From "backward technology" to the new darling of the market, why have extended-range vehicles suddenly become popular?

![]() 09/25 2024

09/25 2024

![]() 521

521

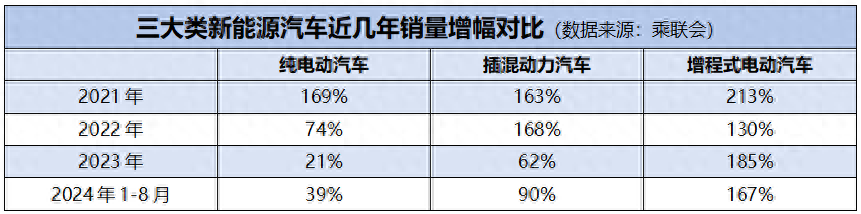

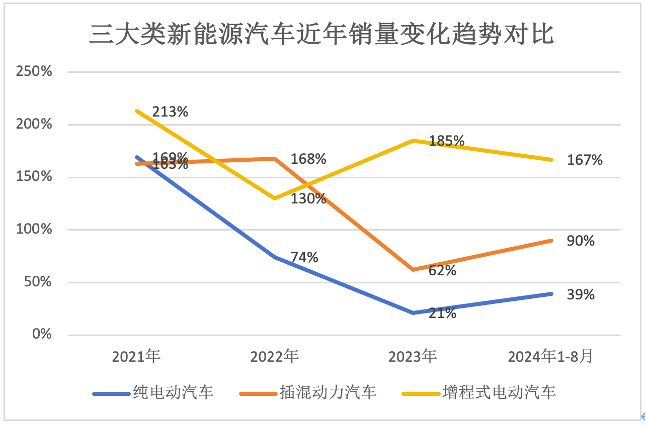

As pure electric vehicles gradually slow down their growth, plug-in hybrid vehicles have become popular, and even more surprisingly, the once-criticized extended-range vehicles have become even more popular than plug-in hybrids.

According to data from the China Passenger Car Association, the wholesale sales of extended-range vehicles reached 115,000 units in August 2024, a staggering 109% increase year-on-year. Meanwhile, pure electric vehicle sales were 592,000 units in August, a 6.6% increase year-on-year, while narrow-sense plug-in hybrid sales were 345,000 units, an 84% increase year-on-year.

The "weakness" of the pure electric market is attributed to the emergence of sales differentiation across different segments of the pure electric market, with the compact and small car segments experiencing accelerated declines. The China Passenger Car Association stated that in June, the wholesale sales of B-segment, A-segment, A0-segment, and A00-segment pure electric vehicles were 218,000, 108,000, 118,000, and 94,000 units, respectively. Among them, A-segment and A0-segment pure electric vehicle sales decreased by 1 percentage point and 10 percentage points year-on-year, respectively. Cui Dongshu believes that with the adjustment of the tax exemption policy for improving electric vehicle range, low-end micro-electric vehicles are shrinking, pure electric trends are weakening, and extended-range and plug-in hybrids will continue to strengthen.

The contrast between the "stagnation" of the pure electric market and the "surge" of the plug-in hybrid and extended-range markets is stark, especially as extended-range vehicles have gradually become a key powertrain form being considered by major OEMs.

According to media reports, Xiaomi Auto's third planned vehicle is an extended-range SUV model, aimed at the family market, and scheduled for launch in 2026. XPeng's progress has been even more rapid, with the company reportedly having clarified its extended-range vehicle project, completing core component sourcing in the first half of this year, and expecting mass production in the second half of 2025. In addition, it has been rumored that IM Motors will also launch an extended-range SUV model comparable to Lixiang L7 in the first quarter of 2025. Even Geely's ZEEKR, which focuses on pure electric vehicles, has hinted at entering the extended-range market, with CEO An Conghui stating at the Zeekr 009 launch event that "in the future, we do not rule out developing extended-range hybrids" when asked about future plans.

Since Lixiang Auto launched its first extended-range vehicle in 2018, extended-range technology has been controversial, frequently criticized by experts, industry insiders, and media as "technologically backward" and "pseudo-environmentally friendly." However, today, extended-range vehicles have proven their worth with a string of impressive data, and major OEMs have demonstrated their recognition of this technology through concrete actions. So why has this supposedly "backward" technology suddenly become so popular?

From Criticism to Adoration

The history of extended-range vehicles dates back over 100 years, when Ferdinand Porsche, the founder of Porsche AG, designed a hybrid vehicle that used an internal combustion engine to power a generator to charge wheel hub motors, but abandoned the technology due to the excessive weight added by the batteries and the inability to solve charging issues.

In the 1990s, Nissan developed the e-POWER hybrid technology, which bears some similarities to extended-range technology. The Nissan NOTE e-POWER, launched in 2016, became famous in Japan but received a lukewarm response in the Chinese market due to its higher price compared to gasoline-powered vehicles of the same class.

It wasn't until the 2018 launch of the Lixiang ONE that extended-range vehicles truly entered the public eye. While brands like NIO, XPeng, and Tesla were firmly committed to the pure electric route, Lixiang Auto chose to enter the new energy vehicle market with extended-range hybrids, a decision that sparked significant controversy and led to years of question and criticism from peers and experts.

Dr. Stephan Wöllenstein, CEO of Volkswagen Group China, once stated at a media briefing, "From an individual vehicle perspective, extended-range electric vehicles have some value, but from a national and global perspective, it's utter nonsense and the worst solution!" He explained, "The ultimate goal of developing electric vehicles is to reduce carbon emissions, but if we're burning fossil fuels to generate electricity, then there's no point in doing so."

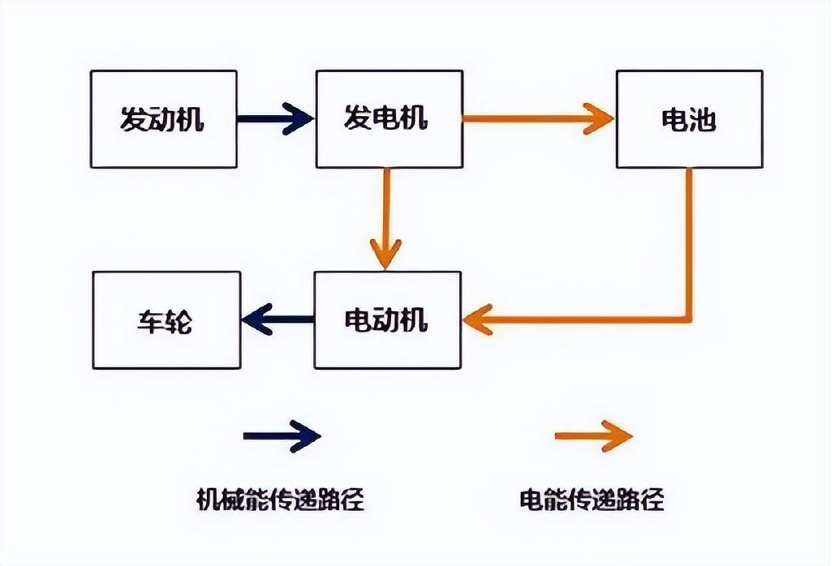

The main reasons why insiders refer to extended-range technology as "backward" are threefold, based on the operating characteristics of extended-range vehicles: the engine is only used to generate electricity, fuel consumption is high when the battery is low, and noise levels are significant.

The engine in an extended-range vehicle does not directly power the wheels but is used solely for electricity generation. This process inevitably leads to energy losses, resulting in low energy conversion efficiency, coupled with higher costs, heavier vehicle weight, and poor fuel economy. Additionally, the engine's electricity generation cannot keep up with the motor's consumption rate, exposing a shortcoming of extended-range vehicles: the need for high-load or full-load operation when the battery is low, leading to significant noise from the range extender.

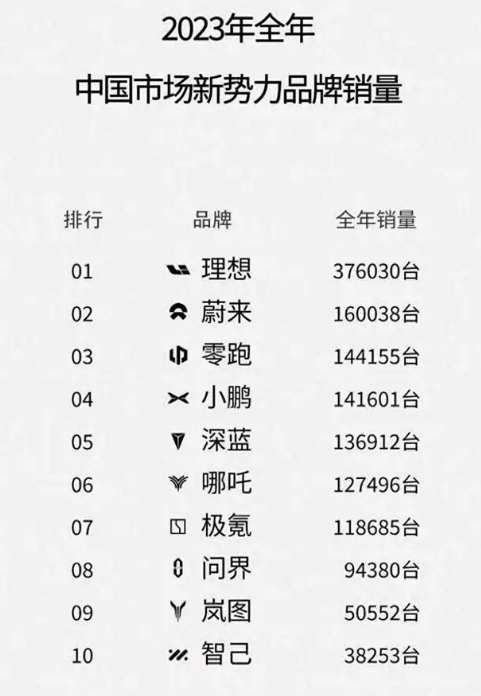

However, the situation did not unfold as expected. On the contrary, Lixiang became an overnight success with its extended-range technology, catapulting it to the top of new energy vehicle sales among new carmakers. In 2023, its sales (376,000 units) even surpassed the combined sales of NIO (160,000 units) and XPeng (141,600 units) during the same period. AITO, which was quick to follow Lixiang's lead in introducing extended-range vehicles, became a big winner, with cumulative sales of over 100,000 units of its M7 model alone in the first half of this year, and around 59,000 units of its other extended-range model, the M9.

From a macro perspective, Lixiang successfully commercialized extended-range technology, opening up a new market segment with growing demand. In 2023, sales of extended-range electric vehicles surged 181% year-on-year, far outpacing pure electric and plug-in hybrid vehicles. In the first half of this year, the growth rate was still as high as 124.2%, making it the fastest-growing powertrain market among the three mainstream new energy vehicle segments.

Why are extended-range vehicles popular?

In fact, the popularity of extended-range vehicles stems mainly from two factors:

From a technical perspective, extended-range vehicles address the most criticized issue with pure electric vehicles: range anxiety. According to McKinsey's "China Automotive Consumer Insights 2024" report, consumer acceptance of pure electric vehicles has declined, with 22% of car owners no longer considering purchasing new energy vehicles in 2023, compared to just 3% in 2022. One of the main reasons is consumer anxiety about recharging. Even in the era of large batteries and fast charging, range and recharging remain two key concerns for pure electric vehicle owners. At this point, extended-range and plug-in hybrid vehicles, which have a "fuel tank," have an inherent advantage. Because they are equipped with a gasoline engine, when the battery runs out of charge, the engine can automatically start to charge the battery or directly power the vehicle, significantly extending driving range, alleviating range anxiety on highways, and better adapting to cold northern winters. On the other hand, extended-range vehicles are equipped with larger battery capacities, providing longer pure electric driving ranges compared to plug-in hybrids. This not only addresses users' range anxiety for long-distance travel but also enables low-cost short-distance urban travel.

From the manufacturer's perspective, extended-range vehicles have a cost advantage over pure electric vehicles. Because they are equipped with smaller batteries, research and development costs and production costs are lower, which meets the needs of many manufacturers to reduce costs and earn quick profits. According to industry insiders, the cost of a mainstream-level range extender is approximately 10,000 yuan, and when combined with the battery cost of an extended-range vehicle, the total cost is only around 40,000 yuan. In contrast, for a 300,000-yuan-class pure electric vehicle, the battery capacity is approximately 80-120 kWh, with a cost of up to 80,000-130,000 yuan.

Based on these two factors, although many industry insiders view extended-range vehicles as a transitional route, as the pure electric vehicle market gradually reaches saturation, the potential of extended-range vehicles is beginning to be unleashed, transforming them from a "cold bench" to a "hot potato."

How long will the popularity of extended-range vehicles last?

After Lixiang Auto, AITO was the first new energy brand to introduce extended-range technology products. Less than two years after the launch of its first extended-range vehicle, several other brands, including Hozon Auto, Leapmotor, Deepal Blue, and Changan, have successively introduced extended-range vehicles. According to the latest market news, over the next year or so, many more brands will launch their own extended-range vehicles, most of which are positioned in the mid-to-low end. This suggests that the extended-range market may face saturation. So, how long can extended-range vehicles, as a "transitional route," remain popular?

Since entering the new energy vehicle era, the market share of traditional gasoline vehicles has continued to decline at a visible rate. In August, sales of traditional gasoline passenger vehicles were only 795,000 units, a year-on-year decrease of 34.1%, accounting for only 45.6% of total passenger vehicle sales in China. In contrast, new energy vehicles have shown vigorous development momentum.

Among the three mainstream powertrains for new energy vehicles—pure electric, plug-in hybrid, and extended-range—sales and market share rankings are in the order of pure electric > plug-in hybrid > extended-range. However, in terms of current growth rates, the order is extended-range > plug-in hybrid > pure electric. Among them, the extended-range segment is the fastest-growing market, but also the smallest and most niche. Therefore, from a market development perspective, there is still significant potential for extended-range vehicles.

On the other hand, while the core trend of China's new energy vehicle industry in the future is to develop pure electric drive technology, neither market demand nor the current technological progress of pure electric vehicles indicate that China's new energy vehicle market is ready to fully embrace the pure electric route in the short term. Instead, the focus is on developing diversified technology routes to support the diverse application needs of Chinese car users.

At present, there is no definitive timeline for pure electric vehicles to overcome range and recharging anxiety, especially in extreme climates and complex road conditions, where pure electric vehicles experience significant range degradation. Extended-range vehicles, which combine the advantages of long-range capabilities and low short-distance travel costs, are undoubtedly a valuable complement.

Professor Zhu Xichan of Tongji University believes that in the context of Europe and the United States slowing down their electrification efforts, the transitional period for extended-range vehicles may last 20-30 years. This means that extended-range vehicles are poised to enter a golden age.

Cui Dongshu, Secretary-General of the China Passenger Car Association, has also stated that extended-range technology is definitely not transitional. It has significant development potential both domestically and internationally, and its market share will increase significantly. Chinese extended-range technology will lead the world in this area and play a crucial role in gradually replacing gasoline vehicles. In other words, extended-range electric vehicles will have a promising future and are expected to remain active for an extended period.

However, as more and more brands enter the extended-range technology arena and launch related products, the extended-range vehicle market will undergo a new round of shuffling in the next two to three years, posing a more stringent test of OEMs' comprehensive capabilities.