Overnight surge of 20%, what's the magic of Shopify?

![]() 11/14 2024

11/14 2024

![]() 426

426

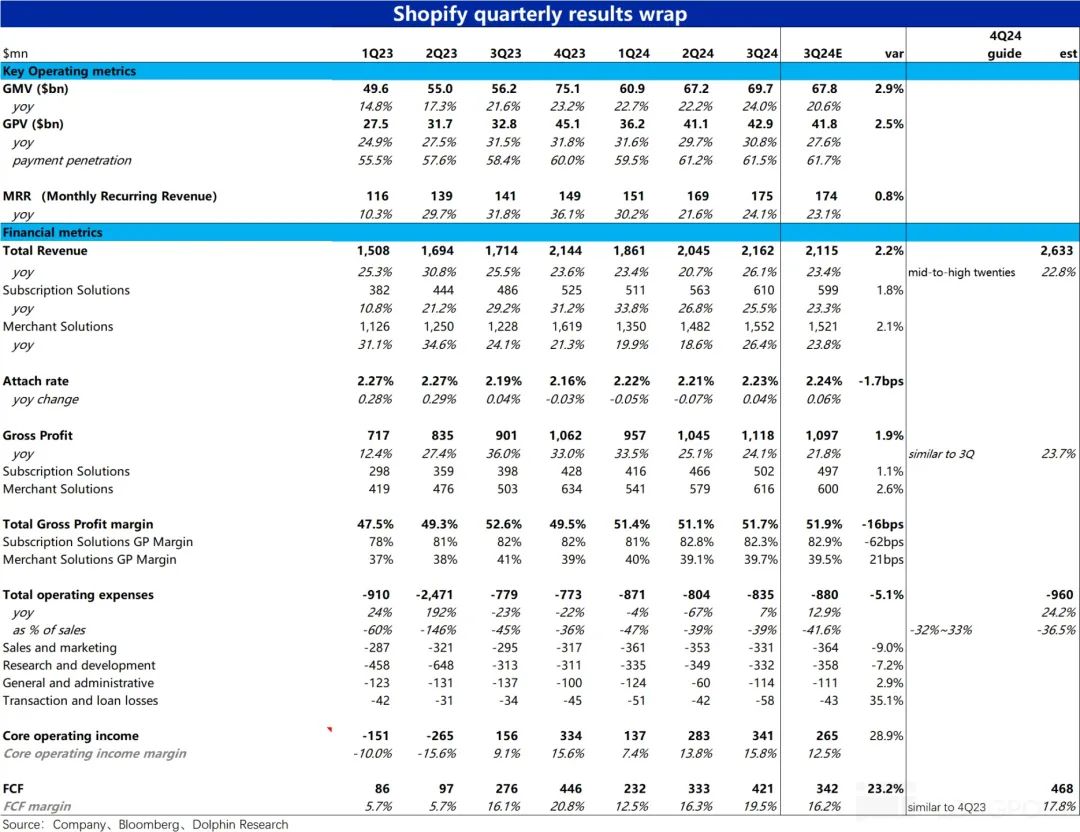

On the evening of November 12, Beijing time, before the U.S. stock market opened, Shopify, the leading independent e-commerce platform in the United States, released its fiscal Q3 2024 earnings report. In summary, this quarter witnessed accelerated revenue growth and a notable increase in profit margins. However, the real surprise was the guidance for Q4, with key details as follows:

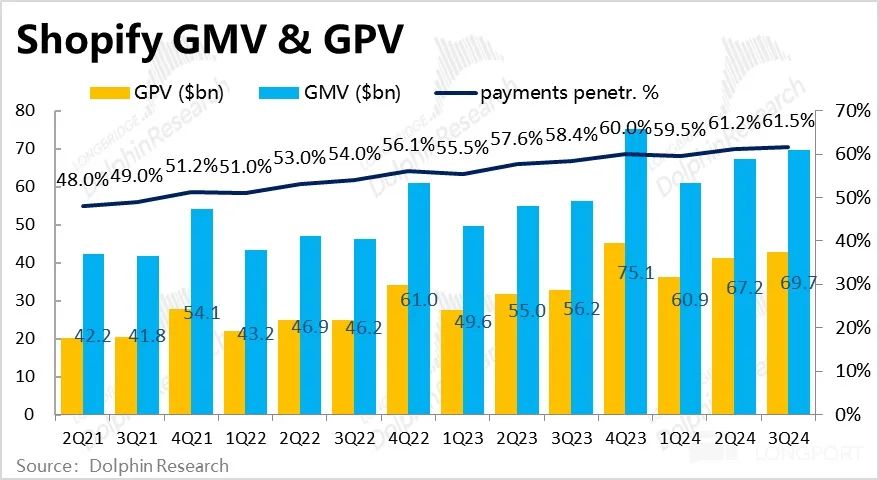

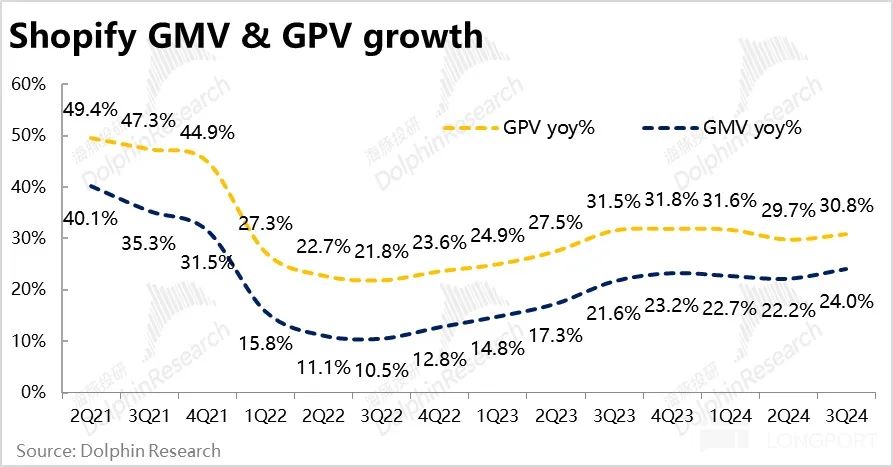

1. Core operating metrics: This quarter, the total sales (GMV) facilitated by the Shopify ecosystem reached $69.7 billion, a year-over-year increase of 24%, an acceleration of approximately 1.8 percentage points from the previous quarter. Market expectations were for GMV growth to slow to 20.6% quarter-over-quarter, but instead, GMV growth accelerated, which was one of the key beats for the quarter. Combined with research and third-party data, Dolphin Investment Research found that the number of merchants on the Shopify platform has been growing at a high speed, and the increase in market share is an important reason for this beat.

The total payment amount processed through Shopify Payment was $42.9 billion, a year-over-year increase of 30.8%, with payment penetration continuing to increase by 0.3 percentage points to 61.5%. However, the increase in penetration rate was slightly lower than expected.

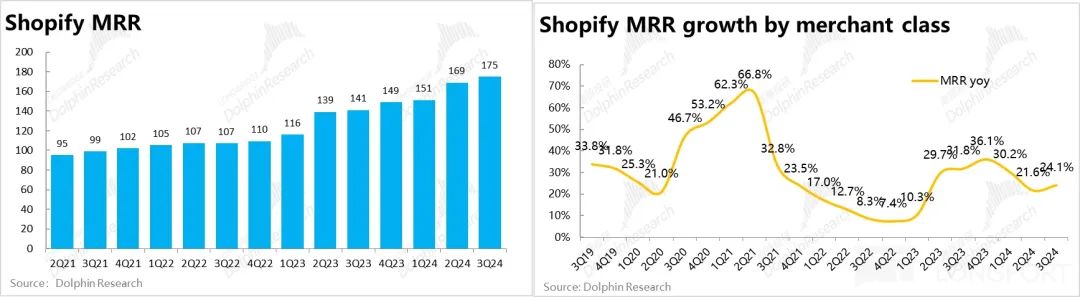

Monthly Recurring Revenue (MRR), which reflects the subscription business, was $175 million per month this quarter, a year-over-year increase of 24.1%, and a noticeable acceleration in growth compared to the previous quarter (+2.5 percentage points). The announced average subscription price increase of over 30% in Q2 contributed significantly, but the actual performance was generally in line with expectations.

Overall, the beats in GMV, GPV, and MRR were not significant, and the key point was the acceleration in growth trends.

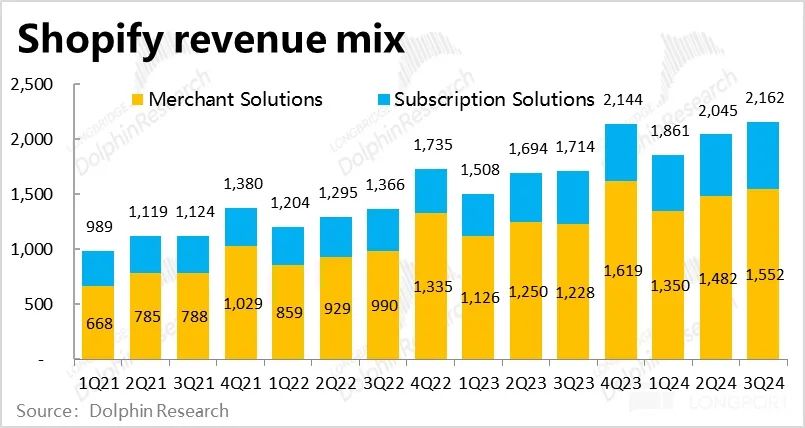

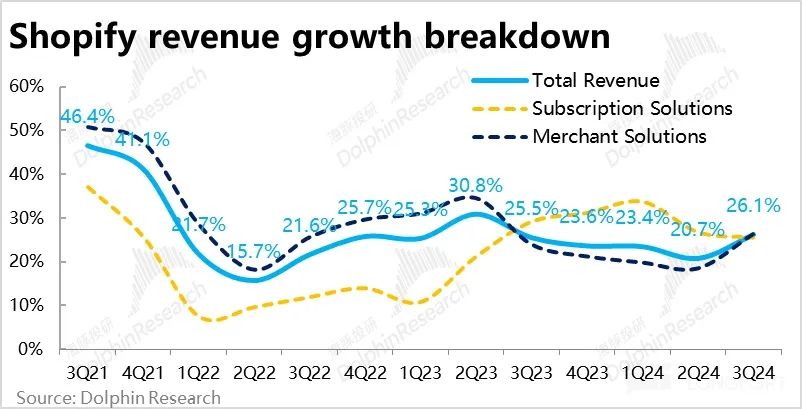

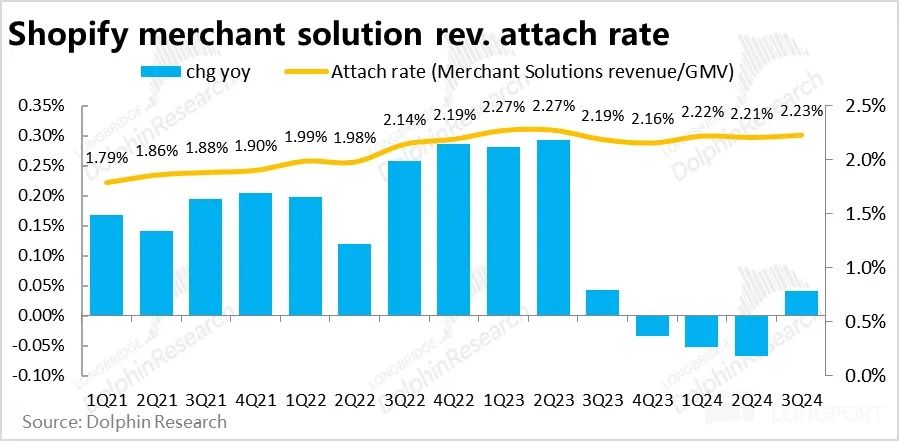

2. Revenue: Revenue from merchant services this quarter was $1.55 billion, a year-over-year increase of 26.4%, significantly outperforming market expectations of 23.8% growth. The acceleration in merchant service growth significantly outpaced GMV and market expectations. Behind this, the monetization rate of merchant services (as a percentage of GMV) increased by 4 basis points year-over-year after three consecutive quarters of year-over-year declines. This reversed the trend of declining monetization rates due to the expansion into enterprise customers and opened up market expectations for future monetization rates.

Revenue from subscription services was $610 million, a year-over-year increase of 25.5%, 2.2 percentage points higher than market expectations, which was also impressive. Overall, thanks to merchant services, Shopify's total revenue reached $2.16 billion, exceeding expectations of $2.12 billion. The actual revenue growth rate reached 26.4%, a notable acceleration from 20.7% in the previous quarter.

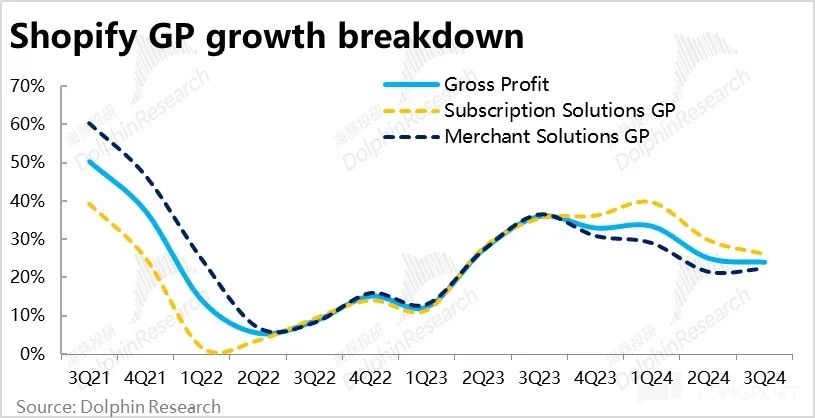

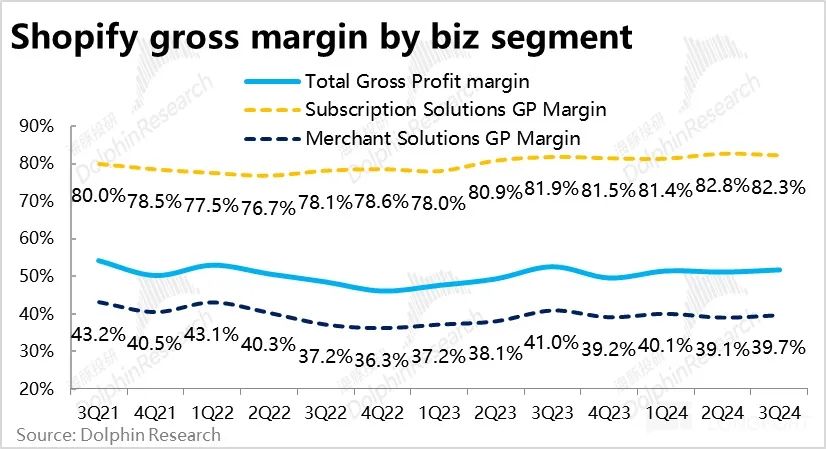

3. Gross profit: Due to the increase in the monetization rate, the gross margin of merchant services also increased by 0.6 percentage points to 36.7% quarter-over-quarter. Surprisingly, in the subscription business, despite the increase in fees, the gross margin declined by approximately 0.5 percentage points quarter-over-quarter.

Combining both businesses, total gross profit increased by 24.1% year-over-year, higher than the expected growth rate of 21.8%. However, due to the unexpected decline in the gross margin of the subscription business, gross profit growth slowed by 1 percentage point compared to the previous quarter and underperformed the total revenue growth rate of 26%.

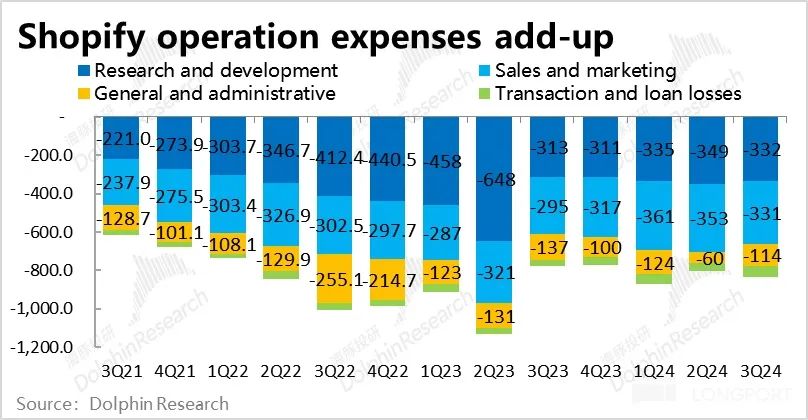

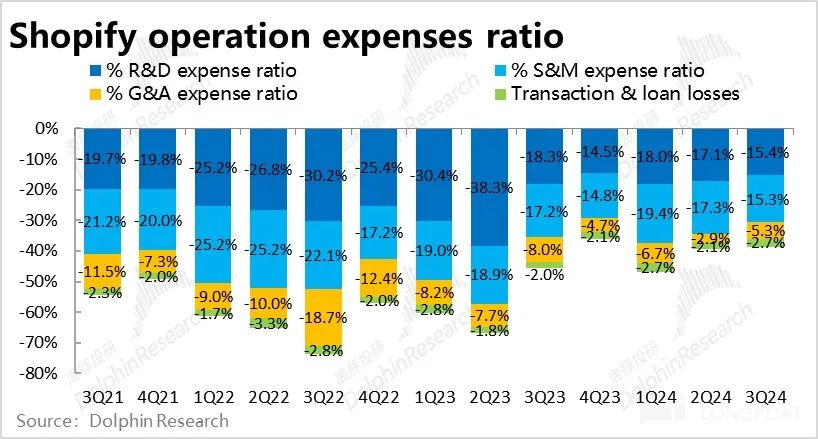

4. Expenses: Shopify's total operating expenses this quarter amounted to $835 million, accounting for approximately 39% of revenue, significantly lower than the company's previous guidance of 41% to 42%. This was mainly due to lower-than-expected marketing and research and development expenses. For example, actual marketing expenses were $330 million, down quarter-over-quarter and significantly less than the expected $360 million.

The management had previously indicated that the company would experience a small peak in investments. Therefore, one of the market's concerns was whether the expansion of expenses would compress profits. However, actual marketing and R&D investments actually declined quarter-over-quarter, largely alleviating these market concerns.

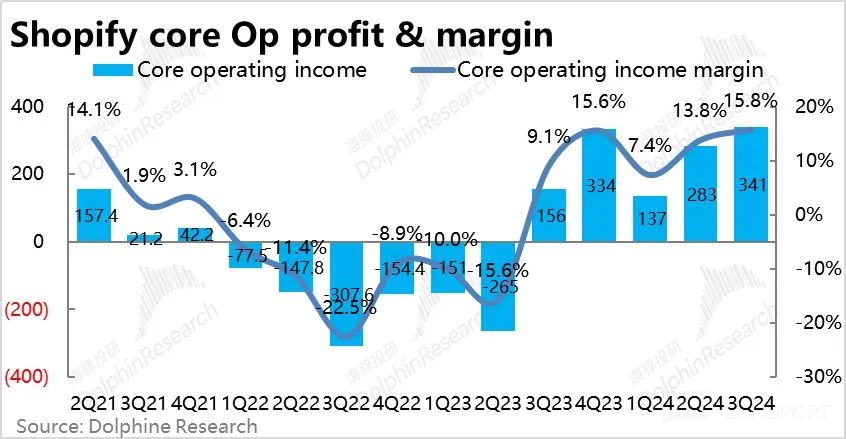

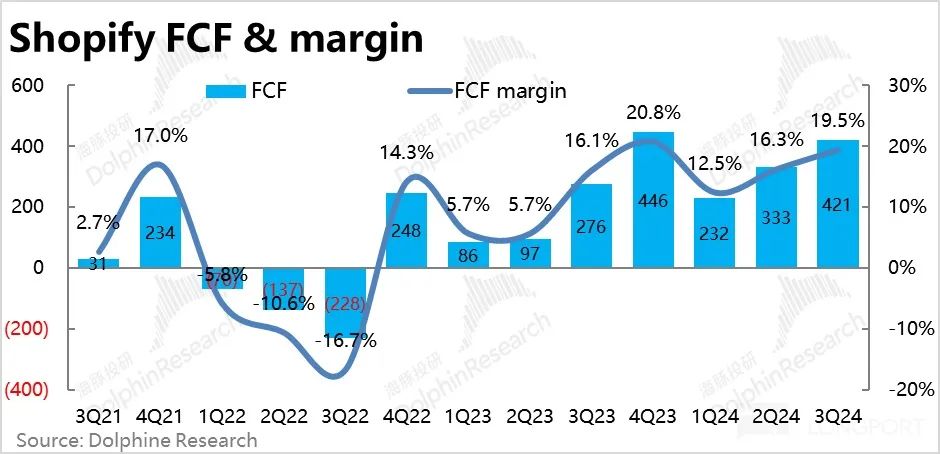

5. Shopify's core operating profit margin (excluding only regular expenses and loan losses) increased by 6.7 percentage points year-over-year to 15.8%, a record high and significantly above market expectations of 12.5%. Actual core operating profit was $340 million, significantly higher than market expectations of $270 million. In terms of free cash flow, which the company pays more attention to, it was $420 million this quarter, also about 23% higher than market expectations.

6. As can be seen from the above, this quarter's performance indicators were impressive, but apart from net profit, which naturally has larger fluctuations, the actual beats were not very significant. The beats in business, revenue, and gross profit indicators were all around 2% to 3%. The real surprise was the guidance for the next quarter.

In terms of revenue, Shopify's guidance for revenue growth is in the mid-to-high twenties, i.e., between 25% and 29%, far exceeding the market's original expectation of 23%.

In terms of gross profit, the guidance for year-over-year growth in gross profit is close to that of Q3, i.e., around 25%, higher than market expectations of 23.7%.

In terms of expenses, the guidance indicates that expenses will account for only 32% to 33% of revenue, far less than market expectations of 36.5%.

In terms of profit, the guidance indicates that FCF will account for around 21% of revenue, close to that of Q4 2023, significantly higher than the market's original expectation of 18%.

The guidance comprehensively exceeded expectations, with considerable beats.

Dolphin Investment Research Perspective:

After the earnings announcement, Shopify surged by over 20% overnight. As analyzed above, the quarterly performance was impressive. Although the beats were not significant, the key point was the accelerating growth in business volume and revenue trends, and the previously feared increase in expense expenditure was also proven false, lifting the risk of profit suppression. The company is currently in a sweet spot of growing revenue and expanding profit margins. More importantly, the guidance for Q4 once again comprehensively exceeded expectations, indicating that accelerated growth and expanded profit margins will continue at least into the next quarter. In the currently exuberant U.S. stock market environment, such a surge is not unreasonable.

From a valuation perspective, Shopify's current market value exceeds $140 billion, corresponding to the market's expected revenue for 2026. The PS valuation is above 10x, and the corresponding PE valuation is above 50x. Obviously, this is a valuation that is difficult to explain under normal circumstances. However, there are also SaaS-like companies in the market with higher valuations than Shopify (such as Palantir, Arm, etc.). It is difficult to judge the cost-effectiveness of their valuations, and they can only be viewed through a sentiment-based investment approach – that is, as long as the performance continues to beat expectations, a high valuation is not a problem in the short to medium term.

Below is a detailed interpretation of this quarter's financial report.

I. Accelerated Growth in Subscription and Payment Operating Metrics

In terms of the most important operating metrics, the total sales (GMV) facilitated by the Shopify ecosystem this quarter reached $69.7 billion, a year-over-year increase of 24%, an acceleration of approximately 1.8 percentage points from the previous quarter. Market expectations were for GMV growth to slow to 20.6% quarter-over-quarter, but instead, GMV growth accelerated, which was one of the core beats for the quarter.

The total payment amount processed through Shopify Payment was $42.9 billion, a year-over-year increase of 30.8%. On the one hand, the GPV growth rate continued to outperform the GMV growth rate, indicating that Shopify's payment penetration rate continued to increase, reaching 61.5% currently. However, compared to market expectations of 61.7%, the increase in the payment penetration rate was slightly lower than expected. The penetration rate increased by 0.3 percentage points quarter-over-quarter, compared to an increase of 1.7 percentage points in the previous quarter, indicating a modest increase in payment penetration this quarter.

The Monthly Recurring Revenue (MRR) indicator, which reflects the subscription business, was $175 million per month this quarter, a year-over-year increase of 24.1%, with a noticeable acceleration in growth compared to the previous quarter (+2.5 percentage points). The announced average subscription price increase of over 30% in Q2 likely contributed significantly. Compared to market expectations of $174 million, this can be considered in line with expectations. The company did not disclose the MRR contribution from Plus merchants this time.

Overall, although the beats in GMV, GPV, and MRR indicators were not significant, the acceleration in growth trends was the more crucial point.

II. Increased Monetization Rate Leads to Notable Increase in Merchant Service Growth

In terms of revenue, merchant service revenue this quarter was $1.55 billion, a year-over-year increase of 26.4%, significantly outperforming market expectations of 23.8% growth. The acceleration in merchant service revenue growth significantly outpaced GMV and market expectations, reflecting that the monetization rate of merchant services (as a percentage of GMV) increased by 4 basis points year-over-year after three consecutive quarters of year-over-year declines. This reversed the previous trend of declining monetization rates due to the expansion into enterprise customers and will open up market expectations for future monetization rates.

Revenue from subscription services was $610 million, a year-over-year increase of 25.5%, 2.2 percentage points higher than market expectations, which was also impressive but relatively smaller compared to the beat in merchant service revenue expectations. Overall, thanks mainly to the significantly accelerated merchant service revenue, Shopify's total revenue reached $2.16 billion, exceeding expectations of $2.12 billion. The actual revenue growth rate reached 26.4%, a notable increase from the less than 21% growth rate in the previous quarter.

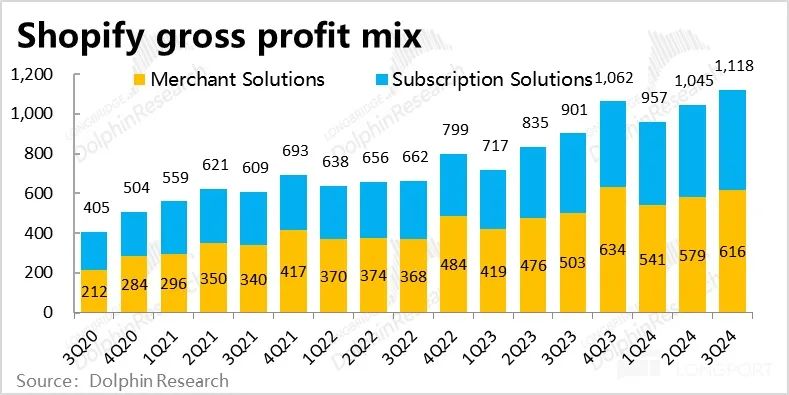

III. Slight Drag from Declining Subscription Business Gross Margin, but Overall Gross Profit Growth Remains Impressive

From a gross profit perspective, as the monetization rate of merchant services increased, the gross margin also increased by 0.6 percentage points to 36.7% quarter-over-quarter. However, surprisingly, in the subscription business, despite the increase in fees, the gross margin declined by approximately 0.5 percentage points quarter-over-quarter. It will be interesting to see if there is an explanation during the conference call.

Due to the increase and decrease in profit margins, the gross profit of merchant services exceeded market expectations by 2.6%, further amplified compared to the 2.1% excess in revenue. In contrast, the excess in subscription business expectations declined to 1.1% (revenue beat was 1.8%).

Overall, merchant services performed relatively stronger, while the subscription business was slightly weaker.

Combining both businesses, total gross profit increased by 24.1% year-over-year, with only a slight slowdown of 1 percentage point compared to the previous quarter and higher than the expected growth rate of 21.8%. However, due to the unexpected decline in the subscription business's gross margin, gross profit growth slightly underperformed the total revenue growth rate of 26%.

IV. Expense Expenditure Decreased Instead of Increased, Is Increased Investment No Longer Necessary?

In terms of expenses, Shopify's total operating expenses this quarter amounted to $835 million, accounting for approximately 39% of revenue, significantly lower than the company's previous guidance of 41% to 42% and market expectations. This was mainly due to lower-than-expected marketing and research and development expenses. Specifically, actual marketing expenses were $330 million, down quarter-over-quarter and significantly less than the expected $360 million.

As the management had previously indicated that the company would experience a small peak in investments to drive business growth, one of the market's concerns was whether the expansion of expenses would compress profits. However, according to this quarter's financial report, while business volume accelerated, marketing and R&D investments actually decreased quarter-over-quarter and were lower than expected. This suggests that Shopify is not forced to increase investments due to external pressure, and concerns about profit compression due to increased investments can be largely alleviated.

V. Accelerated Growth and Reduced Costs Result in Soaring Profits

Due to the exceedingly high revenue growth and unexpected decline in actual expenses, Shopify's profit margin continued to improve significantly this quarter. The core operating margin (excluding only regular expenses and excluding loan losses) increased by 6.7 percentage points year-on-year to 15.8%, setting a new record high and substantially exceeding the market expectation of 12.5%. The actual core operating profit was $340 million, significantly higher than the market expectation of $270 million.

In terms of free cash profit, which the company pays more attention to, it reached $420 million this quarter, about 23% higher than the market expectation. The profit release greatly exceeded expectations.