Electric vehicle charging or battery swapping? Executives from NIO and Huawei argue in vain

![]() 07/11 2024

07/11 2024

![]() 486

486

Charging and battery swapping, these two energy replenishment modes, do not need to be opposed to each other.

From November last year to May this year, just within half a year, seven automakers including Changan Automobile, Geely Holding Group, JAC Motor, Chery Automobile, Lotus Cars, GAC Group, and FAW Group have successively announced their participation in NIO's battery swapping system.

As the main promoter of the battery swapping model, NIO and its battery swapping system seem to have finally gained recognition from peers and consumers. The battery swapping family is growing larger, and NIO will have the opportunity to turn its battery swapping standard into an industry-wide standard.

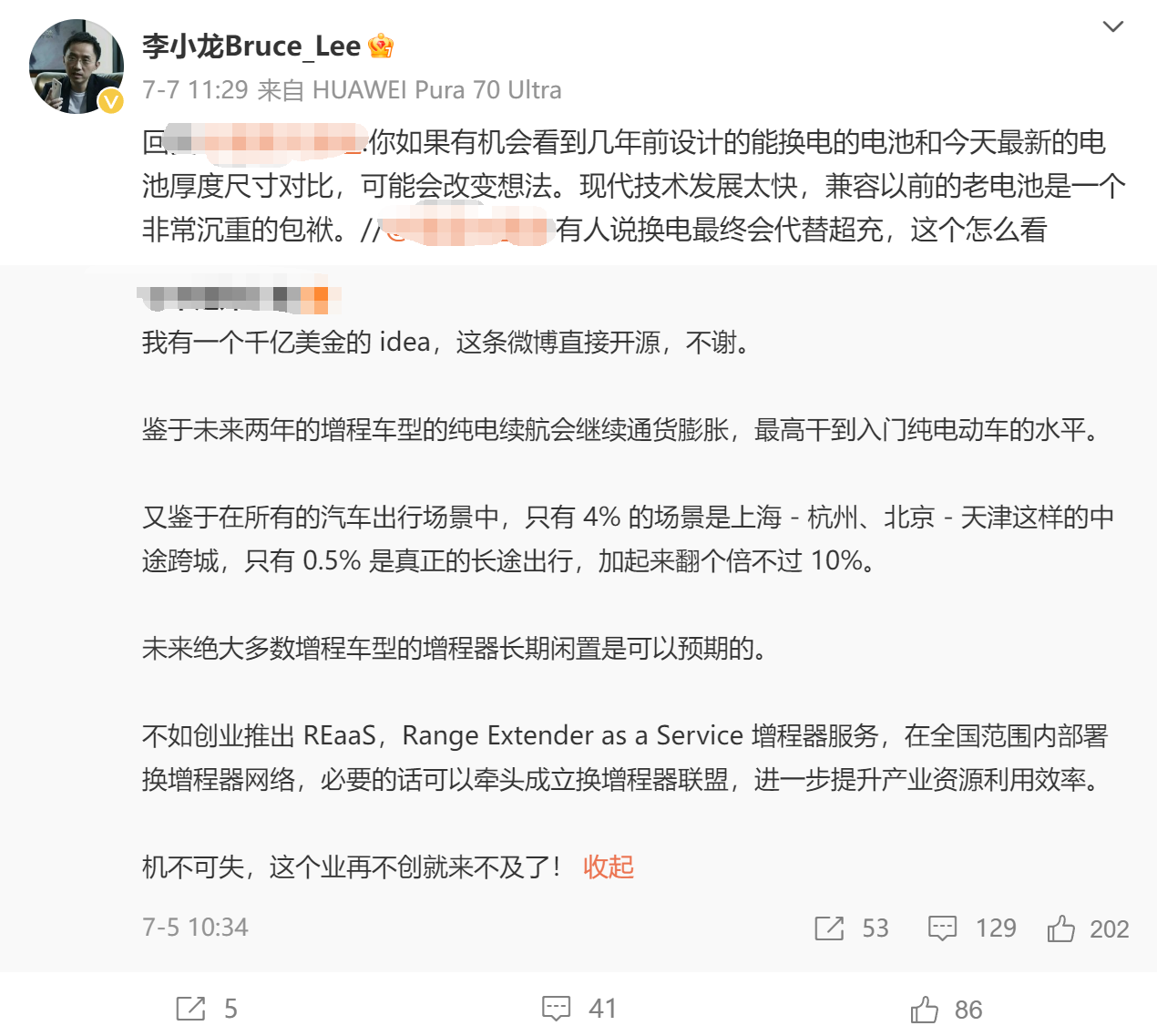

However, Huawei Terminal BG CTO Bruce Lee has a different opinion regarding the battery swapping model. Recently, Bruce Lee tweeted, "If you compare the thickness of battery packs used for battery swapping a few years ago with the latest ones today, you'll change your mind. Battery technology is developing rapidly, and compatibility with old batteries is a heavy burden."

Bruce Lee's question is not about the practicality of the battery swapping model but rather its development potential. As the new energy vehicle industry progresses, the battery swapping model may encounter issues of compatibility and versatility, with older battery packs potentially becoming a burden that hinders the design of new vehicles.

Shortly after these remarks, NIO Vice President Shen Fei directly stated, "Don't easily speak out in areas you're not familiar with, or you'll likely turn from an expert into a bricklayer." Many netizens speculated that Shen Fei's tweet was a response to Huawei's Bruce Lee.

Netizens hold diverse opinions on the remarks made by executives from these two automakers, with some even digging up "dirt" by bringing up Shen Fei's previous comment referring to extended-range technology as a "pacifier".

Both automakers and netizens have significant disagreements regarding the battery swapping model, but to determine its future prospects, we must objectively analyze the strengths and weaknesses of battery swapping and fast charging.

Battery Swapping/Charging, Each with Its Advantages

From the consumer's perspective, the main difference between battery swapping and fast charging lies in energy replenishment efficiency. Currently, the range of domestic pure electric vehicles generally falls between 300 and 800 kilometers (CLTC conditions), although some vehicles can reach over 1,000 kilometers, their battery prices are too high for widespread adoption.

The CLTC conditions themselves have issues with actual range discounts. Given that significant breakthroughs in battery technology have yet to be achieved and high-capacity batteries are costly, improving energy replenishment efficiency is another solution to address range anxiety among car owners. Compared to fast charging, the primary advantage of the battery swapping model lies in its "speed".

On June 13 this year, NIO launched its fourth-generation battery swapping stations in Guangzhou Liwan Huadi Plaza and Luoji Service Area on the G40 Shanghai-Shaanxi Expressway, supporting multiple brands and models. NIO claims that the new-generation battery swapping stations can complete a swap in as little as 2 minutes and 24 seconds, and they are equipped with six ultra-wide-angle lidars and four Orin X chips with a total computing power of up to 1016TOPS, supporting one-click automatic battery swapping and driver-absent battery swapping.

Completing energy replenishment in less than three minutes takes even less time than some fuel-efficient vehicles with larger fuel tanks. Additionally, NIO stated that the fourth-generation battery swapping stations have increased their battery slots to 23, allowing for a maximum of 480 services per day.

Automakers are also exploring the limits of fast charging technology. The 800V fast charging platform, which is gradually becoming popular in luxury pure electric vehicles priced above 200,000 yuan, paired with 5C charging piles, can achieve peak charging power of approximately 500kW. For instance, the Lixiang MEGA, equipped with an 800V platform and CATL's 5C fast-charging battery, boasts "12 minutes of charging for 500 kilometers of range".

Although 5C fast charging still takes about ten minutes longer than battery swapping, the difference between 30 minutes and 5 minutes (the time required by NIO's previous-generation battery swapping stations) is significant, while the difference between ten minutes and two minutes and more is less so. Going to the bathroom or scrolling through your phone can easily pass the time in just ten minutes.

In other words, while the battery swapping model leads in energy replenishment efficiency, the gap with 5C fast charging is not substantial. As charging times shorten to less than 20 minutes, the factors that truly determine the battery swapping and energy replenishment experience have shifted from efficiency to the ecosystem.

After all, only when there are sufficient numbers of battery swapping stations and charging stations can we address users' range anxiety, rather than keeping energy replenishment times on paper.

Ecosystem Capability, the Deciding Factor

Recently, Xiaopeng Motors CEO He Xiaopeng had a friendly interaction with NIO CEO Li Bin, during which He Xiaopeng stated that he would seriously consider joining NIO's battery swapping network once the number of NIO battery swapping stations reached 3,000.

In fact, He Xiaopeng could already consider joining NIO's battery swapping model, as of June this year, the number of NIO battery swapping stations has reached 2,439. According to NIO's plan, it aims to deploy 3,310 battery swapping stations nationwide by the end of 2024. Perhaps due to waiting for the fourth-generation battery swapping stations, NIO's deployment speed was not very fast in the first half of the year, but it is expected to accelerate in the second half. It is predicted that the number of NIO battery swapping stations will exceed 3,000 around October this year.

In terms of charging piles, data from the China Charging Alliance shows that as of April this year, the number of charging piles in China has reached 9.613 million, including 2.977 million public charging piles. By the end of June, the ratio of charging piles to vehicles in China reached 1:3. While this seems like a large number, most of them are still 2C charging piles.

When using a map app to search for charging stations, I found that although there are supercharging piles with powers exceeding 400kW nearby, they account for a small proportion, and most charging piles still have powers between 120kW and 250kW, with even some at 6.6kW and 7kW. During a previous long-distance drive of 1,300 kilometers from south to north, I also noticed that there were very few 5C charging piles in service areas, with generally only one 5C charging pile per charging station.

Obviously, the charging ecosystem has yet to catch up. Unless pure electric vehicles support the 800V platform and 5C fast charging and can access 5C charging piles, their energy replenishment efficiency will still be far lower than that of NIO's previous-generation battery swapping stations. Under normal circumstances with low traffic volumes, this does not cause too much inconvenience to users, but during holidays with high traffic volumes such as Chinese New Year, May Day, and National Day, the energy replenishment experience at charging piles is difficult to compare with battery swapping.

Of course, as Bruce Lee pointed out, battery technology is gradually advancing, with higher energy densities and smaller volumes required to achieve the same capacity, making compatibility with old batteries a potential challenge. Although the fourth-generation battery swapping stations support multiple battery pack specifications, future battery packs with the same capacity will be thinner and smaller, and new vehicle designs may need to consider compatibility with thicker and larger battery packs. The battery swapping model may limit automakers' creativity and make it difficult for them to freely design products in conjunction with battery technology upgrades.

Some netizens also worry that with the arrival of brands like Ledao and the participation of other automakers, there may be an increasing number of battery packs with different capacity specifications. Since battery swapping stations have limited space, they need to stock each battery pack specification, which could potentially lead to shortages of certain capacity specifications.

For example, NIO offers battery packs with capacities of 75kWh, 100kWh, and 150kWh, while Ledao is rumored to provide 60kWh and 90kWh battery packs. Future partners of NIO's battery swapping model may also bring various battery packs with different capacity specifications. If multiple vehicles using the same battery pack simultaneously require battery swapping, there may be a shortage of battery packs at the battery swapping stations, posing a challenge to NIO's battery swapping ecosystem.

In this battle for the ecosystem, both charging and battery swapping have shortcomings. The issue with charging lies in the limited number of 5C charging piles, making it difficult for car owners to experience the theoretical极限fast charging speeds. The battery swapping model, on the other hand, faces challenges in vehicle design and battery swapping station compatibility as technology upgrades and more brands join in.

However, it's worth noting that battery swapping and charging are not mutually exclusive. NIO has always emphasized the option of both charging and swapping, and the two paths can coexist. In fact, more automakers joining the battery swapping model and partnering with NIO to build shared battery swapping stations can accelerate the construction of the battery swapping ecosystem, promote technological development, and thus make up for the deficiencies of the battery swapping model, providing car owners with a better energy replenishment experience.

Dual Paths, the Future Mainstream

As battery technology iterates and upgrades, with higher energy densities and lower prices, the range of pure electric vehicles is also surging, and long-range pure electric vehicles are also entering the lower-end market. As battery pack capacities increase, so does the required charging time. Considering the pressure on the power grid, fast charging technology will ultimately encounter bottlenecks, while battery swapping will maintain its advantage in energy replenishment time compared to charging.

However, a battery swapping station can only serve one vehicle at a time. Currently, NIO's sales volume is not high, and there are rarely queues at battery swapping stations. With the emergence of Ledao and the participation of more brands, more vehicles supporting battery swapping are expected in the future, and NIO's battery swapping stations may also experience long queues. Compared to the nearly 10 million charging piles in China, the number of battery swapping stations is still too low.

Fortunately, battery swapping and charging are not mutually exclusive. When batteries are insufficient or there are too many cars in the queue, NIO, Ledao, and the other seven brands that have joined NIO's battery swapping system can also use charging piles for energy replenishment.

Considering that automakers like GAC, Changan, Chery, Lotus, JAC, and others have joined NIO's battery swapping model in the past half-year or so, many automakers believe that the battery swapping model has great potential in the future. Xiao Tong believes that the battery swapping model not only offers shorter energy replenishment times but more importantly, it provides a unique service experience that differs from traditional energy replenishment methods, helping automakers provide better services to consumers and facilitating the creation of a premium image.

After entering the new energy era, domestic established automakers and new carmaking forces have launched attacks on the high-end market, seeking unique selling points in various aspects of their products. However, to date, the gaps between automakers in terms of intelligent driving, smart cockpits, and smart vehicle control are narrowing, and battery swapping may be the last barrier.

Through the efficient and automated battery swapping model, car owners can enjoy a better energy replenishment service experience. Even the British luxury car brand Lotus has joined NIO's battery swapping model, demonstrating the attractiveness of this model.

Xiao Tong predicts that in addition to NIO and Ledao, we will see a large number of luxury vehicles supporting battery swapping in the future. Some established automakers may even introduce mid-to-low-end models supporting battery swapping to achieve differentiated competition and help expand the battery swapping model into lower-end markets.

The battery swapping model has promising prospects. Bruce Lee's belief that battery swapping is unreliable may stem from the fact that the main sales force of HarmonyOS Intelligent Driving, the AITO M7/9, are primarily extended-range vehicles that do not require battery swapping for energy replenishment. However, issues such as vehicle compatibility and battery ecosystem in the battery swapping model still need to be addressed by NIO in collaboration with other automakers.

Source: Leitech