Xiaomi loses 30,000 yuan per car sold, but holds 151.6 billion yuan in cash. Lei Jun: The strongest performance in history

![]() 11/27 2024

11/27 2024

![]() 504

504

Next year may be the fastest-growing business???

Author: Wang Lei, Qin Zhangyong

Xiaomi has broken the curse in the heavy and costly automotive industry.

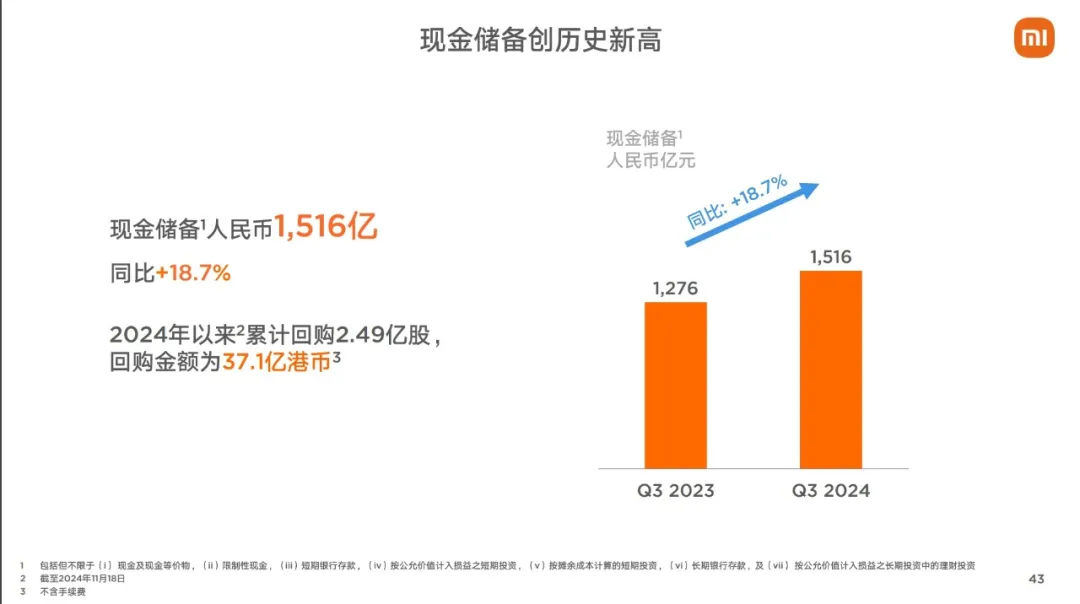

Three years after announcing its entry into the automotive sector, Xiaomi's cash flow has instead increased. According to its third-quarter report, Xiaomi's cash reserves reached 151.6 billion yuan, a record high.

It has to be said that the title of "Beijing's Cash King" is not undeserved.

Xiaomi has three main growth curves: mobile phones, IoT products, and automobiles. The mobile phone business contributes the most, with Q3 revenue of 47.5 billion yuan and global shipments of 43.1 million units. IoT product revenue was 26.1 billion yuan, including consumer goods such as air conditioners, refrigerators, and washing machines.

As for Xiaomi's automotive business, revenue is relatively low at 9.7 billion yuan. If considered separately, the automotive business lost 1.5 billion yuan.

However, Xiaomi's automotive business serves a much broader purpose; it is a crucial part of Xiaomi's human-car-home ecosystem.

At the brand level, since Xiaomi announced its entry into the automotive industry, Lei Jun's personal charisma has reached its peak, with a surge in fan following on various platforms and overwhelming public support. This has significantly contributed to the growth of Xiaomi's other businesses and enhanced its visibility.

Xiaomi Group CFO Lin Shiwei said that the growth in Xiaomi Group's total revenue for the quarter was largely due to the stable growth of the automotive business.

The importance of the automotive business is self-evident. From a historical perspective, it would be unreasonable to expect early profitability.

"As a new business, the automotive sector may see the fastest growth among all our businesses next year," said Lu Weibing in a conference call.

01? Losing 30,000 yuan less per car sold

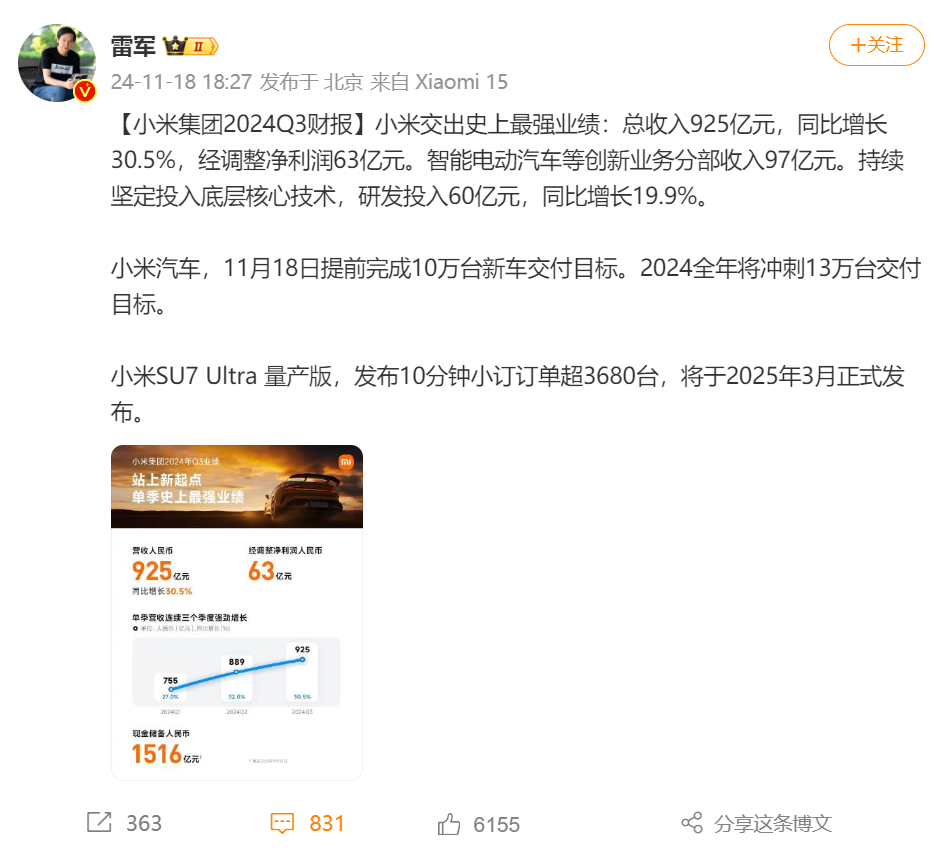

Lei Jun described Xiaomi's third-quarter 2024 financial report as "the strongest performance in history."

Total revenue for the third quarter was 92.51 billion yuan, a year-on-year increase of 30.5%. Adjusted net profit was 6.3 billion yuan, a year-on-year increase of 4.4%. R&D expenditure reached 6 billion yuan, a year-on-year increase of 19.9%.

In terms of revenue, the automotive business's overall contribution to the financial report is not significant. Revenue from the automotive business accounted for about one-tenth of total revenue at 9.7 billion yuan, including 9.5 billion yuan from smart electric vehicles and 200 million yuan from other related businesses.

It should be noted that this is only Xiaomi's performance after delivering vehicles for two quarters. Although the scale and profit are relatively insignificant, the growth rate behind it is astonishing.

In the second quarter, Xiaomi's automotive revenue was 6.4 billion yuan, with a gross margin of about 15.4% and a loss of 1.8 billion yuan. During the same period, Xiaomi delivered 27,307 new vehicles. At that time, some media outlets estimated that Xiaomi lost over 66,000 yuan per vehicle sold.

By the third quarter, Xiaomi had delivered 39,790 new vehicles, translating to a loss of about 38,000 yuan per vehicle, a significant reduction from the over 60,000 yuan loss in the second quarter.

When the concern over Xiaomi SU7 losing over 60,000 yuan per vehicle sold arose, Lei Jun responded, "I think this calculation is both right and wrong because Xiaomi Automobile is still in the investment phase and has just begun. I believe our financial performance is still good. Indeed, in the second quarter, we lost 1.8 billion yuan on innovative businesses such as smart vehicles, in other words, we invested 1.8 billion yuan. But once we reach a certain scale, I believe it will be easy to break even, so everyone doesn't need to worry about us."

Now, Lei Jun's words have been initially validated.

Lu Weibing also responded to the loss issue during the conference call, stating that Xiaomi's automotive business is still in its early stages and has not yet reached a large scale. Due to heavy initial investments in self-built factories and core technology research and development, as well as cost sharing, the business incurred losses in the early stages. However, he remained optimistic and expected the growth rate in the fourth quarter of 2024 to exceed that of the third quarter.

Indeed, the automotive industry is typically a scale economy. As Xiaomi's automotive business achieves stable deliveries, the bill of materials (BOM) cost is expected to continue decreasing, which will greatly help achieve economies of scale and improve the gross margin of the business.

If Xiaomi continues to increase its production capacity and further demonstrates economies of scale, its automotive business may become the fastest-growing new force in electric vehicle manufacturing to achieve profitability.

The confidence stems from the fact that in just six months, Xiaomi's automotive business has caught up with Tesla in terms of profitability per vehicle. In the third quarter, Xiaomi SU7's gross margin increased by another two percentage points from the previous quarter to 17.1%, which is identical to Tesla's automotive business gross margin for the same quarter.

It should be noted that this was achieved with quarterly sales of less than 40,000 units, and gross margin is directly affected by economies of scale. In other words, there is still considerable room for growth in Xiaomi's automotive gross margin.

Benefiting from the "hit product strategy," Xiaomi maximizes economies of scale and, against the backdrop of an industry price war, its vehicles are becoming more expensive.

In the third quarter, Xiaomi's automotive average selling price (ASP) was 238,800 yuan, nearly 11,000 yuan higher than the previous quarter's 227,000 yuan.

Regarding this, Lu Weibing explained during the earnings call that the increase in ASP is ultimately related to the product mix. Simply put, consumers are choosing the Xiaomi SU7 Max and Xiaomi SU7 Pro at a higher proportion, while choosing the lower-priced Xiaomi SU7 Standard Edition less, leading to an increase in ASP.

"I believe that with the launch of products like Xiaomi Automobile Ultra in the future, the overall ASP of the automotive business will increase significantly. This will happen after March next year," he said.

02? Invest heavily and pursue relentlessly

In its third-quarter report, Xiaomi Group also highlighted the recent achievements of its automotive business, achieving the rollout of 100,000 vehicles in 230 days and aiming to deliver 130,000 vehicles annually.

By rolling out the 100,000th new vehicle in 230 days, Xiaomi set a new record for the fastest rollout of 100,000 vehicles by a new automaker. Lei Jun also fulfilled the "flag" he set at the Xiaomi SU7 launch event.

What does it mean to achieve the rollout of 100,000 new vehicles in less than a year?

Before Xiaomi, the fastest record was held by AITO, which achieved this feat in 448 days. As a newcomer to the electric vehicle manufacturing industry, Xiaomi's production speed is seven months faster than AITO's. Earlier, Tesla took 12 years, NIO took three years, and Lixiang One took two years.

Of course, it cannot be denied that Xiaomi's rapid development in the automotive industry benefits from technological advancements and the favorable market environment for new energy vehicles. However, the fact that Xiaomi achieved this milestone with just one model in its first year speaks volumes about the success of the Xiaomi SU7.

Crucially, Lei Jun's "sweet problem" remains unresolved. In terms of orders, Xiaomi's automotive business still has ample potential. Currently, the second-phase factory has not yet commenced production, and the annual rated capacity of the first-phase factory is 150,000 vehicles, equivalent to a monthly rated output of 12,500 vehicles. To achieve a monthly delivery volume of over 20,000 vehicles, Xiaomi's automotive factory's current utilization rate has almost doubled.

Even with two shifts, Xiaomi's current production capacity still faces considerable challenges in fulfilling all orders, especially considering that this is only for the SU7 model. With the Xiaomi SU7 Ultra and upcoming SUV models, production capacity may be stretched to the limit, potentially slowing down the progress of subsequent models.

As of now, Xiaomi's delivery lead time for automotive products is still over 20 weeks, a slight reduction from the initial 25 weeks.

Lu Weibing summarized Xiaomi's automotive "methodology," which mainly consists of four points. The first is product strength. Lu Weibing emphasized that the product is the "1," and marketing is merely the following "0s." If the product is not up to par, nothing else matters.

"Recently, there have been many third-party tests, and in almost every test, Xiaomi Automobile has consistently ranked first or second. You'll find that Xiaomi Automobile uses extremely high-quality materials," he said.

The second point is Xiaomi Automobile's model – the hit product strategy. "We believe that creating and popularizing one exceptional product is key. Therefore, we only have about one-fourth to one-fifth the number of products in any category compared to our competitors. However, the efficiency of our individual products is much higher, and our investment and focus on each product are far greater," said Lu Weibing.

The third point is to develop products based on user needs. Xiaomi creates what consumers need, be it washing machines or automobiles.

The final point is "investing heavily" – in people and technology.

For example, in terms of intelligent driving investments, Xiaomi Automobile's attitude is "no upper limit." The so-called "no upper limit" means investing wherever needed.

This R&D attitude has led to significant investments in Xiaomi Automobile, as investments in autonomous driving have obvious marginal cost effects, which may to some extent drag down Xiaomi Automobile's financial performance.

Xiaomi Group Vice President, CFO, and Chairman of Skylink Finance Lin Shiwei said during the earnings call that even with higher-than-expected gross margins, more resources would be reinvested in future R&D projects. "In other words, even if our gross margins exceed expectations, we will invest the excess gross margins in R&D," he said.

This R&D attitude has resulted in remarkable progress in intelligent driving.

The day before the Guangzhou Auto Show, Lei Jun live-streamed a test of Xiaomi's HAD (Home to Anywhere Driving) system and shared that Xiaomi's intelligent driving system had caught up with three generations in just half a year. At the Guangzhou Auto Show, Lei Jun also shared data on the performance of the nationwide city NOA (Navigation on Autopilot) system after its launch.

From this perspective, although Xiaomi started late, it is relentlessly catching up. Lei Jun is truly comprehensive.