TikTok Shop's foray into Southeast Asia: Key players are the trump card

![]() 11/29 2024

11/29 2024

![]() 562

562

In the global e-commerce market, Southeast Asia is emerging as a key battleground for merchants.

In 2023, the Southeast Asian e-commerce market grew at a rate of 18.6%, ranking first globally. In this era where "not going overseas means missing out," expanding into Southeast Asia is almost a consensus among domestic merchants seeking growth. The question is how to tap into this goldmine.

Similar to China, sales promotions are a driving force for the rapid growth of the Southeast Asian e-commerce market, with their influence and participation increasing year by year. Among them, live streaming e-commerce, represented by TikTok Shop, plays the role of an engine.

According to estimates by Mobius Capital Partners, TikTok Shop's transaction volume in Southeast Asia in 2023 was nearly four times that of the previous year. It can be said that TikTok Shop is a catalyst for brands to achieve explosive growth.

"This Double 11, our TikTok Shop store in Southeast Asia achieved a fivefold increase," revealed the TikTok Shop channel head of well-known 3C brand UGREEN. At that time, UGREEN had been operating a cross-border TikTok Shop in Southeast Asia for about a year. In previous sales promotions such as 9.9 and 10.10, UGREEN also achieved around a threefold increase.

Such growth is not an isolated case. During the recent Double 11, many cross-border brands achieved unexpected growth on TikTok Shop in Southeast Asia, with sales reaching millions of yuan in a single day.

Live streaming e-commerce has built the most important and smooth bridge between cross-border merchants and Southeast Asian consumers.

I. Winning over young people is key to capturing Southeast Asia

The combination of blind boxes and matching games not only captured the heart of Quan Hongchan but also fascinated young people in Southeast Asia.

Ch' Ngọc Yến, a 25-year-old Vietnamese woman, was captivated by "tear-open blind bags" during her first encounter, spending two hours in the live stream. She eventually spent 130,000 Vietnamese dong (approximately RMB 37) on two sets, each containing seven cute toy models. "I was nervous when I watched the seller open my blind bag," Ch' Ngọc Yến said, eventually collecting nearly 30 toy models after matching.

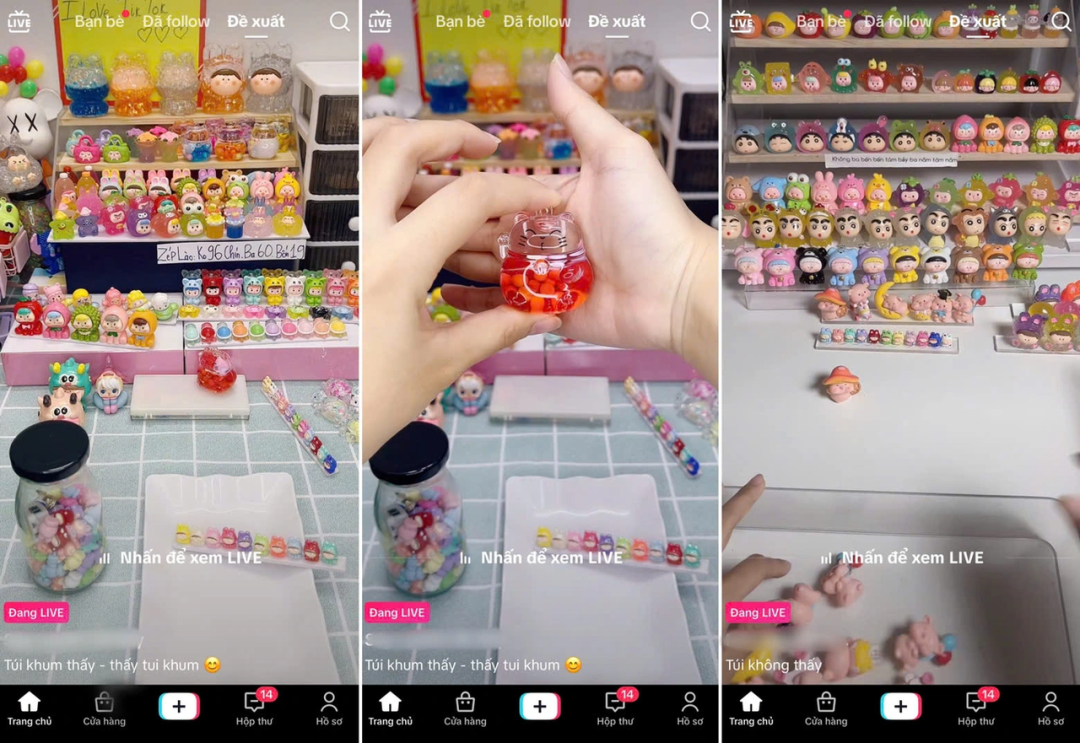

(Live stream of blind bags on TikTok)

Blind bag live streams are representative of the high interactivity and strong entertainment of live streaming e-commerce. In Southeast Asia, there are many users who enjoy live streaming sales.

Southeast Asia has a young population structure. Data shows that Southeast Asia has a population of nearly 700 million, with an average age of less than 29 years. Over 60% are under 35 years old, and only 7% are over 65. Younger people are more eager to explore the world, holding an open and positive attitude towards new things and being more receptive to new products and shopping methods.

It can be said that capturing young users is capturing the Southeast Asian e-commerce market.

TikTok, with its rich content in beauty, food, games, technology, and other areas, stands out for its entertainment attributes, attracting a large number of young users and forming a super traffic pool.

According to Asian Retail News, six out of every ten TikTok users in Southeast Asia watch live streams that blend entertainment and shopping every day.

Daily Indonesia also reported that "as one of the most popular social media platforms in Indonesia with 157.6 million users and an average monthly usage time exceeding 38 hours, TikTok has become an important bridge between merchants and consumers." For example, Swarovski recently announced that it will expand its presence on TikTok to tap into the younger market.

"One of TikTok's advantages is that with a bit of luck and creativity in coming up with the right hashtags, people around the world can see our content without first searching for our brand name," said Aqilah Adnan, founder of the Benew brand. The 26-year-old entrepreneur has built and grown her brand from scratch by continuously live streaming sales of body scrubs, lip scrubs, and scented lotions on TikTok Shop.

Aqilah Adnan's statement not only affirms the abundance of TikTok's traffic but also highlights the uniqueness and high efficiency of the matchmaking process between people and products on TikTok Shop.

Unlike traditional shelf e-commerce, TikTok Shop, as content e-commerce, has changed the logic of meeting consumer needs and reshaped consumer decision-making habits.

On traditional shelf e-commerce platforms, users search for keywords after having a specific need. However, current users may not have a clear need. For example, when browsing vacation-related content on TikTok, users might think about their travel plans, which could stimulate purchasing needs for items like sun hats and power banks, or even lead them to buy the same products featured in the videos.

In other words, TikTok Shop can stimulate endless consumer demand through short videos and live streams. At the same time, based on personalized recommendations from TikTok's vast user profiles, products and consumers can be precisely matched, achieving efficient linkage between good content and good products.

In the traditional shelf e-commerce model where people search for products, merchants are relatively passive. In the content e-commerce model, merchants have more room to exercise initiative. For example, merchants can formulate more precise marketing and product development strategies based on consumer groups. Compared to the one-way path of people searching for products, the two-way interaction between people and products can create a more dynamic ecosystem.

With a large traffic pool, high user acceptance, and efficient product-consumer matching, TikTok Shop has demonstrated tremendous potential and explosive growth in Southeast Asia.

II. Key opinion leaders (KOLs) as a catalyst for explosive growth

In the live streaming e-commerce ecosystem, KOLs are an extremely important link as they profoundly influence young people's decisions.

On the one hand, this is due to the celebrity effect, which is universal. On the other hand, compared to China, Southeast Asia's supply chain and product variety are still being improved. Users rely on KOLs to quickly understand unfamiliar and novel cross-border products.

"When seeing a good product, users are more willing to see how KOLs use it, what its highlights and pain points are, and whether the KOL can teach them how to use it," said the TikTok Shop channel head of UGREEN.

Partipost's "2024 Influencer Marketing Report" shows that about 75% of Southeast Asian consumers prefer to buy products recommended by influencers, and 80% of respondents have made at least one purchase decision based on an influencer's endorsement. The report also mentions that TikTok is the primary channel for influencer marketing.

As consumer acceptance of e-commerce increases, the KOL ecosystem in Southeast Asia is becoming more mature.

In terms of sales capability, more and more Southeast Asian KOLs on TikTok Shop have achieved monthly sales of over a million dollars or even tens of millions of dollars. The previously mentioned UGREEN TikTok Shop representative also stated that many top KOLs are now aiming for single-session GMV exceeding a million dollars.

For example, Võ Hà Linh, a top Vietnamese KOL, set a new record for single-session sales during the 6.6 sales promotion in the first half of the year with a four-hour live stream.

In terms of categories, in addition to rapid growth in major categories such as fashion, beauty, household items, and 3C products, smaller and less straightforward categories like books are gradually gaining market share.

Vietnamese media reported that in the first half of 2024, book sales on TikTok Shop exceeded 600 billion Vietnamese dong, an increase of 100 billion Vietnamese dong compared to the same period in 2023. A recent 2.5-hour live stream attracted nearly 90,000 viewers and generated book sales of 260 million Vietnamese dong. The report also mentioned that many artists and writers have started live streaming book sales.

A brand representative stated, "Today's live streaming sales are a perfect combination of technology and personalization, not only generating revenue but also building trust and long-term connections between the brand and users."

The professionalism of live streamers is also improving, moving beyond the initial stage of simply saying "3, 2, 1, link up." For example, the introduction of the popular blind bag game from China and the rise of Richard Lee, a beauty blogger known as the "Indonesian Li Jiaqi," who gained popularity for his expertise. With a wealth of knowledge in medicine and beauty, he creates relaxed and entertaining videos on beauty skincare tips and product reviews on TikTok, attracting a large number of followers.

It can be seen that at this stage, whether it's the sales capability of top KOLs, the diversity of category-specific KOLs, or their professionalism, TikTok Shop's KOL ecosystem in Southeast Asia is demonstrating robust vitality.

Meanwhile, in the current Southeast Asian e-commerce market, KOL-driven sales are a more cost-effective approach.

According to reports from the Asian Retail Forum, advertising expenditures on influencer marketing are only a fraction of those on traditional social media advertising but can yield significant results. With its thriving KOL ecosystem, TikTok is undoubtedly the most important marketing channel for brands. Data shows that 69% of brands choose to market on TikTok.

III. Local integration is essential for a competitive edge

Masayoshi Son's famous "Time Machine Theory" refers to leveraging the imbalance in the development of different countries and industries. In other words, if a product or business model becomes popular in developed countries, it will likely become popular in less developed countries in the future.

The current state of live streaming e-commerce in Southeast Asia resembles that of China in 2020, characterized by strong growth potential and aggressive momentum from many brands. However, this does not mean that cross-border merchants can simply replicate their strategies. Expanding into Southeast Asia is not as straightforward as a dimensional reduction attack might suggest.

Simply put, due to differences in supply capabilities and demand preferences, whether a cross-border merchant's product is good or not is entirely different from whether it sells well locally.

When reflecting on their experiences expanding into Southeast Asia over the past two years, an operator focused on brand growth mentioned that the development stages of product categories in China and Southeast Asia are completely different. For example, laundry products in China have evolved through several generations, from washing powder to liquid detergent and now laundry pods. However, many people in Malaysia were initially unaware of laundry pods.

Another example is that videos on "reviewing electric toothbrushes" might be popular in China but would first need to address the question of "why use an electric toothbrush" in Malaysia.

Being half a step ahead is progressive, but being three steps ahead can be catastrophic. For Southeast Asian consumer markets, what Chinese merchants lack is not production capacity, research and development, or innovation but the ability to turn leading products into effective demand.

Generational gaps and cultural differences can affect the match between supply and demand.

For example, in the 3C market, males are generally considered the main consumers. However, through research and data from TikTok, brands have discovered that in Vietnam, female consumers also have a strong willingness to buy and a lower return rate.

Therefore, UGREEN designed many power bank models specifically for female consumers. During this year's Double 11, UGREEN collaborated with top Vietnamese KOL @hangkat6668 for sales. The KOL selected a cream-series magnetic power bank, which sold over 1,000 units within nine minutes of the live stream starting, becoming a bestseller. This is because most of hangkat's followers are young women aged 20 to 35, who are more outgoing and have a higher demand for vibrant colors compared to Chinese and European markets.

During subsequent product iterations, @hangkat6668 provided effective suggestions, such as upgrading the power of the cream-series magnetic power bank, as Vietnamese consumers prioritize excellent cost-effectiveness.

Furthermore, as a diverse region with significant cultural differences, Southeast Asia's countries and product categories may not be interchangeable. Therefore, ultimately, the most crucial issue for cross-border merchants expanding into Southeast Asia is the localization of products and marketing.

In addition to understanding local customs and traditions through KOLs, TikTok Shop also "goes native" and "adapts to local conditions," integrating with cross-border merchants to blend into local culture.

For example, with a large Muslim population in Southeast Asia, Ramadan is a significant religious festival for Muslims, involving house cleaning, new clothes, and gatherings. TikTok Shop organized a Ramadan sales promotion in Muslim countries and prepared a "Ramadan Marketing Handbook" for merchants. Additionally, Vietnam has a tradition of celebrating Double Tenth Day, and TikTok Shop also launched corresponding sales promotions.

It can be seen that with the help of TikTok Shop and KOLs, cross-border merchants can better understand local consumer demand, which in turn feeds back to the supply side, enhancing the synergy and precision between production and sales.

IV. Conclusion

The e-commerce market in Southeast Asia is rapidly developing. For a market that is constantly changing, cross-border merchants must adapt their entry strategies, marketing tactics, and product development approaches to the new environment and changes to mitigate risks and identify opportunities.

The most significant change is the development of content e-commerce. TikTok Shop not only gathers the most consumer-hungry groups but also builds an efficient bridge connecting merchants and consumers through live streaming and short videos, facilitating the rapid entry of new cross-border merchants and brands into the market. TikTok Shop has also cultivated a KOL ecosystem, helping merchants quickly tap into the market, establish long-term trust, and find growth paths.

Currently, Southeast Asia already has its "Indonesian Li Jiaqi," and there may be future "Vietnamese Dong Yuhui" equivalents. In the live streaming e-commerce system, the richness and maturity of the KOL ecosystem represent both the credibility and reliability of transactions on the platform and the increasing leverage that merchants can use to drive growth.

In the youthful and consumer-hungry Southeast Asian market, TikTok Shop is driving not just the evolution of e-commerce models but potentially a transformation in the entire consumer culture. As the live streaming and KOL ecosystems in Southeast Asia further mature, merchants who seize the opportunity in content e-commerce first will define the future industry landscape in the region.