NIO: Addressing the Root Cause Rather Than Symptoms

![]() 04/07 2025

04/07 2025

![]() 461

461

The sales figures for the pioneering players in the automotive industry have been unveiled for the first quarter of 2025.

XPeng is leading the pack with 94,008 vehicles delivered, closely followed by Li Auto with 92,864 units. The up-and-coming Leapmotor ranks third, having shipped a total of 87,552 vehicles. All three companies have witnessed year-on-year growth.

The once prominent trio of "NIO-XPeng-Li Auto" has now seen a significant shift in dynamics.

NIO's performance stands out as the most concerning. According to sales data, NIO's cumulative sales stand at a disappointing 27,313 vehicles, marking a 9.1% year-on-year decline—the only brand on the list to experience such a drop. Consequently, President Ai Tiecheng has stepped down, leaving a heartfelt message on the official app.

"We must acknowledge that in recent times, our sales have failed to match the product capabilities of our competitive cars. There are numerous shortcomings in our marketing efforts. As the leader, I have exposed many weaknesses, failed to meet expectations, and deeply regret this. I must take responsibility for this outcome."

This has fueled external doubts about Li Bin and NIO, with a growing consensus that drastic measures are needed to prevent NIO from becoming the next casualty in the fiercely competitive new energy vehicle market.

While this assertion might seem alarmist, it's undeniable that NIO is navigating challenging waters.

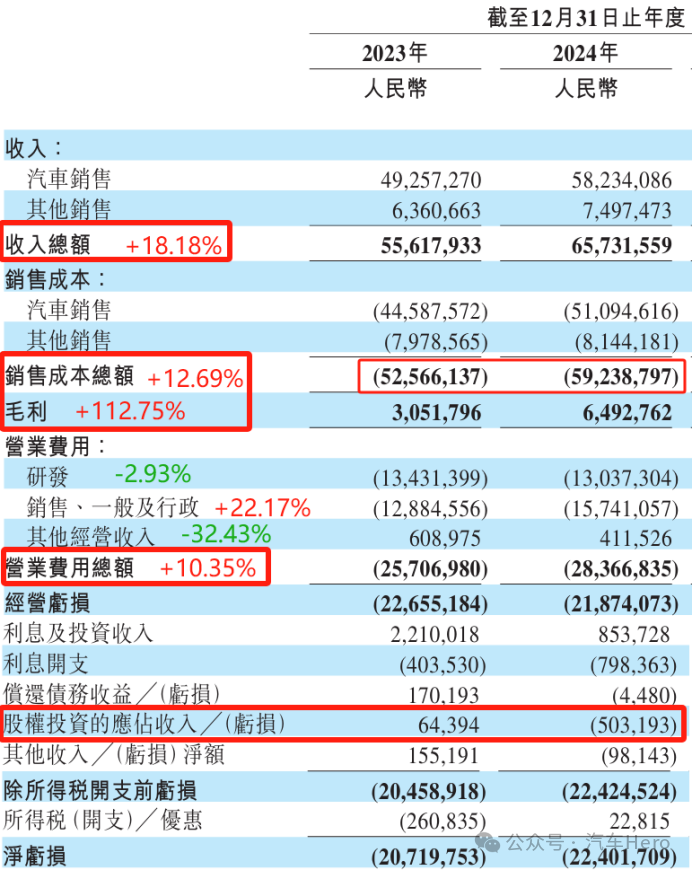

On March 21, NIO released its 2024 financial report, revealing a net loss of 22.4 billion yuan, equating to an average loss of approximately 100,000 yuan per vehicle sold.

The report indicates that despite a 38.7% increase in annual vehicle deliveries to 222,000 units and an 18.2% rise in revenue to 65.73 billion yuan, the net loss widened by 8.1% year-on-year.

In terms of R&D, NIO invested 13.037 billion yuan in 2024, amounting to 58,700 yuan per vehicle, compared to XPeng's 34,000 yuan and Li Auto's 22,000 yuan per vehicle.

The financial report paints a grim picture, with NIO's advantages being gradually eroded.

Historically, NIO's forte has been its battery swapping technology. However, in 2025, the rapid proliferation of Tesla Superchargers, XPeng Superchargers, and BYD's Megawatt Flash Charging is diminishing the efficiency advantage of battery swapping.

In my view, beyond the mismanagement of R&D costs, NIO suffers from a strategic misstep.

In 2022, Li Bin introduced a 'multi-brand strategy' aimed at covering the entire price spectrum, launching the Ledao brand. However, as a key strategy for scale expansion, Ledao's first model, the L60, only achieved one-third of its target sales volume from January to February due to delivery issues, negative public sentiment, and insufficient brand recognition.

The Firefly brand, targeting the 100,000-yuan market segment and scheduled for launch in April 2025, faces stiff competition from BYD's Seagull, which already commands a 70% market share in this niche.

I don't doubt NIO's capability to address these challenges; rather, the question is whether it's truly committed to taking decisive action. In other words, it's about addressing the root cause rather than merely treating symptoms. The courage to do so is crucial. After all, XPeng Motors managed to turn around its fortunes within just six months.

Conclusion

NIO is grappling with maintaining its high-end positioning while fiercely competing in the mid-to-low-end market. It must meet the growth expectations of the capital market while striving to escape the quagmire of losses. This multi-front battle fatigue is the primary reason behind NIO's current predicament.

Frankly, the only viable solution for NIO to truly turn the tide is to introduce a hit model that generates substantial revenue. Time will tell.