The Grand Gamble in the Yangtze River Delta: Akio Toyoda's Bet on Shanghai for the Electric Future

![]() 02/17 2025

02/17 2025

![]() 486

486

Written by: Wuxiubo

Sporting a baseball cap, racing suit, and sunglasses, Akio Toyoda, who returned to China for the first time since the pandemic, made a striking impression on the media.

At the Toyota GR Carnival held in Shanghai in late June last year, the chairman, renowned as the best driver in the automotive world, donned a "non-traditional" outfit, transformed into a professional racer, and dazzled the audience with high-octane stunts.

It was during this event that the vitality and enthusiasm of the Chinese automotive market left a profound impression on him.

Rumors have it that, after shedding his racing gear, Akio Toyoda swiftly completed a fresh round of inspections in Shanghai, preparing to seize the moment and accelerate the localization process of Lexus.

Eight months later, the news of Lexus' localization finally broke.

On February 5, Toyota Motor announced its decision to establish a Lexus pure electric vehicle and battery R&D and production company in Jinshan District, Shanghai, with production scheduled to commence in 2027.

As the current unique hub for new energy vehicle manufacturing globally, with the robust supply chain of the Yangtze River Delta and Tesla's success, the significance of "Shanghai" to Toyota's new energy strategy cannot be overstated.

Conversely, a question that warrants deeper exploration arises:

In the current context of intensifying global competition, rising trade barriers, and the latter half of industrial integration, what does partnering with Toyota, the world's leading automaker, mean for Shanghai?

1. Seeking New Growth for Shanghai with a GDP of Five Trillion

5.4 trillion yuan.

This is Shanghai's impressive economic scorecard for 2025.

What does this number signify? In terms of total economic output, Shanghai undeniably holds the title of "economic first city" in China. Globally, its GDP performance surpasses that of Paris and London, trailing only behind New York, Tokyo, and Los Angeles, making it a true top-5 global metropolis.

When compared on an economic scale, Shanghai's GDP amounts to approximately US$737.6 billion, ranking 22nd globally and outperforming the total economic output of countries such as Argentina, Belgium, and Sweden.

Beyond its remarkable economic achievements, as Shanghai enters the new threshold of five trillion yuan, where it will seek new growth in the next phase is a question that garners global attention.

Among the references that must be mentioned is New York.

Both being economic jewels in the east of major nations, while Shanghai and New York are frequently compared in various articles, from an industrial structure perspective, there are not many similarities between the two.

As a financial city that converges global resources, more than 30% of New York's GDP is attributed to financial services. The total market value of listed companies on the New York Stock Exchange is even eight times that of the Shanghai Stock Exchange.

In contrast, although Shanghai also hosts numerous domestic and foreign financial institutions with an active financial market, the added value of the financial industry accounts for only 19.3% of its GDP.

Referring to the "Shanghai Master Plan (2017-2035)", Shanghai's original positioning was not to be a financial hub that attracts global resources but rather an economic, financial, trade, shipping, and technological innovation center.

Among these, the phrase "technological innovation" not only signifies Shanghai's new atmosphere facing the new era but is also the most emphasized part in this year's "Government Work Report". Combining the report, it is evident that focusing on cultivating and developing new quality productive forces, enhancing technological innovation capabilities, and promoting industrial transformation and upgrading have become crucial in driving Shanghai's development potential after reaching the "five trillion" milestone.

Particularly, as a gathering place for the new energy vehicle industry chain, with Tesla and SAIC as its two aces, Shanghai must capitalize on the new energy wave to bolster its industrial competitiveness.

An interesting coincidence is that the day Toyota officially announced the establishment of a factory in Shanghai coincided with the opening of Shanghai's "First New Year Meeting" and the official release of the 8.0 version of the action plan to optimize the business environment, featuring a total of 58 tasks aimed at improving corporate sentiment and introducing tangible measures that businesses can feel and access.

2. The New Story of the First City of New Energy Vehicles

'I am deeply aware that without the support of the Chinese government, especially the Shanghai municipal government, Tesla would not have achieved such a miracle.'

These were Musk's emotional words at the delivery ceremony of the Model 3 at the Shanghai Gigafactory on January 7, 2020.

As the undisputed "industrial highland" for global new energy vehicles, during decades of collaboration with new energy, Shanghai and the new energy industry have narrated a sample story of win-win cooperation.

Today, one out of every three new energy vehicles is produced in the Yangtze River Delta industrial belt, and one out of every five exported new energy vehicles originates from Shanghai Port.

Combining data from the Shanghai Municipal Commission of Economy and Information Technology and the China Association of Automobile Manufacturers, from January to November 2023, Shanghai's new energy vehicle production reached 1.17 million units, marking a year-on-year increase of 34.3%; the output value of new energy vehicles reached 346.79 billion yuan, up 31.3% year-on-year.

Beyond industrial achievements, Shanghai residents' enthusiasm for new energy vehicles ranks first among major global cities.

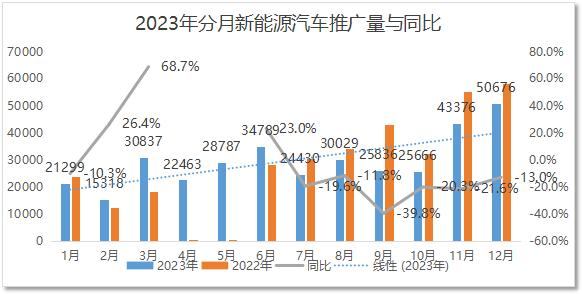

Statistics indicate that in the first 11 months of 2023, the promotion of new energy vehicles in Shanghai reached 303,000 units, with a market penetration rate of 65%, and a cumulative promotion of 1.316 million units.

2023 Shanghai Automobile Sales Market Analysis Report

Lingang District, situated in the southeast of Shanghai, witnesses the remarkable achievements of this first city of new energy.

Driven by the two leading groups of SAIC Motor and Tesla, a significant industrial agglomeration effect is unfolding on this land.

At the current stage, around Lingang District, a comprehensive industrial ecosystem chain for new energy vehicles encompassing batteries, automotive chips, autonomous driving systems, automotive interiors, precision processing, etc., has been established. The new energy vehicle industry has also evolved into the frontier industry with the largest economic scale and the strongest driving benefits in the Lingang New Area, continuously spilling over to the entire Yangtze River Delta region.

This is also the reason why Lingang District was chosen as the first stop for Lexus to establish a factory in China.

Referring to sales data from the first half of 2023, three out of the five cities in China that have the highest preference for Lexus are located in Guangdong Province. However, in this crucial decision that determines the brand's fate, the genuine fondness of Guangdong residents, backed by real money, ultimately lost to Shanghai's factories located just a stone's throw away.

For Shanghai, partnering with Lexus is not merely a bonus but also concerns the future of the "First City of New Energy".

In the current context of highly concentrated supply chains, the competition between cities in the new energy industry often manifests in the form of brand competition.

Among them, compared to NIO and BYD in Hefei, Zeekr in Hangzhou, Li Auto in Changzhou, and Zero Run in Jinhua, although Shanghai boasts Tesla and SAIC as its two giants, it is somewhat limited in terms of high-end industrial space.

From chip interiors to battery intelligent driving, it not only relies on cost-effective models for "volume" but also on high-end models for "quality", emphasizing continuous R&D and innovation.

As a leader among foreign luxury brands, despite recent sales impacts, Lexus' high-end brand perception persists, and the Toyota Group it relies on is also vast in scale. Establishing a factory in Shanghai undoubtedly further complements and optimizes the product structure of Shanghai's new energy vehicle industry.

Moreover, considering that when the new energy market was fiercely competitive, major brands successively passed on pressure to the upstream supply chain, and the industrial chain with a continuously prolonged payment cycle also urgently needed high-quality customers to alleviate financial pressure.

For the local new energy industrial chain, partnering with Lexus not only brings considerable project returns but also new opportunities to break into the supply chain system of Japanese automakers and gain a global perspective.

Finally, Lexus' choice to set up shop in Jinshan District is also expected to assist Shanghai in exploring the possibility of multi-location flowering of the new energy industry beyond the Lingang New Area.

Referring to the "2024 Hurun China New Energy Industry Cluster City Rankings", Shanghai ranks first with a comprehensive score of 87.8, but it only has a slight advantage of a few points or even decimal points over Shenzhen and Changzhou, which closely follow.

On this basis, Lexus' landing in Jinshan District, Shanghai, is by no means a simple transfer of production capacity or a replication of the Tesla model but rather a new exploration grounded in a novel industrial model.

On one hand, from a geographical perspective, Jinshan District is adjacent to Zhejiang, which boasts a complete automotive industry chain and a vibrant private economy, further缩短ing the physical distance between the automotive industry chains of the two regions. It serves as a "bridgehead" for the intersection and collaboration of automotive supply chain resources, talent resources, and market resources between the two, further solidifying Shanghai's position as the "chain leader" in the new energy vehicle industry chain.

On the other hand, when announcing the news, Lexus also mentioned that it will "cooperate with relevant upstream and downstream enterprises in the industrial chain, hydrogen energy, intelligent autonomous driving, and battery recycling and reuse to achieve green and low-carbon transformation goals."

Jinshan is precisely one of the key bases for Shanghai's hydrogen energy industry. According to the "Shanghai Medium and Long-term Development Plan for the Hydrogen Energy Industry (2022-2035)", by 2025, Jinshan's hydrogen energy industry innovation capability will generally reach a domestic leading level, and the industrial scale of the hydrogen energy industry chain will exceed 100 billion yuan; by 2035, the industrial development will generally attain an international leading level.

The aforementioned large-scale and industrialized hydrogen energy industry resources are also expected to be compatible with Toyota's hydrogen fuel cell technology, creating a "new highland for future automobiles" belonging to Shanghai beyond the Lingang New Area.

From this perspective, the partnership between the two parties can be described as a match made in heaven.

3. Man Proposes, God Disposes

Unlike the "human" factor in the Tesla Gigafactory story, Shanghai and Lexus are joining hands amidst the trends and tides of the new energy vehicle industry's development, as well as the "right time and place" accumulated by Shanghai's years of layout in the new energy vehicle industry.

For this reason, the outcome of Lexus' own electric transformation is particularly crucial to the prospects of the cooperation between the two parties.

As one of the few former joint venture brands that insisted on an import strategy and had long-term price increases at the terminal, Lexus experienced its "glorious moments" in the era of fuel vehicles and was one of the few brands that could maintain its price range amidst the impact of new energy and independent brands.

Public data shows that in 2024, Lexus sold a total of 181,906 units in the Chinese market, marking a 0.3% increase over the same period last year. Although the growth performance is not outstanding, compared to Porsche, whose sales declined by 28% during the same period, and BMW, whose annual deliveries fell by 13.4%, it can be considered a "lucky one" in the luxury tier.

However, like other luxury brands, the lag in electric transformation has rendered Lexus' performance in the new energy market unremarkable. In the Chinese market, Lexus' electric vehicle models have little presence, and consumers' attention to its electric products is far less than that for independent brands' new energy vehicle models.

From this perspective, the key for Lexus to turn around its performance may not be building a factory in Shanghai but rather truly launching localized pure electric products that resonate with Chinese consumers and withstand the test of the brutal market.

Toyota executives are well aware of this.

Previously, in an interview, Hiroki Nakashima, CTO of Toyota Motor Corporation, vigorously emphasized the importance of the Chinese market:

'The global status of electrification in the Chinese market is undeniable, and the importance of the Chinese market will not change in our hearts. In the future, Toyota will unwaveringly promote the development of electrified products in the Chinese market.'

As for the final outcome, the market remains the ultimate test.

After all, Shanghai, which converges the most complete supply chain for new energy globally, will only win the favor of more luxury brands in the future; and once the opportunity presented by establishing a factory in Shanghai is missed, Lexus' dream cannot be realized elsewhere.