Apple: Big Loss, but Can Still Hold On

![]() 11/14 2024

11/14 2024

![]() 522

522

Apple (AAPL.O) released its fiscal fourth-quarter earnings report for fiscal year 2024 after the U.S. market closed on November 1, 2024, Beijing time (ending September 2024).

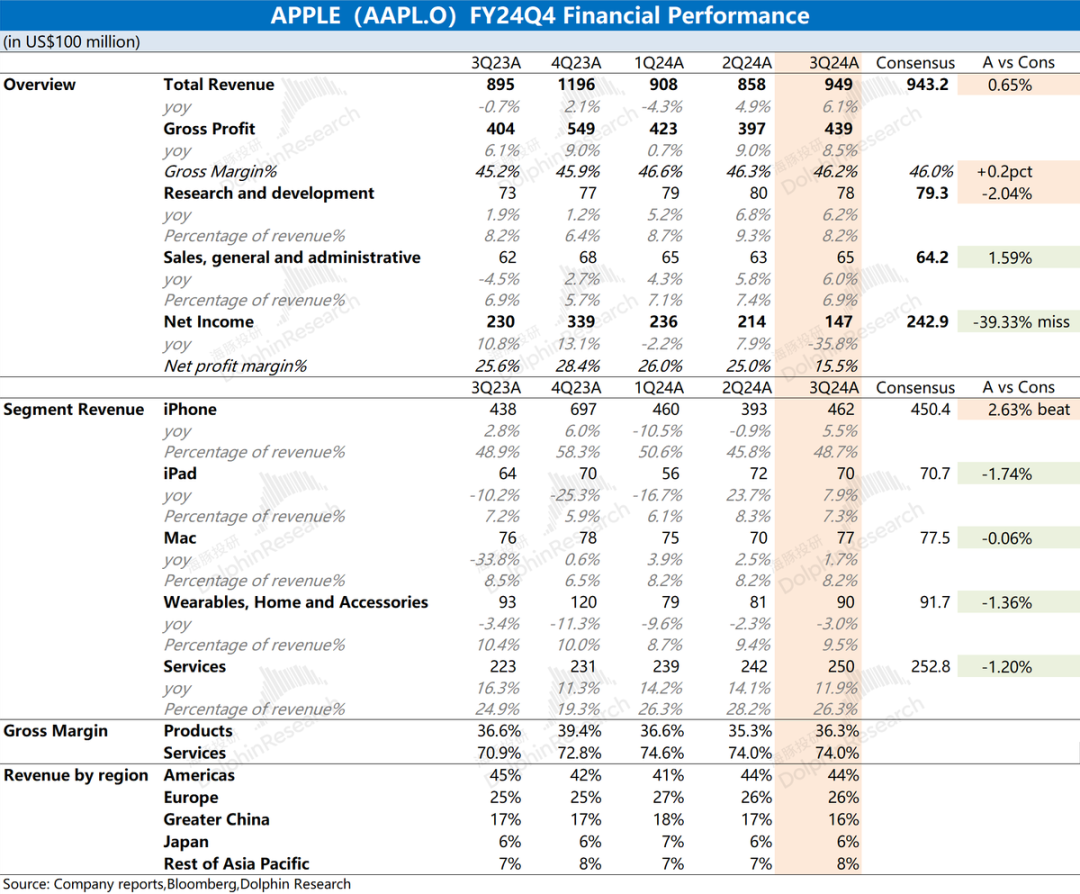

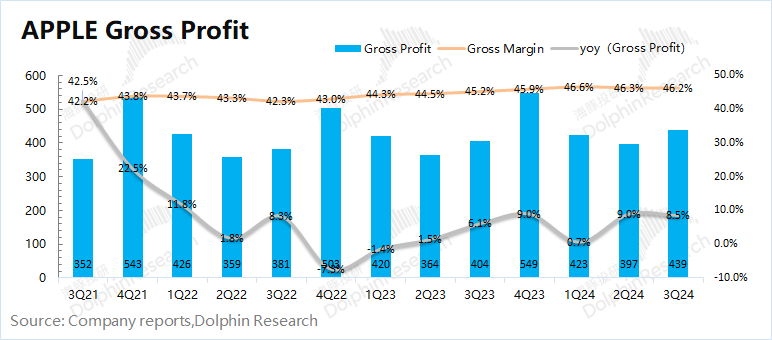

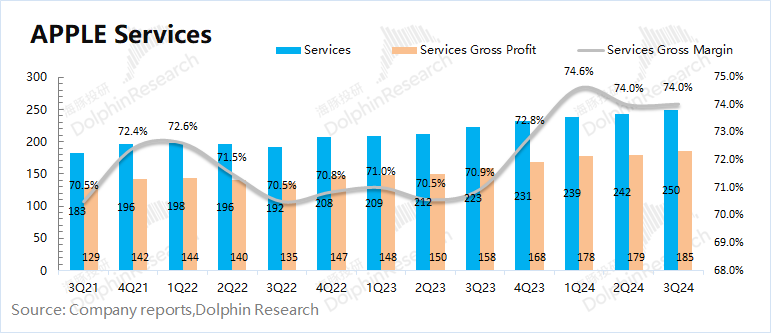

1. Overall Performance: Revenue & Profit, Meeting Market Expectations. Apple achieved revenue of $94.9 billion in this quarter, a year-on-year increase of 6.1%, slightly better than market consensus ($94.32 billion). The revenue growth was mainly driven by the increase in iPhone, iPad, and smart wearable devices. Apple's gross margin was 46.2%, an increase of 1 percentage point year-on-year, basically in line with market consensus (46%). The gross margin of the software service business remained high at 74% this quarter.

2. iPhone: Both Volume and Price Increased. Driven by the launch of the new iPhone 16 series, Apple's smartphone shipments and average selling prices increased this quarter. Dolphin Insights estimates that iPhone shipments increased by 4.5% year-on-year, while average selling prices also increased by 1% year-on-year.

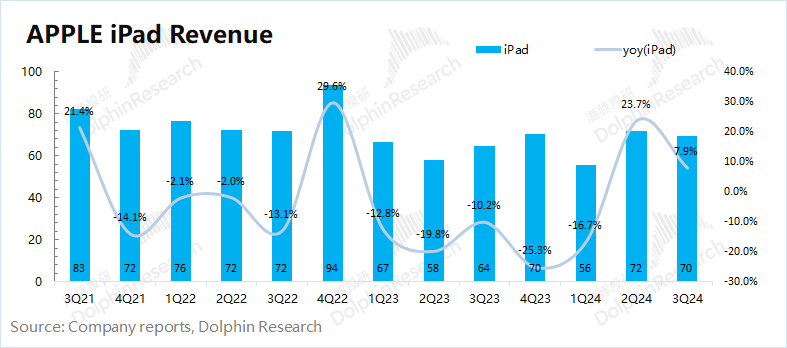

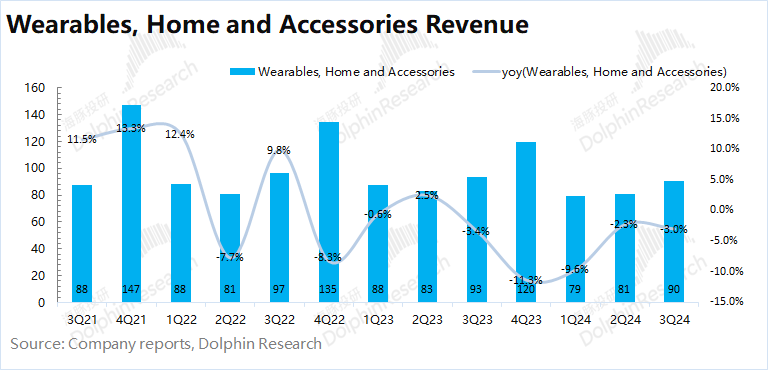

3. Other Hardware Besides iPhone: Mac and iPad Both Grew. The tablet market rebounded, combined with the company's new products this year, iPad revenue remained stable at $7 billion. Although Mac revenue increased this quarter, shipments declined by double digits year-on-year, mainly because customers were waiting for the new M4 Mac products. Other hardware businesses such as wearables continued to decline by 3% this quarter, with demand remaining weak.

4. Software Services: Continuing to Rise. Software services revenue was $25 billion this quarter, lower than market consensus ($25.28 billion). Software service revenue reached a new high this quarter, and the gross margin also remained high at 74%. With a high gross margin, the company's software business generated 44% of gross profit with nearly 26% of revenue, serving as a stabilizer for the company's performance.

Dolphin Insights' Overall View: Apple's earnings report this time was average.

The company's operating performance this quarter met market expectations. Revenue growth was mainly driven by the increase in iPhone, iPad, and smart wearable devices. The sharp decline in net profit was mainly due to the one-time tax payment to the European Union. Excluding the impact of this $10.2 billion tax payment, the company's net profit this quarter returned to $24.9 billion, slightly better than market expectations ($24.3 billion).

Looking at each business specifically: 1) The company's core hardware (iPhone, iPad, and Mac) all showed varying degrees of growth this quarter, with the iPhone business, which accounts for the largest proportion, showing a slight increase in shipments and average prices; 2) The company's wearable and other businesses still declined this quarter, with market demand remaining relatively sluggish; 3) The company's software services business continued to maintain double-digit growth, the most stable part of the company's growth; 4) The company's capital expenditure increased this quarter, with quarterly expenditure rebounding to $2.9 billion, but it was still relatively small compared to the company's operating profit.

Overall, Apple's core hardware segment has shown improvement. After the full range of the new iPhone models were equipped with 3nm chips, the sales of the iPhone 16 series were better than those of the iPhone 15 series in the same period last year. With the support of new products and a rebound in demand, iPad revenue also stabilized at $7 billion. As for Mac shipments, they declined this quarter, mainly because the market was waiting for new models equipped with M4 chips.

Regarding next quarter's revenue guidance, the company provided a year-on-year growth rate of low to mid-single digits, slightly lower than market consensus of 7%. Based on Apple's historical performance, where actual data is slightly better than company guidance, the final revenue may not be too different.

Regarding the company's profit, this quarter was affected by a one-time tax payment to the European Union. Excluding this impact, the company's operating profit this quarter was still $24.9 billion, with an operating net profit of $103.9 billion for fiscal year 2024. The current company's share price corresponds to a PE ratio of approximately 33 times. For companies maintaining single-digit growth, the market gives a valuation of over 30 times, which also includes market expectations for the company's AI terminal and related monetization capabilities. This earnings report basically met market expectations, and further growth will still require the company to exceed expectations. Subsequent attention will be paid to the company's management exchange meetings regarding the company's future outlook, AI-related layouts, and detailed monetization plans.

Below is a detailed analysis

I. Overall Performance: Revenue & Profit, Meeting Market Expectations

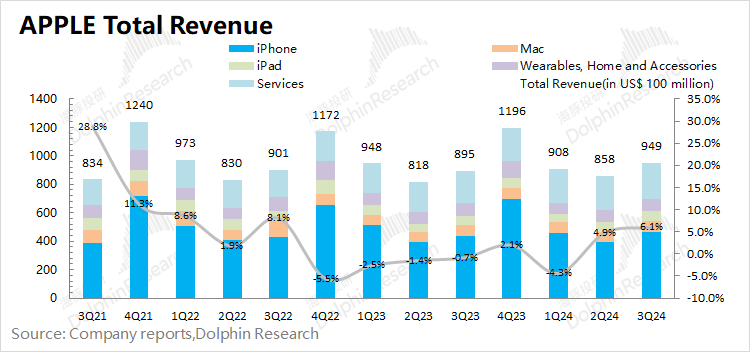

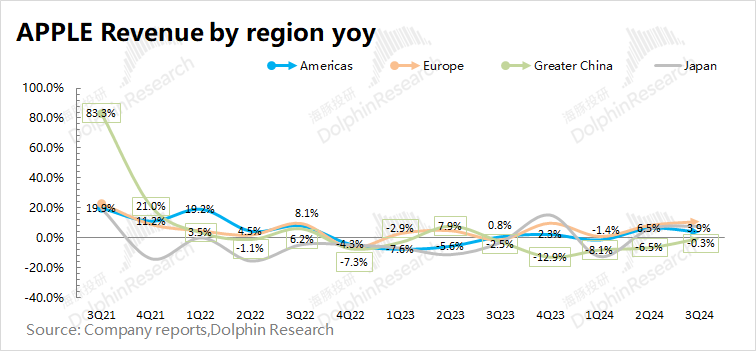

1.1 Revenue: In the fourth quarter of fiscal year 2024 (i.e., 3Q24), Apple achieved revenue of $94.9 billion, a year-on-year increase of 6.1%, slightly better than market consensus ($94.32 billion). The increase in revenue this quarter was mainly driven by the growth of iPhone, iPad, and software services. Although revenue in Greater China declined slightly, revenue in other regions increased to varying degrees.

From both hardware and software perspectives:

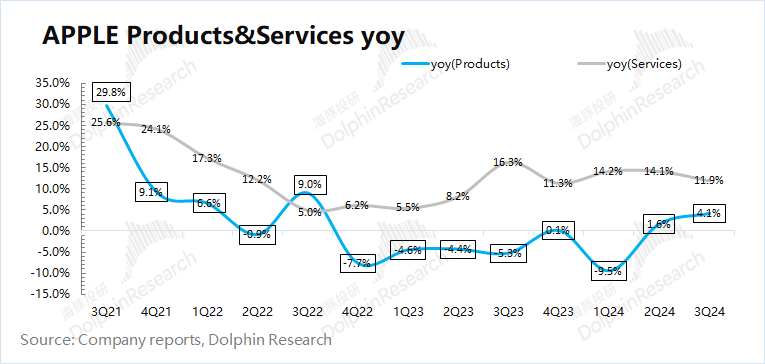

1) Apple's hardware business grew by 4.1% this quarter. The hardware segment continued to grow this quarter. Although wearable and other businesses still declined, the company's core hardware products (iPhone, iPad, and Mac) all showed varying degrees of growth this quarter, directly driving the continued recovery of the hardware segment;

2) Apple's software business grew by 11.9% this quarter, continuing to maintain double-digit growth. The software business has a certain degree of risk resistance. Even during periods of relatively low hardware revenue, software services have maintained growth.

From a regional perspective: Apple's revenue in Greater China still declined this quarter, while it increased to varying degrees in other regions. In Greater China, some products still face the impact of insufficient demand and market competition. Specifically, the Americas region is Apple's largest source of revenue, with a 3.9% increase this quarter; revenue in Greater China declined by 0.3% this quarter.

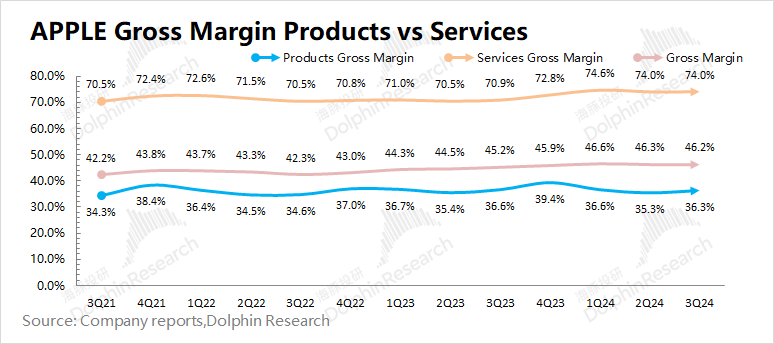

1.2 Gross Margin: In the fourth quarter of fiscal year 2024 (i.e., 3Q24), Apple's gross margin was 46.2%, an increase of 1 percentage point year-on-year, basically in line with market consensus (46%). The increase in the company's gross margin was mainly driven by the growth in the gross margin of the software business.

Dolphin Insights breaks down the gross margins of software and hardware:

Apple's software gross margin remained high at 74% this quarter, which was the main source of the company's gross margin improvement this quarter. The hardware gross margin slightly fell to 36.3%, mainly affected by promotional policies for some products and inventory preparation for new products.

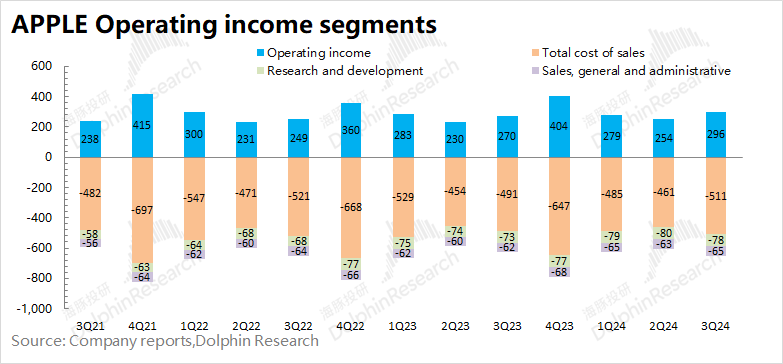

1.3 Operating Profit: In the fourth quarter of fiscal year 2024 (i.e., 3Q24), Apple's operating profit was $29.6 billion, a year-on-year increase of 9.7%. The increase in Apple's operating profit this quarter was driven by the increase in revenue and gross margin.

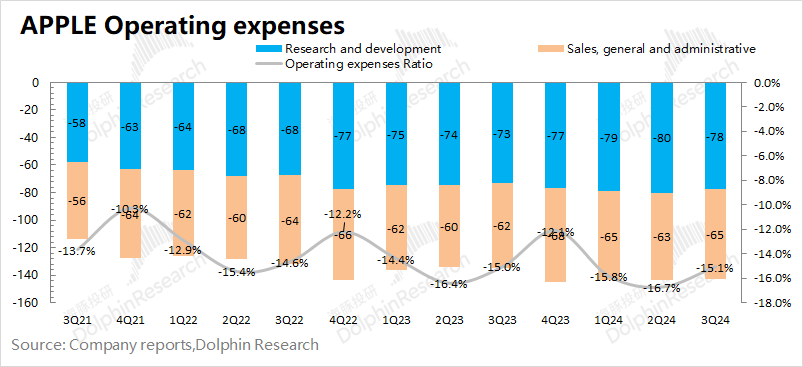

This quarter, Apple's operating expense ratio was 15.1%, a year-on-year increase of 0.1 percentage points. The company's sales and research and development expenses increased this quarter, but the proportions of these two expenses remained stable.

II. iPhone: Both Volume and Price Increased

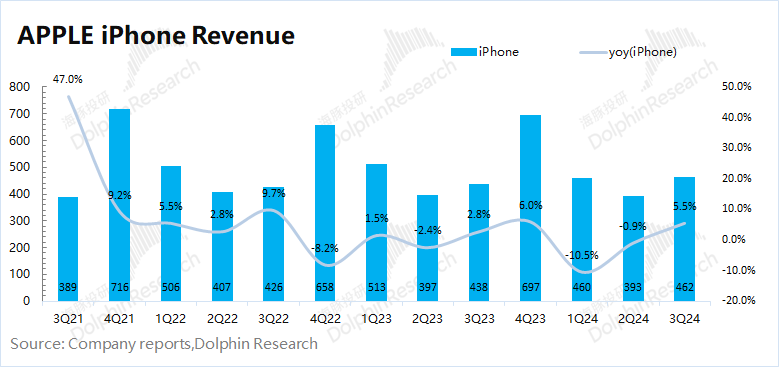

In the fourth quarter of fiscal year 2024 (i.e., 3Q24), iPhone revenue was $46.2 billion, a year-on-year increase of 5.5%, better than market consensus ($45.04 billion). The growth of Apple's iPhone business this quarter was mainly due to the overall recovery in shipments and average selling prices. The new iPhone 16 series began selling on September 20, and sales data for the first eight days were already better than those of the iPhone 15 series in the same period last year.

Dolphin Insights specifically analyzes the relationship between volume and price to understand the main drivers of iPhone business growth this quarter:

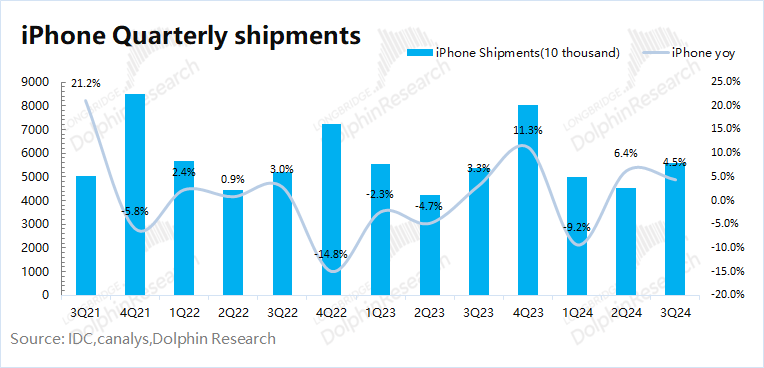

1) iPhone Shipments: According to IDC data, the global smartphone market grew by 4.4% year-on-year in the third quarter of 2024. Apple's shipment growth rate was around 4.5% this quarter, slightly outperforming the overall market;

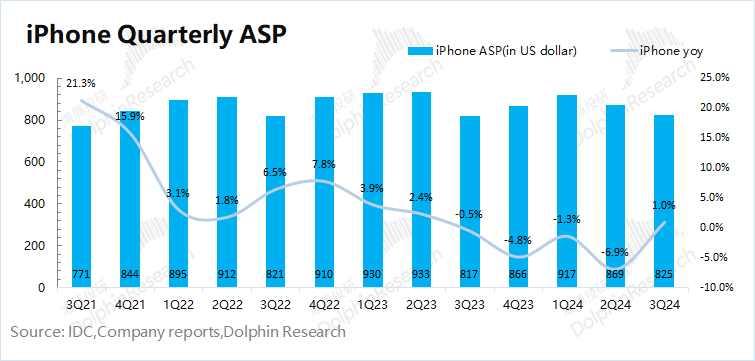

2) iPhone Average Selling Price: Combining iPhone revenue and shipment calculations, the average selling price of iPhones was approximately $825 this quarter, a year-on-year increase of 1%. The third quarter has always been a period when Apple's average iPhone selling price is relatively low, mainly because some customers wait to purchase the newly launched models. Driven by the launch of the new iPhone 16 models this quarter, the average selling price of products increased.

III. Other Hardware Besides iPhone: Mac and iPad Both Grew

3.1 Mac Business

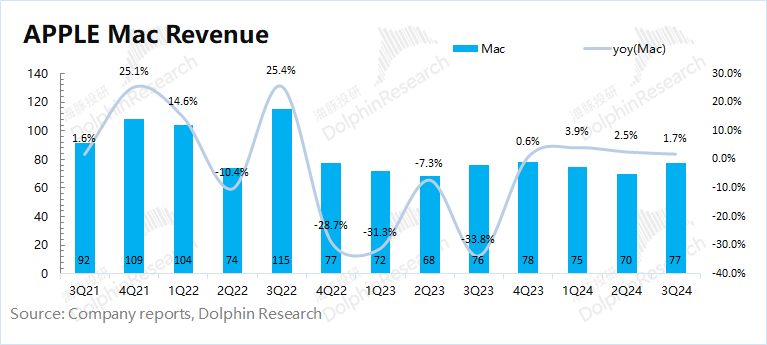

In the fourth quarter of fiscal year 2024 (i.e., 3Q24), Mac revenue was $7.7 billion, a year-on-year increase of 1.7%, basically in line with market expectations ($7.75 billion).

According to IDC's report, global PC market shipments increased by 1% year-on-year this quarter, while Apple's shipments declined by double digits year-on-year, significantly underperforming the overall market. Dolphin Insights believes this is mainly because the market is waiting for the new MacBook Pro models equipped with M4 chips to be launched by the company this year.

Combining company and industry data, Dolphin Insights estimates that Apple's average selling price for Macs this quarter was $1,460, an increase of nearly 30% year-on-year. The growth in Apple's Mac business this quarter was mainly driven by the increase in average selling prices.

3.2 iPad Business

In the fourth quarter of fiscal year 2024 (i.e., 3Q24), iPad revenue was $7 billion, a year-on-year increase of 7.9%, basically in line with market consensus ($7.07 billion). The iPad business remained the fastest-growing hardware segment this quarter.

From an industry perspective, the tablet market has significantly rebounded since the previous quarter. In the second quarter, overall industry shipments rebounded by 21.6% year-on-year, with quarterly shipments stabilizing at over 30 million units, including a 17% increase in iPad shipments. Dolphin Insights believes that since the public health incident, the tablet market has been in a slump, and there has been some demand for replacements. Influenced by Apple's new iPad models launched this year, the company's iPad business quarterly revenue remained at $7 billion.

3.3 Other Hardware such as Wearables

In the fourth quarter of fiscal year 2024 (i.e., 3Q24), revenue from other hardware businesses such as wearables was $9 billion, a year-on-year decline of 3%, slightly lower than market consensus ($9.17 billion). Wearable and other businesses have declined for five consecutive quarters, with overall demand still weak. However, in terms of the decline, the decline in the past two quarters has been significantly narrowed.

IV. Software Services: Continuing to Rise

In the fourth quarter of fiscal year 2024 (i.e., 3Q24), software services revenue was $25 billion, a year-on-year increase of 11.9%, lower than market consensus ($25.28 billion). The software business is the most stable part, with revenue continuing to grow. The growth of the software business is mainly driven by user accumulation and increased revenue per user.

In software services, the most significant concern is the gross margin level of software services. In this quarter, the gross margin of software services remained at 74%, continuing to stay at a high level and stabilizing above 70% for 13 consecutive quarters. With a high gross margin, the company's software business, accounting for nearly 26% of revenue, generates 44% of the company's gross profit, serving as a stabilizer for the company's performance.

- END -

// Reprint Authorization

This article is an original article by Dolphin Investment Research. For reprinting, please obtain authorization.