Sales Plunge 21.5%, Honda Abandoned by Chinese Market, Forced to Establish Tripartite Joint Venture?

![]() 07/09 2024

07/09 2024

![]() 459

459

Honda has officially released its semi-annual financial results, with a combined retail sales of 415,906 units from Guangzhou Honda and Dongfeng Honda, marking a year-on-year plunge of 21.5%. This is the third consecutive year that Honda's sales have declined by more than 20%, a dire situation that is startling.

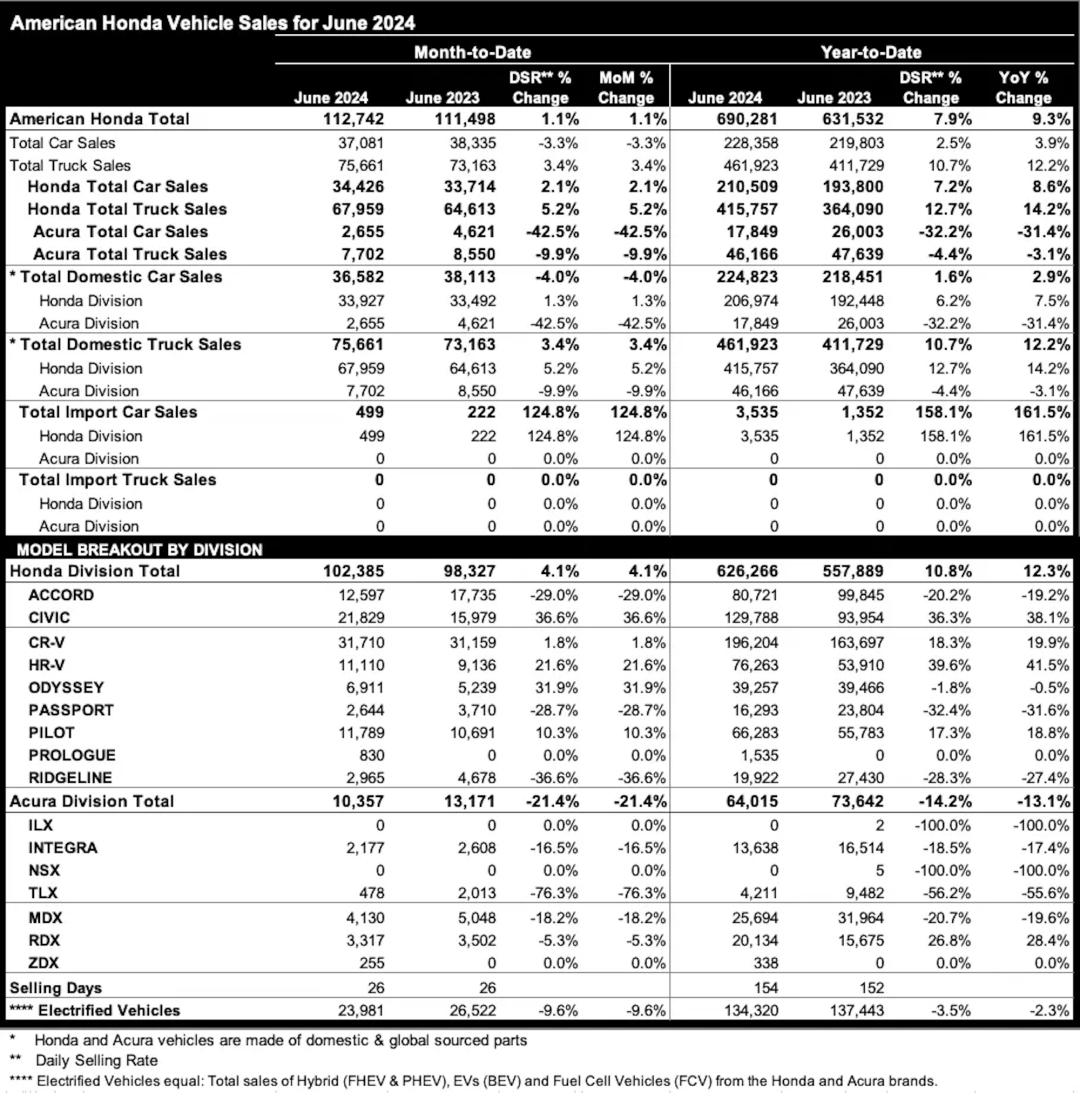

Contrary to its repeated failures in the Chinese automotive market, Honda has experienced continuous growth in the North American market, with semi-annual sales reaching 690,281 units, a year-on-year increase of 9.3%. Honda and Acura have worked together, and their collaboration with General Motors in pure electric vehicles and hydrogen fuel cell vehicles is also in full swing.

As Honda's most direct competitor, Toyota's single sales of its two joint ventures in the Chinese market have gradually approached that of Honda China. In the first half of the year, FAW Toyota sold 329,067 units, while GAC Toyota sold 362,123 units!

While Toyota has aggressively entered social media platforms and launched large-scale promotional activities, constantly seeking innovation and change amidst the fierce competition triggered by independent automakers and new energy automakers, Honda seems to have been abandoned by the Chinese market and users, no longer interested in the battle and preparing to retreat!

From the official signing of the Guangzhou Honda project to the launch of the locally produced Accord, and then to Dongfeng Honda's thriving CR-V, Honda's influence in the Chinese market has gradually expanded, long leading the development of joint-venture automobiles in the Chinese market.

However, when Honda retracted its global market presence, and Guangzhou Honda and Dongfeng Honda experienced consecutive years of declining sales, we suddenly realized that Honda's global sales scale lags far behind that of Hyundai Motor from South Korea and is comparable to BYD.

Faced with the intense competition in the Chinese market, the rise of independent automakers, and the continuous popularity of new energy vehicles, Guangzhou Automobile Group and Dongfeng Motor Corporation perhaps should not demand or expect too much from Honda.

While struggling in the Chinese market, Honda's global market performance has experienced unexpected high-speed growth, with Japan and North America becoming the main drivers of this growth, and the Chinese market beginning to hold back.

North America is Honda's most crucial market, where it cannot afford to fail. While stabilizing sales of fuel vehicles, Honda is leveraging General Motors' Ultium electric vehicle platform to develop pure electric vehicles and jointly developing hydrogen fuel cell platforms and vehicles with GM. New vehicle assembly plants and battery factories have also been successively constructed.

Honda recently announced that it is exploring the possibility of cooperation with Nissan in the fields of electrification and intelligence, including joint research and development and procurement, to jointly address the new challenges brought about by new energy vehicles. Finally, these two Japanese automakers living in the shadow of Toyota are set to collaborate.

The electric vehicles jointly developed by Honda and General Motors are destined to miss out on the Chinese market, and its fuel vehicle models and electric technology reserves have been depleted, unable to support further growth in the Chinese market alone.

To maintain a dignified presence in the Chinese market, Honda must either concentrate resources on maintaining a few main models to sustain a small but exquisite existence, or, if it wants to further develop, the Chinese market and the local resources of joint-venture automakers are its only hope.

As the world's largest market in terms of production and sales volume, Honda, which has been deeply rooted in the market for many years, is undoubtedly unwilling to give up. It has already taken action by introducing the exclusive "Ye" new pure electric vehicle brand to the Chinese market!

Previously, Dongfeng Honda leveraged Dongfeng Motor's electric vehicle platform to launch the world's first joint venture's independent electric vehicle exclusive brand - Lingxi, with its first model, the Lingxi L pure electric sedan, expected to be launched in September this year.

The launch of the Lingxi brand has put Guangzhou Honda, which is in a market dilemma, in an awkward position.

In terms of electric vehicle technology reserves and market operations, Guangzhou Automobile Group, with its Aion and Trumpchi new energy vehicles, has indeed developed better than Dongfeng Motor. The two parties have also established the first joint venture independent brand - Everus.

Even GAC Toyota has decided to introduce electric technology from Guangzhou Automobile Group to tap into China's new energy vehicle market, while Guangzhou Honda remains silent, with cooperation between the joint venture partners limited to the E'NYQ pure electric sedan with the Guangzhou Automobile logo.

For Guangzhou Automobile Group, Guangzhou Honda is the cornerstone of its development, far more than just a role provider of sales and profits; however, Honda has more options. Maintaining the status quo and perhaps retaining only one joint venture company may be in line with its global interests.

Against the backdrop of severely excess capacity caused by limited growth in overall fuel vehicle sales, Guangzhou Honda and Dongfeng Honda each have a dedicated new energy vehicle factory officially put into operation in 2024, but Honda no longer has the resources and capabilities to ensure the smooth operation of these two factories.

Shutting down some production lines, switching from double-shift to single-shift production, and optimizing personnel will be the main themes for these two companies in 2024.

Honda has added automobile export business for the two joint ventures, with the Odyssey being sold back to Japan and the CR-V entering Europe. However, faced with severe overcapacity, these measures are merely drops in the bucket. Guangzhou Automobile Group and Dongfeng Motor Corporation must be psychologically prepared for Honda's withdrawal and strive to avoid such a situation happening to themselves.

A tripartite consortium consisting of Dongfeng, Guangzhou Automobile, and Honda, or separately establishing a joint venture controlled by Honda and another controlled by Guangzhou Automobile or Dongfeng, may be efforts that Honda should consider before withdrawing from competition in China's mainstream market.

Moreover, with the full lifting of the equity ratio restrictions in the automotive industry, leveraging the excess capacity of the two joint venture automakers to reestablish Honda's export base is also an option for Honda to extricate itself from the Chinese market.

Leveraging the unparalleled global automotive parts supply chain and vehicle manufacturing capabilities to explore the global market, without sacrificing profits and brand influence in the intense competition of the Chinese market, is one of Honda's limited options in the Chinese market.

For Honda, the Chinese market remains important, but Honda has fallen behind and lacks the ability to keep up with the rapid development of the Chinese automotive market.