Forward-Looking: Lixiang Auto Anticipates Record Q4 2024 Revenue, Yet Growth Rate to Dip into Single Digits for First Time

![]() 02/28 2025

02/28 2025

![]() 510

510

Lixiang Auto has yet to announce the release schedule for its Q4 2024 and full-year financial reports. Based on past precedents, it is anticipated that the company will disclose these reports by the end of February.

A recent research report by Goldman Sachs projects that Lixiang Auto's Q4 revenue will rise by 5% year-on-year to reach 44 billion yuan, with a quarter-on-quarter increase of 2%. Within this, automotive sales revenue is forecast to increase by 4% year-on-year to 42 billion yuan, while the average selling price of vehicles is expected to decrease by 13% year-on-year to 266,000 yuan.

This forecast falls below not only the upper limit of the company's revenue guidance in its performance outlook but also significantly undershoots the consensus expectation of 47.4 billion yuan from Wind Info. In its Q3 financial report, Lixiang Auto had anticipated Q4 revenue to range between 43.2 billion and 45.9 billion yuan, signifying a year-on-year increase of 3.5% to 10%.

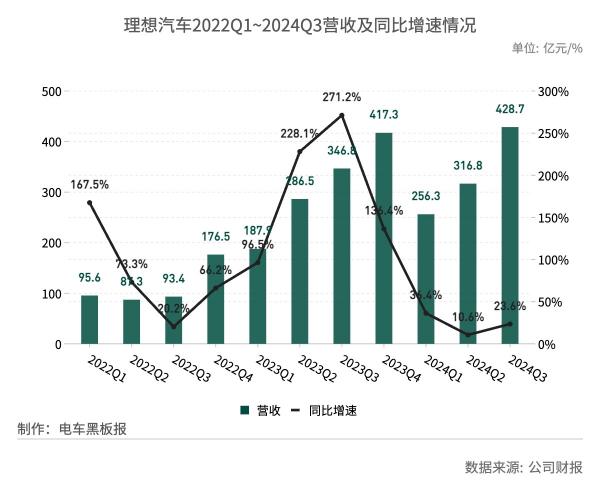

According to the revenue guidance, Lixiang Auto's Q4 revenue will surpass the previous quarter's 42.87 billion yuan, setting a new quarterly record. However, due to actual delivery volumes falling short of company expectations, the revenue during this period is expected to be closer to the lower limit of the guidance, and the year-on-year growth rate will dip into single digits for the first time.

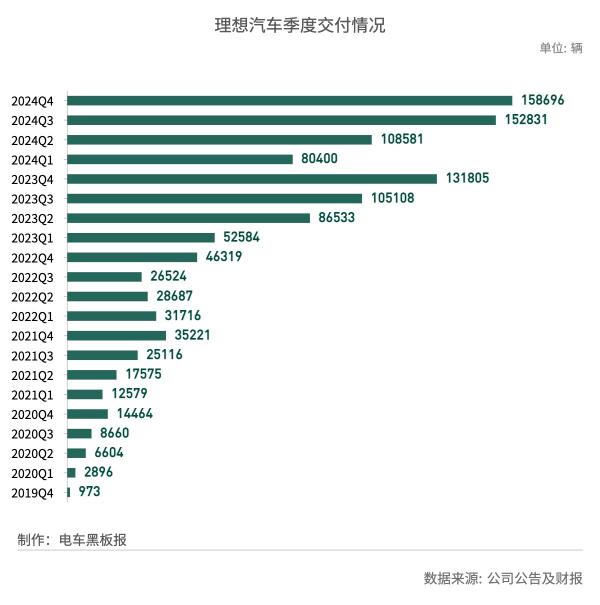

Amidst intensified market competition, Lixiang Auto's Q4 delivery volume grew by 20.4% year-on-year to 158,700 units, failing to meet the company's delivery guidance lower limit of 160,000 to 170,000 units. The quarter-on-quarter growth rate of deliveries also hit a new low since Q4 2022.

Reviewing the company's financial report data, the delivery volume in Q1 2024 stood at 80,400 units, significantly below the delivery guidance lower limit of 100,000 to 103,000 units. Actual revenue during this period was 5.62 billion yuan less than the guidance lower limit. In Q3 2024, the delivery volume was 152,800 units, slightly below the delivery guidance upper limit of 145,000 to 155,000 units, while actual revenue exceeded the guidance upper limit by 670 million yuan.

The decline in the average selling price of vehicles has also impacted the company's profitability. Goldman Sachs predicts that Lixiang Auto's overall gross margin in Q4 will decrease by 1.5 percentage points year-on-year to 22%, with the automotive gross margin declining by 1.4 percentage points year-on-year to 21.3%. Meanwhile, non-GAAP net profit is anticipated to drop by 11% year-on-year to 4 billion yuan, and net profit margin will decrease by 1.6 percentage points year-on-year to 9.1%.

While Lixiang Auto has not released delivery data for specific models, the Lixiang L6, priced between 249,800 and 279,800 yuan, has emerged as the company's best-selling model for three consecutive quarters since its launch in April 2024. As the lowest-priced model in Lixiang Auto's lineup, it accounted for significant portions of the company's sales volume.

According to ECVV data, from Q2 to Q4 2024, the wholesale sales volume of the Lixiang L6 was 39,200 units, 75,100 units, and 77,900 units, respectively, comprising 36.1%, 49.2%, and 49.1% of the company's total sales volume during the same periods. For the entire year 2024, the combined wholesale sales volume of the Lixiang L6 accounted for 38.4% of the company's total sales volume.

Lixiang Auto has not publicly disclosed its delivery target for 2025, but relevant data may be revealed during the company's Q4 2024 financial report conference call.

According to 36Kr Auto, the company's preliminary sales forecast for 2025 stands at 700,000 units, representing a 40% increase over 2024 but significantly below the target of 1.6 million annual deliveries proposed by CEO Li Xiang in late June 2023.

Li Xiang's vision for 2025 included a product matrix comprising one super flagship model, five extended-range electric vehicle models, and five pure electric vehicle models. However, following setbacks with the launch of the first pure electric vehicle model, Lixiang MEGA, in March 2024, the company adjusted its pure electric strategy, reducing the product matrix from eight to five models and postponing the launch of three pure electric SUVs from the second half of 2024 to the first half of 2025.

Deutsche Bank analyst Wang Bin predicted in a research report that Lixiang Auto would launch the large pure electric SUV Lixiang i6, priced between 200,000 and 250,000 yuan, in mid-2025 to fill the gap in the company's pure electric product line below the 250,000 yuan market.

The report further stated that Lixiang Auto's deliveries are expected to reach 700,000 units in 2025, comprising 630,000 extended-range electric vehicles and 70,000 pure electric vehicles.

TF Securities holds a more optimistic outlook, predicting that after Lixiang Auto launches its pure electric SUV models in 2025, they will contribute sales of 90,000 units. Combined with annual sales of extended-range models and MEGA increasing to 600,000 units and 14,000 units, respectively, this is expected to drive annual sales beyond 700,000 units.

However, if Lixiang Auto introduces lower-priced pure electric SUV models in 2025, the company's automotive gross margin may be diluted.

Ping An Securities predicts that if Lixiang Auto launches two new pure electric vehicle models in 2025, including one priced between 200,000 and 300,000 yuan, annual sales of pure electric vehicles will reach 70,000 units. In 2026, with the launch of two additional pure electric vehicle models, bringing the total on sale to five, annual sales of pure electric vehicles are expected to reach 180,000 units. From 2025 to 2026, the gross margins corresponding to pure electric vehicle models are anticipated to be 16% and 17%, respectively.

The institution further notes that due to the higher sales volume of Lixiang Auto's extended-range models, the expected gross margin level will be superior to that of pure electric models. With the scale effect of extended-range models taking hold, the company's automotive gross margin level is expected to stabilize.