Ruqi Limousine & chauffeur's IPO opens below its issue price, the story of autonomous driving is not easy to tell

![]() 07/10 2024

07/10 2024

![]() 459

459

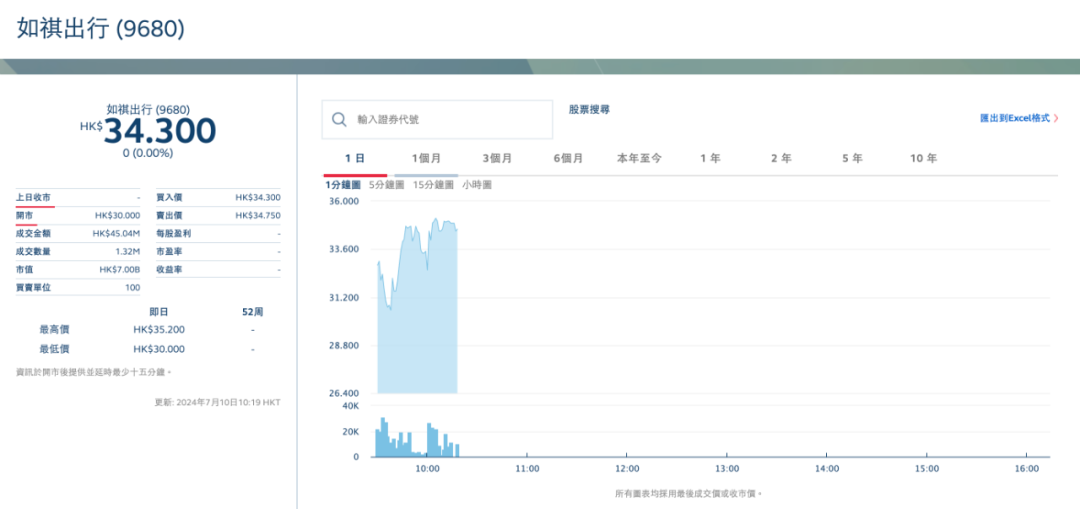

Ruqi Limousine & chauffeur's IPO journey finally came to an end on the morning of July 10, with its official trading debut on the Hong Kong stock market. The stock was priced at HK$35 per share, and ultimately, Ruqi Limousine & chauffeur officially issued 30,004,800 shares, of which 1,804,300 shares were offered in Hong Kong and 28,200,500 shares were placed internationally, valuing the company at over HK$7 billion. Based on the issue price of HK$35, after deducting various expenses related to the issuance, the final IPO raised HK$969 million (approximately RMB 900 million). This share price and final fundraising amount are significantly lower than the pre-sale stage's highest pre-sale price of HK$45.4 per share. In terms of share price performance, it was also not optimistic, with the official opening price reported at HK$30 per share, opening below its issue price. Although the share price rebounded within an hour of listing, it hovered below the issue price throughout.

The fact that Ruqi Limousine & chauffeur's IPO opened below its issue price was, in fact, already reflected in the lack of capital confidence during the pre-sale stage. The Hong Kong Stock Exchange filing by Ruqi Limousine & chauffeur on the evening of July 9 showed that the initial subscription for the Hong Kong offering was only 0.6 times oversubscribed, while the international offering was only 1.17 times oversubscribed (the higher the subscription amount, the higher the investor confidence in the stock). This subscription level is quite low, and combined with the overall share price performance, it is easy to imagine the lackluster nature of Ruqi Limousine & chauffeur's IPO. However, this outcome is not surprising. The prospectus reveals a Ruqi Limousine & chauffeur trapped in the saturated ride-hailing market and preparing a new story that is not easy to tell.

01 Ruqi Limousine & chauffeur, trapped in ride-hailing

In 2016, the domestic ride-hailing market battle had just ended, with Didi taking the lead and engaging in a fierce competition that lasted two years, ultimately ending with Didi emerging victorious. Uber, Kuaidi, Dida, and others either sold out and exited or struggled to survive with a meager market share. The ride-hailing market stabilized, and Didi's leading position was established. However, this relative peace did not last long. In 2018, at a crucial moment for internationalization and new business expansion, Didi's rapidly growing Hitch service was hit by two consecutive passenger safety incidents, coupled with huge losses and tightening ride-hailing regulations. In 2019, Didi began to retract its business.

New possibilities emerged in the ride-hailing market that had already been settled. At this time, a large number of new players with automotive backgrounds entered the market one after another. Ruqi Limousine & chauffeur, backed by GAC Motor, was established and rapidly developed its business during this small window of opportunity. Other players such as T3 and Xiangdao also emerged during this period. Facts have proven that the window did indeed exist. More than a year later, when these newly established ride-hailing companies had stabilized their business foundations, Didi was delisted due to overseas listing regulations, and its business entered a brief standstill for more than a year. During this time, Ruqi Limousine & chauffeur also experienced rapid development.

Ruqi Limousine & chauffeur submitted its second prospectus in March this year. The prospectus data shows that from 2021 to 2023, Ruqi Limousine & chauffeur's revenue was RMB 1.014 billion, RMB 1.368 billion, and RMB 2.161 billion, respectively. The main growth driver came from its core ride-hailing service, with the annual order volume increasing from 46.9 million in 2021 to 97.7 million in 2023, and the transaction value increasing from RMB 1.347 billion to RMB 2.741 billion. The rapid growth in orders brought revenues of RMB 1.012 billion, RMB 1.25 billion, and RMB 1.814 billion to Ruqi Limousine & chauffeur during the same period. On the cost side, due to the continuous expansion of scale and the improvement of driver and customer stickiness, the efficiency of cost expenditure, including driver support and customer acquisition, also increased.

Reflecting on the data, Ruqi Limousine & chauffeur's income cost increased from RMB 1.259 billion to RMB 2.312 billion between 2021 and 2023. While the cost scale increased, the gross margin continued to improve, rising from -24.2% in 2021 to -7% last year. This is the A-side story of Ruqi Limousine & chauffeur, similar to T3 and Xiangdao, which entered the ride-hailing market during the second wave. They were born out of the market gaps left by Didi's first downturn in 2018 and grew during Didi's second downturn and business stagnation in 2021. However, the B-side of the story is that despite business growth, the gaps left by Didi were not large, and to this day, latecomers still cannot fundamentally challenge the giant. According to Ruqi Limousine & chauffeur's prospectus, its market is mainly concentrated in the Greater Bay Area, where it ranked second with a market share of 5.6% in 2023, while Didi ranked first with a market share of 56.5%.

Nationwide, Didi's market share was 75.5% in 2023, while Ruqi Limousine & chauffeur's was only 1.1%. The data indicates that even though Didi's business stagnation gave room for growth to Ruqi Limousine & chauffeur and other second- and third-tier players, this space is extremely limited. This is due to the competitive characteristics of the ride-hailing industry itself, such as whether the fleet size supports a high response rate for user hailing, which also largely determines user stickiness and future growth potential. As the first mover and already holding an absolute dominant position, Didi has a natural advantage in this regard and ultimately forms a situation where the strong get stronger. Therefore, we can see that Ruqi Limousine & chauffeur, backed by automotive companies, has gained a relative advantage in the Greater Bay Area, but even in its home market, it still cannot compete head-to-head with Didi.

The Guangzhou ride-hailing market is tending towards saturation. The high saturation of the ride-hailing market is an even more fatal external factor. Taking Ruqi Limousine & chauffeur's base in Guangzhou as an example, the "Monthly Report on the Operation and Management of the Online Car-hailing Market in Guangzhou" released by the Guangzhou Transportation Bureau each month shows that from September last year to May this year, the number of registered online car-hailing vehicles in Guangzhou increased from 97,400 to 121,200, and the number of registered drivers increased from 129,100 to 138,500. Correspondingly, the average daily orders of online car-hailing vehicles decreased from 14.21 to 12.22, and the revenue per vehicle decreased from RMB 343.34 to RMB 311.63. According to information released by official agencies in various cities this year, not only in Guangzhou but also in major cities nationwide, the situation is roughly the same. New entrants cannot find incremental opportunities and can only share the existing market, which is a concrete manifestation of the saturation of the ride-hailing market. Faced with both internal and external difficulties, almost all ride-hailing platforms have prepared new stories to try to break this dilemma, and Ruqi Limousine & chauffeur is no exception.

02 Ruqi Limousine & chauffeur's new story: Robotaxi

With the ride-hailing market saturated, where does the new story begin? Didi also paved the way for the industry a few years ago, such as leveraging its huge user base and comprehensive platform to break into the food delivery business and compete with Wang Xing's Meituan. Of course, everyone knows the final outcome of this endeavor. Both Didi and Meituan ultimately called it quits. Facts have proven that even for industry leaders, breaking into another industry leader's territory is not a good choice. Subsequently, Didi chose autonomous driving, and so did Ruqi Limousine & chauffeur. According to Ruqi Limousine & chauffeur's prospectus, the funds raised through this IPO will be used for autonomous driving operations and research and development, including Robotaxi, accounting for 40% of the total. Only 20% of the funds will be used for geographic and user expansion of the existing ride-hailing business to increase market share. Clearly, Ruqi Limousine & chauffeur will invest in its existing ride-hailing business, but its focus will still be on the future Robotaxi business. In fact, Ruqi Limousine & chauffeur has been laying out autonomous driving for quite some time, and its positioning has exceeded the functions of a travel platform.

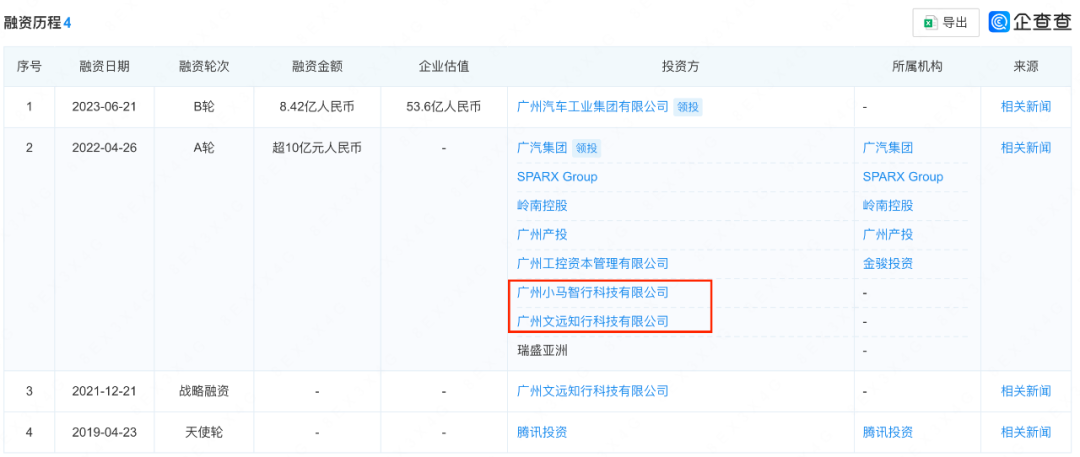

One of Ruqi Limousine & chauffeur's layouts is platform cooperation with Robotaxi players. In 2021, Ruqi Limousine & chauffeur successively received a series of investments from leading autonomous driving companies WeRide and Pony.ai, and subsequently announced the integration of the two companies' Robotaxi models into the Ruqi Limousine & chauffeur platform for commercial operation. Based on this, Ruqi Limousine & chauffeur developed an open Robotaxi operation platform to access Robotaxi models from different technologies and manufacturers. By the end of last year, Ruqi Limousine & chauffeur announced a joint L3-level autonomous driving test with GAC Motor, with plans to launch GAC Motor's L3-level autonomous driving travel service this year. Among domestic travel platforms, Ruqi Limousine & chauffeur should be the shared travel platform with the largest number of integrated autonomous driving companies. With the deepening of cooperation, Ruqi Limousine & chauffeur is no longer satisfied with providing a platform but is leveraging its platform attributes to engage in the "mining + mining tools" business of the autonomous driving industry, i.e., data business.

Ruqi Limousine & chauffeur at WAIC 2024 In 2023, Ruqi Limousine & chauffeur began accessing data from GAC Motor Research Institute, Pony.ai, and WeRide, and at the recently concluded World Artificial Intelligence Conference (WAIC 2024) in Shanghai, Ruqi Limousine & chauffeur showcased its autonomous driving data solutions, which include AI data and model solutions, high-precision maps, and intelligent transportation solutions. It is understood that this data solution can provide one-stop services from data collection, annotation, management to model training for the autonomous driving industry. Currently, this solution has served multiple domestic autonomous driving companies, OEMs, and intelligent driving suppliers. It can be seen that autonomous driving is the new story that Ruqi Limousine & chauffeur has prepared for the outside world.

03 Is the new story of autonomous driving easy to tell?

If we only compare Ruqi Limousine & chauffeur with other Robotaxi players horizontally, it has its own advantages. For example, its deep connection with GAC Motor means that it does not need to invest heavily in vehicles and can serve as an operation platform. At the same time, as a hub for autonomous driving data, providing data services to the autonomous driving industry is also one of its strengths. In addition, backed by the Greater Bay Area, the official driving force for autonomous driving and the advantages of policy precedence are unmatched by other places in China. However, in the current discourse environment, the story of autonomous driving, which was still sexy when Ruqi Limousine & chauffeur began to focus on autonomous driving in 2021, is now met with more skepticism within the industry.

Ruqi Limousine & chauffeur's Robotaxi fleet

In particular, the Robotaxi track has cooled significantly, which is at the core of Ruqi Limousine & chauffeur's new story. What will be the future business model of Robotaxi? Will end-to-end technology truly solve the problems of high-level autonomous driving on public roads? These are all huge unknowns. Of course, travel platforms have their advantages in doing Robotaxi, but it cannot be denied that this is also a matter of self-revolution. In the process of promoting autonomous driving, how to evolve self-organization and how to handle the contradiction between existing ride-hailing drivers and driverless vehicles are both critical issues. These problems are not alarmist; in fact, Baidu's Apollo Go has already encountered these issues in its rollout in Wuhan. Similarly, as a Robotaxi travel platform, Ruqi Limousine & chauffeur will soon encounter them as well.