Review of JD.com's Double 11: Xu Ran's Toughest Battle

![]() 11/14 2024

11/14 2024

![]() 329

329

Text|James Tai Shi In the eyes of JD.com CEO Xu Ran, procurement and sales undoubtedly remain the absolute protagonists of JD.com's Double 11 this year, serving as the vanguard in the crucial battle for the company's retail sector's "content ecosystem." Drawing on last year's successful experience, she continued to compete closely with Li Jiaqi while also directing procurement and sales efforts against all major live streamers across the internet. However, human calculations often fall short of divine arrangements. A single remark by Yang Li caused JD.com to be backlashed by the traffic it had yet to fully master. Should JD.com continue with its "content-oriented" strategy? This is a question the company will undoubtedly have to address after Double 11. Moreover, JD.com's employees may no longer trust Xu Ran's calculations this time around, likely hoping that Chairman Liu Qiangdong will provide an explanation.

Although the incremental female market is highly attractive to JD.com, under the favorable circumstances of "national subsidies," losing the male consumer base and lagging behind in the instant retail market are issues worthy of reflection for CEO Xu Ran.

01 Procurement and Sales Live Streams Competing with Li Jiaqi

According to the Double 11 war report released by "JD.com Blackboard News," the number of users increased by over 20% year-on-year, and the order volume of JD.com's procurement and sales live streams increased by 3.8 times year-on-year. "JD.com Procurement and Sales" remained the favored corner, becoming the highlight of JD.com's Double 11 summary. Throughout Double 11, JD.com's procurement and sales team indeed pulled out all the stops to attract traffic and boost sales. Rewinding to the launch of Double 11, at the "JD.com 11.11 - Cheap and Good" press conference on October 14, the procurement and sales team performed a rap titled "The Procurement and Sales Team Braving All Odds."

JD.com's Procurement and Sales Team Performing Rap Online, "The Procurement and Sales Team Braving All Odds"

"Pre-cooked meals using slot meat, how absurd. Fake goods running amok, all lies spoken. Buying sweet potato noodles, only cassava shakes in your belly. Mixing real and fake goods, no room for negotiation." This passage subtly mocks Xiao Yangge's slot meat and Dongbei Yujie's cassava noodles. Of course, Taobao's top seller Li Jiaqi received special attention from JD.com's procurement and sales live streams - the song title "Braving All Odds" and lyrics "Have wages risen or not?" both allude to him, and openly questioned the reduction in Li Jiaqi's live stream red envelope total from 900 million to 500 million every 5 minutes on the first day of his broadcast; the most damaging move was hanging a banner in the live stream room that read "Lower Prices than Jiaqi" and declaring an additional 10% discount on top of Li Jiaqi's live stream prices... This tactic of dissing competitors and creating topics is indeed becoming increasingly popular in the increasingly saturated live e-commerce market. Xiao Yangge's mooncake incident fermented under Xin Ba's exposure, while Luo Yonghao also continuously commented on Dong Yuhui's independence. JD.com's procurement and sales live streams chose Li Jiaqi as their target. Last year's Haier electrical appliance incident allowed them to taste success, and this year's expanded product categories of JD.com's procurement and sales have even greater overlap with Li Jiaqi's live streams.

JD.com Procurement and Sales Live Stream on Double 11, 2023

JD.com's war report shows that from October 14 to November 5, their most popular live stream room was "JD.com's Really Cheap Procurement and Sales Live Stream," with the most ordered categories being home appliances, household cleaning, and beauty and skincare products. From 8 pm on October 10 to 9 pm on October 31, the number of new users for JD.com's fashion and beauty transactions increased by over 140% year-on-year. This actually continues JD.com's approach of deepening its presence in the female user market since this year. In the first eight months of this year, JD.com's beauty sales amounted to 27.01 billion yuan, a year-on-year increase of 11.37%.

At the same time, data from the National Bureau of Statistics shows that national cosmetics sales in the first eight months decreased by 0.5% year-on-year. Achieving double-digit growth against the trend, this contribution naturally goes to Xu Ran, JD.com's newly appointed female CEO last year. However, extremes meet, and the Yang Li incident, while seemingly accidental, is actually an inevitable result of JD.com's expansion into the female user market. Unless JD.com stays stagnant in providing essential consumer goods, many optional consumer products inherently imply value orientation choices. Some believe that this incident exposes the unprofessionalism of JD.com's brand market. In fact, as long as JD.com continues to pursue incremental growth in the female market, such incidents are only a matter of time.

JD.com's Response to the "Yang Li" Incident

This is an issue encountered by every internet application when expanding its user base. Facing Pinduoduo's aggressive tactics, JD.com proactively introduced more POP products, lowering its price range. JD.com, which was once a quality guarantee in the eyes of the middle class, now also offers low-end goods, and its "only refund" policy is not as competitive as Pinduoduo's. This has to some extent diluted JD.com's brand value. However, it had not previously touched the "gender confrontation" landmine, so the reaction was not as uproarious as this time. JD.com's persistent targeting of Li Jiaqi's live streams, upon closer inspection, is quite peculiar. Li Jiaqi caters to "all girls," while JD.com's anchors, with a procurement and sales background, should logically be a lower-tier version of Luo Yonghao.

How long can this contradictory approach last? JD.com's procurement and sales live streams are equivalent to super store broadcasts, with self-operated goods, no shelf fees or commissions, making the model inherently cheaper than direct broadcasts. In addition, procurement and sales live streams also benefit from JD.com's logistics and customer service. This business model design is quite straightforward, but it initially seems feasible.

JD.com's Double 11 Achievements

But here's the question: Why would someone who pursues extreme cost-effectiveness watch live streams? This may also be the reason why JD.com's procurement and sales live streams do not target Luo Yonghao. Anyway, Luo Yonghao now rarely emphasizes cost-effectiveness in his live streams. The cost of the live streaming e-commerce model is naturally higher than that of shelf e-commerce. It either attracts impulsive spending or realizes premium pricing through viewers' appreciation of the anchor's content value. JD.com's anchors are procurement and sales personnel who "possess both professional knowledge and good content expression abilities." They indeed should have more product expertise than Luo Yonghao, who failed with Smartisan phones, but their content expression and fan base are vastly different.

Live streaming e-commerce is ultimately a traffic business. If JD.com continues to limit its content to lively expressions of professional knowledge, in today's era where everyone can be an anchor, it would be equivalent to shooting itself in the foot. Under such restrictions, to stand out, operators can only create topics that "cross the line," like the Yang Li incident.

The end result is stepping over the red line.

02

The "National Subsidy" Pie and the Price War in Instant Retail

Playing with traffic is increasingly risky, which is why many super anchors are considering stepping back. What if we don't play with traffic but compete on hard power? JD.com's current focus seems to be on its self-operated procurement and sales core. The procurement and sales team received two salary increases in early 2023 and May; at the Double 11 launch event, Xu Ran announced that at least 10,000 procurement and sales personnel would be recruited over the next three years. Three years, an interesting timeline that coincides with the industry's estimated duration of "national subsidies." Undoubtedly, the platform that benefits the most from this "national subsidy" is JD.com. There are two types of "national subsidies": either they fall on major brands like Midea and Gree or on self-operated e-commerce platforms. Because the main drivers of subsidies are local governments, and only self-operated e-commerce revenue can be counted towards local social retail sales.

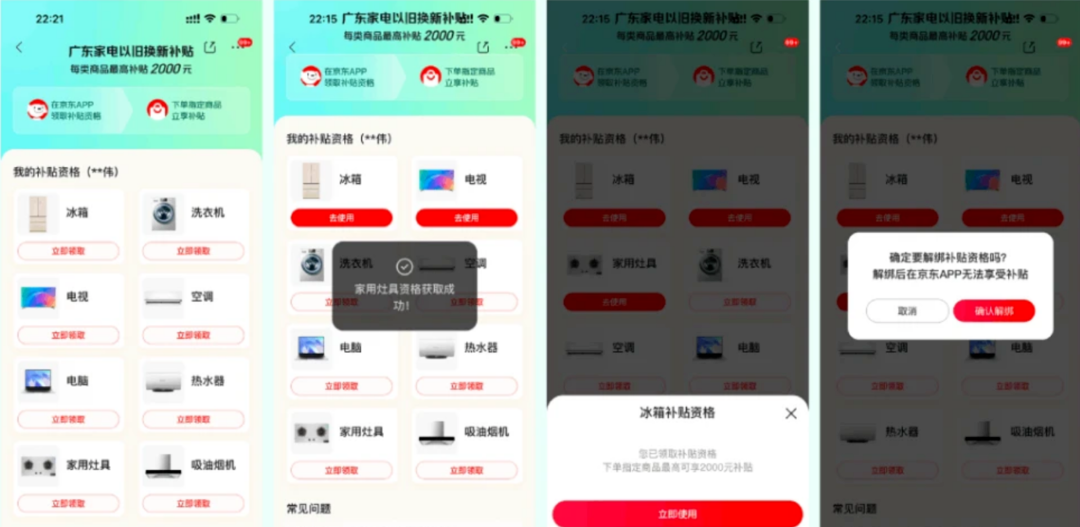

"National Subsidy" Redirect Page

The largest self-operated e-commerce platform is JD.com. In contrast, Tmall can only participate with marginal businesses like Miaozhu and Miaosuda, while Douyin, Kuaishou, and Pinduoduo are absent. Therefore, JD.com has the opportunity to regain a significant share from Pinduoduo's multi-billion subsidy program. Current statistics show that "national subsidies" have primarily driven high-end products. Moreover, subsidies are often given to well-known brands, undoubtedly accelerating brand differentiation. Industry insiders predict that if "national subsidies" continue for more than two years, 80% of small brands and channels will be eliminated. Originally, with the help of "national subsidies" and the rising tide of male consumption, JD.com could have strengthened its core market.

However, Xu Ran's current strategy is to reinforce the female market. She may not have anticipated that "reinforcement" would eventually lead to a "change of focus." The last of Xu Ran's proposed three must-win battles for JD.com Retail in 2024 is "instant retail." On November 1, after completing the integration of its forward warehouses, JD.com's 7FRESH once again launched a price war in the instant retail sector.

Image Source: Internet

However, the current unfavorable situation is quite obvious. Xu Ran, with a financial background, should be able to see that Hema achieved its first off-season profit from March to June this year, and Xiaoxiang Supermarket was also profitable in the first half of the year, not to mention the long-term benchmark Sam's Club. In the community group-buying sector, JD.com's Jingxi Pinpin was defeated. In the instant retail sector, the stable profitability of major competitors suggests that the overall situation is set, and opening fire now may be futile. It has to be admitted that in the increasingly saturated e-commerce market, the best strategy for mature companies may be to "lie flat." But "lying flat" does not align with Liu Qiangdong's ambitions. Therefore, Xu Ran led JD.com into the female incremental market and did not miss the opportunity in instant retail. However, this Double 11 resulted in several bitter fruits - the former's missteps to some extent harmed JD.com's core market, while the latter is likely to face a tough battle due to sluggish action. For investors, they may prefer a stable JD.com, one that knows its strengths.

They are unlikely to favor Xu Ran and may miss the days of Xu Lei.