JD.com vs. Meituan: A Clash of Delivery Strategies

![]() 04/18 2025

04/18 2025

![]() 346

346

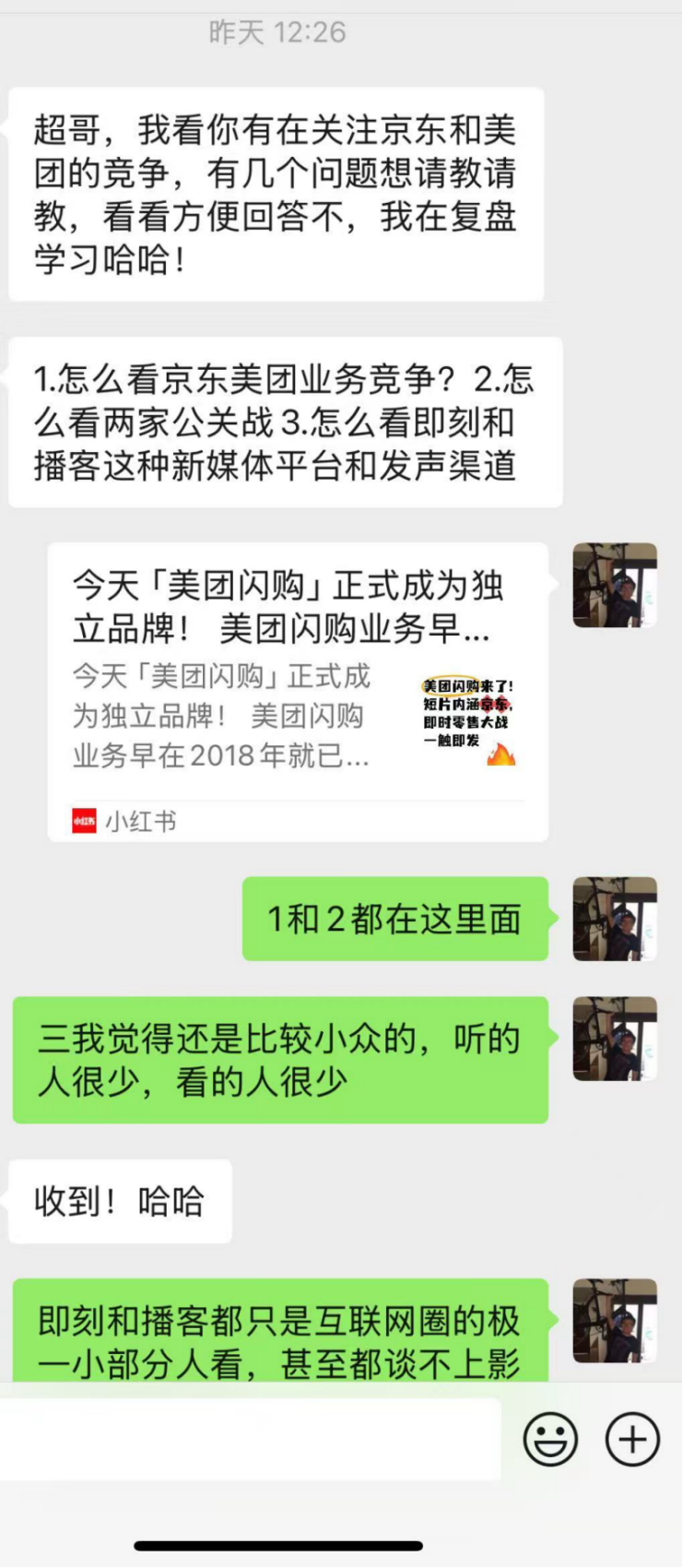

"What are your thoughts on the business rivalry between JD.com and Meituan? How do you see their public relations wars unfolding?" A PR colleague from a leading company inquired. It seems he was analyzing the ongoing "JD-Meituan Battle" for educational purposes. The competition between JD.com and Meituan has emerged as a significant topic of discussion in the industry.

(Image source: Screenshot from my WeChat chat)

JD.com has made a bold foray into the food delivery market, while Meituan has introduced its instant retail brand, "Meituan Flash." Both giants have encroached upon each other's strategic strongholds. Their actions suggest that neither JD.com's entry into food delivery nor Meituan's flash purchase initiative are mere "test runs" like Douyin's food delivery venture, but rather reflect a strong commitment to success.

Numerous industry analyses have delved into the rationale behind the "JD-Meituan Battle," but I'd like to share some insights I've observed.

Firstly, JD.com's food delivery initiative is a top-tier project led by Liu Qiangdong himself.

Although Xu Ran serves as JD.com's CEO, many developments in JD.com's food delivery business are intricately linked to Liu Qiangdong. After a period of silence, Liu Qiangdong updated his Moments with a post about rider social security. A few days ago, Liu Qiangdong indirectly responded to Wang Puzhong through an internal chat, and excerpts from his internal meeting speech were "leaked"... Various indicators suggest that food delivery is a major battle led by Liu Qiangdong upon his return to the frontline, underscoring JD.com's determination in this domain. Its investment in food delivery is likely to far exceed expectations.

Liu Qiangdong's personal oversight of food delivery extends beyond the hard work of the catering business; it encompasses broader retail considerations.

Secondly, JD.com is acutely aware of Meituan's instant retail rise, given its presence on the Meituan platform.

JD.com operates in the retail sector, so why has it suddenly shown such keen interest in catering delivery?

In the latter half of 2016, when Baidu Nuomi (and Baidu Waimai, the industry's third-largest player at the time) sought acquisition, JD.com was already eyeing offline retail. It forged a strategic partnership with Walmart and even acquired Yhd.com. However, the industry didn't foresee the potential of food delivery in offline retail formats back then. In 2017, Ele.me acquired Baidu Waimai and Nuomi's assets at a very low price.

Today, Meituan Flash has evolved from Meituan's food delivery business and is accelerating its incursion into traditional e-commerce territory. The primary categories on Meituan Flash include fruits and vegetables, alcoholic beverages, pharmaceuticals, convenience stores, mobile phones, and household appliances, beauty and personal care products, trendy toys and sports goods, flowers and green plants, mother and baby products, and pet supplies. Most of these categories are core products for JD.com. Brands like Apple, Xiaomi, Huawei, and Midea are rapidly expanding their instant retail presence, and these are all key accounts (KA) for JD.com.

Wang Puzhong stated that the number of non-catering orders on Meituan exceeding 18 million has left some companies feeling "like a bone in the throat, like thorns on the back." In fact, JD.com may have noticed this trend long ago, given its presence on the Meituan platform: JD.com Convenience Stores, JD.com 7FRESH, and JD.com Pharmacy are all listed on Meituan. Previous media reports indicated that the overall sales volume of JD.com Pharmacy's products on Meituan has surpassed 100,000.

(Image source: Meituan App, screenshot taken on April 17, 2025)

Accessing "Flash Buy" from the Meituan App's homepage today, one can still find operating JD.com Convenience Stores (non-self-operated) and 7FRESH supermarkets (self-operated). The JD.com Convenience Store nearest to my home (Jingxi Yunjing Store) has a monthly sales volume exceeding 5,000, and there are even individual stores in Guangzhou with monthly sales volumes surpassing 10,000. This is considered a substantial business scale for local merchants—in 2024, Yonghui Life's self-operated home delivery business covered 920 stores with an average daily order volume of 307,000, translating to an average monthly order volume of 10,000 per store.

(Image source: Meituan App, screenshot taken on April 17, 2025)

Since JD.com operates stores on Meituan, it has a comprehensive understanding of the platform's growth potential. I believe this is the fundamental reason why JD.com is vigorously pursuing food delivery: its true intention lies not in catering but in instant retail, adhering to the adage, "offense is the best defense."

While JD.com and Meituan are locked in a fierce competition, some of JD.com's businesses on the Meituan platform continue unabated. This underscores Meituan's openness and the significant interest garnered by its instant retail traffic and orders. Otherwise, JD.com wouldn't open stores on a competitor's platform and risk being "controlled by others."

JD.com has long been laying the groundwork for its offline business. For instance, it allied with Walmart as early as 2016 and launched 7FRESH supermarkets and JD.com self-operated pharmacies years ago, along with substantial investments in Dada-JD Daojia, among others. However, JD.com's instant retail lacks a high-frequency entry point. Traditional online shopping apps are used a few times a week, whereas the Meituan App is a high-frequency consumption platform utilized several times a day. Meituan Flash's latest positioning as a "new generation shopping platform that accompanies consumers 24 hours a day" reinforces its all-weather high-frequency characteristics.

Food delivery has transcended catering and become a high-frequency consumption entry point used "several times a day." It serves as an instant retail platform catering to the user mindset of "buy now, get it now," which explains why JD.com aims to excel in food delivery and continues to operate on Meituan.

Thirdly, after years of chaos, Meituan Flash has quietly reaped the fruits of instant retail.

Meituan Flash brands itself as the next generation of shopping: for consumers, the experience of no waiting, no rushing, and no stockpiling surpasses that of traditional e-commerce. For merchants, Meituan Flash leverages the "3-day settlement period" card, but its greatest value lies in enabling local merchants once resistant to online shopping to embrace e-commerce and conduct business within their local communities while managing their in-store operations effectively.

Ultimately, Meituan Flash has achieved what Alibaba and JD.com have long aspired to: "New Retail"/"Boundaryless Retail."

In 2016, Jack Ma introduced the concept of "New Retail," with Daniel Zhang (Xiaoyaozi) tasked with its implementation. Alibaba acquired Ele.me and integrated it with Koubei, while also investing in Intime Retail and Sun Art Retail (RT-Mart), and launching Hema, Taoxianda, Tmall Supermarket, and Taobao Caimai, among others. Some of these ventures succeeded, while others failed. What they accomplished is essentially what Meituan Flash has achieved.

JD.com also embarked on its home delivery business very early. As early as 2015, when the O2O concept was still popular, JD.com launched the O2O business "Pai Da Jiao," providing users with delivery of fresh food and supermarket products within a 3-kilometer radius, along with various life service projects like flower delivery and takeout delivery, achieving rapid delivery within 2 hours based on mobile positioning. In retrospect, this was an early prototype of instant retail.

A month later, "Pai Da Jiao" was renamed "JD Daojia." Liu Qiangdong once harbored high hopes for this business. According to media reports, Liu Qiangdong once stated that he would focus his efforts primarily on JD Daojia in 2015, and that JD Daojia's mission was to surpass JD.com. "Our expectations for JD Daojia are akin to Tencent's expectations for WeChat, to create a high-frequency app." In 2016, JD Daojia merged with Dada to form "New Dada," with Dada becoming a key player for JD.com in instant retail. In 2017, JD.com proposed the concept of "Boundaryless Retail," which shares similarities with Alibaba's New Retail.

(Image source: Internet)

In essence, Meituan has turned the dream of a far-field e-commerce platform into reality. The core of instant retail is a seamless retail format that integrates online and offline. Given that Meituan Flash has harvested the fruits of instant retail and directly encroached upon core territories such as 3C and digital products, JD.com cannot afford to remain indifferent or fail to retaliate.

Fourthly, both JD.com and Meituan are increasing their investments in instant retail, but their understandings of it differ vastly.

The food delivery war is essentially a battle for instant retail.

In JD.com's perspective, instant retail is an extension of traditional retail. For instance, when releasing its Q1 financial report, Xu Ran remarked, "From the perspective of consumption scenarios, instant retail is a natural extension of the core retail business, and food delivery is also one of the high-frequency businesses for users in instant retail scenarios. It can enrich JD.com's service scenarios, provide better supply, enhance user stickiness and activity, and thereby lead to an increase in user value." At the same time, JD.com is cognizant of its shortcomings, "JD.com needs to bolster its existing fulfillment capabilities to achieve faster and more flexible instant delivery, which also complements JD.com's original efficient fulfillment network and "211" capabilities (delivery within 2 days for 11 cities)."

In Meituan's view, instant retail is a disruption and even a replacement for traditional retail. In an official short video with strong, assertive language, Meituan Flash positions itself as the "next generation of shopping method." Wang Puzhong even bluntly stated that the new experience of "delivering everything within 30 minutes" will undoubtedly meet the needs of more users and "sweep those large and impractical warehousing and distribution systems into the dustbin of history." The words are harsh, but the core logic is that Meituan Flash's front-end "Lightning Warehouses" + instant delivery system disrupts the "traditional e-commerce central warehouse + logistics and delivery system."

In reality, there has never been a perfect retail format in the past, present, or future. Despite years of e-commerce development, physical retail still holds its ground; the debate about front-end warehouses in the fresh food e-commerce industry persists; new formats like unmanned retail, community group buying, interest-based e-commerce, and live streaming e-commerce emerge endlessly, but they are merely "ripples on the water." Retail is an industry characterized by rapid changes and continuous innovation. While the transformation of instant retail in the e-commerce and retail industry holds promise, it is by no means the ultimate outcome.