The Advanced Battle for Intelligent Driving Equalization: City NOA Merging Huawei's Performance with Tesla's Cost

![]() 04/09 2025

04/09 2025

![]() 462

462

Author | Zhang Lianyi

"The primary barrier to popularizing intelligent driving is its high price. Excellent technology should be accessible to all, which is why BYD aims to democratize intelligent driving." Early this year, BYD swiftly launched an "intelligent driving offensive for all," immediately escalating intelligent driving from a niche market in premium cars to a widespread competition across various automotive segments.

Following suit, automaker groups such as Geely, Chery, Changan, and GAC quickly joined the fray. High-speed NOA has become almost standard across models.

Leapmotor, with a presale price of RMB 129,800, now comes standard with lidar, 200 TOPS+ computing power, end-to-end intelligent driving models, and full-scenario mapless NOA, pushing the price of high-end intelligent driving models equipped with lidar to new lows.

As the era of intelligent driving equalization intensifies, automakers and intelligent driving suppliers are gearing up for battle. With the escalation of the intelligent driving war for all and the rapid penetration of advanced intelligent driving, who will emerge as the biggest beneficiary?

01

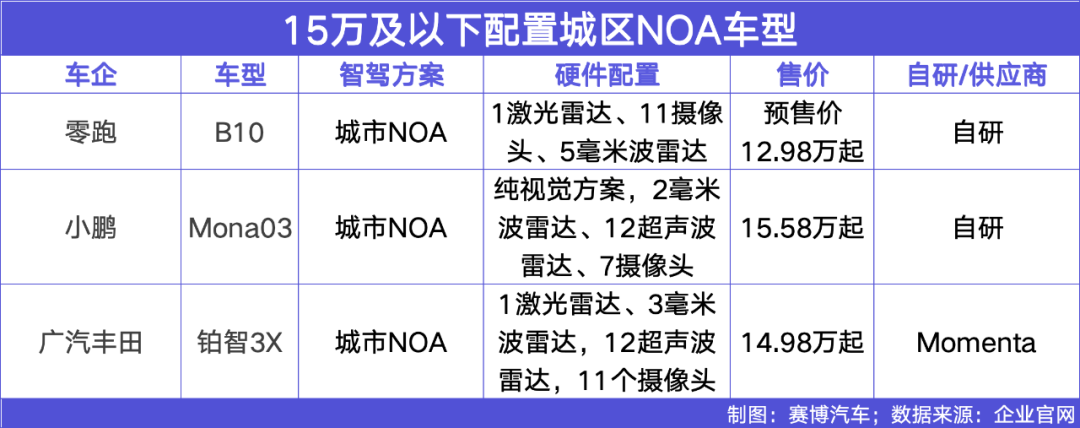

The Intelligent Driving War Heats Up: City NOA Now Available in the RMB 150,000 Price Range

A new battleground has emerged, fueled by market demand.

Until last year, even high-speed NOA was a unique selling point for intelligent driving.

Who would have predicted that the trend of "intelligent driving for all" would arrive so swiftly? With most automakers having deployed high-speed NOA, it is no longer a competitive edge. Many argue, "'Everyone has it,' means no one has an advantage because it's still difficult to prove that others have it, but I have it better." Automakers have realized that competing on "others have it, but I have it better" has become the new norm.

City NOA, with a higher threshold and superior user experience, has become the true game-changer in intelligent driving competition. This year, led by automakers such as BYD, XPeng, and Leapmotor, the price of models standard with City NOA has dropped to RMB 150,000. In the second half of this year, more lidar-equipped models with City NOA functionality priced at RMB 150,000 or below will be launched, accelerating the high-end intelligent driving market to the brink of an explosion.

02

Automakers Must Balance the Economic Benefits of City NOA, with Cost Advantage Becoming a Killer App

Despite over a decade of development in China, only three forces have mature mass production solutions for City NOA: self-developing automakers represented by Li Auto and XPeng, Huawei, and Momenta. Other intelligent driving suppliers and a significant number of automakers' self-development efforts have largely failed in the City NOA arena. Since 2021, no new intelligent driving companies have entered the market, reflecting the survival of the fittest.

Examining the three camps: The self-developing camp, led by newcomers Li Auto and XPeng, follows Tesla's FSD path, using intelligent driving capability as its core selling point, quickly distinguishing itself from traditional automakers.

Huawei leverages its brand advantage, establishing the "AITO" benchmark, with its latest intelligent driving technology primarily supplied to its own brands. Momenta, another supplier with mature mass production solutions, appeared earlier this year in BYD's Tian Shen Zhi Yan and multiple Japanese models such as Platinum Smart 3X.

Through full-stack self-development, Huawei's full-scenario intelligent driving capability has always been ahead in China. However, this also leads to high costs. Huawei's high-end intelligent driving hardware costs exceed RMB 15,000, making it rare in models priced below RMB 300,000.

Automakers pursue Huawei's performance while benchmarking Tesla's cost efficiency. With its pure vision solution, Tesla can forego expensive lidar and rely on powerful model computing power, supporting FSD with only eight cameras. According to industry insiders, the current cost of the FSD suite is only around USD 1,000, highlighting the high cost of Huawei's solution.

As City NOA extends to RMB 150,000 models, automakers must capitalize on City NOA as a selling point while carefully calculating and strictly controlling costs. The current feasible strategy is to replicate Tesla's FSD by omitting expensive equipment like lidar and adopting a pure vision solution. For instance, XPeng's Mona03 and BYD's Tian Shen Zhi Yan C align with FSD in terms of cost.

Momenta, having undertaken a large number of high-end intelligent driving models using the OrinX chip, is the most mature supplier in terms of mass production capabilities. After its software capabilities were recognized, Momenta began planning hardware to consolidate its advantages through self-developed chips. Industry sources revealed that Momenta's self-developed chip boasts computing power exceeding OrinX's 254 TOPS at only 30% of OrinX's cost, providing automakers with a cost-competitive solution akin to Tesla's. If Momenta's intelligent driving solution transitions to a software-hardware integration mode, it will be more beneficial for automakers to control costs while enhancing the City NOA experience, further boosting product competitiveness.

03

The Elimination Race Begins: The Strong Become Stronger

From the advent of intelligent driving to its equalization, a new round of larger-scale intelligent driving battles has arrived, intensifying competition within the industry. Over the past few years, the pricing landscape for high-end intelligent driving features has undergone significant changes.

In 2022, led by companies such as Huawei and Momenta, the integration of intelligent driving technology into vehicles was seen as a symbol of enhancing model prestige, successfully establishing new smart car brands including AITO, IM Motors, and BYD, competing with NIO, XPeng, Li Auto, and Tesla.

Driven by this, in 2023, the intelligent driving market exhibited stepped differentiation. On one hand, it extended to flagship models priced above RMB 500,000 to reinforce its technological benchmark status. At the end of the year, AITO's M9, dubbed by Yu Chengdong as "the best SUV under RMB 10 million," was launched, priced between RMB 469,800 and RMB 569,800. It has been the sales champion of luxury cars priced above RMB 500,000 in China for consecutive months, demonstrating the premium pricing power of intelligent driving. On the other hand, it rapidly penetrated the mainstream price range of RMB 200,000 to RMB 250,000, with the mass production of City NOA becoming a core competitive advantage. In June of that year, XPeng's G6 was launched, priced from RMB 209,900, with the MAX version containing high-end autonomous driving features priced from RMB 229,900. This model also became the sales champion of domestically produced pure electric SUVs priced at RMB 200,000, clearly showcasing the value-added effect of intelligent driving.

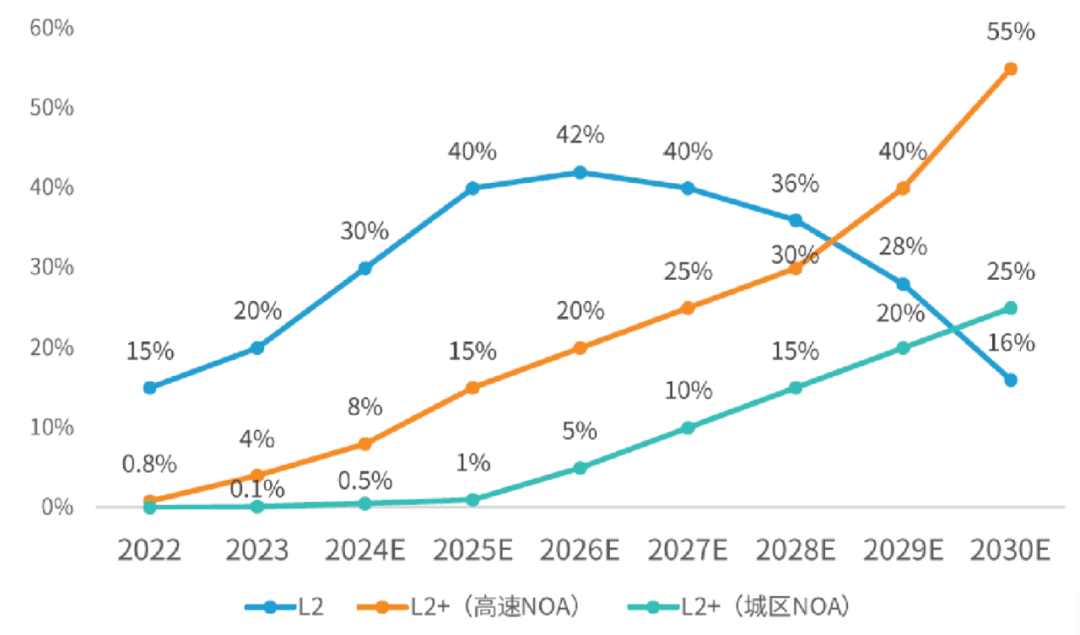

Entering 2024, intelligent driving has become a staple at automaker launches, with the saying "no intelligence, no launch." It is also in this year that, supported by technologies such as mapless navigation and large models, along with the initial emergence of scale effects, high-end intelligent driving continues to penetrate lower price ranges and accelerate its adoption. According to ZoZo Research data, in January 2024, the adoption rate of City NOA in cars priced between RMB 200,000 and RMB 250,000 was only 2.1%; by October 2024, this value had risen to 24.7%. This change marks the accelerated popularization of City NOA, with the RMB 200,000 to RMB 250,000 price range becoming the frontline of competition between automakers and third-party intelligent driving suppliers.

The penetration rate of L2+ level intelligent driving is expected to steadily increase. Data Source: ZoZo Research

At the beginning of 2025, the battle commences. With automakers and third-party intelligent driving suppliers continuing to invest in intelligent driving equipment and technology, the number of low-price models equipped with high-end intelligent driving will further increase in 2025. As these models hold a significant market share, the intelligent driving market is poised for an outbreak.

Consequently, intelligent driving suppliers will also undergo industrial differentiation. Leading enterprises will enjoy the dividends of technology implementation, while the survival space for small and medium-sized players will be further compressed, leading to a situation where the strong become stronger. On one hand, top-tier mass production players will continuously iterate algorithms to solidify their advantages, making the scale effect of intelligent driving more significant. They can not only reduce hardware costs through scale effects but also lessen hardware dependency and enhance user experience through data-driven algorithm iteration. Once the scale effect, cost reduction, and data iteration form a positive cycle, the algorithm flywheel will gradually widen the leading edge. On the other hand, affordable intelligent driving will intensify camp differentiation. As affordable intelligent driving models sell in greater volumes, the widening gap in vehicle inventory between different camps will lead to more pronounced differences in data acquisition.

Clearly, the battle for intelligent driving equalization is also an elimination race for intelligent driving suppliers. Opportunities and challenges coexist. Time will tell who will emerge victorious.