Year-end sales push? Tesla's price reduction stirs up new waves

![]() 11/28 2024

11/28 2024

![]() 423

423

The year-end sales push by various companies is likely to drag on into a price war that extends into next year.

On November 25, Tesla launched an immediate discount on the final payment. From November 25 to December 31, Tesla Model Y rear-wheel-drive and long-range all-wheel-drive versions will receive an immediate discount of 10,000 yuan on the final payment, with prices starting from 239,900 yuan. Additionally, customers can choose a 5-year interest-free financial plan.

Notably, this is the lowest global price for the Tesla Model Y since its launch.

Taking the Model Y rear-wheel-drive version as an example, after a total vehicle price reduction of 10,000 yuan, the price becomes 239,900 yuan. If a 5-year interest-free loan plan is successfully applied for, with a down payment of 79,900 yuan and an annual interest rate of 0%, the monthly installment is approximately 2,667 yuan.

In addition to the Chinese market, Tesla has initiated varying degrees of preferential policies globally, aiming to achieve a sales surge by the end of this year. For example, in the United States, Tesla offers a 3-month free Supercharging and FSD (Full Self-Driving Capability) promotion for customers who take delivery of their vehicles before the end of the year. In Europe, customers who purchase a Model Y before the end of the year can enjoy one year of free Supercharging services.

Just recently, the Model Y faced a significant onslaught in the Chinese market. Following the Ledo L60, Zeekr 7X, and IMAX R7, AITO 07 and IM Auto LS6 have also entered the fray. From a pricing perspective, these models have all set their sights on the Model Y as their competitor.

Moreover, executives from these automakers have all declared that their products will surpass the Model Y, with a comprehensive benchmark against the Model Y being a common mantra in the new energy vehicle industry. However, this goal has yet to be achieved. The Model Y has remained unyielding and become a global best-seller.

In 2023, Tesla Model Y sold 646,847 units in the Chinese market, securing the title of the year's top-selling model. With global sales of 1.223 million units, the Model Y easily claimed the title of the world's best-selling model in 2023.

Li Bin, Chairman of NIO, has also stated, "The Model Y has created a gravitational field at the 250,000 yuan price point. There are many excellent cars above and below this price range."

Now, with prices dipping below 240,000 yuan, it only takes a small maneuver to break through this encirclement, and consumers will vote with their feet.

In October this year, AITO 07 delivered 5,636 new vehicles, Zeekr 7X delivered 11,643, Ledo L60 delivered 4,319, and IMAX R7 delivered 4,730. Even with significant exports in October to ensure supply, the Model Y still delivered 36,204 vehicles in the Chinese market, far exceeding the combined total of all its besiegers.

To some extent, price is Tesla's most powerful weapon in winning over the Chinese market.

According to incomplete statistics, Tesla has conducted at least six price reductions or promotional activities in the Chinese market this year. On January 12, Tesla China adjusted the prices of the Model 3/Y rear-wheel-drive and long-range versions, with reductions ranging from 6,500 to 15,500 yuan.

On February 1, Tesla offered a limited-time discount of 8,000 yuan cash off on specified Model Y versions.

On March 1, Tesla offered limited-time car purchase benefits of up to 34,600 yuan.

On April 21, Tesla reduced prices by 14,000 yuan across all Model Y, Model S, and Model X models sold in the Chinese market.

On July 1, Tesla introduced multiple purchase incentives for the Model 3 and Model Y, including a "5-year interest-free" plan.

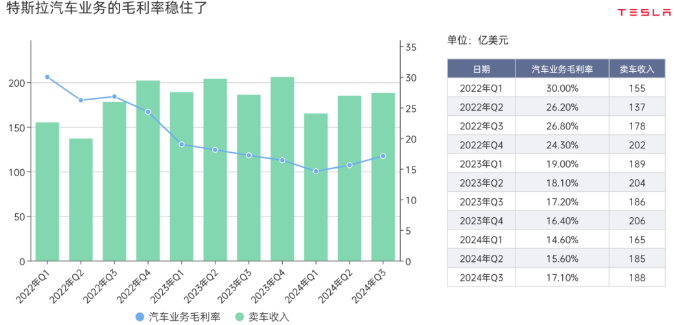

The confidence behind these initiatives stems from Tesla's high gross profit margin. Tesla's latest third-quarter financial report shows that despite the continued decline in the unit price of Tesla vehicles, Tesla's gross profit margin in the third quarter increased rather than decreased. Market expectations were for 15.3%, but Tesla's gross profit margin for the quarter ended up increasing by 2.4% to 17.1%, significantly exceeding market expectations.

In its third-quarter 2024 financial report, Tesla stated that the cost of selling a single vehicle has reached an all-time low. Tesla's Chief Financial Officer, Vaibhav Taneja, attributed this to reductions in raw material costs, freight costs, tariffs, and other one-time expenses, as well as the company's cost reduction and efficiency enhancement initiatives.

It can be said that against the backdrop of continuous declines in vehicle unit prices, Tesla has achieved a significant increase in its automotive business's gross profit margin through a series of cost reduction and efficiency enhancement measures, securing a victory in cost reduction amid intensifying competition in the global electric vehicle market.

As Tesla initiates a wide-ranging price reduction in China, the familiar scent of a price war is beginning to permeate the air.

On November 27, after BYD was reported to have required its suppliers to reduce prices by 10%, sparking heated market discussion, SAIC MAXUS also sent a letter to its suppliers stating that "cost competition" will be the main theme of the automotive industry in 2025. It invited supplier partners to participate in a major cost control project to enhance survival capabilities under complex pressures, with the same goal of reducing costs by 10%.

Li Yunfei, General Manager of BYD Brand and Public Relations, responded on Weibo that annual price negotiations with suppliers are common practice in the automotive industry. "Based on large-scale procurement, we set price reduction targets for suppliers, which are not mandatory but can be negotiated and advanced through discussion."

Among many automakers, BYD stands out as one of the most aggressive in price reductions and relatively unperturbed in price wars. Thanks to BYD's vertical integration of the industrial chain and control over core three-electric technologies, the gross profit margin of BYD vehicles, related automotive products, and other products reached 23.02%, once surpassing that of Tesla, the global leader in new energy vehicles.

The cost savings from technological breakthroughs have given BYD the initiative in this round of new energy vehicle price wars.

Regardless of how corporate strategies are implemented, the consensus remains that companies are preparing for an even more intense competition next year. The competition is far from over.

Several institutions, including UBS, Nomura, and Morgan Stanley, have given optimistic assessments of the development trend of China's automotive market in 2025. Among them, "trade-in for new", "price war", and "intelligent driving" have emerged as the three key phrases.

Gong Min, Head of China Automotive Industry Research at UBS, even stated directly that "a price war in the automotive industry may reappear in the first quarter of 2025, and it may come earlier than in previous years."

In fact, to date, more than 10 automotive companies have joined this "price reduction wave" through direct price cuts, trade-in subsidies, and other forms. The brands involved include Tesla, FAW-Toyota, BYD, Volkswagen Anhui, Haval, FAW-Volkswagen, SAIC Volkswagen, Leapmotor, SAIC-GM-Wuling, Hongmeng Intelligence, and Zeekr. Among them, the company offering the highest discount provides benefits and discounts totaling up to 110,000 yuan.

Although most companies' policies expire at the end of this year, the intensifying competition is likely to drag this year-end sales push into a price war that extends into next year.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.