Overall Business Is Improving, but Why Does NIO Always Attract Negativity

![]() 11/28 2024

11/28 2024

![]() 362

362

Recently, news about BYD acquiring NIO spread rapidly on the internet, attracting widespread attention. Screenshots circulating online showed a post by a suspected BYD employee claiming that BYD and NIO would collaborate to form a new company called B&N Auto Group. Among them, BYD would hold a 51% stake, while NIO would hold 49%. B&N Auto Group would acquire NIO for 16.5 billion yuan, with BYD providing financial and technical support. After the acquisition, B&N Auto Group would directly control NIO, but NIO would still be independently operated by the NIO Group.

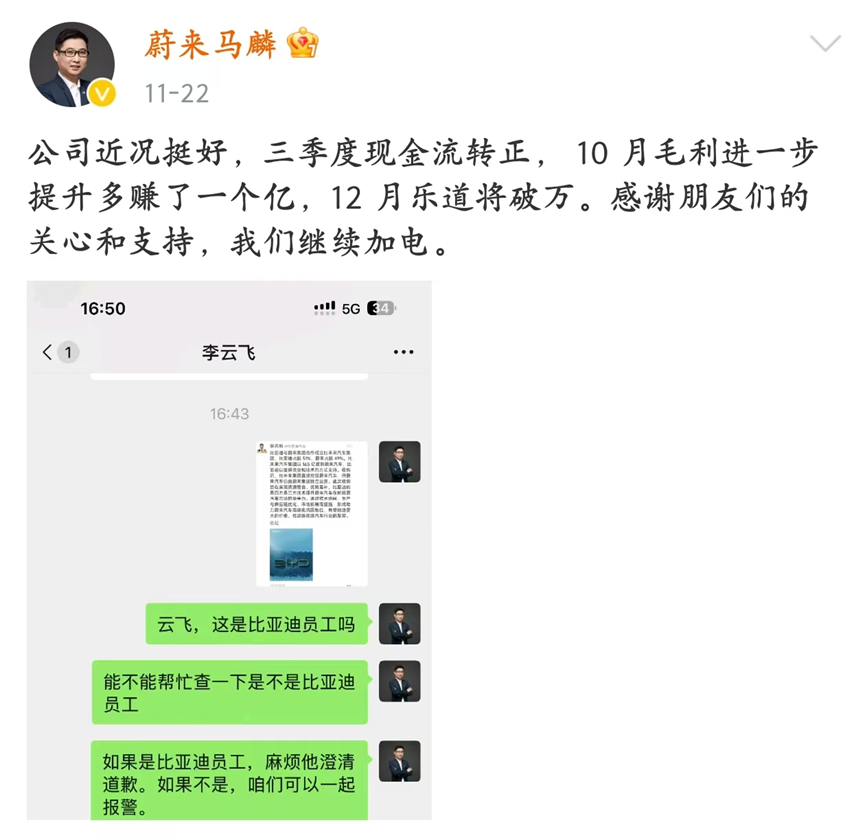

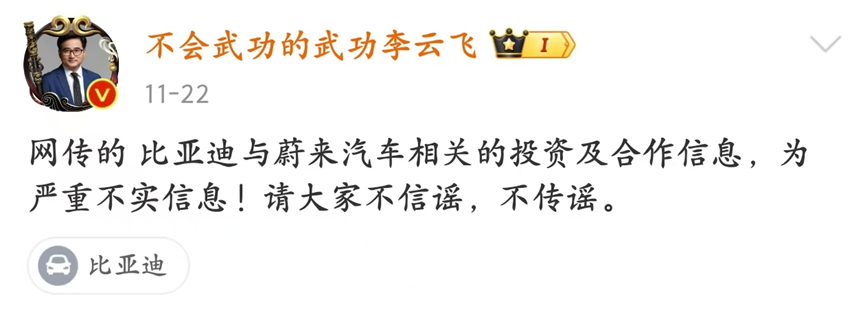

However, this news was quickly denied by both parties. Li Yunfei, General Manager of BYD Group's Brand and Public Relations Department, denied the rumors on social media: "The investment and cooperation information related to BYD and NIO that is circulating online is severely false! Please do not believe or spread rumors." Ma Lin, Assistant Vice President of NIO Brand and Communication, also responded on social media: "The company is doing well recently. Cash flow turned positive in the third quarter, gross margin further improved in October, and sales will exceed 10,000 units in December. Thank you for your concern and support. We will continue to power ahead." Additionally, NIO's Legal Department issued a statement on its official Weibo account, stating that the company had immediately reported the rumors to the police, and the public security organs had officially opened an investigation.

Reflecting on it carefully, NIO has indeed faced quite a few controversies since its inception, with doubts and criticisms persisting. As early as the 2021 Shanghai Auto Show, NIO was implicated in the high-profile case of a Tesla owner seeking rights protection, accused of being behind the rights protection actions. Similarly, at last year's Shanghai Auto Show, the BMW Mini ice cream incident also caused a significant public uproar. Afterwards, rumors spread online that Yiche.com, controlled by NIO's CEO Li Bin, was the mastermind behind these incidents.

In 2022, the topic of "NIO Technology Dissolution" trended on social media, sparking rumors of NIO "running away." However, according to NIO's response, the dissolved NIO Automobile Technology Co., Ltd. had not engaged in actual operations, and its dissolution had no impact on NIO's business. NIO has frequently faced criticism in the past. Why is it so often targeted? In the early stages of NIO's vehicle production, it established a high-end image through exclusive services, with several employees serving a single customer. However, as product sales gradually increased and vehicle ownership surged, service quality could not keep up, with some services becoming less comprehensive, which caused discomfort among many consumers. After all, it is easier to adapt to luxury than to simplicity. During this period, NIO's marketing strategies had the opposite effect. To conceal shortcomings in battery life, NIO conducted various official and unofficial test drives in remote areas. Li Bin also made controversial statements in the media, such as "Wherever fuel vehicles can go, NIO can go too," which ultimately created a satirical contrast with images of trucks towing charging vehicles to charge ES8s.

Furthermore, NIO's battery swapping and energy replenishment approach differs from the mainstream supercharging methods of other emerging forces. It not only solves the issues of long charging times and low efficiency but also offers higher safety due to the battery swapping technology. Although the battery swapping technology has a good intention and approach, it still poses a significant hurdle for consumers to accept, as no one wants to trade in their good battery for someone else's inferior one. This has led to some people disliking this energy replenishment technology, attracting haters. Additionally, NIO CEO Li Bin's controversial statements have also been a focus of negativity towards NIO. Li Bin has made extreme comments on various occasions, such as "The Porsche factory is inferior to the JAC-NIO factory" and "Buying a gasoline car is just to smell the gasoline." While these statements have garnered significant public attention, they have also provided ammunition for critics to attack NIO.

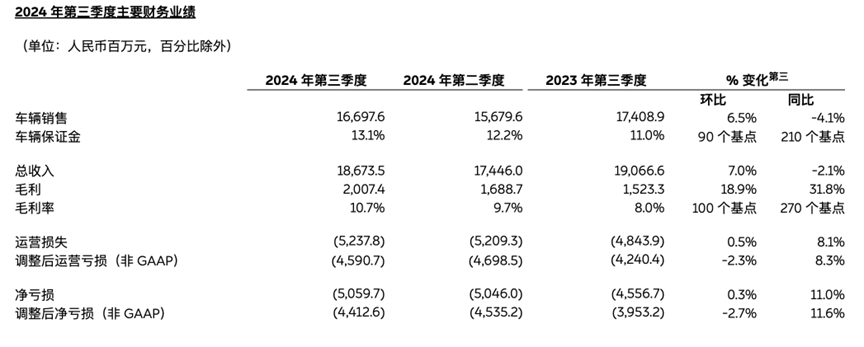

NIO recently released its financial report for the third quarter of 2024, revealing the company's progress and challenges on multiple fronts. In this report, NIO achieved a record high in quarterly deliveries, with 61,855 vehicles delivered. This achievement not only demonstrates market recognition of its products but also provides momentum for its future development. Despite the record delivery volume, NIO's financial situation remains under pressure. In the third quarter, the company's total revenue reached 18.6735 billion yuan, but it decreased by 2.1% year-on-year. Revenue from automobile sales was 16.6976 billion yuan, down 4.1% year-on-year. The net loss amounted to 5.0597 billion yuan, an increase of 8.1% year-on-year, with cumulative losses exceeding 15 billion yuan for the year. These figures reflect that while NIO has made breakthroughs in sales, the path to profitability remains long.

Interestingly, during an earnings call on November 20, NIO's Chairman and CEO Li Bin stated that the company aims to achieve profitability by 2026 and a 100% sales growth in 2025, with annual sales reaching approximately 450,000 units. During NIO's 2021 earnings call, Li Bin had previously ambitiously stated that he hoped NIO would become profitable by 2024. Now that 2024 has arrived, NIO has yet to achieve profitability. Will it succeed by 2026? For the main NIO brand, the NT3.0 platform is seen as the key to sales growth. This platform features a new electronic and electrical architecture, equipped with an 800V high-voltage system and advanced intelligent cockpit and driving technology.

Li Bin revealed that next year, the NIO brand will gradually transition to the new NT3.0 platform, entering a new product cycle. The flagship sedan ET9 will be the first model, with the product switch-over expected to be completed over the next two years. It is anticipated that the launch of new models on the NT3.0 platform will attract a significant number of potential customers who are still undecided. The launch of the Lydio L60 is seen as a new growth engine for NIO. Li Bin has personally promoted the Lydio brand multiple times, demonstrating his emphasis on this line. It is estimated that Lydio L60 has received approximately 40,000 orders. Although current production capacity has not fully met market demand, it is gradually increasing, with an expected capacity of 10,000 units in December and a planned capacity of 20,000 units by March next year. With its balanced product features and affordable price, the Lydio L60 could become a new weapon for NIO to compete in the market.

NIO is also about to launch its third brand, Firefly, targeted at the premium compact car market. It will be officially unveiled next month at NIO Day 2024 and is scheduled to begin deliveries in the first half of 2025. Li Bin stated that NIO's overall sales target for 2025 is to double to around 450,000 units, with a goal of increasing gross margin to 20%.

With the main NIO brand, Lydio, and the newest Firefly brand, NIO's product lineup spans high-end, mid-range, and low-end models, making it the most comprehensive strategic product layout among emerging automakers. Currently, despite frequent criticism, NIO owners demonstrate high brand loyalty, validating NIO's unique approach. NIO also showcases its innovation in brand philosophy, user experience, and business logic. Even though it has faced numerous doubts during its development, as long as NIO can continue to maintain sales and profitability, optimize its brand, and handle marketing issues prudently, it is believed that NIO can gradually turn around its negative image. According to NIO's brand planning, it still has significant potential. However, the market will ultimately determine its fate.

(Images sourced from the internet. Remove if infringing upon rights)