Layoffs rumored! Great Wall Motors stands at a crossroads

![]() 11/27 2024

11/27 2024

![]() 439

439

The automotive industry is in turmoil, and every move by the giants is like a boulder plunging into the sea, causing ripples everywhere!

According to 21st Century Business Herald, a former employee of Great Wall Motors has revealed that the company is conducting layoffs in disguise through job transfers and salary reductions, affecting hundreds of people.

Image Source: Great Wall Motors

The whistleblower claimed that the HR department transferred her from a technical position to a warehouse management position, with her salary reduced to 3,000 yuan per month, based on the reason that "her performance appraisal results were D in three evaluations within the past year, indicating that she was not competent for her current position." This created a significant pay gap compared to her previous salary.

Multiple former Great Wall Motors employees confirmed the existence of such situations, but they occurred sporadically over time, with the cumulative number of layoffs reaching hundreds. As of press time, Great Wall Motors had not yet responded.

If the rumors are true, why would Great Wall Motors resort to 'violent layoffs' despite the potential loss of face?

Sales slump, Great Wall Motors at a crossroads

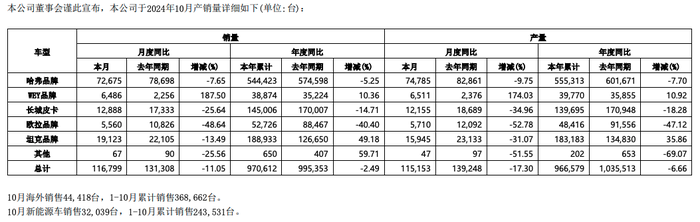

On November 1, Great Wall Motors announced: In October 2024, sales totaled 116,799 units, a year-on-year decrease of 11.05%. Cumulative sales from January to October this year were 976,000 units, a year-on-year decrease of 2.49%.

In contrast, the cumulative sales of domestic 'Big Five' automakers from January to October were: Geely - 2.5619 million units, Changan - 2.1558 million units, Chery - 2.0249 million units, and BYD - 3.297 million units, all exceeding 2 million units. Great Wall Motors, however, has not even surpassed 1 million units, widening the gap with its competitors.

Its brands, including Haval, Great Wall Pickup, and Ora, all experienced year-on-year declines. From the sales data for January to October, Ora saw the largest decline at 40.40%, ranking first among all brands. Great Wall Pickup and Haval recorded cumulative sales of 145,000 units and 574,000 units, respectively, with declines of 14.71% and 15.25%.

Image Source: Great Wall Motors Official

Among the only two brands showing growth, WEY and Tank, their combined annual sales amounted to only about 220,000 units, less than half of BYD's monthly sales.

According to Great Wall Motors' plan, the sales target for 2024 was 1.9 million units. However, in 10 months, the company only sold 976,000 units, achieving only 51% of its annual sales target. In the remaining two months, Great Wall Motors faces immense pressure. Based on current monthly sales estimates, it is uncertain whether the company's sales for the entire year will surpass those of 2023.

Industry insiders have told the media that Great Wall Motors has set overly ambitious sales targets, which is detrimental to motivating employees.

Great Wall Motors apparently did not recognize this issue and announced its ambitious 2025 strategic plan at the 8th Science and Technology Festival. The plan sets a sales target of 4 million units by 2025 and expects operating revenue to exceed 600 billion yuan.

It must be said that the target of 4 million units is indeed ambitious compared to Great Wall Motors' current sales figures.

Apart from declining sales, talent loss is also a major concern for Great Wall Motors. In recent years, there has been a frequent exodus of senior executives. In 2023 alone, multiple senior executives bid farewell to the company.

Early last year, Wang Fengying, the former president of Great Wall Motors, joined XPeng Motors.

In May last year, Wen Fei, general manager of both Ora and Salon brands, resigned from Great Wall Motors.

In October, Chen Siying, the former CEO of the WEY brand, left Great Wall Motors.

At the beginning of November, Guo Tiefu, the former general manager of public relations at Great Wall Motors, joined Geely's Radar Auto.

In December, Li Xiaorui, the former general manager of Great Wall Haval, was rumored to have joined Xiaomi Motors.

Various signs indicate that Great Wall Motors is at a crossroads.

Collective high-profile statements by executives: pros and cons

Amidst fierce competition among competitors using low prices to boost sales, Wei Jianjun, chairman of Great Wall Motors, has frequently spoken out against malicious competition in the industry.

Faced with record sales by new forces and BYD, Wei Jianjun once said in a livestream, 'Even if Great Wall Motors falls out of the top ten, we are not afraid. For healthy development, we would rather do less and have a smaller market share than pursue meaningless sales.'

At the same time, regarding China's new energy vehicles, Wei Jianjun also stated in an interview that the original invention technology for batteries in China's electric vehicle supply chain originated in the United States. China has no advantage in core technology and only leads in the supply chain.

Image Source: Weibo @Great Wall Motors

This viewpoint deviates from the actual situation in the industry. In fact, China's automotive industry currently occupies an important position in multiple sub-sectors. Chinese companies are emerging in areas such as SOC, sensors, storage, multi-functional MCUs, in-vehicle Ethernet, and communication systems supporting OTA upgrades. CATL and BYD's battery, motor, and controller (BMC) technologies are globally leading, and many traditional automakers are seeking cooperation with Chinese automakers, proving international recognition of Chinese automotive technology.

In response, Xiang Ligang, a CCTV commentator and founder of Feixiang Network, harshly criticized Wei Jianjun, chairman of Great Wall Motors, for belittling China's core electric vehicle technology, saying it was actually to cover up his own incompetence. Instead of taking responsibility for running the company poorly, he drags the entire industry down with him.

Image Source: Weibo @Tech Observation by Ligang

It's not just Wei Jianjun; senior executives of Great Wall Motors have also frequently mentioned the industry's disorderly competition.

Li Ruifeng, CGO of Great Wall Motors, implicitly criticized competitors at the launch of the Haval H6: Some say competition in the automotive industry is like playing cards at a table. You play based on your strength. If you can't keep up, you can pass and wait for the next round. But if someone is cheating at the table, we must sound the alarm, stand up, and even overturn the table.

When BYD advocated that 'together, we are Chinese autos,' Wang Yuanli, CTO of Great Wall Motors, said on social media, 'If it's just lip service to say we're together, it must be honey on the lips and arsenic in the heart. It's better to fight first and then be together.'

Image Source: Weibo comments

Netizens commented on Weibo, saying things like, 'Your company doesn't have it, don't drag China into it' and 'I see, Great Wall's new energy technology is outdated.' These comments and more have sparked controversy, damaging Great Wall Motors' public image and negatively impacting its brand reputation and market perception.

The second half of the automotive industry is going crazy; can Great Wall Motors break through with three 'embraces'?

Simply attributing Great Wall Motors' lagging performance to product and technology issues is not comprehensive.

In fact, since 2016, Great Wall Motors has been laying out the battery, motor, and axle industries, as well as the entire chain of autonomous driving and cockpits. Its subordinate brand, HAOMO AI, has become a leading autonomous driving technology service provider. In 2020, the Lemon platform, Tank platform, and Coffee Intelligence technology brands emerged, followed by the Lemon Hybrid DHT and intelligent four-wheel-drive electric hybrid technology Hi4, proving that Great Wall Motors does possess technological strength.

Some Great Wall Motors owners believe that the company may be facing internal product planning chaos, with a lack of continuity in product planning, unclear positioning of new models, and frequent changes in product lines, ultimately leading to the brand losing its original soul.

For example, the luxury brands VV5, VV6, and VV7 were discontinued abruptly, and Ora faced a similar fate. The naming was also haphazard, with models like Haval Chulian, Haval Dagu, and Ora's 'forgiving green' receiving criticism from users. These are all well-known issues and will not be elaborated here.

Image Source: Great Wall Motors

To emerge from this dilemma, Great Wall Motors cannot rely solely on external competition and verbal battles with competitors. It must first address its internal issues. After all, without a strong foundation, how can one overturn the table?

Fortunately, Great Wall Motors is indeed actively making changes, mainly embodied in three 'embraces.'

In terms of product strength, embrace Huawei.

At the 2024 Huawei Connect conference held in Shanghai, Great Wall Motors signed a comprehensive cooperation agreement with Huawei on digital marketing and intelligence. It is widely believed that this may be one step in Great Wall Motors' active embrace of Huawei's intelligent strategy. Perhaps in the near future, we will see Huawei's HarmonyOS cockpit or HUAWEI ADS intelligent driving technology on Great Wall Motors vehicles—although official denials have been made regarding the use of Huawei's intelligent driving technology by Great Wall Motors.

In marketing, embrace internet thinking.

Perhaps influenced by Lei Jun, Wei Jianjun not only updated his long-inactive Weibo account this year but also interacted with Xiaomi Chairman Lei Jun online. He even 'moved' Great Wall Motors' 2024 shareholder meeting to a livestream.

In fact, since internet technology companies entered the automotive industry, new marketing methods have been driving changes in the industry's direction. At the 2024 shareholder meeting, Wei Jianjun admitted, 'This is the internet era, and we must actively embrace internet thinking.'

In industrial layout, embrace overseas markets.

At the 2024 shareholder meeting, Wei Jianjun revealed that Great Wall Motors aims to challenge sales of 500,000 units overseas this year and plans to achieve overseas sales of over 1 million units and high-end model sales accounting for over one-third of total sales by 2030.

It is understood that Great Wall Motors has formed an 'ecological overseas expansion' system integrating research, production, supply, and marketing. Its overseas expansion model has also shifted from mere product exports to the export of comprehensive capabilities, including research and development, supply chains, production, marketing, and services.

Among the 'Big Five,' Chery firmly holds the top spot in overseas expansion and has built global operational capabilities, enviable by all automakers. In this regard, Great Wall Motors also has the opportunity to rise on the world stage in the future.

Final thoughts

In 2020, on the occasion of Great Wall Motors' 30th anniversary, Wei Jianjun personally filmed a promotional video titled, 'Can Great Wall Motors Survive Next Year?' In the video, he asked and answered his own question, 'What will the future bring? In my opinion, it's hanging by a thread.'

Amidst the wave of change in the automotive industry, Great Wall Motors faces not only its own transformation challenges but also opportunities for reshaping the entire industry's competitive landscape. Whether Great Wall Motors can leverage its 30 years of profound experience to achieve a curve overtake on the path of intelligence and globalization, becoming a leader in the automotive industry, remains to be seen over time.

Cover Image Source: Great Wall Motors

Source: Lei Technology