Trump's Assassination Attempt May Impact China's Auto Industry

![]() 07/15 2024

07/15 2024

![]() 530

530

Introduction

The auto industry's pace of internal stability and external expansion will continue, but adjustments will be made in terms of progress and strategy.

Editor-in-Charge | Cao Jiadong

Editor | Wang Yue

"At that moment, I heard someone shouting my name. I turned around and dodged the bullet. I saw God telling me, 'This is my vote.'"

On July 13, 2024, local time in the United States, after Trump was shot in Pennsylvania, someone wrote the above sentence in the style of Donald Trump's Autobiography.

Undoubtedly, Trump's chances of winning the 2024 presidential election have increased significantly. According to data from prediction website Polymarket, after the attack, Trump's odds of winning rose from 60% to 70%.

We're not talking politics, we're just talking about cars.

If the helm changes across the ocean, the global environmental factors facing China's auto industry may undergo drastic changes.

Looking back at Trump's term as the 45th President of the United States, from January 20, 2017, to January 20, 2021, the auto industry will not forget: the outbreak of the Sino-US trade war in 2018, which not only suppressed China's auto parts exports to the United States but also led to US sanctions on Chinese chips, resulting in a structural shortage of auto chips in 2021 and reduced global auto production...

If Trump returns to the White House, what kind of impact will it have on the global auto industry, especially China's, and we must plan ahead.

Slight Benefit for Fuel Vehicles

Seeing through Trump's business nature—loving money—it is inevitable to associate him with the oil he repeatedly mentions, which is also a field closely related to the auto industry.

"In the scenario of Trump's election, the target price for crude oil in 2025 is only $60." In February of this year, Citigroup analyst Eric Lee made such a prediction, while the current WTI crude oil price is around $81.32 per barrel.

Trump advocates fossil fuels and promotes the return of manufacturing. When faced with the request for help from the Crown Prince of Saudi Arabia, he proposed "expanding production and lowering oil prices."

In March 2022, due to Biden's ban on importing Russian oil and gas due to the Russia-Ukraine war, US gasoline prices hit record highs, prompting Trump to tweet "Highest gasoline prices ever!" and not forgetting to seize the opportunity to win over people's hearts by asking, "Do you miss me?"

Therefore, Trump's attitude towards the oil industry is deregulation and encouragement of investment, which is conducive to the expansion of practitioners' scale, promotions, and salary increases. It represents the interests of oil and gas users and oil industry employees but is bearish for oil shareholders.

When oil prices fall, there will be relatively good conditions for fuel vehicles. However, domestic refined oil prices are influenced by many factors, resulting in slight benefits. Nonetheless, since the beginning of this year, the domestic auto industry has increasingly realized that "gasoline vehicles' profit contributions and hybrid vehicles' balancing effects are irreplaceable by pure electric vehicles for a certain period." Therefore, if Trump is re-elected, it will strengthen this perception.

In the first half of 2024, when overall passenger vehicle retail sales increased by only 2.9% year-on-year to 9.933 million units, new energy vehicles stood out with 4.111 million sales and a 33.1% increase, resulting in a penetration rate of 41.4%. Among them, plug-in hybrids (including extended range) surged by 69.5% year-on-year, while pure electric vehicles increased by 15.8%. The 1.687 million plug-in hybrids are not far from the 2.425 million pure electric vehicles.

It is expected that the decline in fuel vehicle sales will narrow with the relaxation of prices and the fall in oil prices after Trump's election; hybrid vehicles will remain popular.

Adverse to Auto Exports, Especially to the Russian Market

Currently, China's auto industry is paying more attention to going global, and its achievements have taken big strides forward, becoming one of the models of the dual-circulation economy.

Regardless of whether Trump is elected or not, it will not change the macro trend of China's auto industry continuing to make efforts to go abroad, but it will affect the regional business structure and change the situation of China's auto exports due to currency exchange rates.

First, let's look at currency exchange rates.

Trump has consistently tried to boost US domestic manufacturing and suppress the dollar's exchange rate, thereby creating a favorable development environment for US domestic manufacturing and facilitating the return of production capacity. Therefore, his "second coming" will be bearish for the dollar's exchange rate.

In addition, the rise in China's domestic demand mentioned below will be associated with risk assets, treasury yields, etc., prompting the appreciation of the RMB.

The fall of the US dollar and the rise of the RMB will have the most direct impact on the auto industry, which is unfavorable for exports. Of course, China's current auto exports have shifted from simple KD assembly in the past to technology and brand exports, and the localization system will absorb some of the exchange rate shocks, but ultimately, the exchange rate impact cannot be completely avoided.

Second, structural changes will occur in export regional markets.

As we all know, Trump has a close relationship with Russia. If Trump returns to the White House, it will accelerate the end of the Russia-Ukraine war and ultimately favor Ukraine's concessions to Russia.

Whether it is the strengthening of the RMB that is unfavorable for China's exports to Russia or the easing of relations between Russia and other countries, which may consider reintroducing other auto brands to form competition, China's "most comfortable days" in the Russian auto market may be set in 2023-2024.

According to statistics from the Association of European Businesses in Russia, six Chinese auto brands ranked among the top ten in Russia's passenger car market sales in 2023. Russia sold 1.0587 million new cars, an increase of 69% year-on-year. According to data from Otkritie Bank, a large Russian commercial bank, Chinese brands accounted for 49% of the market share.

From January to June 2024, Russian auto sales increased by 75% year-on-year to over 700,000 units, of which 69,400, or 53.1%, of the 130,700 new cars sold in June came from China.

However, China's current auto exports are more three-dimensional and rational. When the Russian market cools down, markets such as Southeast Asia may gain more traction.

Domestic Auto Market Demand Policies Will Be More Active

When Biden was in the White House, his preference was to give China's low- to mid-end exports a relatively loose environment, as it could fully utilize China's "world factory" characteristics to provide low-cost raw materials and light processed products to the United States. Therefore, during Biden's term, China strengthened its export business.

Exports are for earning profits, while domestic demand is for profit distribution. When exports are strong, the optimization of domestic demand is not so urgent. In 2023, the domestic auto market did not perform too well, with price wars directly lowering the profits of the entire auto manufacturing industry, and domestic passenger vehicle terminal sales falling short of the 2017 peak. However, thanks to new export highs, China's auto sales exceeded 30 million units for the first time.

Once Trump, whose policy direction is different from Biden, takes office, and after the US policy adjustments, it will be bearish for China's exports but bullish for the RMB exchange rate and China's domestic demand.

This year, the auto industry has already seen signs of "loosening the reins" in cities with license plate quotas and purchase restrictions, which will be strengthened by changes in the United States. "It is expected that more domestic demand policies will be introduced, and they will be more powerful than the semi-convergence of previous years, no longer hidden," said a friend in the financial sector.

This will drive robust domestic demand in sectors including the auto industry, which is linked to China's risk assets, treasury yields, etc., accompanying the appreciation of the RMB exchange rate, which will be more favorable for first-time car buyers, gasoline vehicles, and hybrid vehicles.

Not Conducive to Building China's Auto Technology Industry Chain in the United States

As Trump has consistently shouted the slogan of "revitalizing manufacturing," many believe that Trump would prefer to bring China's leading manufacturing companies to the United States.

Yes, we mentioned earlier that Trump's "manufacturing tendency" will have an impact from the perspective of currency exchange rates. However, Trump's orientation in the dimension of manufacturing technology iteration will hinder China's auto industry from building a technology industry chain in the United States—even if it proactively offers technical exchanges in good faith, it may not necessarily gain opportunities.

Trump, who represents the "redneck" trend of thought, has firmly chosen to support the popularization of oil and traditional energy sources (rather than the interests of oil tycoons) and will not encourage the rapid development of electric vehicles. CATL's plan to enter the United States to build a factory was formed during Biden's term.

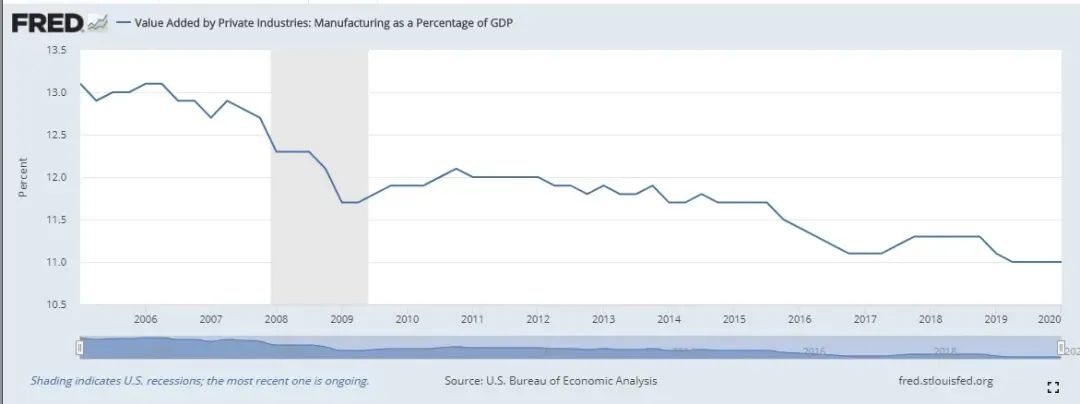

Precisely because of this, during Trump's term, the share of US manufacturing in GDP did not increase substantially. From the second quarter of 2017 to the first quarter of 2019, when performance was best, it only increased by 0.2 percentage points, from 11.1% to 11.3%, and then declined to 11.0%; instead, the contribution of financial services continued to soar.

Therefore, it is highly unlikely that China's auto industry can use electric vehicle technology as a way to open the door to the North American market, especially when Trump is in power, by "sharing technology and industry chains."

The "Water Army Industry" Relatively Quiets Down, Benefiting Auto Marketing Correction

Finally, after Trump's election, the factor that is the least substantive but easiest to disturb public vision at the public opinion level is that the "water army industry" will be relatively quieter than during the Biden era.

In recent years, China's auto industry has struggled with "excessive marketing" and "fan club marketing" in the marketing dimension, with religious brand water armies creating chaos.

In a sense, the water armies of current affairs and industries may share the same batch of people or bots. Trump has a reputation for "cutting off dog food" and disdains the effect of water army public opinion wars. In the internet environment, fans like "a certain filial son of the auto industry" often highly overlap with political fans like "squid" and "octopus."

After Trump returns to power, the internet environment, including the auto industry, may instead become slightly more "ear-and-eye-friendly."

In conclusion, Trump's taking office will not fundamentally change China's auto industry or the entire Chinese economy, but it will bring non-negligible changes to the details of the development path, whether in terms of structure or progress. How to adapt to changes and seize opportunities is a capability that China's soaring auto industry must master.