Alibaba's Positive News Surge, Yet Far from Secure Victory

![]() 02/27 2025

02/27 2025

![]() 340

340

How did Alibaba achieve its recent performance? Why is it suddenly thriving? Is investors' optimism well-founded?

Author: Gu Xiao

Editor: Yang Ming

After enduring a string of setbacks, including plummeting share prices, declining e-commerce market share, being surpassed by Pinduoduo in market capitalization, and challenges in business spin-offs and listings, Alibaba's positive news has recently dominated headlines.

The reason is straightforward: Alibaba recently released its financial report for the third quarter of fiscal year 2025.

Investors, analysts, and the market have unanimously hailed this report as exceeding expectations, marking a significant breakthrough, and signaling a resurgence. The stock price responded impressively, with notable gains in both US and Hong Kong stocks, sparking a broad rally across the Alibaba ecosystem.

Particularly after the earnings call following the report's release, investors' confidence surged further upon hearing Alibaba's AI narrative and its commitment to significantly expanding capital expenditures over the next three years, equivalent to the total over the past decade.

So, how did Alibaba achieve its recent performance? Why is it suddenly thriving? Is investors' optimism well-founded?

01

Comprehensive Growth Surpassing Expectations

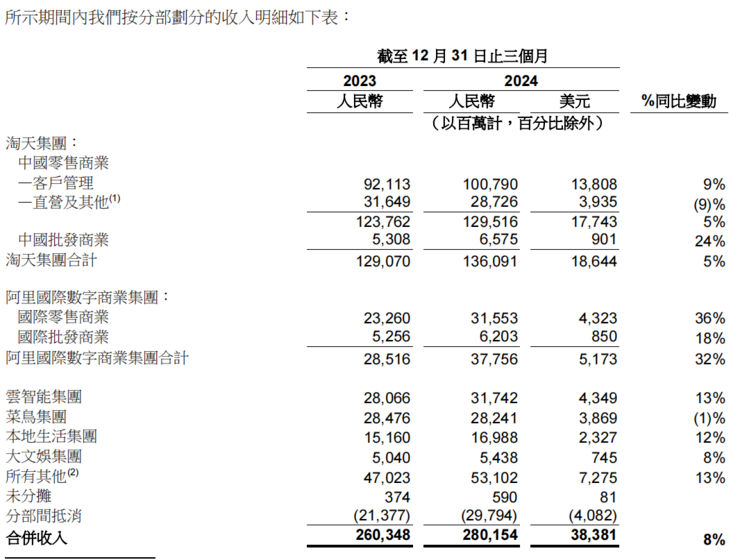

The financial report reveals that for the third fiscal quarter of 2025 (ended December 31, 2024), revenue was RMB 280.15 billion, an 8% year-on-year increase; operating profit was RMB 41.205 billion (approximately USD 5.645 billion), an 83% year-on-year increase; and net profit attributable to ordinary shareholders was RMB 48.945 billion (approximately USD 6.705 billion), a 333% year-on-year increase.

Focusing on the financial report itself, there are roughly three highlights:

First, core e-commerce has resumed growth. Previously, the most contentious issue regarding Taobao and Tmall was the mismatch between CMR growth and GMV growth. However, from this report, the core customer management revenue increased by 9%, GMV grew, and the Take rate also improved year-on-year.

Some attribute this to Jiang Fan's reforms. In November last year, Jiang Fan returned to Taobao, and Alibaba's e-commerce strategy was adjusted to abandon low-price competition. However, the report covers the period ending December, and a month of changes is hardly discernible in performance. Therefore, the report has little to do with Jiang Fan. Instead, it's more appropriate to trace back further, such as Jack Ma's three major tasks for Taobao and Tmall proposed a year and a half ago – "returning to Taobao, returning to users, and returning to the internet." From a timeline perspective, this may be the underlying turning point for Alibaba.

Second, the revenue of the Cloud Intelligence Group increased significantly year-on-year. This quarter, Alibaba Cloud's AI-related product revenue achieved triple-digit year-on-year growth for the sixth consecutive quarter, driving Alibaba Cloud's revenue back to double-digit growth of 13%, reaching RMB 31.742 billion.

A year ago, Alibaba's cloud business barely garnered attention, and the market focused on how much Pinduoduo's market capitalization would surpass Alibaba's. As for Alibaba Cloud, apart from persistent concerns about service outages, no one paid heed to its business valuation.

But this year, the situation has reversed.

First, the emergence of DeepSeek showcased the imagination of China's AI to overseas capital. Then, major news broke that Alibaba collaborated with Apple in developing AI functionalities, proving Alibaba's AI capabilities. Of course, what's crucial is that the combination of Apple and Alibaba confirms that companies with large scenarios and users benefit the most from the AI narrative. If Alibaba can comprehensively improve AI scenario penetration and convert hundreds of millions of daily active AI applications, the story becomes highly imaginative.

More importantly, after DeepSeek gained popularity, NVIDIA on the other side of the ocean first suffered a heavy blow. In the face of low-cost model training, investors believed that the demand for computing power was exaggerated. But soon, the market concluded that the demand for computing power would only expand and not weaken, and subsequently, NVIDIA's share price stabilized.

In China, as various sectors actively integrate models like DeepSeek for edge-side local deployment, enterprises will rely more on cloud vendors' APIs and infrastructure, further driving a surge in demand for AI computing power across industries. This demand is mostly concentrated among leading cloud vendors, with Alibaba Cloud emerging as a new beneficiary of this narrative.

In particular, according to current market projections, large models will become smarter and cheaper, attracting more users. AI software and edge-side products will become more common. At this point, among the three major components of algorithms, data, and computation execution, computation execution becomes the most critical. According to this financial report, more than 90,000 AI models are now running on Alibaba Cloud daily, and Alibaba Cloud has established itself in the AI infrastructure narrative.

Third, Alibaba has successfully shed unprofitable businesses. As previously analyzed by "Jidian Business," a few years ago, Alibaba predicted that internet growth had reached a bottleneck, so it turned around and embarked on new retail.

To this end, Alibaba invested heavily in acquiring Intime Retail and Sun Art Retail Group and became the second-largest shareholder of Suning. However, the results were disappointing. Instead of complementing Alibaba's e-commerce business, these became money-losing burdens. Therefore, over the past year, Alibaba has been desperately shedding these burdens. Unprofitable projects that could be sold were all disposed of. For example, RT-Mart and Intime Department Store, which suffered heavy losses of RMB 22.5 billion, were also sold off at a loss.

In this financial report, Alibaba's loss reduction is evident, with Cainiao Network, Alibaba Games, Alibaba Pictures, and Gaode Maps all becoming profitable, and money-burning businesses like Ele.me and Youku reducing their losses. At the same time, the number of employees decreased from 198,000 to 194,000, equivalent to laying off more than 3,600 people in a quarter, significantly improving management efficiency and achieving notable success in "downsizing." With fewer marginalized, money-losing projects, more funds can naturally be invested in AI and robotics industries.

It can be said that these three highlights are the factual support for Alibaba's upward trend.

02

Victory is Premature

However, upon closer inspection, it may be premature to declare Alibaba's victory and celebrate prematurely.

Among Chinese stocks, Alibaba has always been a significant bellwether, so it's not surprising that Alibaba is at the forefront of this round of revaluation of Chinese technology assets.

Since the beginning of this year, Alibaba's share price has risen by 50%, meaning that the optimistic gains after the financial report are built on top of that 50% increase.

Looking back at Alibaba's share price movements over the past few years, it becomes evident that the root cause of its previous continuous decline has not been completely eradicated.

For a long time, Alibaba has been regarded as an e-commerce company. Therefore, when Alibaba's e-commerce business peaked in 2020, its share price was also at its peak. However, the situation began to deteriorate thereafter, with e-commerce competitors emerging from all directions. Alibaba's e-commerce showed signs of sluggish growth and was even surpassed by Pinduoduo, crowning a new king.

Alibaba also tried to fight back, but the pursuers came from all directions. While activating high growth in the e-commerce business is the core issue, achieving it is challenging. Therefore, Alibaba has been seeking new narratives to prove that it is not just an e-commerce company. After multiple rounds of significant adjustments in strategy and organizational structure, Alibaba finally established two strategic focuses: "User-first" and "AI-driven," becoming an AI+e-commerce-driven technology company.

This time, although Alibaba's rebound shows signs of hope in its core e-commerce business, investors must note that Alibaba's e-commerce has merely stopped further declining, and its sluggish growth is still very apparent. The key growth issues remain unresolved.

Especially when compared horizontally, over the past year, Pinduoduo's revenue and net profit have not only achieved double-digit growth consecutively but have even reached triple-digit growth in some quarters. In contrast, Taobao and Tmall still face considerable growth pressure.

Alibaba's e-commerce is still fighting back by "seeking change." With JD.com in front and Pinduoduo behind, as well as competition from Douyin on the left and Kuaishou on the right, it remains a difficult challenge for Jiang Fan to lead this giant ship to turn around.

Another important factor supporting Alibaba's valuation is AI, and Alibaba's position is far from secure.

It should be noted that the core driver of Alibaba's current upswing is the revaluation of Chinese technology assets triggered by DeepSeek. However, on the flip side of DeepSeek's popularity, it also proves that innovation in the AI field does not originate solely from giants. Actual cases show that startups have the potential to overtake giants through coordinated attacks at extremely low costs. Will Alibaba become the next protagonist of such an overtaking story? This remains a question mark.

Moreover, Alibaba is not the only giant targeting AI opportunities. Tech giants like ByteDance, Huawei, and Tencent are also continuously increasing their investments, all trying to find their own points of differentiation. Alibaba is facing a full-scale war but lacks a phenomenal product like DeepSeek on the consumer side. Such a product is indispensable if Alibaba wants its AI to succeed and stand out. How to quickly penetrate the minds of massive users in the consumer market is a question Alibaba needs to answer immediately.

Overall, Alibaba has caught its breath, but the counterattack in e-commerce has only just begun, and its outcome is uncertain. Meanwhile, the "arms race" in AI has only just commenced.

There are still too many things Alibaba needs to prove and must prove.

END

Producer: Huang Qiangqiang