Which Huawei mobile phone enterprise has the strongest profitability?

![]() 11/20 2024

11/20 2024

![]() 424

424

Huawei mobile phones are smart devices belonging to Huawei's consumer business, one of its three core businesses. Huawei mobile phones not only occupy an important position in the global market but have also made remarkable achievements in technological innovation and product diversity, such as the launch of the Mate, P, nova series. Profitability is generally reflected in the amount of corporate earnings and their level over a certain period. The analysis of profitability is an in-depth analysis of a company's profit margins. This article is part of the Enterprise Value Series on [Profitability], selecting a total of 59 Huawei mobile phone enterprises as research samples, using return on equity, gross profit margin, net profit margin, etc., as evaluation indicators. The data is based on historical information and does not represent future trends; it is for static analysis only and does not constitute investment advice.

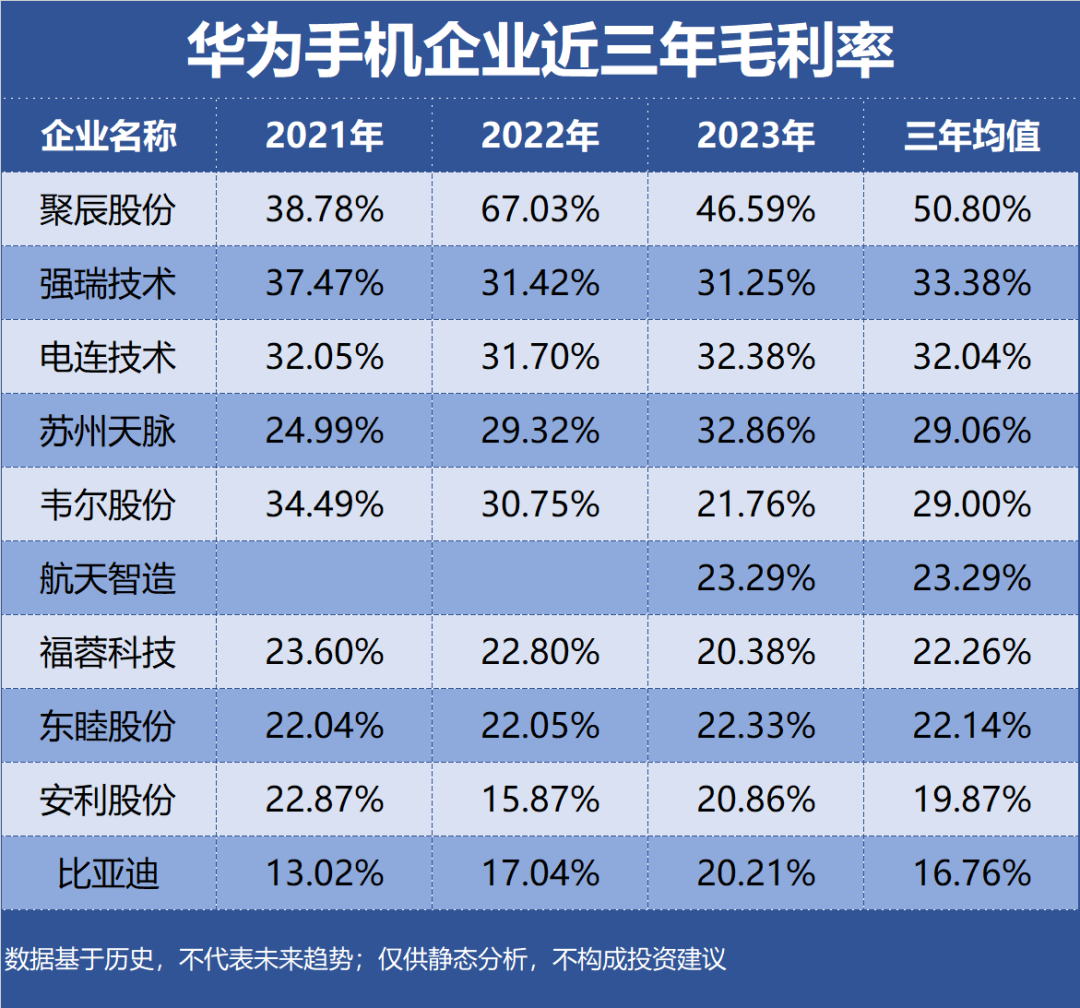

Top 10 Huawei mobile phone enterprises in terms of profitability:

10th Aerospace Intelligence Industry Segment: Auto Body Accessories and Trim Profitability: Return on Equity 19.00%, Gross Margin 23.29%, Net Profit Margin 8.97% Performance Forecast: Highest ROE in the past three years was 19.00%, latest forecast average 13.40% Main Product: Automotive interior trim is the primary source of revenue, accounting for 59.28% of revenue, with a gross margin of 17.04% Company Highlight: Aerospace Intelligence's electromagnetic wave protection film products are mainly used in flexible printed circuits (FPC) that require electromagnetic interference elimination in electronic devices such as smartphones and tablets.

9th Sunway Coax Industry Segment: Consumer Electronics Components and Assembly Profitability: Return on Equity 10.14%, Gross Margin 32.04%, Net Profit Margin 13.08% Performance Forecast: ROE fluctuated between 8%-12% in the past three years, latest forecast average 12.97% Main Product: Automotive connectors are the primary source of revenue, accounting for 27.85% of revenue, with a gross margin of 40.78% Company Highlight: Sunway Coax is a leading domestic supplier of micro electrical connectors and interconnection system-related products and has entered the supply chain of global mainstream smartphone brands, with Huawei as an important customer.

8th Weir Corporation Industry Segment: Digital Chip Design Profitability: Return on Equity 13.95%, Gross Margin 29.00%, Net Profit Margin 8.74% Performance Forecast: ROE has been declining for three consecutive years to 2.98%, latest forecast average 13.38% Main Product: Semiconductor design is the primary source of revenue, accounting for 86.77% of revenue, with a gross margin of 32.22% Company Highlight: Wellchip's self-developed semiconductor products have entered well-known domestic mobile phone brands such as Huawei and Xiaomi.

7th Furong Technology Industry Segment: Consumer Electronics Components and Assembly Profitability: Return on Equity 18.58%, Gross Margin 22.26%, Net Profit Margin 15.72% Performance Forecast: ROE fluctuated between 14%-23% in the past three years, latest forecast average 14.80% Main Product: Consumer electronics aluminum profiles are the primary source of revenue, accounting for 78.53% of revenue, with a gross margin of 16.02% Company Highlight: Furong Technology provides aluminum structural components for Huawei's smartphones and supplies foldable screen phones in bulk.

6th Anli Leather Industry Segment: Other Plastic Products Profitability: Return on Equity 9.46%, Gross Margin 19.87%, Net Profit Margin 5.97% Performance Forecast: ROE fluctuated between 5%-13% in the past three years, latest forecast average 13.95% Main Product: Eco-functional synthetic leather is the primary source of revenue, accounting for 93.01% of revenue, with a gross margin of 26.56% Company Highlight: Anli Leather's leather materials are used in Huawei's Mate30, Mate40, Mate50, Mate60, X2, X5 series phones.

5th Dongmu Shares Industry Segment: Metal Products Profitability: Return on Equity 4.99%, Gross Margin 22.14%, Net Profit Margin 3.57% Performance Forecast: Highest ROE in the past three years was 7.76%, latest forecast average 14.63% Main Product: Powder pressing products are the primary source of revenue, accounting for 47.18% of revenue, with a gross margin of 25.56% Company Highlight: The Huajing Powder Company, in which Dongmu Shares holds shares, directly and indirectly supplies Huawei mobile phones with MIM structural parts, wearable device components, 5G routers, and other products.

4th GigaDevice Semiconductor Industry Segment: Digital Chip Design Profitability: Return on Equity 10.99%, Gross Margin 50.80%, Net Profit Margin 22.05% Performance Forecast: ROE fluctuated between 5%-21% in the past three years, latest forecast average 14.83% Main Product: Memory chips are the primary source of revenue, accounting for 79.84% of revenue, with a gross margin of 51.82% Company Highlight: GigaDevice Semiconductor's main business is high-performance, high-quality integrated circuit products, and its EEPROM products are used in Huawei's smartphone product series.

3rd Suzhou Tianmai Industry Segment: Consumer Electronics Profitability: Return on Equity 21.66%, Gross Margin 29.06%, Net Profit Margin 13.20% Performance Forecast: ROE fluctuated between 20%-23% in the past three years, latest forecast average 20.70% Main Product: Vapor chambers are the primary source of revenue, accounting for 66.42% of revenue, with a gross margin of 40.11% Company Highlight: Suzhou Tianmai has successively developed and mass-produced high-performance thermal dissipation products such as graphite films, heat pipes, and vapor chambers, which have been certified by well-known brand customers such as Huawei.

2nd Qiangrui Technology Industry Segment: Other Special Equipment Profitability: Return on Equity 9.22%, Gross Margin 33.38%, Net Profit Margin 10.14% Performance Forecast: ROE fluctuated between 4%-17% in the past three years, latest forecast average 14.40% Main Product: Fixtures are the primary source of revenue, accounting for 53.05% of revenue, with a gross margin of 35.29% Company Highlight: Qiangrui Technology's products sold to Huawei are primarily used in its mobile electronic devices such as smartphones, with some used in its network communication products (including IT servers, small wireless base stations, etc.).

1st BYD Industry Segment: Electric Passenger Vehicles Profitability: Return on Equity 14.76%, Gross Margin 16.76%, Net Profit Margin 3.74% Performance Forecast: ROE has increased consecutively to 24.40% in the past three years, latest forecast average 22.40% Main Product: Automobiles, automobile-related products, and other products are the primary sources of revenue, accounting for 75.82% of revenue, with a gross margin of 23.94% Company Highlight: BYD is a leading manufacturer in the development, production, and assembly of global smart products, with major customers including Samsung, Huawei, Apple, Xiaomi, vivo, Lenovo, and other leading smart mobile terminal manufacturers.

Top 10 Huawei mobile phone enterprises in terms of profitability, return on equity, gross margin, and net profit margin over the past three years: