Honda, once known for its "hit cars," is declining in the Chinese market

![]() 07/12 2024

07/12 2024

![]() 396

396

Introduction: Honda's market advantage built on gasoline-powered vehicles is suffering from the wave of new energy vehicles, and its market position is rapidly slipping.

By Zhang Junzhi | Presented by Lishi Business Review

1

Falling from Grace

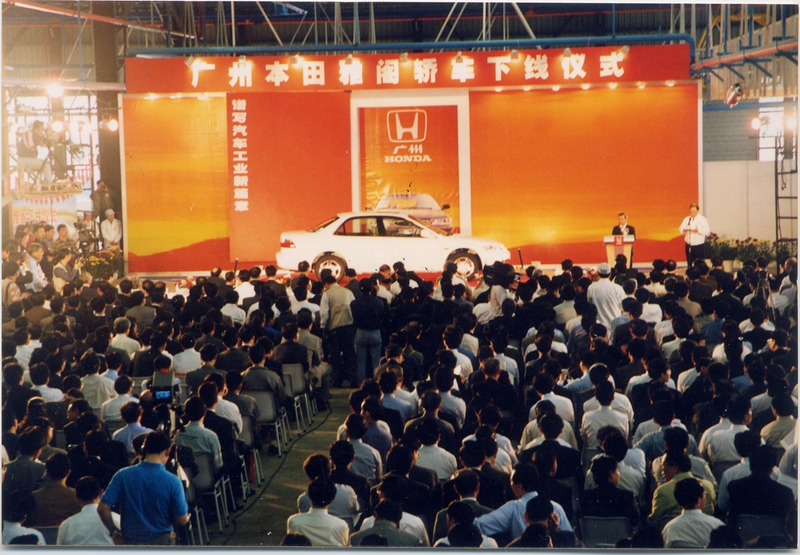

In 1996, after the failure of the Guangzhou Peugeot project, the Guangzhou Municipal Government began to search for new foreign partners. At that time, the Guangzhou Municipal Government's biggest trump card was holding the qualification for designated automobile production nationwide. In the 1990s, foreign automakers who wanted to jointly produce cars in China had to negotiate with the domestic "Big Three" (FAW, Dongfeng, and SAIC) and "Small Three" (Beijing Jeep, Tianjin Xiali, and Guangzhou Peugeot).

News of this quickly attracted numerous international automotive giants such as Opel, Hyundai, Kia, BMW, Fiat, Ford, Mercedes-Benz, and Mazda to explore.

Honda was the last to arrive but had the greatest determination. Later, Takeo Munakata, the then-chairman of Honda Motor Co., Ltd., recalled that he came with the mindset of resigning if the negotiations failed. Since the Huizhou project, which had been cooperating with Dongfeng since 1991, had made no progress, Honda saw this cooperation as its last chance to enter the Chinese market.

There was a small episode during the negotiations: At that time, the country had a 40% localization rate requirement for automobiles, and the Guangzhou Municipal Government hoped to strive to achieve it. However, Honda frankly told the Guangzhou Municipal Government leaders that not only could they not achieve a 40% localization rate, but even if all parts were handed over to the Chinese side, the Chinese side would not be able to assemble them. Objectively speaking, Honda, which was sweeping the American market at that time, was indeed a formidable presence for Chinese automakers.

Due to Honda's determination and sincerity in technology transfer and capital investment, ultimately, the Guangzhou Municipal Government chose Honda among many "buyers." It turned out that the Guangzhou Municipal Government made the right decision, and Honda also opened up a huge market.

On March 26, 1999, the first Accord rolled off the production line, and just nine months later, the 10,000th Accord was produced. Ten years later, the Accord had nearly one million users in China. As of this year, Honda has sold a cumulative total of 3.3 million Accord models in the Chinese market alone.

In addition to the Accord, Honda has also launched a series of phenomenal products in the Chinese market, such as the Dongfeng Honda CR-V, which pioneered urban SUVs in China, the Civic, the king of the A-segment market, the Fit, one of the most competitive products in the A0-segment market, and the Odyssey, a leading product in the MPV market. From cities to villages, from highways to country roads, Honda vehicles can be seen everywhere.

By 2020, Honda's two joint ventures in China, Guangqi Honda and Dongfeng Honda, both set new records for annual sales, with a combined sales volume of 1.627 million vehicles. This achievement ranks second only to the German Volkswagen Group among joint venture automakers.

However, after 2020, Honda's sales in China have shown a trend of accelerated decline: 1.5615 million vehicles in 2021, a year-on-year decrease of 4%; 1.3731 million vehicles in 2022, a year-on-year decrease of 12.1%; and 1.2342 million vehicles in 2023, a year-on-year decrease of 11%.

From January to June this year, Honda's cumulative sales in China were 415,900 vehicles, a year-on-year decrease of 21.48%. In particular, from February to June this year, Honda's sales declined significantly, with year-on-year decreases of 38.63%, 26.32%, 22.18%, 34.66%, and 39.04%, respectively. In June's sales, only the CR-V and Accord models sold over 10,000 units, and among the 25 models currently on sale, 14 had monthly sales of less than 1,000 units, and even some models sold only in single digits.

As sales plummeted rapidly, layoffs seemed to be Honda's inevitable choice. In June this year, due to generous compensation, news of Guangqi Honda employees "rushing to be laid off" hit the top trending list. Guangqi Honda originally planned to lay off about 1,700 employees, accounting for 14% of the total workforce, but in fact, more than 2,300 people chose to be laid off.

It is worth mentioning that this is the first large-scale layoff in the 25-year history of Guangqi Honda since its establishment in 1998, and in Japanese corporate culture, layoffs are usually not the preferred option.

On the other hand, Dongfeng Honda's situation is also not optimistic, and it is rumored that Dongfeng Honda will initiate a layoff plan soon.

Why has Honda, which was once "godlike" in the Chinese market, fallen from its peak in just a few years?

2

Why Did Honda End Up Here?

To explore the reasons for Honda's decline, it is necessary to first understand why Honda was able to win the Chinese market in the past.

In the early years, when other joint venture automakers were still "squeezing toothpaste" to launch new models in the Chinese market, Honda was the first automaker to introduce globally synchronized technology models. This is why models such as the Accord and CR-V were able to sell well in the market as soon as they were launched.

These globally synchronized models not only helped Honda rapidly expand the Chinese market but also established a brand image of advanced products in the Chinese market. The widespread saying "One Honda, Lifetime Honda" is proof of Chinese consumers' trust in Honda's product strength.

In addition, there has always been a joke in the automotive industry that "buying a Honda engine comes with a free car," which refers to the advanced and powerful performance of Honda's engines. Not only do they deliver high output and horsepower, but they also balance fuel economy. Models equipped with Honda's i-VTEC engines were almost all best-sellers earlier on. Later, Honda's i-MMD hybrid technology was almost the only one that could rival Toyota's hybrid technology.

Under the premise of excellent power and fuel economy, Honda's automotive products also demonstrate remarkable reliability. For example, Guangqi Honda has won the first place in J.D. Power's Initial Quality Study (IQS) for new vehicles for many years. The market also has a reputation for "Honda cars that never break down."

In terms of resale value, Honda models are outstanding. On the China Automobile Resale Value Research Ranking, models such as the Accord, Fit, CR-V, Civic, and XR-V consistently rank among the top in their respective segments in terms of resale value.

In addition, Honda automobiles are also highly regarded by Chinese consumers in terms of exterior design, interior space, and after-sales service.

However, with the rise of Chinese automakers in recent years and the advent of the new energy wave in the automotive industry, Honda has suffered a severe blow, and most of its aforementioned advantages have dissipated.

For example, Honda prides itself on its engines. Among its currently available products, the 2.0L hybrid engine in the fourth-generation i-MMD hybrid system has the highest thermal efficiency of 41%. However, today, engines from Chinese automakers such as BYD, Geely, and Chery have surpassed Honda in terms of thermal efficiency. For example, Geely's Leishen hybrid engine has a thermal efficiency of 46%, and BYD's fifth-generation DMi technology even achieves a thermal efficiency of 46.06%.

Better thermal efficiency also allows domestic new energy automakers to deliver better power performance and superior fuel economy. In the past, the myth of Honda's A0-segment Fit breaking the 100 km/h barrier in seven seconds is now commonplace or even lagging behind in the face of domestic plug-in hybrids and pure electric vehicles. In terms of fuel economy, BYD's Qin L has achieved an astonishing result of 2.9L/100km under NEDC standards when running on electricity.

It can be said that in terms of power performance and fuel economy, Chinese automakers have taken the lead over Honda.

Moreover, with the help of new energy technologies, Chinese automakers, which have essentially improved their product strength in recent years, have captured market share, making the Chinese automotive market the most competitive globally. Major joint venture automakers have had to frequently reduce prices to maintain sales, and Honda is no exception. For example, the Accord and CR-V, which used to cost around 200,000 yuan, have now dropped to below 150,000 yuan. With such discounts and promotions, the so-called resale value is no longer relevant.

But even so, Honda's past glory is difficult to recreate. Because in just a few short years, the penetration rate of new energy vehicles in China has exceeded 50%. In such a market context, gasoline-powered vehicles are naturally becoming harder to sell, and Honda, which relies on gasoline-powered vehicles for sales, is naturally declining.

Overall, it is the rise of domestic new energy automakers that has directly impacted Honda's market base, leading to its decline from grace.

So why hasn't Honda, which has always been known for its technology, made a push in the field of new energy vehicles?

3

Honda's Current Status in New Energy

Honda actually has its own new energy vehicles. Currently, there are 7 new energy models available from the Honda brand that can be registered with green license plates, including plug-in hybrids and pure electric vehicles.

However, these models have extremely low market presence, and even many car enthusiasts are unfamiliar with them. In June's auto sales rankings, Honda's top-selling new energy model was the plug-in hybrid version of the Accord, with sales of 650 units, followed by the pure electric model e:NP2, with sales of 435 units. Such sales performance is completely insignificant in the current new energy vehicle market.

Why is Honda performing so poorly in the new energy field? Let's first look at the plug-in hybrid sector.

Compared to the current popularity of plug-in hybrids, Japanese automakers led by Toyota and Honda have focused on hybrid routes for many years. Their basic working principle is to use electric motor intervention to compensate for the weakness of low engine torque, keeping the engine operating at its optimal condition to achieve fuel savings. Both Toyota's THS and Honda's i-MMD hybrid technologies can significantly reduce fuel consumption.

Plug-in hybrids, on the other hand, rely primarily on electric drive, with the engine acting as an assist. Due to larger batteries, these vehicles not only deliver better power performance but also excel in fuel economy. More importantly, in the Chinese market, plug-in hybrids can be registered with green license plates and are exempt from purchase tax.

Which of these two hybrid technologies is more beneficial to consumers is self-evident. As for why Honda did not deploy plug-in hybrid technology earlier, some analysts believe that there are both objective and subjective factors at play.

On the objective level, since Honda aims at the global automotive market, and plug-in hybrids rely more on the popularity and convenience of charging facilities, in most countries, especially developing ones, charging infrastructure is relatively backward, making hybrid vehicles more practical. In addition, while plug-in hybrids enjoy policy advantages in China, these advantages are not global. Therefore, Honda has not been very enthusiastic about plug-in hybrid technology.

On the subjective level, it may be more due to cost considerations. Japanese companies have always focused on cost control, but the larger battery components and more complex electronic control systems of plug-in hybrids lead to increased vehicle costs. Furthermore, the construction of infrastructure requires significant investments in land, materials, and labor, which goes against the cost-control ethos of Japanese companies. Moreover, Honda has spent years developing and iterating its hybrid technology, which not only has good reliability but also enjoys a good market reputation. It would indeed be a pity to abandon it.

Due to both objective and subjective factors, Honda did not deploy plug-in hybrid products early, and the products it eventually launched performed poorly. For example, the plug-in hybrid version of the Accord has a WLTC pure electric driving range of only 82km and takes nearly 8 hours to fully charge. With such product strength, it is not surprising that sales are dismal.

Beyond the plug-in hybrid sector, let's look at Honda's performance in the pure electric field.

If we say that traditional gasoline-powered automakers, except for Volkswagen, have generally been slow in their electric transformation, then Honda can be considered sluggish.

In 2021, when competition among various brands' pure electric vehicles had become fierce, Honda only announced its electric strategy for the Chinese market in October, and its first pure electric model, the e:NS1, was officially launched the following June.

However, this model, which is widely regarded as an oil-to-electric version of the XR-V (Honda claims it is a pure electric platform model), has virtually no market presence after its launch, with monthly sales consistently hovering around a few hundred units. Even after significant price cuts, sales have remained sluggish. To the extent that some commentators have said that if a car doesn't even receive criticism, it may be time for it to be phased out.

After the e:NS1, Honda has successively launched several other pure electric models, but they have similarly struggled with low sales. Even the latest e:NP2, with a range of 545km and a maximum power of 204 horsepower, is only mediocre in today's market, and it is difficult to match many domestic models in terms of intelligent cockpits and autonomous driving.

Clinging to outdated ideas will only lead to elimination by the tide of the times. Facing the trend of electrification in the automotive industry, how will Honda respond?

4

From Conservative to Radical

Early on, Honda's electric transformation was undoubtedly very slow, but now it appears to be very radical.

In 2023, Honda significantly advanced its electric transformation plan, clarifying that it will "stop launching gasoline-powered vehicles" in the Chinese market from 2030 to 2027, and by 2035, the sales proportion of pure electric vehicles will reach 100%.

To accelerate its electric transformation, Honda also stated that it will invest 10 trillion yen in electrification by 2030, double the research and development expenses (totaling about 5 trillion yen in electrification and software fields) proposed in 2022.

According to the new plan, Honda will no longer launch new gasoline-powered vehicles in the Chinese market in three years and will instead fully transition to the new energy field. Considering the current dismal performance of Honda's new energy vehicles in the Chinese market, this plan is undoubtedly extremely risky.

Does Honda have any sophisticated methods or countermeasures? It seems not.

Honda's current main strategy is collaboration. For example, it is borrowing General Motors' Ultium electric platform to develop pure electric vehicles in the North American market; strengthening cooperation with Contemporary Amperex Technology Co., Limited (CATL) in China; and exploring the possibility of cooperation with Nissan in the fields of electrification and intelligence, including joint research and development and procurement.

The second is a localization strategy. In April this year, Honda China officially launched a new electric brand, "Ye," emphasizing that the "Ye" brand is designed and developed by Honda China's R&D team, leveraging China's resources and technologies. It is reported that Chinese local supply chain enterprises such as CATL, Huawei, and iFLYTEK will be suppliers for the "Ye" brand.

In addition, in September last year, Dongfeng Honda, leveraging Dongfeng's electric vehicle platform, launched the world's first joint venture independent electric vehicle brand—Lingxi. The first model, the Lingxi L pure electric sedan, is scheduled to be released this September.

In addition to the aforementioned strategies, Honda is also betting on solid-state batteries and hydrogen fuel cells. Solid-state batteries are seen as a game-changing product in the current new energy vehicle market, and Honda aims to equip its new generation of vehicles with these batteries by 2030. As for hydrogen energy, Honda envisions leveraging its advantages in special application fields such as commercial vehicles and construction machinery.

How effective will these strategies be for Honda? Currently, the outlook is not very optimistic. First, relying on products from partners and supply chain companies makes it difficult to highlight Honda's own technological advantages and distinctive features. Second, partners like Dongfeng and GAC already have their own electrification brands, and it remains uncertain how much synergy can be achieved between them. Moreover, the depth of collaboration with supply chain giants like Huawei and CATL also remains to be seen. For instance, merely purchasing in-car screens and batteries from these companies will offer very limited enhancement to Honda's product capabilities.

As for high-energy-density, safer solid-state batteries, they are still largely in the experimental stage globally. It is unpredictable when Honda will actually obtain this "killer app," and whether Chinese car manufacturers will also have access to it by then. Even if these batteries move out of the laboratory, the timeline for their commercial application remains a significant question.

Overall, considering Honda's current technological reserves and strategic layout in the field of new energy technology, it will still face considerable competition from Chinese new energy vehicles in the Chinese market for some time. The market position it established with traditional fuel vehicles is also likely to continue to decline.