Tesla's FSD Makes Its China Debut: Is the Competitive Era Upon Us?

![]() 02/28 2025

02/28 2025

![]() 565

565

Tesla Treads Cautiously in China

On February 25, the first batch of Tesla owners embarked on a journey to "try Tesla's FSD" (Full Self-Driving).

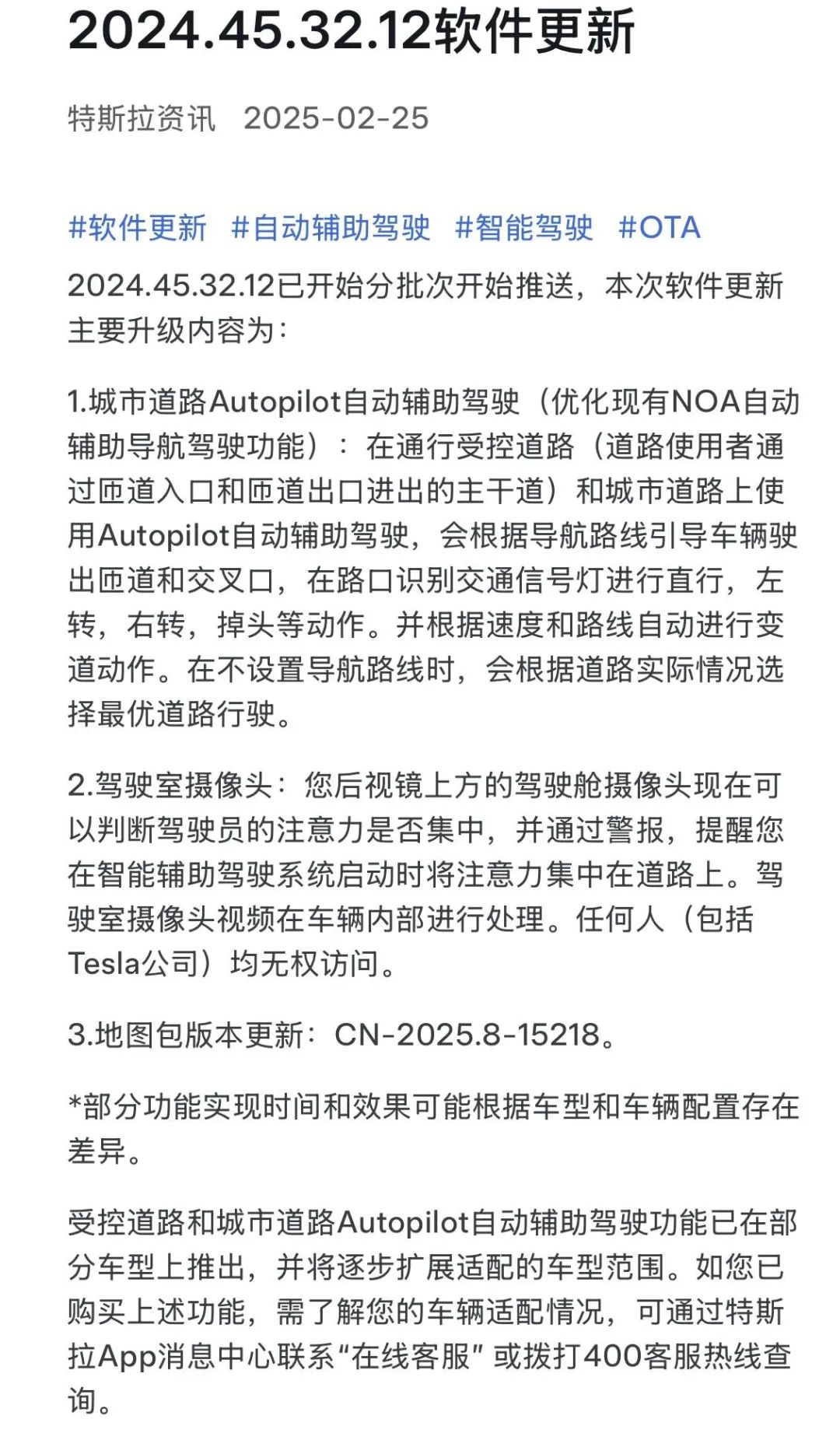

On this day, Tesla announced that it would roll out software updates in batches for Chinese customers, optimizing and upgrading its existing Autopilot automated driving assistance system. These updates will bring driving assistance features akin to those of FSD in the US market to China.

Image source: Tesla

While Tesla has taken a significant step towards the launch of FSD in China, it is still some way off from a full-fledged introduction. Tesla's description of this OTA (Over-The-Air) update is notably cautious, avoiding any mention of FSD and instead referring to it as 'Autopilot for city roads'.

Academician Ouyang Minggao discusses Tesla's FSD entering China (Photo/Liu Shanshan)

'I used to fear that the arrival of Tesla's FSD would lead to a 'winner-takes-all' scenario, disrupting the Chinese autonomous driving market, but my concerns have now greatly diminished,' said Academician Ouyang Minggao of the Chinese Academy of Sciences and Vice Chairman of the China Electric Vehicle Hundred People Forum at the forum's expert media exchange meeting.

Ouyang Minggao candidly stated that while the computing power required for FSD is immense, Chinese automakers' widespread access to DeepSeek has bolstered his confidence that domestic enterprises will maintain a leading position in intelligent driving even after Tesla's FSD enters China. Additionally, given the current international situation, the true entry of FSD into China will need to navigate various hurdles.

Tesla stirs the pot once again. Can Chinese automakers continue to lead in the realm of intelligence?

FSD's True Introduction to China is Still Pending

This is a highly anticipated OTA update.

Image source: Tesla

The key updates in Tesla's software version 2024.45.32.12 include: the introduction of Autopilot for city roads (optimizing the existing NOA automated navigation driving assistance function), enabling Autopilot on controlled access roads (main roads with ramp entrances and exits) and city roads, guiding vehicles through ramps and intersections based on navigation routes, recognizing traffic lights for straight, left, right turns, U-turns, and other maneuvers. It also automatically changes lanes based on speed and route. When no navigation route is set, it selects the optimal path based on actual road conditions.

This feature is exclusively available to users who have purchased the FSD suite for 64,000 yuan, initially limited to certain models. Tesla has specifically included a disclaimer in the update instructions, emphasizing that the temporal and spatial effectiveness of feature implementation may vary based on vehicle configuration.

Notably, Tesla's description of the intelligent driving features being pushed to Chinese consumers is particularly stringent, avoiding any mention of FSD and simply referring to it as 'optimizing the existing NOA automated navigation driving assistance function'. In contrast, on Tesla's US market official website, this section is described as: users can spend $8,000 to install 'Full Self-Driving (FSD)', enabling 'your car to drive itself almost anywhere with minimal driver intervention'.

In reality, Tesla still faces numerous challenges in bringing fully capable FSD to China.

Firstly, the most ideal scenario for Tesla to advance autonomous driving in China would be to establish a local supercomputing and data center. However, the US government prohibits Tesla from training its core AI models and algorithms within China. Currently, while Tesla has a data center at its Shanghai Gigafactory, its supercomputing cluster is based in the US.

Additionally, despite the power of Tesla's FSD, this 'golden algorithm' from North America may struggle to adapt when introduced to China. For instance, the dynamic restrictions on bus lanes in China (such as morning peak hour bans in Beijing and all-day bans on certain road sections in Shanghai) require algorithms to make real-time dynamic decisions. Tesla, however, relies solely on publicly available videos for simulation training, making it difficult to cover complex scenarios.

Screenshot of Musk's tweet

On February 25, Musk tweeted, 'We've utilized publicly available videos of Chinese roads and traffic signs from the internet for simulation training.'

During the post-earnings interview session following Tesla's fiscal fourth-quarter and full-year 2024 results, Musk also stated, 'One of the biggest challenges for Tesla's FSD to enter China is the bus lanes, and some restrictions create a complex situation for deploying FSD in the Chinese market.'

Currently, 'smart driving for all' is a buzzword in the domestic automotive market. Ouyang Minggao specifically pointed out that the 'intelligence' in 'smart driving for all' refers to intelligent assistance, not autonomous driving. It's 'intelligent driving assistance for all', not 'autonomous driving for all'.

'NOA is still L2 or at most L2+ intelligent driving assistance or partial autonomous driving, and the driver must remain attentive. The next step, which is more challenging, is the promotion of L3 conditional autonomous driving and L4 advanced autonomous driving, which must be approached cautiously and progressively. It's premature to mention full autonomous driving,' emphasized Ouyang Minggao. 'There's still a process involved, particularly when it comes to safety. It's essential to first acclimate customers through intelligent driving assistance and also gather data through it. Without data collected from intelligent driving assistance for all, there can be no so-called L4 highly autonomous driving, as while the thresholds for computing power and algorithms have lowered, data remains crucial.'

Are Domestic Automakers Prepared?

Whether it arrives as 'Autopilot' or the hotly debated 'FSD (Full Self-Driving)', Tesla has finally entered the fray this time. Chinese enterprises will face intensified competition for market share in the mid-to-high-end smart car market, especially in niche segments where intelligent driving features are key selling points.

Tesla's FSD benefits from a real-time data loop from over a million vehicles globally, enabling rapid algorithm iteration. In contrast, Chinese enterprises lag in data accumulation and data processing efficiency, necessitating a faster pace in algorithm optimization and feature updates. Strong competitiveness in the intelligent driving market will be a pivotal bargaining chip for Tesla to capture market share.

Nevertheless, domestic automakers possess natural advantages in the Chinese market, such as a deeper understanding of Chinese consumers' needs and driving habits, enabling tailored feature development and optimization. They excel in handling China-specific traffic scenarios like lane cutting and pedestrian yielding, making it easier to gain consumer recognition. Currently, local players like Huawei and XPeng employ the 'lidar + vision fusion' solution, which is relatively more stable in extreme conditions like rainy and foggy weather and low nighttime lighting. In contrast, Tesla's pure vision solution may reveal perception blind spots when data is insufficient.

After experiencing the FSD V12.3.6 version in the US last year, He Xiaopeng, Chairman of XPeng Motors, stated that while Tesla's capabilities are certainly ahead of XPeng's, the gap is not substantial. He expressed confidence that XPeng has the potential to surpass FSD in China.

Yu Chengdong, Executive Director of Huawei, Chairman of the Terminal BG, and Chairman of the Intelligent Automobile Solutions BU, has also expressed confidence in winning the competition. Yu noted that Huawei's intelligent driving, even without lidar, surpasses FSD, and its performance with lidar is even better. 'They (Tesla) don't use lidar, but we do, enhancing our perception capabilities. In China, we have a slight edge over them.'

BYD adopts a 'divine eye' tiered strategy, popularizing basic intelligent driving features on models priced at 100,000 yuan and above, and standardizing advanced intelligent driving on models priced at 300,000 yuan and above. Currently, BYD has accumulated data from 4.4 million L2 vehicles and has partnered with AI company DeepSeek to establish a 'vehicle-cloud' dual-cycle data iteration capability.

Li Auto announced that it aims to achieve L3-level intelligent driving by 2025, enabling intelligent driving from parking space to parking space with manual takeovers every 500-1000 kilometers.

Xiaomi is also increasing its investment in autonomous driving technology, achieving full-stack in-house research and development with over 200 test vehicles and over 10 million kilometers of test mileage. It has also acquired autonomous driving technology company DeepMotion to bolster its technical prowess.

Furthermore, according to Changan Automobile's 'Beidou Tianshu 2.0' plan, it intends to cease developing non-digitalized new products from 2025 onwards.

While the true Tesla FSD has yet to fully arrive, the launch of Tesla's Autopilot for city roads still holds significant industry importance. Currently, domestic automakers are vigorously pursuing intelligence, and with the continuous integration of DeepSeek and the automotive industry, the development of domestic electric vehicle intelligence has also entered a fast lane.

The era of intelligent cars is accelerating.