Xiaomi's Mixed Fortunes: Auto Gross Margin Soars While Smartphone Business Hits Rock Bottom

![]() 11/20 2024

11/20 2024

![]() 555

555

"Third-quarter earnings see a significant turnaround, with a nearly 40% reduction in per-vehicle losses, dropping from 60,000 yuan per vehicle to 37,000 yuan, signaling a dawn on the path to profitability!"

@Tech News Original

After three years of development, Xiaomi's automotive business has seen a substantial increase in gross margin, while its smartphone business has experienced a decline in gross margin.

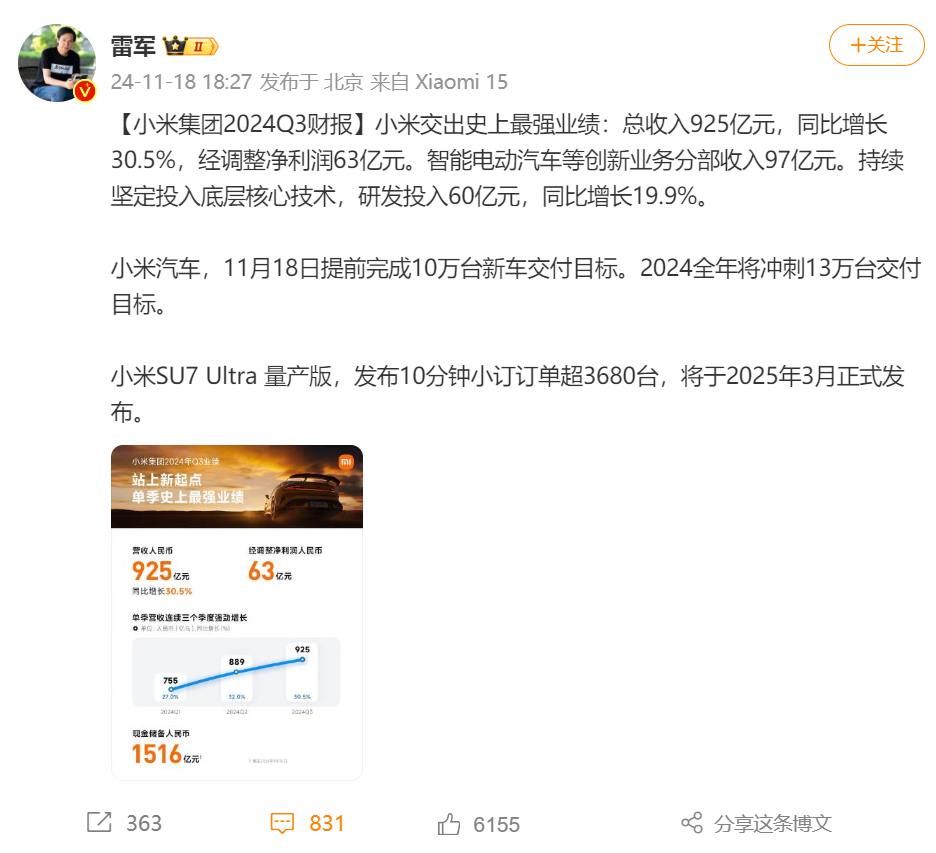

On November 18, Xiaomi Group released its third-quarter financial report for 2024, reporting revenue of 92.51 billion yuan, a year-on-year increase of 30.5%, exceeding estimates of 90.28 billion yuan; net profit reached 5.35 billion yuan, surpassing estimates of 4.73 billion yuan, with a year-on-year increase of 4.4%. Adjusted net losses for innovative businesses, including smart electric vehicles, amounted to 1.5 billion yuan. The overall gross margin reached 20.4%. Xiaomi CEO Lei Jun proudly declared, "Xiaomi has delivered its strongest quarterly performance ever."

Despite continued investment in vehicle manufacturing, Xiaomi's cash reserves have continued to rise, reaching 151.6 billion yuan as of September 30, 2024, setting a new record high.

It is worth noting that Xiaomi's overall gross margin experienced a sequential decline. The decline in gross margin for the smartphone business was the primary factor contributing to the decline in Xiaomi's overall gross margin in the third quarter.

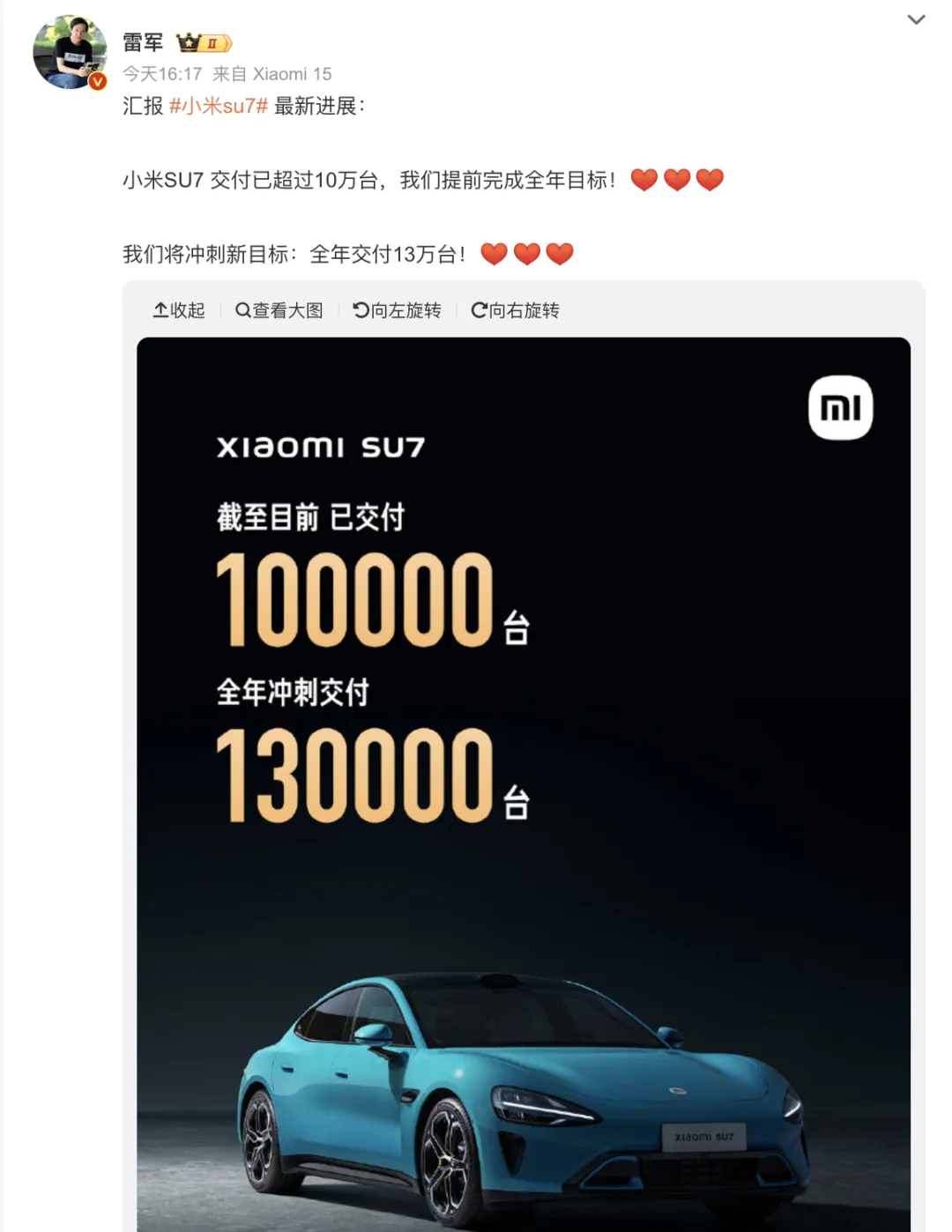

Currently, Xiaomi has rolled off its 100,000th vehicle and is aiming to deliver 130,000 vehicles annually. Based on the delivery volume of the Xiaomi SU7 in October, achieving this new target should not be an issue.

Xiaomi may become the fastest profitable new force in vehicle manufacturing, but its current sales rely solely on the SU7. The high price of the Xiaomi SU7 Ultra makes it a non-volume model, and it is difficult to support the company alone. Xiaomi needs to introduce powerful new models to compete in the fiercely competitive new energy vehicle market.

01

Lowest Gross Margin for Smartphones

It is undeniable that Xiaomi's SU7, which has been in development for three years, has been a success. However, in its latest financial report, Xiaomi's smartphone business gross margin has declined. Xiaomi disclosed in its financial report that this was due to rising prices of core components and increased competition.

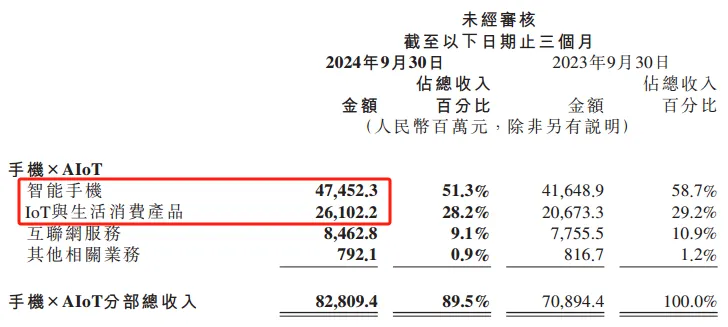

The smartphone business remains Xiaomi's mainstay, with third-quarter revenue reaching 47.5 billion yuan, a year-on-year increase of 13.9%. Xiaomi explained that this was mainly due to an increase in the average selling price (ASP) and shipment volume of smartphones.

In the third quarter of this year, Xiaomi's smartphone ASP increased from 997.0 yuan per unit in the third quarter of 2023 to 1,102.2 yuan per unit. Global smartphone shipments reached 43.1 million units, a year-on-year increase of 3.1%.

Xiaomi's President Lu Weibing also mentioned that the gross margin for Xiaomi's smartphone business hit its lowest point in the third quarter and will rebound in the fourth quarter. The price of Xiaomi's flagship phone for this year, the Xiaomi 15 series, has been adjusted upwards, but sales still exceeded one million units at a rapid pace.

It is worth mentioning that in the mainland market in the third quarter of this year, Xiaomi's high-end smartphone shipments accounted for 20.1% of total smartphone shipments, an increase of 7.9 percentage points year-on-year.

According to Canalys' report, Xiaomi ranked third in the global smartphone market with a market share of 13.8% in the third quarter of 2023. In the Chinese mainland market, Xiaomi's smartphone ranking rose to fourth, with a market share of 14.7%, a year-on-year increase of 1.2 percentage points.

Lu Weibing expressed confidence in this, stating that "Xiaomi Group's premiumization strategy is progressing very much in line with expectations."

02

Losing 30,000 Yuan per Vehicle Sold

In the third quarter of 2024, Xiaomi's smart electric vehicle business generated revenue of 9.5 billion yuan, with additional related business revenue of 200 million yuan. The gross margin for innovative businesses, including smart electric vehicles, was 17.1% in the third quarter.

In the third quarter, Xiaomi delivered 39,790 SU7 series vehicles. After adjustments, the net loss for innovative businesses, including smart electric vehicles, still amounted to 1.5 billion yuan, with a loss of approximately 37,000 yuan per vehicle. It is worth noting that the hashtag "Xiaomi loses 30,000 yuan per vehicle sold" trended on social media and was mocked by some netizens, who wondered why Xiaomi continues to sell so many vehicles if it loses money on each one.

In fact, during the second quarter of this year, after Xiaomi released its financial report, "Xiaomi loses over 60,000 yuan per SU7 sold" quickly became a focal point of public opinion. Xu Jiye, the head of PR at Jiyue, even criticized Xiaomi on social media, stating, "Xiaomi loses 60,000 yuan per vehicle. Why are you selling so many if you're losing that much money? In the past, that would be called dumping."

Regarding the reasons for the losses in the third-quarter financial report, Lu Weibing explained that Xiaomi's automotive business is still in its early stages and has not reached a sufficient scale. Building its own factories and researching core technologies require heavy upfront investments and cost sharing, leading to initial losses. This is a common trend in the entire electric vehicle industry.

Nowadays, more and more automakers are complaining about selling cars at a loss. For example, Yu Chengdong, Chairman of Huawei's Intelligent Automobile Solutions BU, once stated that selling one AITO Asker results in a loss of approximately 30,000 yuan. However, selling cars at a loss is now a common practice in the automotive industry. Only by increasing delivery volumes can losses be narrowed. Excessively emphasizing the amount of money lost per vehicle sold may damage consumer sentiment and have a negative impact.

Xiaomi's CFO Lin Shiwei also revealed that in the first three quarters of this year, Xiaomi invested approximately 8.8 billion yuan in its automotive business, most of which was spent on research and development. As of September 30, 2024, Xiaomi had opened 127 sales outlets for its automotive business in 38 cities nationwide.

The latest pre-sale price for the mass-produced version of the Xiaomi SU7 Ultra is 814,900 yuan, and orders are still growing. Earlier pre-orders for the mass-produced version of the Xiaomi SU7 Ultra showed that 3,680 orders were placed within 10 minutes.