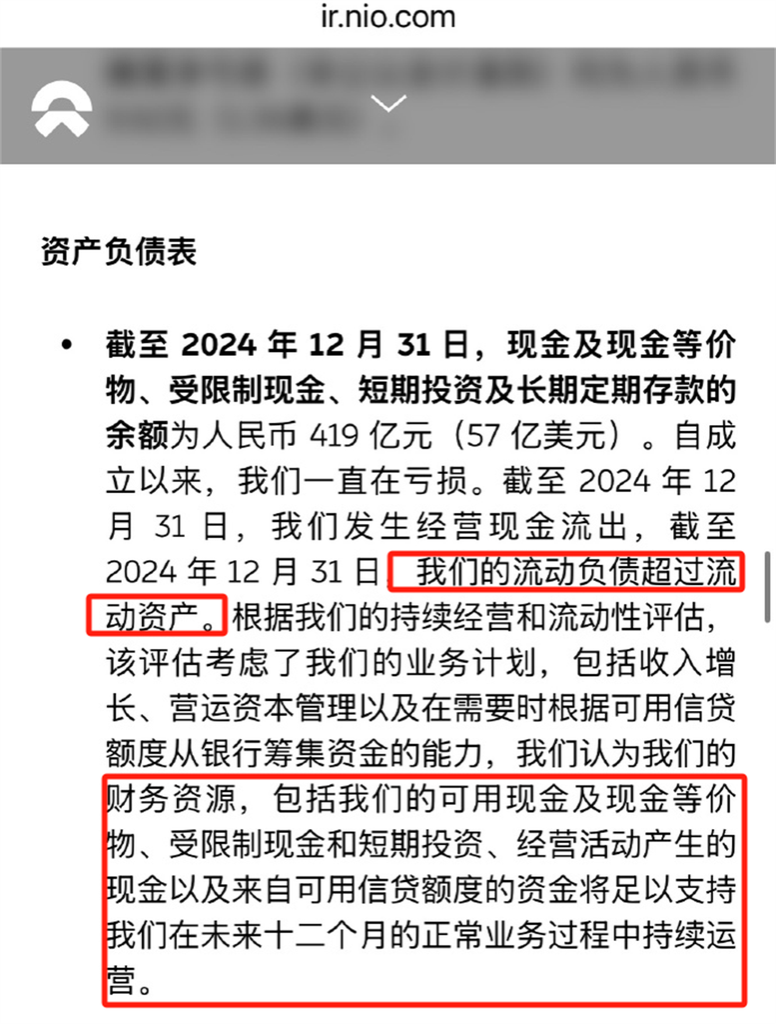

Firefly's emergence signals another crucial test for NIO, which, despite its size and strength, stands as the most loss-making automaker among new energy vehicle startups. Current data reveals that in 2024, NIO reported a total revenue of 65.73 billion yuan, with a gross margin of 9.9% and a net loss of 22.4 billion yuan, up 8.1% year-on-year, averaging over 61 million yuan in daily losses. This net loss is four times that of XPeng Motors (5.79 billion yuan). As of December 31, 2024, NIO's liquidity, including cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits, amounted to 41.9 billion yuan. However, NIO's 2024 financial report indicates that current liabilities exceeded current assets, suggesting that financial resources could only sustain operations for another year.

LeDao, once highly anticipated, has faltered in the market. Initially, sales of the LeDao L60 steadily climbed from 832 units to 10,528 units. However, this upward trend was short-lived, with deliveries declining in early 2025. Official figures show that in the first quarter of 2025, LeDao sold only 14,781 vehicles, averaging under 5,000 units per month, with March deliveries totaling 4,820 vehicles. This sales performance ultimately led to Ai Tiecheng's resignation, taking responsibility for the disappointing market reception. The unsuccessful launch of LeDao's first model has intensified pressure on NIO, prompting reforms in organizational structure and new car introductions to boost sales and profitability.

In the first quarter of this year, NIO implemented comprehensive cost-cutting measures, including increasing parts commonality and sharing seat frame platforms between NIO and LeDao. Both brands are also streamlining costs in their dual-brand strategy, particularly in after-sales, finance, and human resources. In some regions, management teams are even managing sales and service for both brands concurrently. NIO plans to launch nine new products in 2025, including 2025 models of ET9, 5566 (ET5, ET5T, ES6, EC6), and one major new model. At a 2025 closed-door meeting, Li Bin emphasized that NIO's core objective for the year is to achieve profitability in the fourth quarter, with an overall sales target of 440,000 vehicles. However, NIO faces significant challenges; from January to March 2025, it delivered 13,863, 13,192, and 15,039 vehicles, respectively, totaling 42,094 vehicles in the first quarter. To meet the 440,000-vehicle sales target, NIO must deliver 132,635 vehicles in the second, third, and fourth quarters combined.

NIO's third brand, Firefly, has emerged as a beacon of hope. However, it remains uncertain whether Firefly can shoulder the responsibility of boosting sales. Notably, Firefly targets the niche premium compact car market, where competitors like MINI and smart have demonstrated sales success. Furthermore, within the 150,000 to 200,000 yuan price range, numerous spacious and cost-effective models exist, such as XPeng's Mona M03, Deep Blue's L07, Zero Run's C10, Lynk & Co's Z20, and Dongfeng's eπ008, available in both sedan and SUV forms. Thus, it's challenging to predict if Firefly, with its precise positioning, can distinguish itself amidst fierce competition. It's worth mentioning that Firefly prioritizes overseas markets, with China's mature electric vehicle market not being its primary focus. As Firefly prepares for launch, time will tell if it can propel NIO towards its 2025 profitability goal.

(Images sourced from the internet. Please remove if infringement occurs)