Bull markets have always been the ones that eat people

![]() 11/25 2024

11/25 2024

![]() 418

418

Weekly review of the auto stock market, observing various dynamics in the auto industry.

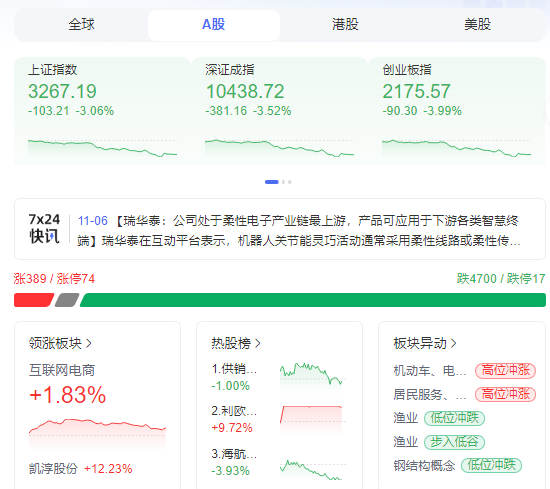

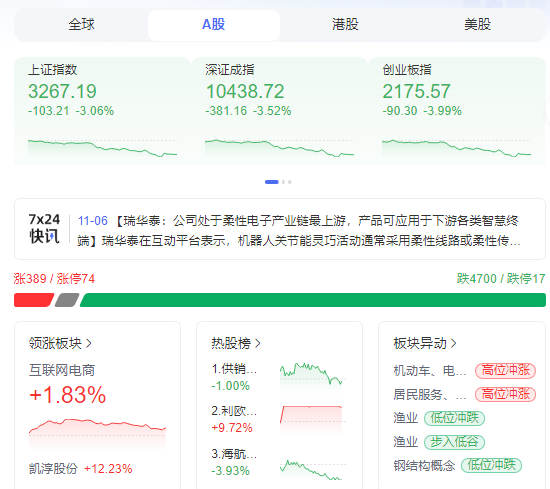

On November 22, the three major indexes opened slightly lower, weakened in the morning session, and fell sharply in the afternoon. By the end of the trading day, the Shanghai Composite Index fell 3.06% to close at 3,267.19 points; the Shenzhen Component Index fell 3.52% to close at 10,438.72 points; and the ChiNext Index fell 3.99% to close at 2,175.57 points. All three major indexes closed at their lowest points of the day, marking their largest single-day decline since mid-October.

The total trading volume of A-shares for the day was approximately RMB 1.83 trillion, an increase of more than RMB 170 billion from the previous day. This marked the 38th consecutive trading day with trading volume exceeding RMB 1 trillion and the 27th consecutive trading day exceeding RMB 1.5 trillion.

At the individual stock level, 4,917 stocks fell across the market, accounting for over 90% of the total, with 17 stocks hitting their daily limit down.

Many investors lost all the money they had earned by luck in one go, losing both principal and interest due to their own misjudgments.

Overall, the market continued to consolidate with declining volume on Monday, with the ChiNext Index leading the decline and market sentiment worsening. On Tuesday, the market staged a V-shaped rebound in the afternoon, with the ChiNext Index leading the gains and the Shanghai Composite Index regaining the 3,300-point level. Over 4,500 stocks rose, with a concentrated rally in lithium mining stocks and some popular high-profile stocks recovering. This was the best time for investors to take a break.

On Wednesday, the market continued to rebound across the board, with all three major indexes closing higher. The distribution of hot spots was relatively even, but the growth rate of each sector was limited. Soon after, on Thursday, the market experienced narrow fluctuations, with the three major indexes showing mixed performances. This immediately affected market sentiment, which deteriorated significantly on Friday. The ChiNext Index led the decline, and the Shanghai Composite Index fell by more than 100 points, losing the 3,300-point level.

Over a longer period, from the entire month of November to date, only November 4 and November 20 have recorded net inflows. Despite the prolonged and consistent net outflows, even if the amounts were not large, trading volumes consistently exceeded RMB 1 trillion. Market sentiment remained unable to withstand the pressure, and there were signs of a collapse this week.

The sharp decline in the overall market has indeed left most investors confused, feeling lost and panicked. Some investors said, "I lost 3 million in the bear market, but directly lost 5 million in the bull market." The bear market has never been predatory; it is only in bull markets that people truly get trapped.

Notably, even against this backdrop, more than a dozen stocks still hit their daily limit up, and the last two digits of their stock codes were consistent.

Bohai Chemical (600800.SH), Daheng Technology (600288.SH), Yuegui Co., Ltd. (000833.SZ), Haining Picheng (002344.SZ), Dongfang Jinggong (002611.SZ), Daqian Ecology (603955.SH), Risun (603366.SH), Fuchun Co., Ltd. (300299.SZ), Changchun Gas (600333.SH), and ZNZK (002877.SZ) all hit their daily limit up.

It has to be said that such a mysterious operation can only be pulled off by the A-share market.

On the news front, on November 18, the Ministry of Finance announced that it had allocated a debt limit of RMB 6 trillion to various regions on November 9, and some provinces had already initiated issuance. Additionally, the ultra-long-term special treasury bonds supporting the "two new" funds of RMB 300 billion had also been fully allocated. Apart from this clear positive news, there was no more stimulating news to boost confidence.

In terms of industry performance, the retail, transportation, and banking sectors experienced relatively smaller declines this week, while the semiconductor and insurance sectors saw relatively larger declines.

Some analysts believe that based on economic data from October and high-frequency data from November, the domestic economy is gradually stabilizing. It is expected that continuous economic improvement will be observed in the next one to two quarters. Fundamental performance will further drive stock market performance. Coupled with the current stock market being at a reasonable level overall, although the P/E ratio valuation of some high-priced stocks is slightly high, most industries are at a reasonable to low valuation level. From a longer-term perspective, it is relatively certain that the stock market will stabilize after fluctuations.

In the automotive sector, even powerful players like the Huawei ecosystem experienced a correction this week. Listed automakers including Thalys, JAC Motor, and BAIC BJEV all hit their all-time highs last week and experienced fluctuations and adjustments this week.

On November 22, Thalys closed at RMB 123.99 on Friday, down 4.00%, with a maximum weekly decline of 6.75%. Its trailing P/E ratio reached 48.22 times. The latest financial results show that in the third quarter of 2024, the company achieved revenue of RMB 106.627 billion, up 539.24% year-on-year; net profit was RMB 4.038 billion, up 276.02% year-on-year; and the gross profit margin was 25.23%.

JAC Motor closed at RMB 38.85 on Friday, down 5.75%, with a maximum weekly decline of 6.74%, almost mirroring Thalys' chart. It seems that JAC Motor and Thalys share the same investor base.

Among the Huawei ecosystem, BAIC BJEV is currently the least affected, apart from Chery, which is not yet listed. The associated BAIC BJEV stock price has remained below RMB 10 without significant improvement. Perhaps this makes BAIC BJEV one of the most promising stocks within the Huawei concept.

After all, Thalys has reached its limit, JAC Motor has yet to materialize, and Chery is not a publicly traded company. If BJEV can make improvements at the terminal level, it may become a good investment target within the Huawei concept.

Amidst the widespread lament in the A-share market, the U.S. stock market saw gains. On November 22, the three major U.S. stock indexes closed higher collectively. The Dow Jones Industrial Average rose 0.97%, setting a new all-time closing high and gaining 1.96% for the week. The S&P 500 Index rose 0.35%, with a weekly gain of 1.68%. The Nasdaq Composite Index rose 0.16%, with a weekly gain of 1.73%.

Among them, Tesla once again hit a new high since April 2022, with a total market capitalization of USD 1.13 trillion. Its market value increased by USD 41.5 billion (approximately RMB 300.7 billion) overnight. Bitcoin continued to press towards the USD 100,000 mark, reaching an intraday high of USD 99,588, setting a new all-time high.

As the fourth-largest holder of Bitcoin among U.S. listed companies, Tesla currently holds 9,720 Bitcoins. The appreciation of these Bitcoins alone exceeds USD 4 billion.

It has to be said that the value of Musk's bet against the president is still rising.

On Friday, news emerged that Tesla is preparing for the launch of its Cybertruck electric pickup truck in the Chinese market. It is reported that Tesla is adopting two different engineering solutions to improve the Cybertruck to meet the market access requirements in China, as "China has stricter regulations on pedestrian impact protection." Currently, some imported Cybertrucks have successfully been licensed in China.

With the simultaneous launch of the Cybertruck and FSD in China next year, Tesla may usher in a second renaissance in the country.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.