Xiaomi Boldly Enters Luxury Car Market with Aggressive SU7 Ultra Launch

![]() 02/28 2025

02/28 2025

![]() 434

434

Xiaomi has ventured into the electric vehicle market for less than a year and is now making a bold foray into the luxury car segment.

On the evening of February 27, Xiaomi CEO Lei Jun unveiled the Xiaomi SU7 Ultra, describing it as "performing on par with Porsche, catching up to Tesla in technology, and rivaling BBA in luxury".

During Xiaomi's new product launch event, Lei Jun revealed that the standard version of the car is priced at 529,900 yuan, significantly lower than the pre-sale price of 814,900 yuan, with deliveries commencing immediately. Additionally, customers placing orders during the initial sales period will receive benefits worth up to 90,000 yuan.

Xiaomi's substantial price adjustment aims to achieve its sales target while lowering the barrier to entry for luxury car buyers.

Lei Jun did not mention the previously set annual sales target of 10,000 units for the SU7 Ultra during the launch event.

According to the latest data from Xiaomi Car, the number of confirmed orders for the SU7 Ultra exceeded 6,900 units within 10 minutes of its launch. Some netizens commented on Xiaomi Car's Weibo post, saying, "Lei Jun's annual target has been almost achieved within 10 minutes."

Currently, Xiaomi Car's production capacity is the primary factor limiting a significant increase in deliveries, which will also determine whether the company can achieve its annual delivery target of 300,000 units.

The focus on the annual sales target for the SU7 Ultra may have shifted.

On the first working day of the Year of the Snake (February 5), Xiaomi Car set a sales target of 10,000 units for the SU7 Ultra for the year. Lei Jun commented at the time, "For a luxury car at this price point, this is already a very impressive number."

Market expectations generally anticipated that the actual pricing of the SU7 Ultra would not deviate significantly from the pre-sale price. Market research firm Canalys also analyzed before the launch event that the market's focus would be on whether Xiaomi's SU7 Ultra could achieve its sales target of 10,000 units in 2025.

The day after announcing the target, Lei Jun invited netizens to vote on Weibo about how many SU7 Ultra units Xiaomi could sell this year. Out of the 69,000 netizens who participated, less than 10% chose "cannot complete the task", 23,000 believed "can complete the task", and 39,000 believed "more than 10,000 units".

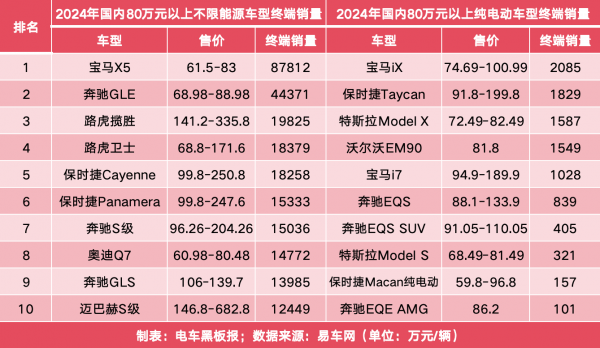

Comparing this target with sales data for cars priced above 800,000 yuan in China over the past year, regardless of energy type, Xiaomi's SU7 Ultra target appears ambitious.

According to Bitauto data, in 2024, BMW X5, Mercedes-Benz GLE, and Land Rover Range Rover ranked among the top three in China with terminal sales of 87,800 units, 44,400 units, and 19,800 units, respectively. Although Xiaomi's SU7 Ultra target of 10,000 units did not make it into the top ten sales list, it was only 700 units shy of the eleventh-placed BMW 7 Series.

However, the final sales price being much lower than expected has made the sales target for the SU7 Ultra less daunting but has also intensified competition for the car. In addition to foreign brands like BBA and Tesla, domestic new energy vehicle makers such as Li Auto and NIO also have models priced in the same range.

Based on the 2024 sales ranking of pure electric vehicles priced at 500,000 yuan in China, Xiaomi's SU7 Ultra target of 10,000 units could rank among the top four, with the top three models being the Zeekr 009, AITO M9, and Li Auto MEGA.

Since the pre-sale price of the SU7 Ultra was the same as the domestic price of Tesla's Model S Plaid version, it was also perceived by the market as being targeted at Tesla. Lei Jun responded at the launch event that the actual configuration of the standard version of the SU7 Ultra is higher than that of the Model S Plaid.

The above sales data highlights the challenges of selling luxury cars, with pure electric luxury cars posing an even greater hurdle. However, the day before the launch event, Lei Jun expressed strong confidence in Xiaomi's SU7 Ultra, stating that the company is 90% confident in achieving the annual sales target of 10,000 units.

At the launch event, Lei Jun emphasized that Xiaomi's SU7 Ultra aims to be "the fastest four-door mass-produced car on the planet".

In terms of power, the car adopts a potent three-motor system, equipped with two V8s motors and one V6s motor, delivering a maximum output power of 1,548 horsepower. Excluding the starting time, the SU7 Ultra can accelerate from 0 to 100 km/h in 1.98 seconds and has a top design speed of 350 km/h.

Lei Jun noted that powerful performance is just one aspect of the SU7 Ultra. Two days before the launch event, Xiaomi Car gradually rolled out end-to-end full-scenario intelligent driving OTA updates to users of the SU7 Pro and Max versions.

As Xiaomi's first luxury car, the SU7 Ultra comes equipped with end-to-end full-scenario intelligent driving functionality and Xiaomi's Pengpai intelligent cockpit right out of the factory.

Demand for the SU7 remains high, with production capacity being the primary limiting factor.

Xiaomi Car aims to challenge its delivery target of 300,000 units this year, equivalent to an average monthly delivery of 25,000 units. The officially launched SU7 Ultra, along with the Xiaomi SU7 and the upcoming SUV model Xiaomi YU7 set for release in the middle of the year, will jointly bear the target of doubling delivery volumes.

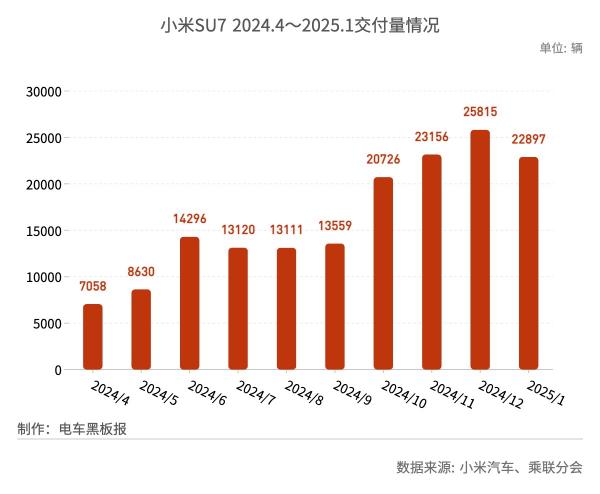

Data from the Passenger Car Association shows that Xiaomi's SU7 delivered a total of over 139,000 units from April to December 2024.

Lei Jun revealed at the beginning of the launch event that Xiaomi's SU7 has accumulated over 248,000 confirmed orders in the nine months since its launch. This indicates consistent strong demand for the car since its inception; however, with nearly 110,000 pending orders, the issue of insufficient production capacity has been further amplified and has become the main factor hindering rapid growth in deliveries.

According to Xiaomi Car's official website, the estimated delivery period for the three versions of the SU7 after confirmed orders has been extended by two weeks compared to a week ago. Specifically, the standard and Pro versions require a wait of 32-35 weeks and 30-33 weeks, respectively; the Max version has the shortest wait time, but it still reaches 26-29 weeks.

Judging from the cumulative confirmed orders disclosed for the first time, the company's current production capacity is far from being able to cover the backlog and new orders for the SU7. Moreover, Xiaomi Car's limited production capacity will also need to be partially allocated to the newly launched SU7 Ultra, which may further strain the company's production capabilities.

According to the design plan, the annual production capacity of Phase I of Xiaomi Car's factory is 150,000 units. However, to ensure deliveries, the factory has been operating on a double-shift system since June 2024; in July of the same year, a new round of production line maintenance was carried out to further increase production capacity.

Regarding Xiaomi Car's production capacity issues, Lei Jun posted on Weibo in early February this year that the company would seriously discuss ways to further increase production while ensuring quality and production safety.

Phase II of Xiaomi Car's factory is expected to be completed and operational by mid-2025, at which time the combined designed production capacity of the two factories will reach 300,000 units. However, it should be noted that Phase II of the factory is primarily dedicated to the second model, Xiaomi YU7, which will be launched simultaneously. If the YU7 experiences a surge in orders similar to the SU7, Xiaomi Car may face a "production capacity dilemma".

Nonetheless, the Beijing Economic-Technological Development Area officially stated in mid-February that it will ensure the continuous ramp-up of Xiaomi Car's production capacity, and the region's total vehicle production is expected to exceed 1 million units by 2030. This provides a favorable guarantee for Xiaomi Car.

In a research report, Everbright Securities stated that with the steady improvement in production capacity, Xiaomi Car's advantages in production scale will continue to emerge, enhancing its bargaining power and control over the supply chain, which is expected to boost the company's automotive gross margin to nearly 20% in Q4 2024 compared to the previous quarter.

Huatai Securities predicts that after the commissioning of Phase II of the factory, Xiaomi Car's total annual production capacity may approach 400,000 units. Considering the expected increase in gross margin due to economies of scale and a possible decline in expense ratios, Xiaomi Car's business may become profitable in 2025.