From AI phones to 'building cars', Star Techmology and Meizu's determination and helplessness

![]() 09/27 2024

09/27 2024

![]() 425

425

Can Star Techmology and Meizu's 'AI Ecosystem Story' impress the capital market and consumers?

This was a highly anticipated and 'topical' press conference.

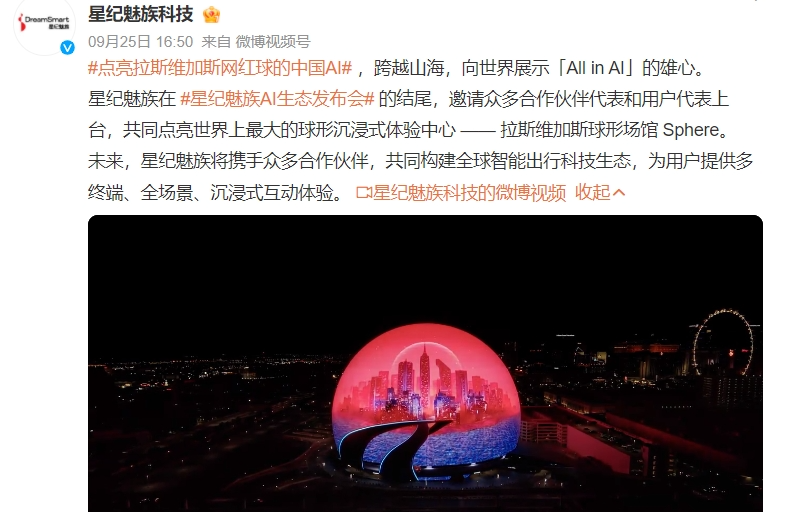

On September 25, the 'Star Techmology and Meizu AI Ecosystem Press Conference' was held in Beijing, where numerous products were unveiled, including the Meizu Lucky 08 AI phone, AR smart glasses StarV View, StarV Air2, smart ring StarV Ring2, and the Z10 STARBUFF e-sports customized model jointly developed by Star Techmology and Meizu with Lynk & Co.

Image source: Weibo screenshot

Thus, Star Techmology and Meizu officially became the third mobile phone company in China to enter the automotive industry after Huawei and Xiaomi. For Star Techmology and Meizu, this is a new story about ecosystems, as they attempt to achieve deep synergy around 'phones + XR + smart cars' to provide users with a multi-terminal, full-scene, immersive experience.

However, while this story may sound appealing, it is not easy to tell. Whether it's the Meizu AI phone or the AR smart glasses, which have been renamed StarV, their product influence remains marginal. Now, Star Techmology and Meizu are attempting to extend their business boundaries and ecosystem territory by deeply customizing models with Lynk & Co., but it is difficult for them to gain sufficient influence and discourse power. Can such an ecosystem story impress the capital market and consumers?

01. Insufficient AI Ecosystem

If one had to say which mobile phone manufacturer has the best AI technology, there may not be a universally agreed-upon conclusion. But if one had to say which company cares the most about AI and is the most determined, it would undoubtedly be Star Techmology and Meizu.

Since announcing the strategic plan of 'All in AI' at the beginning of this year, Star Techmology and Meizu have placed all their bets on AI. To this end, they have been strengthening the concept of AI phones and AI systems, among other terminal products, in an attempt to reinforce consumers' new perceptions of Star Techmology and Meizu, as was also the case at this AI ecosystem press conference.

Image source: Weibo screenshot

According to Liao Qinghong, Chief Operating Officer of Star Techmology and Meizu, at the press conference, 'Star Techmology and Meizu are building an AI-cored ecosystem known as Flyme AIOS. Based on the technical foundation of Flyme AIOS, we aim to achieve deep synergy and innovative development across various fields such as mobile phones, XR, and smart cars, creating a globalized intelligent ecosystem product system.'

If Star Techmology and Meizu can successfully tell the story of their AI ecosystem and lead the way, attracting the attention and favor of numerous capital investors, it will undoubtedly bring new development opportunities. However, every 'bet' comes with both risks and opportunities; if they fail to create a substantial gap with their competitors, their so-called AI ecosystem will at best be a mere facade.

Yet, telling this AI ecosystem story is no easy feat. While Star Techmology and Meizu are committed to building a powerful AI ecosystem, namely Flyme AIOS, which already boasts over 100 AI functions, there are still deficiencies in the depth and breadth of Flyme AIOS's core technologies. Moreover, these AI functions lack groundbreaking innovations and are mostly combinations and optimizations of previously common features.

Image source: Weibo screenshot

For instance, in terms of smart voice assistants, while Flyme AIOS can execute basic commands like checking the weather and playing music, it does not exhibit a significant advantage in terms of interaction naturalness and comprehension ability compared to similar products from other manufacturers. In image recognition and processing, while Flyme AIOS offers features like AI removal, AI photography, and AI image enlargement, it primarily performs routine presets or filter processing, with limited capabilities for recognizing and optimizing complex scenes.

Furthermore, the development of AI relies heavily on vast amounts of data. Companies like Huawei and Xiaomi, with their extensive smart device product lines and vast user bases, have accumulated rich data resources that provide a solid foundation for training and optimizing their AI algorithms. In contrast, Flyme AIOS has a relatively small user base, lacking diversity and scale in its data, which means it cannot build its AI models independently and must rely on third-party large model platforms for empowerment.

In terms of cross-domain synergy, although Star Techmology and Meizu have layouts in mobile phones, XR, and smart cars, the depth of integration and effectiveness of their AI technology in practical applications remain to be tested by the market. If Star Techmology and Meizu want to stand out in the current fierce competition and tell a compelling story about their AI ecosystem, they may need to invest even more in AI technology and products.

02. How Strong is the AI Product Power?

In addition to the Flyme AIOS operating system on the software side, the most important AI product carrier for Star Techmology and Meizu is the Meizu AI phone on the hardware side. Since the launch of the Meizu 21 PRO open AI terminal in February this year, Meizu has labeled all its phones as AI phones, intending to differentiate them from traditional smartphones and emphasize that they belong to a new category.

It's worth mentioning that at this year's Mobile World Congress (MWC), Xiaomi Group President Lu Weibing expressed his opposition to conceptualizing AI and appending 'AI' to the names of existing phones, stating that he believes it is meaningless.

Image source: Weibo screenshot

In reality, however, a 'race' among major mobile phone manufacturers to develop large AI models has already begun.

Since 2023, AI has become a key focus for domestic mobile phone manufacturers. From the second half of 2023, phones equipped with large AI models began to hit the market. In August 2023, Xiaomi announced that it had successfully developed a 1.3 billion-parameter edge-side model that was operational on mobile phones and integrated into the Xiaomi 14 series. In November last year, vivo's self-developed 'AI Blue Heart Large Model' debuted on its mid-range phones. This year, OPPO, Honor, Huawei, and others have also launched their own edge-side large model products.

Even Apple has integrated OpenAI's ChatGPT generative AI large model into its latest iPhone 16 series.

According to 'Business Insight,' there are currently two primary ways to integrate mobile phones with large AI models: edge-side AI and cloud-side AI. Edge-side AI refers to deploying large AI models or related computing capabilities directly on users' mobile phones, enabling them to process AI tasks locally without relying on cloud servers. Cloud-side AI, on the other hand, relies on cloud servers to process users' data and requests transmitted over the network before returning the results to the mobile phone.

Image source: Canned Stock Photo Library

Due to the direct deployment of AI computing capabilities on end devices, edge-side AI can respond to user requests in real-time and more quickly, while better protecting users' privacy data. However, limited by hardware conditions (such as processor performance and memory size), its ability to process complex AI tasks is relatively constrained.

In contrast, cloud-side AI, with the powerful computing and storage resources of cloud servers, can provide more robust computing capabilities. However, network latency and bandwidth limitations may affect the user experience and pose potential privacy risks. Furthermore, in offline environments, users will be unable to access cloud-dependent AI features.

In Lu Weibing's view, so-called AI phones are actually AI Feature phones, utilizing AI technology to implement specific AI functions, i.e., cloud-side AI phones. A true AI phone, he argues, should be equipped with an operating system rebuilt based on large AI models, constituting a deep edge-side AI phone. In other words, an AI phone should integrate the capabilities of large AI models from the bottom layer of the operating system, enabling a more comprehensive and intelligent experience.

Image source: Weibo screenshot

Currently, Meizu AI phones primarily rely on cloud-side AI, applying AI technology to implement specific AI functions. Meizu has previously admitted that its AI phones are primarily open to global large model teams, allowing third-party models to complete applications and achieve differentiation advantages.

However, this reliance on third-party models poses numerous hidden dangers.

Firstly, Meizu has limited control over the stability and security of third-party models. If these models encounter issues, it may directly impact the user experience of Meizu AI phones and even lead to severe consequences such as data breaches.

Secondly, due to its reliance on third-party models, Meizu may be constrained by their research and development progress and decisions regarding AI technology upgrades and optimizations, making it difficult to respond quickly to market changes and user needs.

Furthermore, this approach is unlikely to form a genuine competitive edge. In the fiercely competitive market, the lack of independently developed core technologies and reliance solely on differentiation advantages provided by third-party models may not be sustainable in the long run.

Image source: Weibo screenshot

In contrast, mobile phone manufacturers committed to developing edge-side AI, despite significant investments in technology research and development, can grasp core technologies to deliver more efficient, secure, and stable AI experiences. They can continuously optimize and upgrade their large AI models based on product requirements and user feedback, providing users with more personalized and intelligent services.

03. Meizu Has 'Changed'

At this press conference, with the official launch of the Meizu Lucky 08, the Meizu Lucky series became a new mobile phone product line following the digital series and Note series. Positioned as both visually appealing and practical, it complements the digital series, which focuses on all-around flagship features, and the Note series, which emphasizes performance, forming a more comprehensive and segmented Meizu mobile phone product matrix.

Image source: Meizu Mall screenshot

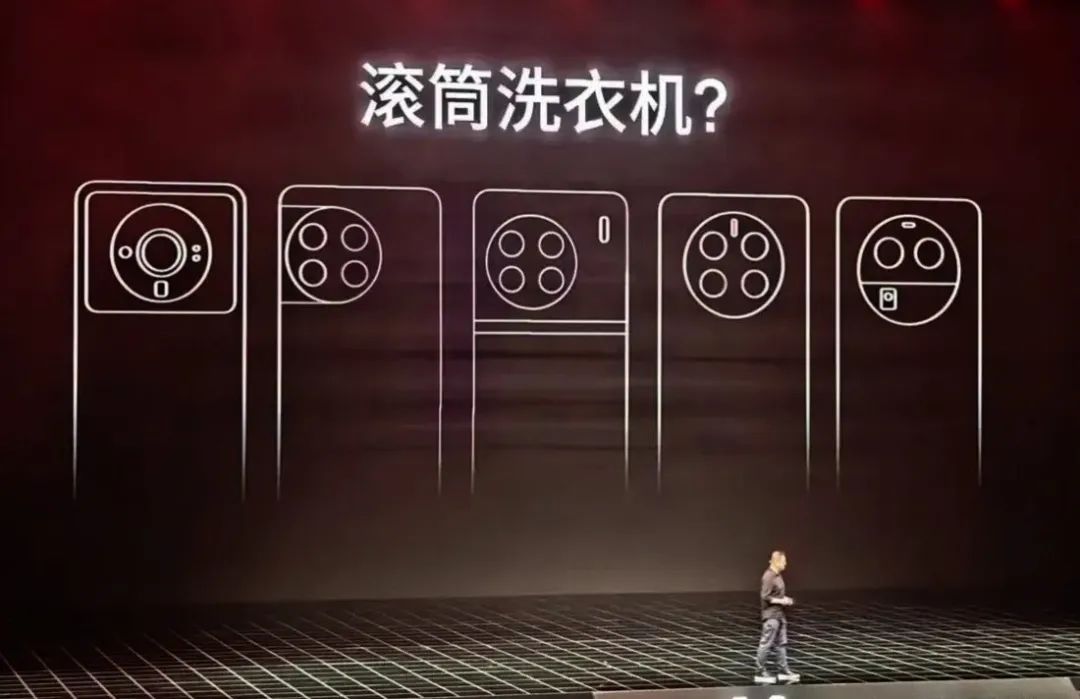

Ironically, the Meizu Lucky 08 abandons Meizu's traditional minimalist design philosophy and follows the mainstream trend with a large, circular camera module. Last March, at the Meizu 20 series press conference, the former CEO of Star Techmology and Meizu, Shen Ziyu, criticized rival manufacturers for adopting a 'washing machine' design style, which now seems somewhat ironic and self-contradictory.

Image source: Weibo screenshot

In fact, starting with the launch of the Meizu 20 series, the extreme product design philosophy espoused by Meizu's founder Huang Zhang in the early days has gradually been abandoned, replaced by the compromise and mass-market mindset of Star Techmology and Meizu's current leaders, Shen Ziyu and Su Jing. The introduction of the Meizu Lucky 08 is a clear example of this shift.

This transformation reflects, to some extent, adjustments in Star Techmology and Meizu's market strategy. In the fiercely competitive mobile phone market, Meizu's past pursuit of extreme product design often meant higher costs and a narrower audience, trapping the company in a 'small but beautiful' niche. However, this unique design philosophy and attention to detail also earned Meizu a highly dedicated fan base.

Now, as product design trends towards compromise and mass appeal, Meizu's original characteristics and brand aura are gradually fading, with greater emphasis on the breadth of market demand and cost-effectiveness. Whether this approach is right or wrong can only be verified by market sales figures.

Image source: Canned Stock Photo Library

Although Shen Ziyu told the media that Meizu's smartphone sales exceeded 1 million units in 2023, the highest number of flagship phones sold in the company's history, sources revealed that Meizu's full-year 2023 sales figures fell short of expectations. As product shortcomings emerged and reputation suffered, Meizu's marketing head has quietly been replaced.

Similarly, the XR business may not be faring well either. In November last year, Star Techmology and Meizu officially launched the new MYVU AR smart glasses brand, including MYVU, MYVU Explorer Edition smart glasses, and MYVU Ring smart rings, and announced offline collaborations with Boshi Optical stores. However, less than a year after its launch, this AR smart glasses brand primarily relies on online sales channels. Nonetheless, on third-party e-commerce platforms like JD.com, MYVU AR smart glasses have been quietly removed, and with the introduction of the Star Techmology and Meizu AI Ecosystem Press Conference, MYVU has now been renamed the StarV smart glasses brand.

Source: CanTouTuKu

Regarding the sudden name change, Star Era Meizu has not disclosed the specific reasons, but this move may indirectly reflect mispositioning and poor sales in the XR business. MYVU has not gained sufficient influence and response in market communication and consumer perception. The name change from MYVU to StarV may be an attempt to redefine its positioning, reshape its brand image, and thereby enhance its attractiveness and competitiveness.

However, it remains uncertain whether the renewed smart glasses brand StarV can reverse Star Era Meizu's declining trend in the XR business. Following the failure of the original MYVU brand, consumers may be cautious about the new StarV brand, requiring Star Era Meizu to demonstrate the value and strength of the new brand through concrete actions.

04. Challenges of Cross-border 'Car Making'

At the conference, Star Era Meizu unveiled its first customized vehicle, the Z10 STARBUFF, available in two configurations: a 95kWh 766km rear-wheel-drive version priced at 242,800 yuan and a 95kWh 680km rear-wheel-drive version priced at 329,800 yuan.

As the first e-sports customized model jointly developed by Star Era Meizu and LYNK & CO, the Z10 STARBUFF is deeply customized for e-sports enthusiasts. Based on the LYNK & CO Z10, it incorporates the world's first Flyme Auto high-performance e-sports entertainment cockpit, enabling the freedom to play 3A console games and PC online games.

Source: Weibo Screenshot

The Z10 STARBUFF's e-sports entertainment cockpit boasts gaming capabilities comparable to a PC, equipped with numerous hardcore devices including the Ecarx Makalu computing platform, AMD V2000A desktop-grade chip, AMD RX6600M dedicated graphics card, water-cooled cooling, Samsung OLED high-refresh-rate automotive display, 1TB SSD, and 5G high-speed in-vehicle network, aiming to provide immersive cockpit audio experiences for e-sports players.

With the Z10 STARBUFF's positioning, playing 3A games in a car is no longer a luxury but can also expand to various derivative scenarios including e-sports gaming, immersive movie watching, real-time office work, and video conferencing.

Regarding the question of why play e-sports games in a car, Star Era Meizu CEO Su Jing believes, 'Star Era Meizu does not intend to traditionally manufacture cars but relies on our automaker partners' mature manufacturing system and combines our ecological advantages to create innovative automotive products.'

Breaking conventions in the traditional automotive industry, Star Era Meizu's integration of e-sports entertainment and car driving, two seemingly unrelated fields, is a bold attempt.

Source: Weibo Screenshot

Despite the Z10 STARBUFF's significant breakthroughs in the e-sports entertainment cockpit, technical integration challenges remain. As a highly complex mechanical product, automotive safety and stability are crucial. The integration of e-sports equipment undoubtedly increases the complexity of the automotive electronic system, posing a challenge for Star Era Meizu to ensure stable operation in various complex driving environments.

From a sales perspective, for Star Era Meizu to stand out in this competition, it must not only rely on unique product positioning and innovative technology but also establish a new mindset among consumers. Educating consumers about the advantages and value of the Z10 STARBUFF, breaking traditional car-buying perceptions, and cultivating demand for e-sports entertainment vehicles are additional challenges for Star Era Meizu.

05. New CEO's 'Worries'

Star Era Meizu's all-in bet on the AI ecosystem is both a necessity for development and a 'forced move.' After all, neither Meizu phones nor StarV AR smart glasses have sufficiently strong product competitiveness. Rather than persisting with a single product line, bundling different product categories into a rich and comprehensive ecological story may better appeal to consumers and investors.

However, both AI ecosystem development and cross-border 'car making' are capital-intensive endeavors with long payback periods. Given Star Era Meizu's previous staff optimization rumors, it remains uncertain whether its funds are sufficient to maintain the stable operation of its entire business system.

At Star Era Meizu's AI Ecosystem Conference, CEO Su Jing, the 'female leader,' attracted attention as she made her debut at a conference since taking office in May. The former CEO Shen Ziyu, who previously vowed to 'bring Meizu back to the top 5 in China's mid-to-high-end smartphone market within three years,' has quietly stepped down to focus on the operation and promotion of the Polestar automotive brand.

Source: Weibo Screenshot

With Su Jing's succession, it may signify her push for Star Era Meizu's IPO process. Before joining Star Era Meizu, Su Jing co-founded Star Era and served as CFO, leading major projects like the acquisition of Meizu Technology.

According to industry sources, Su Jing has also served as Secretary and Vice President of the PetroChina State United Fund, Executive Director of Guoxin Innovation and Technology Investment Fund, and Managing Director of Guofeng Venture Capital, boasting rich investment experience in next-generation information technology, new energy vehicles, and entertainment.

While Star Era Meizu's IPO financing situation remains unclear, preparations for a Hong Kong listing are underway. However, based on previous statements, Star Era Meizu aimed to list in Hong Kong in Q2 2024 with a target valuation of 20 billion yuan (current valuation: 10 billion yuan). However, progress indicates a likely delay in the listing plan.

Source: Weibo Screenshot

In January this year, rumors circulated that Star Era Meizu had laid off employees, including many recent graduates and former Star Era veterans, from late last year to early this year. Additionally, the chip business, a forward-looking technology of Star Era Meizu Group, was terminated in August 2023.

Both staff reductions and business closures may reflect Star Era Meizu's less-than-optimistic actual situation. To push forward with the IPO goal, staff optimization and a focus on core businesses are straightforward methods to reduce labor costs, increase profitability, and present strong financial performance and growth in financial statements.

Source: Weibo Screenshot

Star Era Meizu faces arduous challenges. On one hand, it must continuously enhance product competitiveness in the fiercely competitive market, creating differentiated ecological products. On the other hand, it must address financial constraints to ensure stable business operations. Simultaneously, it must confront IPO challenges and replan its development strategy, testing the operational and decision-making abilities of the new CEO Su Jing.

As Star Era Meizu stands at a critical juncture of development, building a solid 'moat' to effectively convey its AI ecosystem story is crucial amidst current opportunities and challenges. However, how much time remains for Star Era Meizu to fully leverage its potential remains to be seen.