Sales Slump Continues: Changhong TV's Quest for Rebirth

![]() 04/21 2025

04/21 2025

![]() 486

486

Amidst the rapid evolution of the color TV industry, Changhong TV, a venerable giant in China's home appliance sector, once stood as a 'national brand' cherished by Chinese consumers for its exceptional technological innovation and product quality.

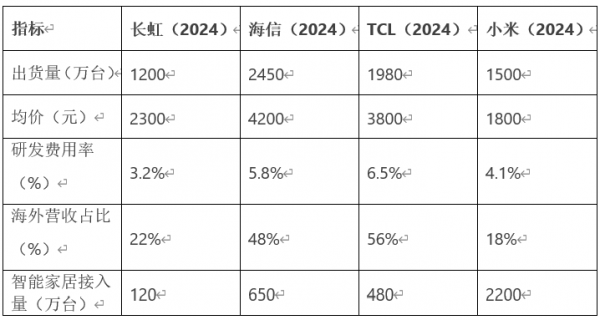

However, entering 2024, this established giant found itself in an increasingly precarious position. Annual TV sales plummeted to 3.8 million units, marking a 12% year-on-year decline, and its market share shrank to 9.8%, dropping out of the industry's top three for the first time. Even more disheartening, sales in the first quarter of 2025 further nosedived to 780,000 units, a 28% year-on-year drop, trailing behind brands like Xiaomi and TCL. From 'national brand' to 'laggard,' what lies behind Changhong TV's predicament?

Changhong TV's struggles are not isolated; they reflect a common challenge faced by traditional manufacturing giants amidst the waves of intelligence and globalization. On one hand, demand for emerging fields like smart homes and AIoT (Artificial Intelligence of Things) is surging; on the other hand, the traditional TV market is growing at a sluggish pace, exacerbated by a slow global economic recovery and waning consumer confidence, placing immense pressure on the entire industry. In this transformative era, Changhong TV is grappling with both the hidden perils of technological bottlenecks and the heavy burdens of ecological dilemmas.

A Life-or-Death Struggle Between Scale and Profit

Changhong's 2024 financial report appears stable on the surface, but it conceals underlying crises. While domestic shipments reached 8.6 million units, the average price dropped by 12% year-on-year to 2,300 yuan, resulting in a meager 2% year-on-year revenue growth. Meanwhile, Hisense bolstered its market share of high-end models above 75 inches to 38% with ULED X technology, and TCL achieved a 18% year-on-year increase in average price through its Mini LED product line. A two-pronged battle of 'losing the high-end market and shrinking low-end profits' has already commenced.

First: The 'Slow Suicide' of Price Wars

In 2024, Changhong launched a 'Hundred Cities, Thousand Stores' price promotion, with 55-inch 4K TVs once dipping below 999 yuan, driving a short-term sales spike of 15%. However, this low-price strategy caused the gross profit per unit to plummet from 210 yuan in 2021 to 75 yuan in 2024, with the net profit margin falling below 4%. More damagingly, the brand became synonymous with 'cheap' in consumers' minds; the keyword 'cheap' accounted for 47% of search terms on its Tmall flagship store, far outstripping 'picture quality' (12%) and 'intelligence' (9%).

Second: The 'Sunk Cost' of Offline Channels

Changhong's 12,000 exclusive stores nationwide remain its primary sales force (accounting for 65%), but the average annual sales per store declined from 420 units in 2021 to 270 units in 2024. In contrast, Xiaomi minimized channel costs to 60% of Changhong's through the 'online direct sales + supermarket joint venture' model, with online sales accounting for over 75% in 2024. A regional dealer candidly remarked, 'Changhong requires stores to display 20 models, but 70% of sales stem from three low-priced models, and inventory turnover days are 40% higher than the industry average.'

Third: The 'Half-Baked' Project of Intelligent Transformation

Although Changhong introduced its CHiQ series of smart TVs as early as 2016, the average daily usage time of its self-developed Honglingjin system in 2024 was only 32 minutes, less than one-third of Xiaomi's PatchWall system. Even more embarrassingly, Changhong's collaboration with Huawei HarmonyOS and Google Android TV has remained at a superficial level of adaptation, with only 1.2 million smart home devices connected in 2024, less than one-fifth of Hisense's 'ecosystem'.

Industry Competition Under Siege from All Sides

The color TV industry in which Changhong TV operates is fiercely competitive. On one hand, traditional home appliance giants are all venturing into the realm of intelligence, encircling Changhong TV with their robust technological prowess, capital advantages, and market resources. On the other hand, emerging technology companies are continuously emerging, challenging Changhong TV with their agile innovation models and unique technological advantages.

First Tier: The 'Technology + High-End' Double Whammy of Hisense and TCL

Hisense holds an unassailable advantage in the market above 75 inches with its ULED X laser TVs, boasting a 32% gross profit margin for high-end products in 2024. TCL reduced the cost of Mini LED by 20% through vertical integration with CSOT, with its revenue in the North American market surging by 45% year-on-year.

Second Tier: The 'Ecological Dimension-Reducing Strike' of Xiaomi and Huawei

Through the 'hardware negative profit + advertising revenue sharing' model, Xiaomi TV achieved internet service revenue of 5.8 billion yuan in 2024, with an average annual revenue per user of 42 yuan. Huawei's Smart Screen, leveraging HarmonyOS, achieves seamless interconnection with mobile phones and tablets, with a repurchase rate exceeding 60% for its high-end models.

The 'False Prosperity' of Overseas Markets

Changhong views overseas markets as its second growth trajectory, with shipments surging by 35% year-on-year to 2.6 million units in 2024. However, these impressive figures cannot conceal structural flaws—the net profit margin of its overseas business is a mere 1.8%, and it faces the double squeeze of geopolitics and localized operations.

First: The 'Low-End Trap' of Emerging Markets

In Southeast Asia and Africa, Changhong aggressively grabbed market share with a '10% below cost price' strategy, achieving a 17% market share in Vietnam in 2024. However, this low-price model led to a vicious cycle: dealers in the Philippines requested an extension of the payment period to 180 days, and Nigeria suffered exchange losses of 120 million yuan due to currency depreciation. More severely, TCL invested 800 million dollars to establish a local factory in Indonesia, reducing costs by 15% through supply chain localization, swiftly eroding Changhong's price advantage.

Second: The 'Wall' of High-End Positioning in Europe and the United States

In 2025, Changhong announced its grand entry into the European market, but its 8K TVs were swiftly pulled from shelves for failing to pass the German TÜV color certification, and its OLED product line had to shell out 230 million yuan in licensing fees to LG due to patent issues. Consequently, its average price in the European market was only half that of Hisense (499 euros vs. 998 euros), and 90% of sales originated from Walmart's private label orders, yielding virtually zero brand premium.

Third: The 'Choking' Crisis of the Supply Chain

Panel procurement costs account for 60% of Changhong's total costs, yet its dependence on BOE and CSOT is as high as 85%. In the third quarter of 2024, as panel factories prioritized the supply of major customers like Hisense and Xiaomi, Changhong's procurement price for 55-inch panels was forced to increase by 8%, directly leading to a 23% decline in quarterly profits.

Rebirth or Sink?

Changhong's 12 million shipment milestone is both a testament to its manufacturing prowess and an irony of its ineffectual transformation. In the short term, contracting low-end product lines and forging ties with panel giants may sustain cash flow; in the long term, whether it can achieve breakthroughs in the three frontiers of 8K, OLED, and chips will determine whether it can shed the cheap label of 'Made in China'.

As Hisense proclaims 'display technology knows no borders' and TCL sets the ambitious goal of 'top three globally in the high-end market,' Changhong's paramount priority may be to address a fundamental question: 'Beyond price, what else can we rely on to convince consumers to buy?'